Markov-Switching Models for Volatility Forecasting and Trading

- 1. Page 1 of 16 (Version 1) Volatility trading using Markov-Regime Switching models: Dynamic replication of variance swap Chong Seng Choi Imperial College London, MSc ARTICLE INFO ABSTRACT Keywords: Markov-Switching Multifractal model Markov-Swithing GARCH model Volatility Variance swap Volatility trading In this paper, I evaluate the performance of Markov-Switching Multifractal model and Markov-Switching GARCH in forecasting and trading volatility. Using data on four major U.S index, I find the following results. First, MSM outperforms MS-GARCH out-of-sample at forecasting horizons of 10-50 days but is comparable to MS-GARCH at 1-day forecasting horizon. Second, MS- GARCH generates too high a forecast in volatile period and for assets with high historical volatility and too low a forecast in low volatility environment and in multi-step ahead forecast. In contrast, MSM is able to capture the multiscaling and long memory characteristics of volatility as well as structural changes in the volatility process. Third, in terms of trading profits, MS- GARCH outperforms MSM in both intra-day volatility and monthly variance swap trading. However, I find that the outperformance in monthly trading is due to inefficient market pricing of implied volatilities, which tend to be under- priced in volatile period but over-priced in low volatility period. Lastly, using at-the-money implied volatility as predictor of the direction of future realized volatility, I find significant return from monthly variance swap trading - results that lend support to the conclusion that implied volatilities are mispriced. 1. Introduction Volatility of asset returns is an integral part of profitably trading and pricing of financial derivatives such as options. However, the time-varying and high persistent characteristics of volatility mean that volatility can move suddenly but also clusters around different volatility levels. Early empirical researches have showed that volatility clustering can remain substantial over long horizons (Ding, Granger, and Engle, 1993) but volatility persistence can vary from a horizon of few days to few years. Thus, under the conditions that volatility is both highly persistence and highly variable, it is natural to expect that volatility fluctuations have significant impact on valuation and risk- management. Many academia and practitioners use autoregressive conditional heteroskedasticity (ARCH) model by Engle (1982) and the generalized ARCH (GARCH) model by Bollerslev (1986) to model time-varying volatility. Although ARCH/GARCH models generally provide better forecasts over historical and implied volatility, Klaassen (2002) showed, using daily data on U.S dollar exchange rates, that these models generate forecasts that are, nonetheless, too high in volatile periods. Klaassen (2002) attributed the excessive GARCH forecasts to the well- known high persistence of individual shocks in those forecasts. According to Lamoureux and Lastrapes (1990), as cited by Klaassen (2002), persistence of shocks in volatility may originate from structural change in the volatility process, if shocks persist and remain constant for some time, albeit short, the persistence of shocks in those periods may result in volatility persistence. Standard GARCH models, which pick up the short-run autocorrelation in volatility, put all volatility persistence in the persistence of individual shocks (Klaassen, 2002). For this reason, one would expect to improve forecasts by incorporating the structural changes in volatility process in GARCH models. Markov regime-switching model, first adopted by Hamilton (1989, 1990) to describe the U.S. business cycle, can be used to describe the switches between regimes with different volatility process. Klaassen (2002) developed a two-regimes GARCH model to solve the problem of excessive GARCH forecasts. The resulting Markov-Switching GARCH permits the conditional mean and return volatility to depend on an unobserved latent state that switches stochastically, thus capturing the changes in volatility dynamics while yielding an extra source of volatility persistence.

- 2. Page 2 of 16 Although MS-GARCH generally improves upon standard GARCH model, application of the MS-GARCH requires researchers to process separately regime switches at different frequencies and rely on GARCH components to capture the autoregressive dynamics in volatility. If one thinks of volatility as consisting finitely many states, with each state capturing different degree of volatility persistence, regime-switching ARCH/GARCH models quickly become unusable when one tries to incorporate the entire volatility dynamic as the number of parameters grows quadratically with the number of regimes. The Markov-Switching Multifractal model of Calvet and Fisher (2004) breaks this barrier by assuming that volatility is the product of large number discrete states, each of which represents different degree of frequencies and can randomly switch to a new value drawn from a pre-specified distribution. Volatility jumps when regime switches affect the high frequency components of volatility but the change in volatility can be extremely persistent if the switches affect the low frequency components. The multi-frequency structure of the model is consistent with the intuition that volatility shocks have highly heterogeneous degrees of persistence, and the decomposition of volatility into frequency components means that MSM can capture long- memory feature in volatility, intermediate volatility transition, and high-frequency volatility shocks all within a single regime-switching model. This paper examines the forecasting performance of MS- GARCH 1 and MSM and compares their performance according to a set of statistical loss functions and the trading profits obtained from a portfolio of hedged options that replicates the payoffs of variance swaps. Section 1 reviews the Markov-Switching GARCH. Section 2 devotes into details of MSM model. Section 3 describes the data and out- of-sample results. Section 4 discusses the trading strategies and performance. Section 5 concludes. 2. Markov-Switching GARCH2 The main feature of Markov-Switching GARCH is that it combines short-run autoregressive dynamics of GARCH with regime switches to capture structural changes in the data generating process (Gray, 1996; Klaassen, 2002). Let 𝑠" 𝜖 1,2 be the variance regime at time t in which 𝑠" = 1 denotes the low variance regime and otherwise. Further, it is assumed that the latent state 𝑠" follows a first-order Markov process with transition probability 𝑝*+ = ℙ 𝑠" = 𝑗 𝑠"./ = 𝑖) which represents the probability that state 𝑖 will be followed by state 𝑗 (Hamilton, 1994). Collecting the probabilities in matrix form, the transition matrix of a two- state Markov chain is given by 1 Appendix 1 provides a formal review of the properties of standard GARCH model and its likelihood function. 2 The first Markov-Switching GARCH was introduced by Gray (1996) but the model does not permit a convenient ℙ = 𝑝// 1 − 𝑝33 1 − 𝑝// 𝑝33 where 𝑝//is the probability of going to regime 1 and 1 − 𝑝// is the probability of going to regime 2 given that the current state is regime 1. Hence, in the most general form, a two-state Markov- Switching GARCH can be written as 𝑟"|𝐼"./ ~ 𝑓(𝜃" / ) 𝑓(𝜃" 3 ) 𝑤𝑖𝑡ℎ 𝑝𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑝/," 𝑤𝑖𝑡ℎ 𝑝𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 1 − 𝑝/," where 𝐼"./ denotes the information set at date 𝑡 − 1 , 𝑓 · represents the conditional distribution of the variance process and 𝜃" * denotes the vector of parameters in the 𝑖-𝑡ℎ variance regime that characterizes the distribution. For regime 𝑖 𝜖 1,2 , let ℎ" * = 𝑉𝑎𝑟"./ 𝑟" 𝑠" = 𝑖) be the variance of return 𝑟" conditional on 𝑠" = 𝑖 and past return {𝑟+}+G* "./ . Klaassen (2002) assumes that, given the unobserved regime path 𝑠" = (𝑠", 𝑠"./…), the conditional variance of 𝑟" equals 𝑉𝑎𝑟"./ 𝑟" 𝑠") and thus the conditional dynamics of his specification equal ℎ" * 𝑟" 𝑠" = 𝜔* + 𝛼* 𝜀3 "./ + 𝛽* Ε"./ ℎ* "./ 𝑟"./ 𝑠"./ 𝑠" ] and 𝑟" = 𝜇" * + 𝜀" = 𝜇" * + 𝜂" ℎ" * where 𝜇* = Ε 𝑟" 𝐼"./) is the conditional mean of regime 𝑖, 𝜂" is a zero mean, unit variance process. The conditional variance not only depends on information 𝐼"./ and 𝑟" but also depends on the regime path 𝑠"./ . To simplify computation, Klaassen integrated out the regime 𝑠"./ at time 𝑡 − 1 such that ℎ"./ 𝑟"./ 𝑠"./ is independent of 𝑠".3 and ℎ" 𝑟" 𝑠" depends on the current regime only, thus ℎ" * 𝑟" 𝑠" = 𝜔* + 𝛼* 𝜀3 "./ + 𝛽* Ε"./ ℎ* "./ 𝑟"./ 𝑠"./ 𝑠" ] Further, one of the main advantages of Klaassen’s (2002) specification over Gray’s (1996) is that it allows for convenient multi-step ahead volatility forecasts for which forecasts at time 𝑇 depend only on information at time 𝑇 − 1. Let ℎS,STU be the 𝜏-day later volatility forecast at date 𝑇, the total volatility over a period of 𝐾 days from 𝑇 + 1 to 𝑇 + 𝐾 is calculated as follows: multi-period ahead variance forecasts. For simplicity, this paper uses the model proposed by Klaassen (2002) and will be focusing on normal distribution.

