More Related Content

Similar to IN-116 - Income Tax Payment Voucher

Similar to IN-116 - Income Tax Payment Voucher (20)

More from taxman taxman (20)

IN-116 - Income Tax Payment Voucher

- 1. *071131199*

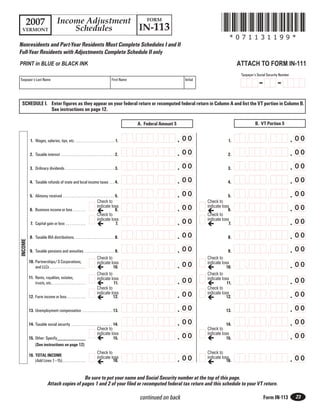

Income Adjustment FORM

2007

IN-113

Schedules

VERMONT

*071131199*

Nonresidents and Part-Year Residents Must Complete Schedules I and II

Full-Year Residents with Adjustments Complete Schedule II only

ATTACH TO FORM IN-111

PRINT in BLUE or BLACK INK

Taxpayer’s Social Security Number

- -

Taxpayer’s Last Name First Name Initial

SCHEDULE I. Enter figures as they appear on your federal return or recomputed federal return in Column A and list the VT portion in Column B.

See instructions on page 12.

B. VT Portion $

A. Federal Amount $

. 00 . 00

, ,

, ,

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . 1. 1.

. 00 . 00

, ,

, ,

2. Taxable interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. 2.

. 00 . 00

, ,

, ,

3. Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. 3.

. 00 . 00

, ,

, ,

4. Taxable refunds of state and local income taxes . . . 4. 4.

. 00 . 00

, ,

, ,

5. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. 5.

Check to Check to

. 00 . 00

, ,

, ,

indicate loss indicate loss

6. Business income or loss . . . . . . . 6. 6.

Check to

Check to

. 00 . 00

indicate loss

indicate loss

, ,

, ,

7. Capital gain or loss . . . . . . . . . . . 7. 7.

. 00 . 00

, ,

, ,

8. Taxable IRA distributions. . . . . . . . . . . . . . . . . . . . . . . 8. 8.

INCOME

. 00 . 00

, ,

, ,

9. Taxable pensions and annuities . . . . . . . . . . . . . . . . . 9. 9.

Check to Check to

10. Partnerships/S Corporations,

. 00 . 00

indicate loss indicate loss

, ,

, ,

and LLCs . . . . . . . . . . . . . . . . . . . . 10. 10.

Check to Check to

11. Rents, royalties, estates,

. 00 . 00

indicate loss indicate loss

, ,

, ,

trusts, etc.. . . . . . . . . . . . . . . . . . . 11. 11.

Check to Check to

. 00 . 00

, ,

, ,

indicate loss indicate loss

12. Farm income or loss. . . . . . . . . . . 12. 12.

. 00 . 00

, ,

, ,

13. Unemployment compensation . . . . . . . . . . . . . . . . . 13. 13.

. 00 . 00

, ,

, ,

14. Taxable social security . . . . . . . . . . . . . . . . . . . . . . . 14. 14.

Check to Check to

indicate loss indicate loss

. 00 . 00

, ,

, ,

15. Other: Specify____________ 15. 15.

(See instructions on page 12)

Check to

Check to

16. TOTAL INCOME

. 00 . 00

, ,

, ,

indicate loss

indicate loss

(Add Lines 1–15) . . . . . . . . . . . . . 16. 16.

Be sure to put your name and Social Security number at the top of this page.

Attach copies of pages 1 and 2 of your filed or recomputed federal tax return and this schedule to your VT return.

continued on back 23

Form IN-113

- 2. *071131299*

Form IN-113, page 2

*071131299*

Carried forward from __________________________________ _______________________________

Line 16A Line 16B

A. Federal Amount $ B. VT Portion $

17. IRA (1040-Line 32; or 1040A-Line 17); Keogh/SEP/SIMPLE (1040-Line 28):

. 00 . 00

, ,

, ,

Self ______________17.Spouse ______________ . . . . . . 17. 17.

