Report

Share

Recommended

More Related Content

What's hot

What's hot (20)

Similar to TITAN

Similar to TITAN (20)

Finding your way through the Venture Capital gauntlet

Finding your way through the Venture Capital gauntlet

All financial ratios of bata shoe of last five years

All financial ratios of bata shoe of last five years

Analysis of financial statements & earnings quality: Textiles Industry

Analysis of financial statements & earnings quality: Textiles Industry

State of the Cloud 2021: The Age of Cloud Unicorns with Bessemer Venture Part...

State of the Cloud 2021: The Age of Cloud Unicorns with Bessemer Venture Part...

The Global Reptrak 2015 - Las marcas con la mejor reputación del mundo

The Global Reptrak 2015 - Las marcas con la mejor reputación del mundo

Corporate finance project financial analysis for dar al dawa

Corporate finance project financial analysis for dar al dawa

More from Vinit Pimputkar

More from Vinit Pimputkar (6)

Recently uploaded

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUDHABI}}+971581248768in dubai+971581248768_)whatsapp*abortion pills in dubai/buy cytotec misoprostol and mifepristone in dubai

More arrow_drop_down

WHATSAPP +971581248768 ABORTION PILLS IN DUBAI,MISOPROSTOL IN DUBAI,@CYTOTEC TABLETS IN DUBAI/cytotec in abu dhabi/abortion pills in sharjah/MIFEPRISTONE IN DUBAI/misoprostol in ajman/@abortion pills in ras al khaimah@mifepristone in sharjah>mifepristone in abu dhabi>ABORTION PILLS FOR SALE IN ABU DHABI,KUWAIT,AJMAN,SHARJAH,RAS AL KHAIMAHSALMIYA,AL WAKRAH,JOHANNESBURG,AL AIN,CYTOTEC IN DUBAI+971581248768 cytotec price in dubai,abu dhabi.al ain,ajman,sharjah,,OTTAWA,ALBERTA,CALGARY,TORONTO,IDAHO,OHIO, Midrand ,Sandton,Hyde Park,Johannesburg,New Hampshire,South Dakota,North Dakota,how how can i get abortion pills in dubai ,abu dhabi,,riyadh.oman.muscat,Arkansas ,Kansas,West Virginia, abortion pills in for sale in dubai.abu dhabi+971581248768 Oklahoma,Nebraska,Vermont,Idaho,South Carolina,Wisconsin ~ misoprostol price in dubai.ajman.al ain.kuwaitcity,Alabama,Maine,New Mexico, soweto+971581248768,cytotec pills in kuwait,sharjah,ajman,ras al khaimahMissouri,, un wanted kit in dubai, Victoria, Sydney, ajman, Botswana ,misoprostol in abu dhabi.sharjah.dubai Alabama,get abortion pills in ras al khaimah,al ain,ajman,abu dhabi.sharjah,kuwaitcity,al satwa,deira. Charlotte,Austin,San Francisco,New York,Seattle,farwaniyah,cytotec pills for sale in al ain ,ajman,dubai,Washington,misoprostol tablets available +971581248768 in dubai,abu dhabi,sharjah,al ain,deira,ajman) abortion pills in abu dhabi,sharjah,dubai,fujairah,jumeirah,ras al khaimah,Rockhampton,Toowoomba,Coffs Harbour,J!~+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUD...

!~+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUD...DUBAI (+971)581248768 BUY ABORTION PILLS IN ABU dhabi...Qatar

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...Falcon Invoice Discounting

Recently uploaded (20)

Falcon's Invoice Discounting: Your Path to Prosperity

Falcon's Invoice Discounting: Your Path to Prosperity

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

SEO Case Study: How I Increased SEO Traffic & Ranking by 50-60% in 6 Months

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

Escorts in Nungambakkam Phone 8250092165 Enjoy 24/7 Escort Service Enjoy Your...

Escorts in Nungambakkam Phone 8250092165 Enjoy 24/7 Escort Service Enjoy Your...

Horngren’s Cost Accounting A Managerial Emphasis, Canadian 9th edition soluti...

Horngren’s Cost Accounting A Managerial Emphasis, Canadian 9th edition soluti...

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

Paradip CALL GIRL❤7091819311❤CALL GIRLS IN ESCORT SERVICE WE ARE PROVIDING

!~+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUD...

!~+971581248768>> SAFE AND ORIGINAL ABORTION PILLS FOR SALE IN DUBAI AND ABUD...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Quick Doctor In Kuwait +2773`7758`557 Kuwait Doha Qatar Dubai Abu Dhabi Sharj...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Unveiling Falcon Invoice Discounting: Leading the Way as India's Premier Bill...

Marel Q1 2024 Investor Presentation from May 8, 2024

Marel Q1 2024 Investor Presentation from May 8, 2024

Over the Top (OTT) Market Size & Growth Outlook 2024-2030

Over the Top (OTT) Market Size & Growth Outlook 2024-2030

joint cost.pptx COST ACCOUNTING Sixteenth Edition ...

joint cost.pptx COST ACCOUNTING Sixteenth Edition ...