- 3. Page 3 of 16 ℎST/: STY = Pr 𝑠STU = 𝑖 𝐼S./) ℎS,STU {𝑠STU = 𝑖} 3 *G/ Y UG/ where ℎS,STU {𝑠STU = 𝑖} is 𝜏-day ahead volatility forecast in regime 𝑖 made at date 𝑇 and can be calculated as follows: ℎS,STU 𝑠STU = 𝑖 = Ε"./ ℎSTU./ 𝑠STU = 𝑖 = 𝜔]^_G* + 𝛼]^_G* Ε"./ 𝜀STU./ 3 𝑠STU = 𝑖 + 𝛽]^_G* Ε"./ ℎ* STU./ 𝑠STU = 𝑖 ] = 𝜔]^_G* + 𝛼]^_G* Ε"./ Ε"./ 𝜀STU./ 3 𝑠STU 𝑠STU = 𝑖 + 𝛽]^_G* Ε"./ ℎ* STU./ 𝑠STU = 𝑖 ] = 𝜔]^_G* + 𝛼]^_G* + 𝛽]^_G* Ε"./ ℎS,STU./ 𝑠STU = 𝑖 Hence, the forecast is a weighted average of volatility forecast in each regime where the weights are the ex ante probabilities Pr 𝑠STU = 𝑖 𝐼S./) given by Pr 𝑠STU = 1 𝐼S./) Pr 𝑠STU = 2 𝐼S./) = ℙ ∙ Pr 𝑠S./ = 1 𝐼S./) Pr 𝑠S./ = 2 𝐼S./) where ℙ is the transition matrix and Pr 𝑠S./ = 1 𝐼S./) will be discussed in more detail later. Let us first derive the expectation for Ε"./ ℎS,STU./ 𝑠STU = 𝑖 : Ε"./ ℎS,STU./ 𝑠STU = 𝑖 = E ℎSTU./ 𝑠STU = 𝑖 , 𝐼S./ = E Ε 𝑟STU./ 3 𝑠STU = 𝑗 , 𝐼S./ − Ε 𝑟STU./ 𝑠STU = 𝑗 , 𝐼S./ 3 𝑠STU = 𝑖 , 𝐼S./ = E Ε 𝑟STU./ 3 𝑠STU = 𝑗 , 𝐼S./ 𝑠STU = 𝑖 , 𝐼S./ −E Ε 𝑟STU./ 𝑠STU = 𝑗 , 𝐼S./ 3 𝑠STU = 𝑖 , 𝐼S./ where, E Ε 𝑟STU./ 3 𝑠STU = 𝑗 , 𝐼S./ 𝑠STU = 𝑖 , 𝐼S./ = Ε 𝑟STU./ 3 𝑠STU = 𝑗 , 𝐼S./ 3 +G/ ∙ Pr 𝑠STU./ = 𝑗 𝑠STU./ = 𝑖 , 𝐼S./) = Ε 𝜇STU./ + 𝜀STU./ 3 𝑠STU = 𝑗 , 𝐼S./ 3 +G/ ∙ Pr 𝑠STU./ = 𝑗 𝑠STU./ = 𝑖 , 𝐼S./) = 𝑝+*,"./ Ε 𝜇STU./ 3 + ℎSTU./ 𝑠STU = 𝑗 , 𝐼S./ 3 +G/ Applying the same reasoning to the second term, we have E Ε 𝑟STU./ 𝑠STU = 𝑗 , 𝐼S./ 3 𝑠STU = 𝑖 , 𝐼S./ = 𝑝+*,"./ Ε 𝜇STU./ 𝑠STU = 𝑗 , 𝐼S./ 3 3 +G/ where, 𝑝+*,S./ = Pr 𝑠STU./ = 𝑗 𝑠STU = 𝑖 , 𝐼S./) = 𝑝+* Pr 𝑠STU./ = 𝑗 𝐼S./) Pr 𝑠STU./ = 𝑖 𝐼S./) and, Ε"./ ℎS,STU./ 𝑠STU = 𝑖 = 𝑝+*,"./ Ε 𝜇STU./ 3 + ℎSTU./ 𝑠STU = 𝑗 , 𝐼S./ 3 +G/ − 𝑝+*,"./ Ε 𝜇STU./ 𝑠STU = 𝑗 , 𝐼S./ 3 3 +G/ For example, Ε"./ ℎ / "./ 𝑠"] = 𝑝//,"./ 𝜇"./ / 3 + ℎ / "./ + (1 − 𝑝//,"./) 𝜇"./ 3 3 + ℎ 3 "./ − [ 𝑝//,"./ 𝜇"./ / + 1 − 𝑝//,"./ 𝜇"./ 3 ]3 To calculate the regime probabilities, let us recall from above that the conditional distribution of the return series 𝑟" can be written as 𝑟"|𝐼"./ ~ 𝑓(𝑟"|𝑠" = 1 , 𝐼"./) 𝑓(𝑟"|𝑠" = 2 , 𝐼"./) 𝑤𝑖𝑡ℎ 𝑝𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑝/," 𝑤𝑖𝑡ℎ 𝑝𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 1 − 𝑝/," where 𝑓(𝑟"|𝑠" = 1 , 𝐼"./) denotes the assumed distribution of the return series, i.e. a normal distribution. Then given Pr 𝑠" = 𝑖 𝐼"./) at time 𝑡 − 1, the regime probabilities can be calculated as 𝑝*" = Pr 𝑠" = 𝑖 𝐼"./) = Pr 𝑠" = 𝑖 , 𝑠"./ = 𝑗 𝐼"./) 3 +G/ = Pr 𝑠" = 𝑖 𝑠"./ = 𝑗) 3 +G/ Pr 𝑠".3 = 𝑗 𝐼"./) = 𝑝+* Pr 𝑠"./ = 𝑗 𝐼"./) 3 +G/

