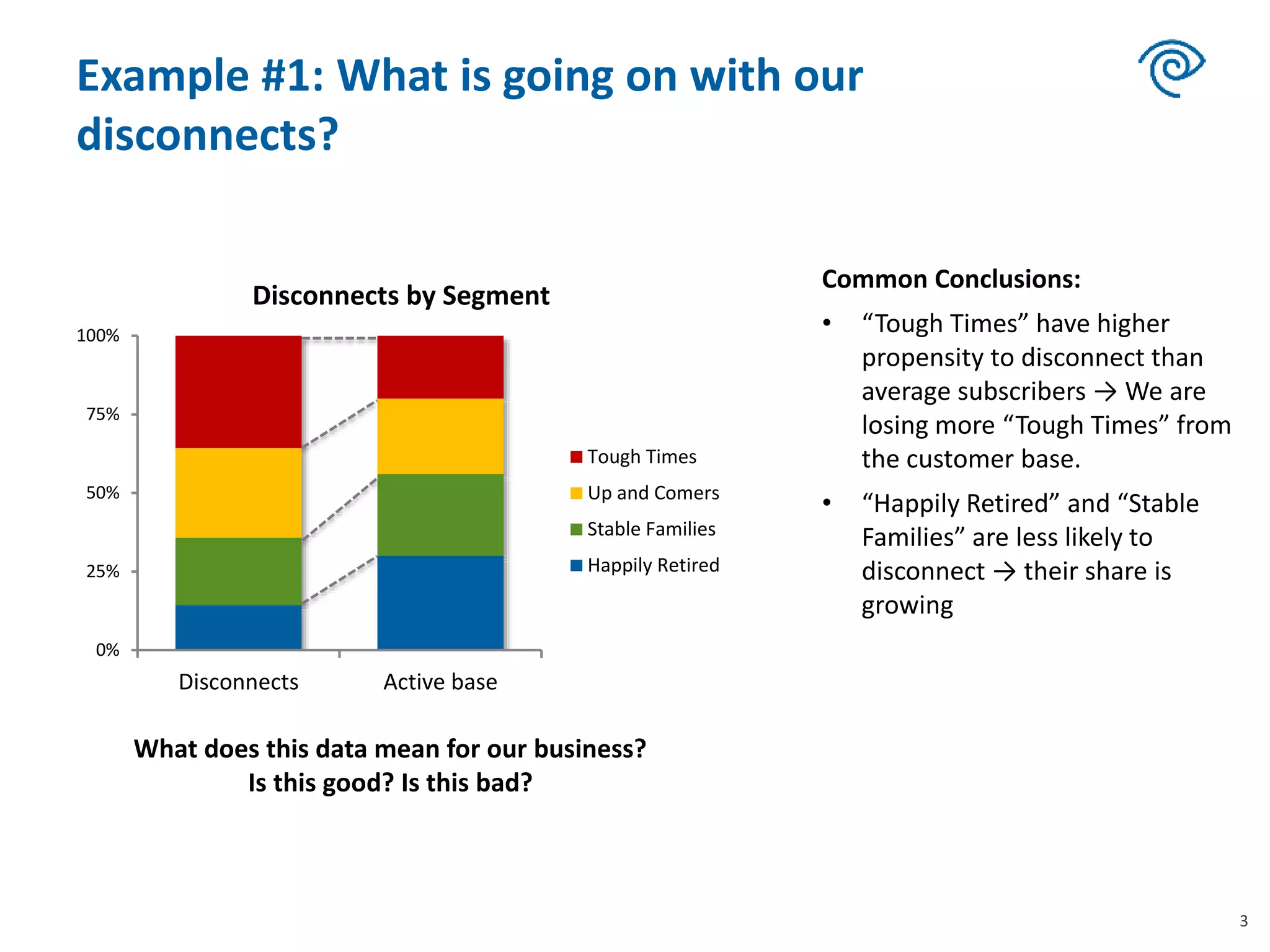

