Black scholas theory for venu(RVSKVK)

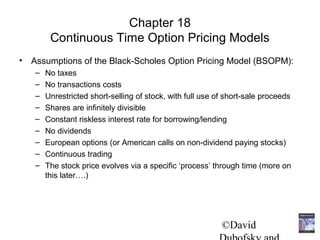

- 1. Chapter 18 Continuous Time Option Pricing Models • Assumptions of the Black-Scholes Option Pricing Model (BSOPM): – No taxes – No transactions costs – Unrestricted short-selling of stock, with full use of short-sale proceeds – Shares are infinitely divisible – Constant riskless interest rate for borrowing/lending – No dividends – European options (or American calls on non-dividend paying stocks) – Continuous trading – The stock price evolves via a specific ‘process’ through time (more on this later….) ©David

- 2. Derivation of the BSOPM • Specify a ‘process’ that the stock price will follow (i.e., all possible “paths”) • Construct a riskless portfolio of: – Long Call – Short ∆ Shares – (or, long ∆ Shares and write one call, or long 1 share and write 1/∆ calls) • As delta changes (because time passes and/or S changes), one must maintain this risk-free portfolio over time • This is accomplished by purchasing or selling the appropriate number of shares. ©David

- 3. The BSOPM Formula C = SN( d1 ) − Ke −rTN( d2 ) where N(di) = the cumulative standard normal distribution function, evaluated at di, and: ln(S/K) + (r + σ 2 /2)T d1 = σ T d2 = d1 − σ T N(-di) = 1-N(di) ©David

- 4. The Standard Normal Curve • The standard normal curve is a member of the family of normal curves with μ = 0.0 and σ = 1.0. The X-axis on a standard normal curve is often relabeled and called ‘Z’ scores. • The area under the curve equals 1.0. • The cumulative probability measures the area to the left of a value of Z. E.g., N(0) = Prob(Z) < 0.0 = 0.50, because the normal distribution is symmetric. ©David

- 5. The Standard Normal Curve The area between Z-scores of -1.00 and +1.00 is 0.68 or 68%. Note also that the area What is N(1)? to the left of Z = -1 What is N(-1)? equals the area to the right of Z = 1. This holds for any Z. The area between Z-scores of -1.96 and +1.96 is 0.95 or 95%. What is the area in each tail? What is N(1.96)? What is N(-1.96)? ©David

- 6. Cumulative Normal Table (Pages 560-561) Cumulative Probability for the Standard Normal Distribution 2nd digit of Z z 0.00 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 -1.3 0.0968 0.0951 0.0934 0.0918 0.0901 0.0885 0.0869 0.0853 0.0838 0.0823 1.3 0.9032 0.9049 0.9066 0.9082 0.9099 0.9115 0.9131 0.9147 0.9162 0.9177 N(-d) = 1-N(d) N(-1.34) = 1-N(1.34) ©David

- 7. Example Calculation of the BSOPM Value • S = $92 • K = $95 • T = 50 days (50/365 year = 0.137 year) • r = 7% (per annum) • σ = 35% (per annum) What is the value of the call? ©David

- 8. Solving for the Call Price, I. • Calculate the PV of the Strike Price: Ke-rT = 95e(-0.07)(50/365) = (95)(0.9905) = $94.093. • Calculate d1 and d2: ln(S/K) + (r + σ 2 /2)T ln(92/95) + (0.07 + 0.1225/2)0 .137 d1 = = σ T 0.35 0.137 ln(0.96842 ) + 0.01798 − 0.03209 + 0.01798 = = = − 0.1089 (0.35)(0.3701) 0.12955 d2 = d1 – σT.5 = -0.1089 – (0.35)(0.137).5 = -0.2385

- 9. Solving for N(d1) and N(d2) • Choices: – Standard Normal Probability Tables (pp. 560-561) – Excel Function NORMSDIST – N(-0.1089) = 0.4566; N(-0.2385) = 0.4058. – There are several approximations; e.g. the one in fn 8 (pg. 549) is accurate to 0.01 if 0 < d < 2.20: N(d) ~ 0.5 + (d)(4.4-d)/10 N(0.1089) ~ 0.5 + (0.1089)(4.4-0.1089)/10 = 0.5467 Thus, N(-0.1089) ~ 0.4533 ©David

- 10. Solving for the Call Value C = S N(d1) – Ke-rT N(d2) = (92)(0.4566) – (94.0934)(0.4058) = $3.8307. Applying Put-Call Parity, the put price is: P = C – S + Ke-rT = 3.8307 – 92 + 94.0934 = $5.92. ©David