- 4. Page 4 of 16 because the current regime 𝑠" depends only on the regime one period ago 𝑠"./. Moreover, at the end of time 𝑡, we can observe the return at time 𝑡 along with the information set. Thus, Pr 𝑠" = 𝑖 𝐼") can be calculated as follows: Pr 𝑠" = 𝑖 𝐼") = Pr 𝑠" = 𝑖 𝑟", 𝐼") = 𝑓(𝑟", 𝑠" = 𝑖 , 𝐼"./) 𝑓(𝑟" | 𝐼"./) where 𝑓 𝑟", 𝑠" = 𝑖 , 𝐼"./ = 𝑓 𝑟"|𝑠" = 𝑖 , 𝐼"./ 𝑓 𝑠" = 𝑖 | 𝐼"./ = 𝑓 𝑟"|𝑠" = 𝑖 , 𝐼"./ Pr 𝑠" = 𝑖 𝐼"./) and 𝑓(𝑟" | 𝐼"./) = 𝑓 𝑟", 𝑠" = 𝑖 | 𝐼"./ 3 *G/ = 𝑓 𝑟"|𝑠" 3 *G/ = 𝑖 , 𝐼"./ Pr 𝑠" = 𝑖 𝐼"./) denote respectively the joint density of returns and the 𝑖-𝑡ℎ regime, and marginal density function of returns. Hence, Pr 𝑠" = 𝑖 𝐼") = 𝑓(𝑟", 𝑠" = 𝑖 , 𝐼"./) 𝑓(𝑟" | 𝐼"./) = 𝑓 𝑟"|𝑠" = 𝑖 , 𝐼"./ Pr 𝑠" = 𝑖 𝐼"./) 𝑓 𝑟"|𝑠" = 𝑖 , 𝐼"./ Pr 𝑠" = 𝑖 𝐼"./)3 *G/ = 𝑝*" 𝑓 𝑟"|𝑠" = 𝑖 , 𝐼"./ 𝑝*" 𝑓 𝑟"|𝑠" = 𝑖 , 𝐼"./ 3 *G/ Lastly, the likelihood function for calculating the model parameters is given by ℒ 𝜃 = log Pr 𝑠" = 1 𝐼"./ S "G/ 𝑓 𝑟" 𝑠" = 1, 𝐼"./) + [1 − Pr 𝑠" = 1 𝐼"./)] 𝑓 𝑟" 𝑠" = 2, 𝐼"./)] where 𝑓 𝑟" 𝑠" = 𝑖, 𝐼"./) = 1 2𝜋ℎ" * exp −0.5 (𝑟" − 𝜇" * )3 ℎ" * 3 According to Lux, Arias and Sattarhoff (2011), the notion of multiscaling or multifractality in financial time series data refers to ‘the variations in the scaling behavior of 2. Markov-Switching Multifractal model The Markov-Switching Multifractal model of Calvet and Fisher (2004) is fundamentally different from GARCH- class models in that it incorporates the multiscaling3 or multifractality behaviour of time-series data (Lux and Kaizoji, 2007). MSM assumed that instantaneous volatility is determined by the product of 𝑘 random multipliers, 𝑀" = (𝑀/,", 𝑀3," … 𝑀p,") ∈ ℝT p , with heterogeneous decay rates, and that financial return is of the form 𝑟" = 𝜎" 𝜖". In this specification, return volatility 𝜎" is decomposed into large number of volatility components and is driven by the following multiplicative structure 𝜎" = 𝜎 𝑀*," p *G/ //3 where the scale factor 𝜎 is the unconditional standard deviation of innovation 𝑟" and the volatility components 𝑀p," are independent, persistent, non-negative and satisfy the conditions 𝑀p," ≥ 0 and Ε(𝑀p,") = 1. Thus, for any state values 𝑚 = (𝑚/,", 𝑚3," … 𝑚p,") ∈ ℝT p if 𝑔(𝑚) denotes the product 𝑚*," p *G/ , the stochastic volatility process can be written as 𝜎" = 𝜎[𝑔 𝑚 ]//3 (Calvet and Fisher, 2004). The volatility components of the state vector 𝑀" are assumed to have the same marginal distribution but evolves at different frequencies. For example, if the volatility state vector is constructed up to date 𝑡, then for 𝑘 ∈ {1, … , 𝑘 }, the next period multiplier 𝑀p,"T/ is drawn from a pre- defined distribution 𝑀 with probability 𝛾p and is otherwise equal to its previous value 𝑀p,"T/ = 𝑀p," with probability 1 − 𝛾p. The switching probabilities 𝛾 ≡ (𝛾/, 𝛾3, … , 𝛾p) are given by 𝛾* = 1−(1 − 𝛾p)z{.p where 𝛾p ∈ (0,1) and 𝑏 ∈ (1, ∞). The specification implies that the switching probabilities of low frequency components increase approximately at geometric rate 𝑏 while the switching probabilities of high frequency components converge to 1, (𝛾* ~ 1) . This is consistent with the intuition that volatility jumps frequently (high frequency switches) but is less likely to cluster around its long-run mean (low frequency switches). Although MSM imposes minimal restrictions on the distribution of 𝑀p , this paper follows the lognormal distribution of Lux, Arias and Sattarhoff (2011) in which the various moments or to different degrees of long-term dependence of various moments’ (p.5).

- 5. Page 5 of 16 random multipliers take the form of 𝑀p,"~ 𝑓(−𝜆, 𝜈3 ). The condition that Ε(𝑀p,") = 1 leads to exp −𝜆 + 0.5𝜈3 = 1, where the shape parameter 𝜈 = 2𝜆 . Thus, the full parameter vector of MSM is 𝜃 ≡ (𝜆, 𝜎, 𝑏, 𝛾p) ∈ ℝT p where 𝜆 characterizes the distribution of the volatility components, 𝜎 is the unconditional return volatility, 𝑏 and 𝛾p specifies the transition probabilities. Similar to MS-GARCH/ARCH models, the volatility state vector 𝑀" is assumed to follow a first-order Markov process and its dynamics are characterized by the transition matrix ℙ with transition probabilities 𝑝*+ = Pr 𝑀"T/ = 𝑚* 𝑀" = 𝑚+). Since the state vector 𝑀" is latent, one can only observe the returns, 𝑟" = 𝜎[𝑔 𝑚 ]//3 𝜖", but not the state vector. The state vector 𝑀" must therefore be computed recursively by Bayesian updating (Calvet and Fisher, 2004). Let Π" + = Pr (𝑀" = 𝑚+ |𝑟/, 𝑟3, … , 𝑟") denotes the conditional probabilities that the period 𝑡 volatility state takes the value 𝑚+ conditional on past returns. The conditional probabilities4 for the unobserved state values (𝑚/ , 𝑚3 , … , 𝑚+ ) can be computed by Π" = 𝑓 𝑟" 𝑀" = 𝑚+ )⨀ (Π"./ℙ) 𝑓 𝑟" 𝑀" = 𝑚+ ⨀ (Π"./ℙ)]1′ where 𝑎 𝑏 denotes the Hadamard product (𝑎/ 𝑏/, … , 𝑎+ 𝑏+) ∈ ℝ+ , ℙ denotes the transition matrix, and 𝑓 𝑟" 𝑀" = 𝑚+ ) is given by 𝑓 𝑟" 𝑀" = 𝑚+ ) = 1 2𝜋 exp −0.5 𝑟" 𝜎 𝑔 𝑚 3 𝜎 𝑔 𝑚 Similarity, multi-step ahead forecast can be calculated by 𝜎ST/: STY = 𝜎 Pr 𝑀STU = 𝑚* 𝐼S./) 𝑚* / 3 + *G/ Y UG/ where the ex ante probabilities Pr 𝑀STU = 𝑚* 𝐼S./) = Π"ℙU . The log likelihood function is given by ℒ 𝜃 = 𝑙𝑛 S "G/ 𝑓 𝑟" 𝑀" = 𝑚+ ) ∗ (Π"./ℙ) (Hamilton, 1994; Calvet and Fisher, 2004) 4 Similar to MS-GARCH, the initial vector Π„ is chosen to be the ergodic distribution of the Markov process. 5 For the 20-day forecasting horizon, the number of days corresponds to the number of actual trading days in any 3. Data I consider four major U.S. equity indices namely S&P500, S&P100, Dow and NASDAQ 100, whose characteristics are summarized in Appendix 2. The sample uses the daily adjusted closing prices of the indices and covers the period from July 1997 to July 2017, resulting in 5031 daily observations. To calculate the 1-month implied variance swap strikes, I use the implied volatilities derived from at- the-money options with 1-month to expiration. For delta hedging, I use the adjusted closing prices of the indices’ front month futures. All data are obtained from Bloomberg. 3.1 Forecasting methodology Using maximum likelihood, I employ a rolling window forecasting method where I estimate the parameters of the models in-sample with data up to date 𝑡 and use the parameters to forecast volatility 𝑘 period ahead for horizons 𝑘 = 1,10, 𝟐𝟎, 505 . I then re-estimate the parameters of the models with data up to date 𝑡 + 𝑘. Moreover, to evaluate the forecasting performance in different period, I separate the out-of-sample results in three different periods. The first sample corresponds to the turmoil period from July 2007 to July 2012. The second sample corresponds to the tranquil period from July 2012 to July 2017. The third sample contains the full forecasting results. 3.2 Performance measure As has been pointed out by previous studies such as Bollerslev, Engle and Nelson (1994), it is difficult to choose a particular statistical loss function as the best and unique standard to evaluate the forecasting performance of volatility models. Therefore, I employ the following four popular loss functions: 𝑀𝐴𝐸 = 1 𝑇 | S "G"Tp 𝜎" − 𝜎"| 𝑀𝑆𝐸 = 1 𝑇 ( S "G"Tp 𝜎" − 𝜎" )3 𝑅3 𝑙𝑜𝑔 = 1 𝑇 ln 𝜎" 𝜎" 3 S "G"Tp 𝑄𝐿𝐼𝐾𝐸 = 1 𝑇 ln 𝜎" 3 + S "G"Tp 𝜎" 3 𝜎" 3 where 𝜎" is the volatility forecast and 𝜎" is the 𝑘 period realized volatility computed as 𝑟" 3"Tp "G"T/ . Furthermore, when evaluating forecasting accuracy of different models, it given month. For example, the number of trading days in July 2007 is 21 days and thus the forecasting horizon corresponds to 𝜎ST/: ST3/.