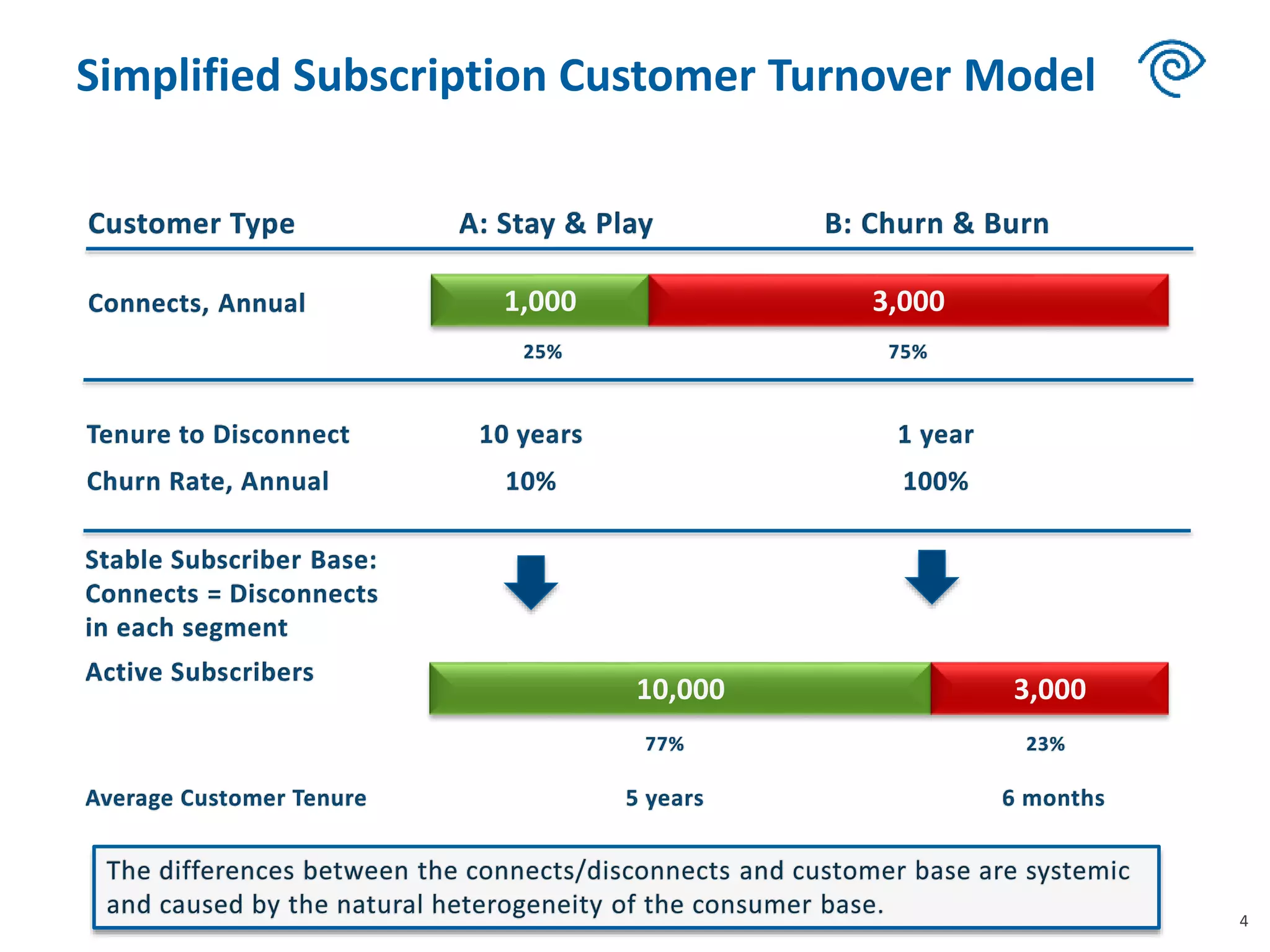