- 11. Lognormal Distribution • The BSOPM assumes that the stock price follows a “Geometric Brownian Motion” (see http://www.stat.umn.edu/~charlie/Stoch/brown.html for a depiction of Brownian Motion). • In turn, this implies that the distribution of the returns of the stock, at any future date, will be “lognormally” distributed. • Lognormal returns are realistic for two reasons: – if returns are lognormally distributed, then the lowest possible return in any period is -100%. – lognormal returns distributions are "positively skewed," that is, skewed to the right. • Thus, a realistic depiction of a stock's returns distribution would have a minimum return of -100% and a maximum return well beyond 100%. This is particularly important if T is long. ©David Dubofsky and 18-11 Thomas W. Miller, Jr.

- 12. The Lognormal Distribution E ( ST ) = S0 e µT 2 2 µT σ 2T var ( ST ) = S0 e (e − 1) ©David

- 13. BSOPM Properties and Questions • What happens to the Black-Scholes call price when the call gets deep-deep-deep in the money? • How about the corresponding put price in the case above? [Can you verify this using put-call parity?] • Suppose σ gets very, very close to zero. What happens to the call price? What happens to the put price? Hint: Suppose the stock price will not change from time 0 to time T. How much are you willing to pay for an out of the money option? An in the money option? ©David

- 14. Volatility • Volatility is the key to pricing options. • Believing that an option is undervalued is tantamount to believing that the volatility of the rate of return on the stock will be less than what the market believes. • The volatility is the standard deviation of the continuously compounded rate of return of the stock, per year. ©David

- 15. Estimating Volatility from Historical Data 1. Take observations S0, S1, . . . , Sn at intervals of t (fractional years); e.g., τ = 1/52 if we are dealing with weeks; τ = 1/12 if we are dealing with months. 2. Define the continuously compounded return as: S S + div ri =ln i ; on an ex-div day: ri = ln i S S i− 1 i−1 3. Calculate the average rate of return 4. Calculate the standard deviation, σ , of the ri’s 5. Annualize the computed σ (see next slide). ©David

- 16. Annualizing Volatility • Volatility is usually much greater when the market is open (i.e. the asset is trading) than when it is closed. • For this reason, when valuing options, time is usually measured in “trading days” not calendar days. • The “general convention” is to use 252 trading days per year. What is most important is to be consistent. σ annual = σ per trading day × 252 σ annual = σ weekly × 52 σ annual = σ monthly × 12 Note that σyr > σmo > σweek > σday ©David

- 17. Implied Volatility • The implied volatility of an option is the volatility for which the BSOPM value equals the market price. • The is a one-to-one correspondence between prices and implied volatilities. • Traders and brokers often quote implied volatilities rather than dollar prices. • Note that the volatility is assumed to be the same across strikes, but it often is not. In practice, there is a “volatility smile”, where implied volatility is often “u-shaped” when plotted as a function of the strike price. ©David

- 18. Using Observed Call (or Put) Option Prices to Estimate Implied Volatility • Take the observed option price as given. • Plug C, S, K, r, T into the BSOPM (or other model). • Solving σ (this is the tricky part) requires either an iterative technique, or using one of several approximations. • The Iterative Way: – Plug S, K, r, T, and σ into the BSOPM. ˆ – Calculate σ ˆ (theoretical value) – ˆ Compare c (theoretical) to C (the actual call price). – If they are really close, stop. If not, change the value of and start over again. ©David

- 19. Volatility Smiles In this table, the option premium column is the average bid-ask price for June 2000 S&P 500 Index call and put options at the close of trading on May 16, 2000. The May 16, 2000 closing S&P 500 Index level was 1466.04, a riskless interest rate of 5.75%, an estimated dividend yield of 1.5%, and T = 0.08493 year. call price put price Strike Call price Call IV with σ = 0.22 Put Price Put IV with σ = 0.22 1225 1.5625 0.336 0.054 1250 2.34375 0.3283 0.153 1275 2.625 0.3021 0.39 1300 3.8125 0.292 0.904 1325 5.75 0.2855 1.919 1350 129.5 0.2834 124.335 8.25 0.2762 3.753 1375 107.625 0.2689 102.51 11.375 0.2641 6.809 1400 86.625 0.2534 82.353 14.875 0.2463 11.533 1425 67.625 0.2423 64.288 20.0625 0.2315 18.35 1450 50.6875 0.2324 48.648 29 0.2285 27.592 1475 35.625 0.2201 35.612 38.625 0.2152 39.437 1500 22.5 0.2036 25.178 50.875 0.2016 53.885 1525 14 0.1982 17.173 66.75 0.1923 70.762 1550 7.875 0.1912 11.291 85.375 0.1826 89.761 1575 4.375 0.1896 7.154 106.875 0.1788 110.505 1600 2.28125 0.1881 4.367 129.5 0.1668 132.6 1625 1.21875 0.1897 2.569 153.375 0.1512 155.684 1650 0.625 0.1912 1.457 ©David