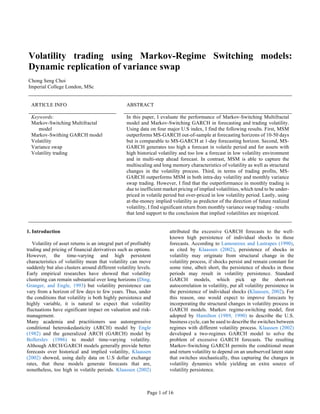

- 6. Page 6 of 16 would be useful to determine the number of times that a particular model has successfully predicted the change in the direction of realized volatility. For this analysis, I use a simple measure denoted as Success Rate (SR) to calculate the percentage of time that a model has successfully forecasted the direction of 𝑘 period ahead volatility. The results are summarized in Table 1 and Appendix 3 plots the one-month volatility forecasts versus the subsequent realized volatility. Table 1: Multi-step ahead forecasting results I. One-day ahead forecasting results II. Ten-day ahead forecasting results III. One-month ahead forecasting results Table 1: Loss function statistics and Success Rate. The table display results of the relative MAE, MSE, QLIKE, 𝑅3 𝑙𝑜𝑔 and SR for each forecasting horizon 𝑘 = 1,10,20,50. The models in comparison are MSM with 8 volatility states and Two-regime MS- GARCH (MSG). The forecasting performance is measured using daily absolute returns 𝑟" 3"Tp "G"T/ , where 𝑟" = 100 ∗ log 𝑠" − log 𝑠"./ . Numbers in bold indicate that the corresponding models have the lowest forecasting losses or the highest success rate. MAE MSE QLIKE SR MAE MSE QLIKE SR MAE MSE QLIKE SR MSM 0.86 1.3 1.58 2.17 73.33% 0.45 0.32 0.4 2.34 67.09% 0.65 0.81 0.99 2.25 70.23% MSG 1.16 3.25 1.85 2.37 69.13% 0.43 0.35 2.14 2.06 70.75% 0.79 1.8 1.99 2.22 69.95% MSM 0.83 1.22 1.51 1.96 71.90% 0.45 0.31 0.38 2.23 66.93% 0.64 0.77 0.94 2.09 69.43% MSG 1.18 3.49 1.77 2.21 67.46% 0.43 0.37 2.3 1.93 70.59% 0.8 1.93 2.03 2.07 69.04% MSM 0.78 1.07 1.39 2.02 71.35% 0.43 0.28 0.32 2.17 68.20% 0.61 0.68 0.86 2.09 69.79% MSG 0.99 2.57 1.98 2.05 70.63% 0.4 0.3 2.26 1.83 72.26% 0.69 1.43 2.12 1.94 71.46% MSM 0.91 1.41 1.75 2.03 70.56% 0.56 0.46 0.77 2.17 67.41% 0.73 0.94 1.26 2.1 69.00% MSG 2.14 16.23 2.13 2.94 61.59% 0.71 1.15 1.02 2.35 65.90% 1.43 8.69 1.57 2.64 63.76% SPXOEXDJINDX Tranquil period Full periodTurmoil period !"#$% !"#$% !"#$% MAE MSE QLIKE SR MAE MSE QLIKE SR MAE MSE QLIKE SR MSM 4.68 38.91 5.88 0.25 58.87% 2.95 13.07 4.7 0.35 54.76% 3.81 25.89 5.29 0.3 56.57% MSG 6.08 107.06 5.99 0.27 50.81% 2.51 11.29 5.55 0.37 44.44% 4.28 58.79 5.77 0.32 47.41% MSM 4.54 37.32 5.81 0.26 57.26% 2.87 12.56 4.66 0.36 52.38% 3.7 24.84 5.23 0.31 54.58% MSG 6.58 130.03 5.91 0.31 49.19% 2.58 11.93 5.7 0.4 45.24% 4.56 70.51 5.8 0.35 47.01% MSM 4.33 33.97 5.71 0.27 57.26% 2.79 11.38 4.62 0.34 53.97% 3.55 22.59 5.16 0.31 55.38% MSG 5.38 98.51 6.09 0.29 51.61% 2.31 9.67 6.17 0.42 46.03% 3.83 53.74 6.13 0.36 49.00% MSM 5.04 42.84 6.08 0.25 50.81% 3.35 17.54 5.06 0.34 54.76% 4.19 30.09 5.56 0.3 52.59% MSG 20.16 1314.02 6.66 0.9 45.97% 5.68 101.92 5.24 0.55 50.79% 12.86 703.16 5.95 0.72 48.21% NDX Turmoil period Tranquil period Full period SPXOEXDJI !"#$% !"#$% !"#$% MAE MSE QLIKE SR MAE MSE QLIKE SR MAE MSE QLIKE SR MSM 8.97 134.95 7.33 0.22 57.63% 6.24 59.36 6.17 0.32 50.85% 7.6 97.16 6.75 0.27 53.78% MSG 8.67 188.04 7.77 0.24 49.15% 5.47 50.33 7.99 0.49 44.07% 7.07 119.18 7.88 0.36 47.06% MSM 8.85 132.78 7.25 0.22 55.93% 6.06 55.9 6.14 0.33 52.54% 7.45 94.34 6.69 0.27 53.78% MSG 9.86 248.21 7.6 0.24 44.07% 5.66 51.13 7.81 0.49 47.46% 7.76 149.67 7.71 0.37 46.22% MSM 8.79 128.38 7.14 0.23 59.32% 5.97 52.97 6.11 0.34 50.85% 7.38 90.67 6.62 0.28 54.62% MSG 8.67 211.51 8.12 0.34 54.24% 5.65 50.73 9 0.64 49.15% 7.16 131.12 8.56 0.49 52.10% MSM 10 150.5 7.51 0.21 52.54% 7.2 78.27 6.54 0.31 54.24% 8.6 114.38 7.02 0.26 52.94% MSG 42.1 5342.69 8.1 0.86 45.76% 12.81 572.7 6.74 0.56 52.54% 27.46 2957.7 7.42 0.71 48.74% NDX Turmoil period Tranquil period Full period SPXOEXDJI !"#$% !"#$% !"#$%

