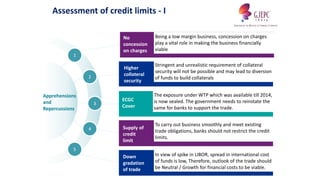

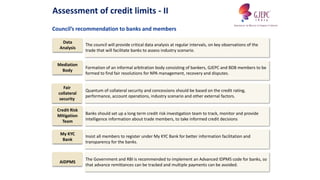

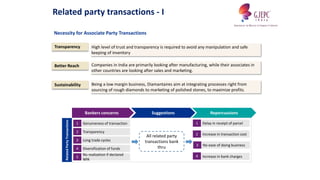

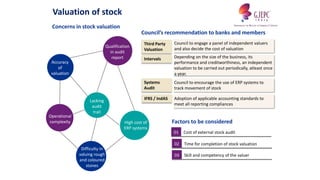

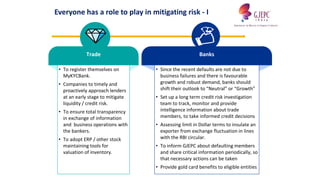

This document discusses several proposals to improve financing conditions for the diamond and jewelry industry in India. It summarizes concerns from banks and trade members and makes recommendations. Key points include establishing a credit risk team at banks to better assess members, encouraging use of technology like ERP systems for inventory tracking, setting guidelines for collateral requirements based on credit ratings, and forming an informal arbitration body to resolve disputes and non-performing asset issues. The document also addresses proposals around related party transactions, stock valuation, and the role of government agencies in providing support.