- 20. Graphing Implied Volatility versus Strike (S = 1466): Implied Volatility Volatility Smiles 0.4 0.3 Call IV 0.2 Put IV 0.1 0 1200 1400 1600 Strike Price 2 S S IV = α + β1ln + β 2 ln + ε X X Using the call data: α= 2.17; β1 = -4.47; β2 = 2.52; R2 = 0.988 ©David

- 21. Dividends • European options on dividend-paying stocks are valued by substituting the stock price less the present value of dividends into Black-Scholes. * -rT C = S 0 N(d1 ) - Ke N(d 2 ) Where: S* = S – PV(divs) between today and T. • Also use S* when computing d1 and d2. • Only dividends with ex-dividend dates during life of option should be included. • The “dividend” should be the expected reduction in the stock price expected. • For continuous dividends, use S* = Se-dT, where d is the annual constant dividend yield, and T is in years. ©David

- 22. The BOPM and the BSOPM, I. • Note the analogous structures of the BOPM and the BSOPM: C = SΔ + B (0< Δ<1; B < 0) C = SN(d1) – Ke-rTN(d2) • Δ = N(d1) • B = -Ke-rTN(d2) ©David

- 23. The BOPM and the BSOPM, II. • The BOPM actually becomes the BSOPM as the number of periods approaches ∞, and the length of each period approaches 0. • In addition, there is a relationship between u and d, and σ, so that the stock will follow a Geometric Brownian Motion. If you carve T years into n periods, then: u = eσ T/n −1 d = e −σ T/n − 1 and, the probability of an uptick, q, must equal μ T q = 0.5 + 0.5 σ n ©David

- 24. The BOPM and the BSOPM: An Example • T = 7 months = 0.5833, and n = 7. • Let μ = 14% and σ = 0.40 • Then choosing the following u, d, and q will make the stock follow the “right” process for making the BOPM and BSOPM consistent: u = e 0.40 0.0833 − 1 = 0.1224 d = e −0.40 0.833 − 1 = −0.10905 and, the probability of an uptick, q, must equal 0.14 q = 0.5 + 0.5 0.0833 = 0.5505 0.40 ©David

- 25. Generalizing the BSOPM • It is important to understand that many option pricing models are related. • For example, you will see that many exotic options (see chap. 20) use parts of the BSOPM. • The BSOPM itself, however, can be generalized to encapsulate several important pricing models. • All that is needed is to change things a bit by adding a new term, denoted by b. ©David

- 26. The Generalized Model Can Price European Options on: 1. Non-dividend paying stocks [Black and Scholes (1973)] 2. Options on stocks (or stock indices) that pay a continuous dividend [Merton (1973)] 3. Currency options [Garman and Kohlhagen (1983)] 4. Options on futures [Black (1976)] ©David

- 27. The Generalized Formulae are: Cgen = Se ( b-r ) T N ( d1 ) - Ke -rTN ( d2 ) Pgen = Ke -rTN ( -d2 ) - Se( N ( -d1 ) b-r ) T ln(S/K) + (b + σ 2 /2)T d1 = σ T ln(S/K) + (b − σ 2 /2)T d2 = = d1 − σ T σ T ©David

- 28. By Altering the ‘b’ term in These Equations, Four Option-Pricing Models Emerge. By Setting: Yields this European Option Pricing Model: b=r Stock option model, i.e., the BSOPM b=r-d Stock option model with continuous dividend yield, d (see section 18.5.2) b = r – rf Currency option model where rf is the foreign risk-free rate b=0 Futures option model ©David

- 29. American Options • It is computationally difficult to value an American option (a call on a dividend paying stock, or any put). • Methods: – Pseudo-American Model (Sect. 18.10.1) – BOPM (Sects. 17.3.3, 17.4) – Numerical methods – Approximations • Of course, computer programs are most often used. ©David

- 30. Some Extra Slides on this Material • Note: In some chapters, we try to include some extra slides in an effort to allow for a deeper (or different) treatment of the material in the chapter. • If you have created some slides that you would like to share with the community of educators that use our book, please send them to us! ©David