- 7. Page 7 of 16 IV. Fifty-day ahead forecasting results Table 1: Loss function statistics and Success Rate. The table display results of the relative MAE, MSE, QLIKE, 𝑅3 𝑙𝑜𝑔 and SR for each forecasting horizon 𝑘 = 1,10,20,50. The models in comparison are MSM with 8 volatility states and Two-regime MS- GARCH (MSG). The forecasting performance is measured using daily absolute returns 𝑟" 3"Tp "G"T/ , where 𝑟" = 100 ∗ log 𝑠" − log 𝑠"./ . Numbers in bold indicate that the corresponding models have the lowest forecasting losses or the highest success rate. 3.3 Out-of-sample performance Table 1 reports the out-of-sample performance of one- day, ten-day, one-month, and fifty-day forecasts of the models in terms of the statistical loss functions and the success rate discussed above. Consistent with Calvet and Fisher (2004), MSM is comparable to MS-GARCH in one- day forecasting horizon, but dominates MS-GARCH in ten- day and one-month horizon. However, the results between the two models are mixed in fifty-day forecasting horizon. The relative merits of MSM and MS-GARH are more clearly revealed when the sample is separated into turmoil and tranquil period. Looking at the volatile sub-period, MSM dominates MS- GARCH for the MAE, MSE and SR criterions over one-day, ten-day and one-month forecasting horizons across the four equity indices. The larger forecasting losses and lower SR suggest that MS-GARCH generates too high a forecast in volatile period – results that contradict with the conclusion of Klaassen (2002). For the tranquil sub-period, it is clear that MS-GARCH performs significantly better in less volatile period than in volatile period in terms of forecasting losses. However, the relative performance between MSM and MS-GARCH is unclear. MS-GARCH dominates MSM for the MAE and MSE criterions over one-day, ten-day and one-month forecasting horizon for three of the equity indices. Although MS-GARCH has lower forecasting losses relative to MSM over ten-day and one-month horizon, it also has lower forecasting accuracy in terms of SR. I attribute this observation to the explanation of Lamoureux and Lastrapes (1990) that the persistence generated by GARCH models becomes much weaker following structural changes in the volatility process. Turning to fifty-day forecast, MS-GARCH seems to dominate MSM in both forecasting losses and forecasting accuracy. However, upon closer evaluation, the fifty-day forecasts generate by MS-GARCH for S&P500, S&P100, and Dow are too low compared to subsequent realized volatilities (Appendix 4). In majority of the cases, MS- GARCH is unable generate a forecast that is higher than current fifty-day realized volatility, and the SR criterion simply denotes the percentage of observations in which realized volatility has decreased over the sample period. The results are thus consistent with Calvet and Fisher (2004) that GARCH-class models are unable to capture the long- memory property of volatility. From the results of NASDAQ 100 (Appendix 3 and Appendix 4), the forecasts generate by MS-GARCH are too high compared to realized volatilities. As the in-sample data includes period of the dot-com bubble, the results suggest that the high persistence of individual shocks in GARCH- class models continues to exit in MS-GARCH even after accounting for structural changes in the variance process. In sum, the results support the conclusion that MSM performs significantly better in volatile period and for assets with high volatility. While GARCH-class models capture well the short-run autoregressive dynamics, the weaker persistence following a structural break explains the large decrease in forecasting losses but lower SR relative to volatile period because volatility forecasts remain too low. 4. Trading strategies In recent years, volatility has emerged as an asset class in that financial engineering has provided various ways to gain exposure to the volatility of an asset. For example, one way to gain an exposure to volatility of S&P500 is to trade directly the VIX futures or volatility exchange-traded notes such as VXX. Another way is through variance swaps which offer pure exposure to the realized volatility of the underlying. To evaluate the trading performance of MSM and MS-GARCH over different horizons, I consider an intra-day trading strategy on VXX and front month VIX futures as well as a monthly strategy on the variance swaps of the four indices considered in this paper. MAE MSE QLIKE SR MAE MSE QLIKE SR MAE MSE QLIKE SR MSM 28.93 1424.48 9.29 0.25 41.67% 9.94 165.26 7.8 0.13 54.17% 19.43 794.87 8.55 0.19 46.94% MSG 20.98 1165.95 10.84 0.4 58.33% 15.16 304.17 13.71 0.9 58.33% 18.07 735.06 12.27 0.65 59.18% MSM 28.11 1341.87 9.2 0.25 37.50% 9.48 158.73 7.76 0.12 58.33% 18.8 750.3 8.48 0.19 46.94% MSG 19.21 1008.64 10.14 0.32 66.67% 13.33 247.02 10.25 0.62 58.33% 16.27 627.83 10.2 0.47 63.27% MSM 26.81 1217.35 9.08 0.27 37.50% 9.48 163.41 7.73 0.13 62.50% 18.14 690.38 8.4 0.2 48.98% MSG 24.71 1272.75 14.05 0.79 62.50% 16.26 314.23 13.03 1.03 54.17% 20.49 793.49 13.54 0.91 59.18% MSM 31.13 1476.06 9.43 0.25 45.83% 11.51 197.36 8.15 0.12 58.33% 21.32 836.71 8.79 0.18 51.02% MSG 103.29 23589.78 10.01 1.01 41.67% 28.85 1445.48 8.5 0.42 41.67% 66.07 12517.63 9.26 0.72 40.82% NDX Turmoil period Tranquil period Full period SPXOEXDJI !"#$% !"#$% !"#$%

- 8. Page 8 of 16 4.1 Intra-day volatility trading Since volatility futures and exchange-traded notes offer exposure to an asset’s implied volatility, it may be logical to trade the securities in the same direction of volatility forecasts. In the case of S&P500, however, the negatively skewed6 return distribution means that a predication of an increase in realized volatility has a higher probability of a positive return tomorrow than a negative return while a forecast of a decrease in realized volatility may simply imply a mean reversion after consecutive positive returns. Given this view and the inverse relationship between return and implied volatility, I consider a strategy that short sells VXX and VIX futures when the models forecast an increase in realized volatility and vice versa. Table 2 summarize the results of the daily strategy. Table 2a shows the results7 of trading the S&P500 directly, which confirm the above argument. Table 2: Intra-day trading results I. Intra-day volatility trading strategy Table 2: Out-of-sample volatility trading results. Note: Since VXX only began trading in January 2009, the trading results only cover period from January 2009 to July 2017 for both VIX Futures and VXX in order to facilitate comparison. 6 The skewness of the return distribution of S&P500 for the sample from July 2007 to July 2017 is -0.3. Separating the sample into turmoil and tranquil period, the skewness is - 0.08 and -0.32 respectively. 7 To examine the argument, I trade directly the S&P500 and separate the trading gains in 2 cases. In the first case, I reverse the volatility trading signals but filter out the long/short S&P500 signals that have a negative/positive skewness over the past five trading days. In the second case, I trade only signals that were filtered out. In both cases, I find positive returns over the sample period. Table 2a: Intra-day S&P500 trading results II. Intra-day trading on S&P500 Table 2a: Out-of-sample S&P500 trading results. 4.2 Medium term volatility trading Although it is widely held that vanilla options can be used to trade volatility, options are exposed factors such as movements of the underlying, volatility and time-to- maturity. From the standard Black-Scholes model, exposure to underlying movements can be hedged away in the form of continuous delta-hedging and exposure to volatility is paid for in the form of option Theta and the Gamma PnL resulted from delta-hedging (Allen, Einchcomb, and Granger, 2006). However, in practice, stocks are not traded continuously nor volatility remains constant over time. The convexity of option payoff means that a replicating trade is not only sensitive to stock movements but also sensitive to option gamma8 . In light of this disadvantage, I consider a trading strategy using variance swaps, which provide pure exposure to realized volatility 4.3 Variance swap The path dependence problem of trading volatility via delta hedged options can be attributed to the fact that dollar gamma9 increases linearly with strikes and stock prices (Figure 1), thus causing non-constant exposure to realized volatility. One solution to obtain constant exposure to dollar gamma is to construct a portfolio with out-of-the-money calls and puts each weighted by the inverse of strike squared (Figure 1a). The method was originally pioneered by Carr and Madan (1998) but the impractical assumption of trading a continuous range of strikes was later modified by Derman et al. (1999). According to Derman et al. (1999), exposure 8 Such path dependence means that the amount of Gamma Pnl from delta hedging not only depends on the difference between implied and realized volatility but also depends on the strike of the option and where and when the volatility is realized (Allen, Einchcomb, and Granger, 2006). 9 The dollar gamma represents the change in dollar delta, $∆, for a 1% change in stock price and is given by multiplying option gamma by the square of stock price divide by 100, $Γ = Γ𝑆3 /100. Max. gain Max. loss Average daily return Annualized return Sharpe ratio MSM 30.70% -27.25% 0.09% 13.89% 0.27 MSG 30.70% -27.25% 0.28% 25.94% 0.81 VXX MSM 21.24% -18.81% 0.27% 25.34% 1.11 MSG 21.24% -18.81% 0.30% 26.94% 1.26 Sample period from January 2009 to July 2017 VIX Futures Max. gain Max. loss Average daily return Annualized return Sharpe ratio MSM 6.82% -4.79% 0.04% 6.96% 0.79 MSG 6.82% -4.79% 0.05% 9.37% 1.18 Case 2 MSM 6.92% -6.15% 0.01% 2.70% 0.25 MSG 6.92% -6.15% -5.30E-05 -1.41% -0.11 Combine MSM 6.92% -6.15% 0.05% 8.67% 0.72 MSG 6.92% -6.15% 0.05% 8.67% 0.72 Full sample Case 1