18. Education Deductions: Educator expenses (1040-Line 23;

. 00

. 00 ,

1040A-Line 16); Student Loan Interest (1040-Line 33; 1040A-Line 18);

,

,

,

Tuition fees (1040-Line 34; 1040A-Line 19). . . . . . . . . . . . . . . . . . . . . . . . 18. 18.

. 00 . 00

19. Employee Deductions: Reservists, Performing Artists, Fee-basis

, ,

, ,

Gov’t Officials (1040-Line 24) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19. 19.

20. Self-Employment Deductions: Tax (1040-Line 27), and Health

. 00 . 00

, ,

, ,

Insurance (1040-Line 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20. 20.

. 00 . 00

, ,

, ,

ADJUSTMENTS TO INCOME

21. Health Savings Account (1040-Line 25) . . . . . . . . . . . . . . . . . . . . . . . . . . . 21. 21.

. 00 . 00

, ,

, ,

22. Moving Expenses (1040-Line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22. 22.

. 00 . 00

, ,

, ,

23. Penalty on Early Withdrawal of Savings (1040-Line 30) . . . . . . . . . . . . . . . 23. 23.

. 00 . 00

, ,

, ,

24. Alimony Paid (1040-Line 31a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24. 24.

. 00 . 00

, ,

, ,

25. Domestic Production Activities (1040-Line 35). . . . . . . . . . . . . . . . . . . . . 25. 25.

. 00 . 00

, ,

, ,

26. Deductions not listed above but included on 1040-Line 36 . . . . . . . . . . . 26. 26.

. 00 . 00

, ,

, ,

27. TOTAL ADJUSTMENTS (Add Lines 17 – 26) . . . . . . . . . . . . . . . . . . . . . 27. 27.

Check to indicate

. 00

,

,

loss

28. Adjusted Gross Income (Subtract Line 27A from Line 16A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.

Check to indicate

. 00

,

,

loss

29. VT Portion of AGI (Subtract Line 27B from Line 16B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29.

Check to indicate

. 00

,

,

loss

30. Non-VT Income (Subtract Line 29 from Line 28. Enter result here and on Schedule II, Line 32 below). . 30.

Dates of VT residency in 2007: From ____________ to ____________ Name of state(s), Canadian province or country during non-VT residency: __________________

SCHEDULE II. Adjustment for VT Exempt Income

Check to indicate

31. Adjusted Gross Income If Schedule I completed, enter Line 28.

. 00

,

,

loss

Otherwise, enter amount from Form IN-111, Section 2, Line 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.

Check to indicate

. 00

,

, (Full-year VT residents enter 0 on Line 32)

loss

32. Non-VT Income . . . . . . . . . . . . . . . . . . . . . . . . . . . 32.

(Enter amount from Line 30 above)

Part-Year Residents: For Lines 33-39

Enter only income included in Schedule I, Line 29

. 00

,

,

33. Military pay. Number of months on active duty____ (See instructions) . 33.

. 00

,

,

VT EXEMPT INCOME

34. Federal Employment Opportunity income adjustment . . . . . . . . . . . . . . . 34.

. 00

,

,

35. Railroad Retirement income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.

. 00

36. VT State payments to a family for support of developmentally

,

,

disabled person(s) (See instructions on page 44) . . . . . . . . . . . . . . . . . . 36.

. 00

,

,

37. Americans with Disabilities Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37.

. 00

,

,

38. Nonresident Commercial Film Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38.

. 00

,

,

39. VT Telecommunication Authority bond/note interest . . . . . . . . . . . . . . . 39.

Check to indicate

. 00

,

,

loss

40. Total (Add Lines 32-39) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40.

Check to indicate

. 00

,

,

loss

41. VT income (Subtract Line 40 from Line 31). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41.

. %

42. INCOME ADJUSTMENT % (Divide Line 41 by Line 31) Enter here and on Form IN-111, Section 4, Line 21. See instructions. . . . . . . . . . . . . . . . . $ 42.

Form IN-113

24