- 31. The Stock Price Process, I. • The percent change in the stock prices does not depend on the price of the stock. • Over a small interval, the size of the change in the stock price is small (i.e., no ‘jumps’) • Over a single period, there are only TWO possible outcomes. ©David

- 32. The Stock Price Process, II. • Consider a stock whose current price is S • In a short period of time of length ∆t, the change in the stock price is assumed to be normal with mean of µ S ∆t and standard deviation, ∀ µ is expected return and σ is volatility σS Δt ©David

- 33. That is, the Black-Scholes-Merton model assumes that the stock price, S, follows a Geometric Brownian motion through time: dS =µ σ Sdt + Sdz dS =µ σ dt + dz S σ2 dlnS = μ − dt + σdz 2 ©David

- 34. The Discrete-Time Process ∆S = µ∆t + σ∆z S ∆S St +∆t − St S = = ln t +∆t ÷ S St St ∆t = a unit of time z = a normally distributed random variable with a mean of zero, and a variance of t ∆z = is distributed normally, with E(∆z) = 0, and VAR(∆z)=∆t ©David

- 35. Example: • Suppose ∆t is one day. • A stock has an expected return of µ = 0.0005 per day. – NB: (1.0005)365 – 1 = 0.20016, 20% • The standard deviation of the stock's daily return distribution is 0.0261725 – NB: This is a variance of 0.000685 – Annualized Variance: (365)(0.000685) = 0.250025 – Annualized STDEV: • (0.250025)0.5 = 0.500025, or 50% • (0.0261725)(365)0.5 = 0.500025, or 50% ©David

- 36. Example, II. • Then, the return generating process is such that each day, the return consists of: – a non-stochastic component, 0.0005 or 0.05% – a random component consisting of: • The stock's daily standard deviation times the realization of ∆z, ∀ ∆z is drawn from a normal probability distribution with a mean of zero and a variance of one. • Then, we can create the following table: ©David

- 37. The First 10 Days of a Stochastic Process Creating Stock Returns: NON‑ STOCHASTIC STOCHASTIC S(T)=S(T‑ 1)[1.0+R] TREND PRICE COMPONENT R = µ∆t + σ∆z DAY ∆z S(T)=S(T‑ 1)[1.00050] (0.0261725)∆z ∆t = 1 DAY 0 1.000000 1.000000 1 ‑ 2.48007 1.000500 ‑ 0.064910 0.935590 2 ‑ 0.87537 1.001000 ‑ 0.022911 0.914623 3 ‑ 0.80587 1.001501 ‑ 0.021092 0.895789 4 ‑ 1.03927 1.002002 ‑ 0.027200 0.871871 5 0.10523 1.002503 0.002754 0.874709 6 0.66993 1.003004 0.017534 0.890483 7 ‑ 0.21137 1.003505 ‑ 0.005532 0.886002 8 2.19733 1.004007 0.057510 0.937398 9 ‑ 0.82807 1.004509 ‑ 0.021673 0.917551 10 0.58783 1.005011 0.015385 0.932126 ©David

- 38. The Result (Multiplying by 100): A Graph of a Stock Price Following a Geometric Brownian Motion Process 110.000 Price (times 100) 100.000 90.000 80.000 1 6 11 16 21 26 31 36 41 46 51 56 61 Day ©David

- 39. Risk-Neutral Valuation • The variable µ does not appear in the Black-Scholes equation. • The equation is independent of all variables affected by risk preference. • The solution to the differential equation is therefore the same in a risk- free world as it is in the real world. • This leads to the principle of risk-neutral valuation. Applying Risk-Neutral Valuation: 1. Assume that the expected return from the stock price is the risk-free rate. 2. Calculate the expected payoff from the option. 3. Discount at the risk-free rate. ©David

- 40. Two Simple and Accurate Approximations for Estimating Implied Volatility 1. Brenner-Subramanyam formula. Suppose: S = Ke − rT then, 2π C σ≈ × T S ©David

- 41. 2. Corrado and Miller Quadratic formula. S − Ke −rT C − ÷ 8π 2 If S > Ke −rT : σ≈ × T 3S − Ke −rT S − Ke −rT C − ÷ 8π 2 If S ≤ Ke −rT : σ≈ × T 3Ke −rT −S ©David

- 42. Let’s Have a Horse Race • Data: S = 54, K = 55, C = 1.4375, 29 days to expiration (T=29/365), r = 3%. We can verify: • The actual ISD is 30.06%. • Brenner-Subramanyam estimated ISD is 23.67%. • Corrado-Miller estimated ISD is 30.09%. ©David