- 9. Page 9 of 16 to realized volatility can be obtained by trading and re- hedging a position in a log contract, whose payoffs can be approximated through a portfolio of out-of-the-money calls and puts weighted by the inverse of strike squared as well as through intra-day delta hedging via forward/future contracts. At maturity, a long options/short forward portfolio represents a long position in realized volatility with a payoff of a long variance swap given by 𝑁’“”(𝜎” 3 − 𝜎p 3 )10 . Figure 1: Dollar gamma across strikes Figure 1a: Option portfolio weighted by 1/𝒌 𝟐 4.4 Replication methodology To replicate the payoff of variance swap, I use the method of Allen, Einchcomb, and Granger (2006) which is an analytical derivation of the variance swap pricing model of Derman et al. (1999). For option data, I use the implied volatility of at-the-money options with 1-month to expiry and approximate the volatility skew11 using the implied volatilities of out-of-the-money calls and puts with the same expiration date from January 2007 to June 2007. Due to limited access to data, I only consider 20 strikes for out-of- the-money calls and another 20 strikes for out-of-the-money puts with the spot price as the splitting point between calls and puts, i.e. 𝑘3„,– < ⋯ < 𝑘/,– < 𝑆" < 𝑘/,™ < ⋯ < 𝑘3„,™. The approximated skews for the four equity indices are illustrated in Figure 2. Figure 2: Volatility skew 10 𝜎” 3 is the realized variance, 𝜎p 3 is the variance swap strike, and 𝑁’“” is the variance notional. Figure 2: Average approximated implied volatilities of out- of-the-money options for S&P500, S&P100, Dow and NASDAQ 100 over the period from June 2007 to June 2017. The x-axis represents the strike points above (call) and below (put) spot price. Furthermore, I consider the following equation from Derman et al. (1999) to calculate the monthly variance swap strikes for each index 𝐾’“” = 2 𝑇 (𝑟𝑇 − 𝑠„ 𝑠∗ 𝑒”S − 1 − log 𝑠∗ 𝑠„ + 𝑒”S 1 𝑘3 𝑃 𝑘 𝑑𝑘 + ∗ „ 1 𝑘3 𝐶 𝑘 𝑑𝑘 ž ∗ ‘Fair value of future variance’ (Derman et al., 1999:p.23) where I set 𝑠∗ = 𝑠„ = 𝑠" , the spot price at which the replicating portfolio is formed, and derive 𝑃 𝑘 and 𝐶 𝑘 from the standard Black-Scholes model with interest rate, 𝑟, equals the 1-year U.S treasury yields. However, from a practical perspective, it is not optimal to hedge with large number of out-of-the-money options due to transaction costs and liquidity issues. Therefore, I use only limited strike range and strike interval for each index. Table 3 summarizes the strike data and Figure 3 the variance swap strikes in volatility term. Table 3: Strike interval data Table 3: Strike interval data for S&P500, S&P100, Dow and NASDAQ 100. Note: Since there are no options traded on the full level of Dow (DJIA), I use the CBOE 1/100 Dow (DJX) options. The contract multiplier for the four indices is $100 per index point. 11 I approximate the volatility skew by calculating a set of skew betas based on constrained regression, min ¡ / 3 𝐶 ∗ 𝑥 − 𝑑 , using the out-of-the-money implied volatilities. S&P500 S&P100 Dow* NASDAQ 100 Strike interval (index point) 5 5 1 5 Out-of-the-money calls 20 10 5 20 Out-of-the-money puts 20 10 5 20

- 10. Page 10 of 16 Figure 3: Variance swap strike Figure 3: One-month variance swap strikes estimated using the pricing model of Derman et al., (1999). Swap strikes are expressed in volatility term. 4.5 Variance swap trading strategy For the monthly volatility strategy, I consider a buy-and- hold approach where I forecast next month aggregate volatility at the end of the last trading day of each month and enter a long/short swap position corresponding to a forecast of an increase/decrease 12 in realized volatility. Aside from the standard approach, I also consider two additional scenarios where the long/short signals are filtered by a set of trading rules. The three cases considered are summarized in the following table. Table 4: Trading signals Table 4: Trading signals The reason for considering Scenario 1 is that a forecast of increase/decrease in realized volatility may have already been priced in by the market via higher/lower swap strike and conversely an unusually high/low strike at month 𝑡 relative to month 𝑡’s aggregate realized volatility may mean that the swap strike is overpriced/under-priced due to market irrationality. Moreover, since implied volatility represents market expectation of future realized volatility, Scenario 2 simply examines whether economic profits can be obtained from trading market expectations alone. The trading results for the three cases are summarized in Table 5, and Appendix 5 the equity curves. Instead of calculating trading profits via the simple identity 𝑁’“”(𝜎” 3 − 𝜎p 3 ), the profit13 of each position is calculated by summing the net payoff of the option portfolio as well as the PnL resulted from daily delta hedging using front-month futures of the respective index. Lastly, results are shown in dollar amount with a variance notational of one-dollar, 𝑁’“” = $1, for each trade. Table 5: Variance swap trading results I. Standard case Table 5: Variance swap trading results. Positions are entered at the last trading day of each month and held until end of next month, and variance notional for all positions 12 Since variance swap provides direct exposure to future realized volatility, the argument presents in above for the intra-day trading strategy on implied volatility does not hold in this case. 13 Since the replication of log contract is an imperfect hedge, there are differences between the theoretical payoff given by the above identity and the PnL obtained through replication. Thus, the trading payoff is calculated in this way to facilitate practical evaluation. Nevertheless, the average adjusted 𝑅3 and mean square error between the theoretical and actual payoff for the four indices across the sample is around 90% and $150 for 𝑁’“” = $1. Long Short Standard !"#$ > !" !"#$ < !" Scenario 1 !"#$ > !" and ()*+,- .- < 0.9 !"#$ < !" and ()*+,- .- < 0.7 !"#$ < !" and ()*+,- .- > 0.7 !"#$ > !" and ()*+,- .- > 0.9 Scenario 2 3456," > 3456,"7$ 3456," < 3456,"7$ Turmoil period Tranquil period Full period Max gain Max loss Average monthly gain Total gain Max gain Max loss Average monthly gain Total gain Max gain Max loss Average monthly gain Total gain SPX MSM $4,427.00 -$2,251.31 $46.84 $2,810.23 $548.50 -$302.14 -$30.00 -$1,800.03 $4,427.00 -$2,251.31 $8.42 $1,010.21 MS-GARCH $4,429.25 -$2,504.30 $122.77 $7,366.50 $301.37 -$548.68 $13.71 $822.51 $4,429.25 -$2,504.30 $68.24 $8,189.01 OEX MSM $4,906.37 -$1,479.12 $47.31 $2,838.54 $657.00 -$328.05 -$34.43 -$2,065.90 $4,906.37 -$1,479.12 $6.44 $772.64 MS-GARCH $4,908.02 -$2,602.61 $91.46 $5,487.82 $245.31 -$657.10 $22.26 $1,335.58 $4,908.02 -$2,602.61 $56.86 $6,823.39 DJI MSM $4,793.37 -$1,345.61 $41.29 $2,477.51 $652.80 -$630.90 -$47.06 -$2,823.38 $4,793.37 -$1,345.61 -$2.88 -$345.87 MS-GARCH $4,793.37 -$2,217.82 $82.82 $4,969.18 $630.90 -$652.80 $36.29 $2,177.58 $4,793.37 -$2,217.82 $59.56 $7,146.77 NDX MSM $4,141.86 -$2,755.69 $171.17 $10,270.42 $584.57 -$788.89 $16.62 $997.17 $4,141.86 -$2,755.69 $93.90 $11,267.58 MS-GARCH $4,141.86 -$656.62 $260.68 $15,640.85 $584.57 -$788.89 $24.48 $1,469.00 $4,141.86 -$788.89 $142.58 $17,109.85