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Mifepristone Available in Muscat +918761049707^^ €€ Buy Abortion Pills in Oman

Mifepristone Available in Muscat +918761049707^^ €€ Buy Abortion Pills in Oman

Power point presentation on enterprise performance management

Power point presentation on enterprise performance management

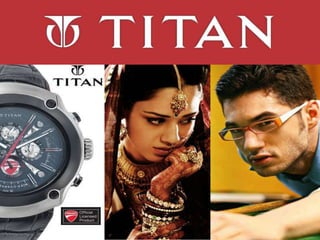

TITAN

- 2. PRESENTED BY75- TWINKLE CHHADWA 76- UJWALA PAI 77- VAIBHAV ROKADE 78- VAIBHAVI SHAH 79- VINIT PIMPUTKAR

- 3. COMPANY PROFILE • • • • • • Name-Titan Industries Ltd. Industry- other Apparels And Accessories Market Cap- 21440.04crs Founded In- 1984 Chairman- Hans Raj Verma Managing Director- Bhaskar bhatt

- 4. • A joint venture Between Tata Sons and Tamil Nadu Industrial Development Corporation, Ltd. (Tidco). • Listing Date- 4 Sept,2004 • Strength in Retail: 968 stores with over 1.3 million sq.ft area • More than 11,000 multi-brand outlets

- 5. JOURNEY

- 7. SOME FACTS • World’s 5th largest Watch Manufacturer • 65% market share in organized watch market • Fastrack: India’s largest youth brand • Tanishq: India’s leading Jewellery player • Titan Eye+: India’s largest retail chain in Eyewear • Precision Engineering: Preferred vendor for high precision components to many global manufacturers

- 8. AWARDS AND ACCOLADES Corporate• Titan Company Awarded the “Fabulous 50” company award by Forbes Asia in December 2012 Jewellery• Jewellery Division was presented the Rolta Corporate Award 2011 for securing 22nd position among top 500 hundred companies in India Watches• Brand Trust Report Card(2012) : Titan Is 12th most trusted across categories, Fastrack is 19th in India

- 9. BRANDS

- 14. SALES EVOLUTION IN SALES ( in crs .) 10112.6 1 EVOLUTION IN SALES (%) 42.51 39.35 32.67 8388.38 6661.75 3881.7 FY09 20.42 4674.42 FY10 14.41 FY11 FY12 FY13 FY09 FY10 FY11 FY12 FY13

- 15. INCOME AND EXPENDITURE 12000 10000 Rs in crs 8000 6000 4000 2000 0 EXPENDITURE INCOME FY08-09 FY09-10 FY10-11 FY11-12 FY12-13 3786 4095 4498 4906 6415 7088 8763 9693 9923 11037

- 16. PAT • EVOLUTION IN PAT (IN CRS.) • EVOLUTION IN PAT(%) 725.18 71.95 600.16 57.47 430.42 39.43 36.79 250.32 20.83 158.96 FY09 FY10 FY11 FY12 FY13 FY09 FY10 FY11 FY12 FY13

- 19. CURRENT RATIO 1.42 1.4 1.38 1.36 1.34 1.32 1.3 1.28 1.26 1.24 1.4 1.3 FY09 1.3 FY10 1.3 1.3 FY11 FY12 FY13 higher the current ratio better it is but not below 1

- 20. ROE AND ROCE ROE(%) 60 50 40 30 20 10 0 ROCE(%) 49.2 48.5 39.2 32.2 42.5 70 60 50 40 30 20 10 0 58.5 61.8 55.3 45.4 34.2 A higher returns on both indicate profitability

- 21. RS. EPS 100 90 80 70 60 50 40 30 20 10 0 92.9 53.9 34.1 6.5 FY09 FY10 FY11 7.8 FY12 FY13 higher EPS is the sign of higher earnings, strong financial position and, therefore, a reliable company to invest money

- 22. P/E RATIO 45 40 35 30 25 20 15 10 5 0 41 35.3 34.2 32.8 22.9 FY09 FY10 FY11 FY12 FY13 A high pe ratio i.e 25+ may have high future growth earnings or present earnings may be low or speculative bubble is created

- 23. DEBT EQUITY RATIO 0.45 0.4 0.35 0.4 0.3 0.25 0.2 0.2 0.15 0.1 0.1 0.05 0 0 FY09 FY10 FY11 0 FY12 FY13 A low debt equity ratio is usually preferred

- 24. TECHNICAL ANALYSIS OF THE COMPANY

- 25. SHARE HOLDING PATTERN 22% promoters holding 2% 53% 20% domestic institutions FII non promoters public andothers 3%

- 27. TITAN SHARE PRICE V/S SENSEX

- 28. SHARE PRICE RETURNS TITAN SENSEX 266.48% Absolute returns 46.06% 10.43% -3.87% 1 YR RETURN 1.80% 3 YR RETURNS 21.04% 4 YR RETURNS

- 29. FUTURE PLANS • Titan has launched its fragrance brand, Skinn. This marks the first foray into personal care category. • Titan is targeting a turnover of Rs 250 crore in the next three-five years. • It plans to invest Rs 50 crore over next three-five years on this, largely on branding, marketing activities, as it will not be manufacturing the product • Titan is also looking to enter the helmet category

- 30. CONCLUSION • Titan’s business is largely driven by the jewellery segment. • Exports too are a big driver of future growth • Precision components manufacture, while being a lower margin business, has a very large global potential. • This will help to increase the profitability of the titan share

- 31. BIBLIOGRAPHY • http://titan.co.in/awards • http://www.moneycontrol.com/india/stockpri cequote/miscellaneous/titan-industries/TI01 • http://economictimes.indiatimes.com/titanindustries-ltd/stocks/companyid-12903.cms • http://money.rediff.com/companies/TitanCompany-Ltd/12600001/ratio

- 32. THANK YOU