- 11. Page 11 of 16 II. Scenario 1 & Scenario 2 Table 5: Variance swap trading results. Positions are entered at the last trading day of each month and held until end of next month, and variance notional for all positions 4.6 Trading results evaluation From a trading perspective, MS-GARCH dominates MSM in both intra-day (Table 5) and monthly trading over the period considered. In intra-day trading, it is not surprising to see that MS-GARCH slightly outperforms MSM. The short forecasting timeframe benefits GARCH- class models as they capture well the short-run autoregressive dynamics of volatility while the hyperbolic decay of the autocorrelation function of absolute returns combines with the multi-scaling behaviour of time series data implies that MSM is a better candidate for long-run forecasts. Under the Standard case of the swap trading strategy, MSM fails to generate significant economic profits and only outperforms MS-GARCH in Scenario 2 for two of the equity indices. However, the monthly trading results alone should not be taken for grounds to disprove the superior statistical results of MSM because a large part of the contradicting results can be attributed to inefficient market pricing of implied volatilities. The main findings are summarized in the following table: As shown in the above table, implied volatilities of the four equity indices have a strong tendency to be overpriced by the market. Taking as an example the case of S&P500, over half of the sample period has implied volatilities and thus implied swap strikes trading higher than subsequent realized volatilities. More importantly, there are also 26 months in which a successful prediction of the direction of realized volatility by MSM have realized trading losses. Turning to trading positions, the net short position of MS- GARCH is consistent with the conclusion in Section 3.3. The opposite of the argument is also reinforced by the findings in NASDAQ 100. To test whether implied volatilities are on average mispriced, I use the change in direction in swap strikes between month 𝑡 − 1 and month 𝑡 as a predictor of next month’s realized volatility (Scenario 3). If implied volatilities are fairly priced, trading on market expectations alone should not yield any significant economic profits. Nevertheless, as shown in Table 5, trading volatility in this way outperforms both model in volatile period but underperforms in low volatility environment. The results from Scenario 3 suggest that implied volatilities are under- priced in volatile environment but are also over-priced in low volatility environment. Thus, I argue that the discrepancies in the trading gains between MSM and MS- GARCH are due to fact that MS-GARCH continues to generate too high a forecast in volatile period and too low a forecast in low volatility period, leading to a trend- following type strategy that longs volatility in volatile period and shorts volatility in low volatility period. The discrepancies are also reinforced by inefficient market pricing of implied volatilities. Turmoil period Tranquil period Full period Max gain Max loss Average monthly gain Total gain Max gain Max loss Average monthly gain Total gain Max gain Max loss Average monthly gain Total gain SPX MSM $4,427.00 -$1,871.47 $186.20 $11,171.90 $548.50 -$302.14 $21.79 $1,307.56 $4,427.00 -$1,871.47 $104.00 $12,479.46 MS-GARCH $4,427.00 -$2,503.61 $117.66 $7,059.90 $302.14 -$548.50 $26.10 $1,565.85 $4,427.00 -$2,503.61 $71.88 $8,625.75 !"#$,&'( $4,427.00 -$2,503.61 $154.38 $9,262.87 $302.14 -$548.50 -$9.65 -$578.88 $4,427.00 -$2,503.61 $72.37 $8,684.00 OEX MSM $4,906.37 -$1,574.45 $190.99 $11,459.10 $657.00 -$197.50 $31.66 $1,899.38 $4,906.37 -$1,574.45 $111.32 $13,358.49 MS-GARCH $4,906.37 -$2,602.20 $106.36 $6,381.50 $328.05 -$657.00 $29.94 $1,796.26 $4,906.37 -$2,602.20 $68.15 $8,177.76 !"#$,&'( $4,906.37 -$2,602.20 $134.68 $8,080.82 $188.18 -$657.00 -$35.32 -$2,119.02 $4,906.37 -$2,602.20 $49.68 $5,961.79 DJI MSM $4,793.37 -$2,217.82 $61.77 $3,706.50 $630.90 -$652.80 $28.03 $1,681.71 $4,793.37 -$2,217.82 $44.90 $5,388.21 MS-GARCH $4,793.37 -$2,217.82 $57.23 $3,433.66 $630.90 -$652.80 $42.41 $2,544.60 $4,793.37 -$2,217.82 $49.82 $5,978.26 !"#$,&'( $4,793.37 -$1,345.61 $120.23 $7,214.01 $326.35 -$652.80 -$25.94 -$1,556.31 $4,793.37 -$1,345.61 $47.15 $5,657.70 NDX MSM $4,141.86 -$1,980.53 $188.46 $11,307.67 $584.57 -$788.89 -$21.51 -$1,290.40 $4,141.86 -$1,980.53 $83.48 $10,017.27 MS-GARCH $4,141.86 -$1,980.53 $188.46 $11,307.67 $584.57 -$788.89 -$21.51 -$1,290.40 $4,141.86 -$1,980.53 $83.48 $10,017.27 !"#$,&'( $4,141.86 -$2,755.69 $104.69 $6,281.19 $788.89 -$584.57 -$0.41 -$24.47 $4,141.86 -$2,755.69 $52.14 $6,256.72 Net position !"#$,& > (&)* + (&)* + > (& + !"#$,& > (&)* + (&)* + > (& + Total LossMSM MS-GARCH SPX 100L -58S 78 56 26 -$2,236.55 OEX 100L -60S 80 56 24 -$1,812.15 DJI 102L -78S 86 58 31 -$1,281.78 NDX 106L 120L 45 58 7 -$345.51

- 12. Page 12 of 16 5. Conclusions Multiscaling and long-run dependence are well-known stylized facts of financial return volatility. However, traditional GARCH-class models, which assume exponential rather than hyperbolic decay of autocorrelation functions of absolute returns, fail to capture many of the characteristics of volatility especially in multi-step ahead forecasts. Such issues have spurred the development of Markov-Switching GARCH in an effort to capture the multi-frequency and long-memory characteristics of volatility as well as structural breaks in the volatility process. More recently, the Markov-Switching Multifractal model of Calvet and Fisher (2004) has been developed to account for the multiscaling behaviour of financial time series. The multiplicative structure of MSM and the decomposition of volatility into large number of states give rise to many of the apparent characteristics of volatility, and in many cases, MSM has been found to improve upon GARCH-class models in terms of mean square errors. Although numerous studies have found superior forecasting performance of MSM, few have investigated its performance in practical application. In this paper, I investigated performance of Markov-Switching Multifractal and Markov-Switching GARCH in 1-day, 10- day, 20-day and 50-day ahead forecasts as well as their performance in volatility trading – the ability to forecast change in direction of future realized volatility. My results suggest that MSM outperform MS-GARCH in multi-step ahead forecasts in terms of several statistical loss functions and success rate. However, MS-GARCH continues to generate too high a forecast in volatile period and for asset with high volatility and too low a forecast in low volatility period and in multi-step ahead forecasts, leading to spurious outperformance over MSM in some cases. Further, from a trading perspective, MSM is unable to generate significant economic returns in variance swap trading and is only comparable to MS-GARCH in intra-day trading. However, the outperformance of MS-GARCH over MSM in the monthly trading strategy is mainly due inefficient market pricing of implied volatilities. In sum, my results lend support to earlier studies that MSM has greater forecasting abilities than GARCH-class models especially in multi-step ahead forecasts. Reference Allen, P., Einchcomb, S., and Granger, N. (2006) “Variance Swap.” European Equity Derivatives Research, J.P. Morgan. Bollerslev, T. (1986) “Generalized autoregressive conditional heteroskedasticity.” Journal of Econometrics 31, 3077327. Bollerslev, T., Engle, R. F., and Nelson, D. (1994) “ARCH models.” In R. F. Engle & D. L. McFadden (Eds.), Handbook of econometrics, vol. IV (pp. 2961–3038). Amsterdam: Elsevier Science B.V. Calvet, L. E., and Fisher, A. J. (2004) “How to forecast long-run volatility: regime switching and the estimation of multifractal process.” Journal of Financial Econometrics, 2, 49–83. Carr, P., and Madan, D. (2001) “Towards a Theory of Volatility Trading.” In R. Jarrow (Ed), Volatility: New Estimation Techniques for Pricing Derivatives (London: Risk Publications), 417–427. Derman, E., Demeterfi ,K., Kamal, M. and Zou, J. (1999) “More than you ever wanted to know about variance swaps.” Quantitative Strategies Research Notes, Goldman Sachs. Ding, Z., Granger, C.W.J., and Engle, R.F. (1993) “A long memory property of stock market returns and a new model.” Journal of Empirical Finance 1, 83–106. Engle, R. (1982) “Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation.” Econometrica 50, 987-1007. Gray, S.F. (1996a) “Modeling the conditional distribution of interest rates as a regime-switching process.” Journal of Financial Economics 42:27–62 Gray, S.F. (1996b) “An analysis of conditional regime- switching models.” Working paper Fuqua School of Business Duke University. Hamilton, J. (1989) “A New Approach to the Economic Analysis of Nonstationary Time Series and the Business Cycle.” Econometrica 57, 357-384. Hamilton, J. (1990) “Analysis of Time Series Subject to Change in Regime.” Journal of Econometrics 45, 39-70. Hamilton, J. (1994) Time Series Analysis. Princeton, NJ: Princeton University Press. Klaassen, F. (2002) “Improving GARCH Volatility Forecasts with Regime Switching GARCH.” Empirical Economics 27, 363-394. Lamoureux, C., and Lastrapes, W. (1990) “Persistence in variance, structural change and the GARCH model.” Journal of Business and Economic Statistics, 8, 225–234. Lux, T., and Kaizoji, T. (2007) “Forecasting volatility and volume in the Tokyo stock market: Long memory, fractality and regime switching.” Journal of Economic Dynamics and Control, 31, 1808–1843.

- 13. Page 13 of 16 Lux, T., Arias, M., and Sattarhoff, C. (2011) “A Markov- switching Multifractal Approach to Forecasting Realized Volatility.” Working Paper, Kiel Institute for the World Economy. Marcucci, J. (2005) “Forecasting Stock Market Volatility with Regime-Switching GARCH models.” Working Paper, University of California, San Diego. Sopipan, N., Sattayatham, P., and Premanode., B. (2011) “Forecasting Volatility of Gold Price Using Markov Regime Switching and Trading Strategy.” Journal of Mathematical Finance, 2, 121-131. Appendix Appendix 1: GARCH model A1. GARCH Under standard GARCH(p,q) model, returns are characterized by 𝑟" = ℎ" 𝜀" where 𝜀" is i.i.d. with zero mean and unit variance and where ℎ" denotes the conditional variance of 𝑟" at date 𝑡 − 1 . The conditional variance follows an autoregressive process and evolves according to ℎ" = 𝜔 + 𝛽/ℎ"./ + ⋯ + 𝛽*ℎ".* + 𝛼/ 𝑟3 "./ + ⋯ + 𝛼+ 𝑟3 ".+ ℎ" = 𝜔 + 𝛽*ℎ".* – *G/ + 𝛼+ 𝑟3 ".+ £ +G/ (Hamilton, 1994) for 𝜔 > 0, 𝛽* ≥ 0, and 𝛼+ ≥ 0 to ensure non-negativity of ℎ". Therefore, GARCH is a smooth deterministic function of past squared returns. Moreover, calculation of the conditional variance {ℎ"}"G/ S would require a pre-sample to estimate values for ℎ.–T/, … , ℎ„ and 𝑟3 .–T/, … , 𝑟3 „ . For GARCH (1,1) model, the variables can be initialized according to a set of starting values where ℎ„ = (1 − 𝛽/ − 𝛼/) ./ Iterating forward to obtain {ℎ"}"G/ S , the sequence can be used to evaluate the log likelihood function, which is then maximized numerically to obtain the optimal parameters for the GARCH process. According to Hamilton (1994), the likelihood function is given by ℒ 𝜃 = − 𝑇 2 log 2𝜋 − 1 2 log ℎ" S "G/ − 1 2 ℎ" ./ 𝑟" − 𝜇 − 𝜙𝑟"./ S "G/ 3 ‘Likelihood function of GARCH model’ (Hamilton, 1994:p.352) See also Baillie and Bollerslev (1992) for detailed discussions of forecasts and deviations for GARCH process, and Bollerslev (1986) for maximum likelihood estimates of GARCH parameters. Appendix 2: Descriptive statistics of S&P500, S&P100, Dow and NASDAQ 100 daily returns Note: The statistics cover the full sample period from July 1997 to July 2017. Appendix 3: One-month volatility forecasts and subsequent realized volatility S&P 500 SPX OEX DJI NDX Mean 0.02% 0.02% 0.02% 0.03% Daily volatility 1.23% 1.23% 1.16% 1.85% Maximum 10.96% 10.66% 10.51% 17.20% Minimum -9.47% -9.19% -8.20% -11.11% Skewness -0.23 -0.18 -0.14 0.10 Kurtosis 10.86 10.35 10.77 8.82

- 14. Page 14 of 16 S&P 100 Dow Jones Industrial Average NASDAQ 100 Appendix 4: MS-GARCH Fifty-day volatility forecasts and subsequent realized volatility S&P 500

- 15. Page 15 of 16 S&P 100 Dow Jones Industrial Average NASDAQ 100 Appendix 5: Variance swap trading equity curves S&P 500 S&P 100

- 16. Page 16 of 16 Dow Jones Industrial Average NASDAQ 100 Appendix 5: Equity curves of monthly variance swap trading strategy of S&P500, S&P100, Dow and NASDAQ 100. Note: ‘o’ denotes the Standard case. ‘+’ denotes Scenario 1 and ‘∗’ denotes Scenario 2.