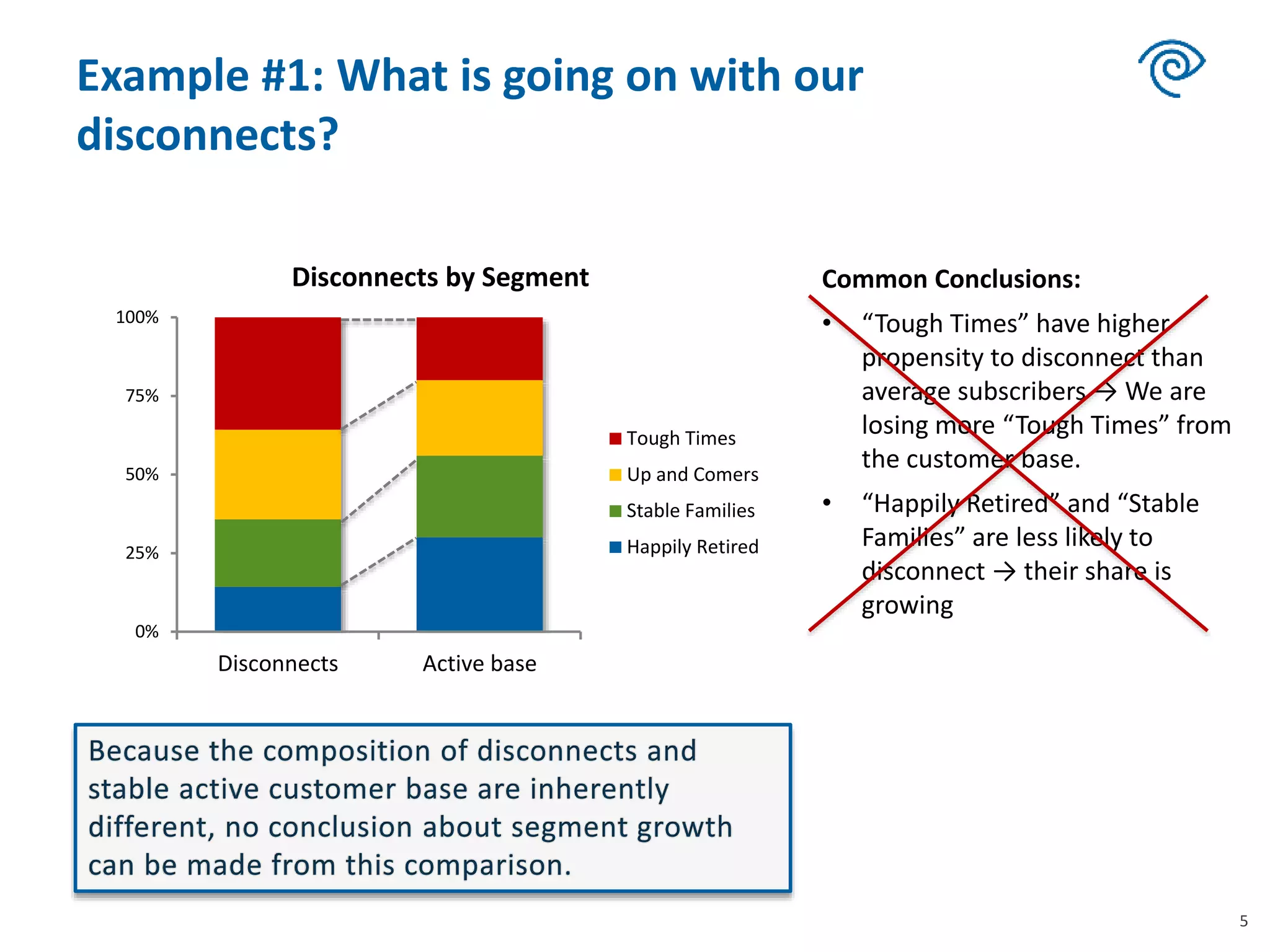

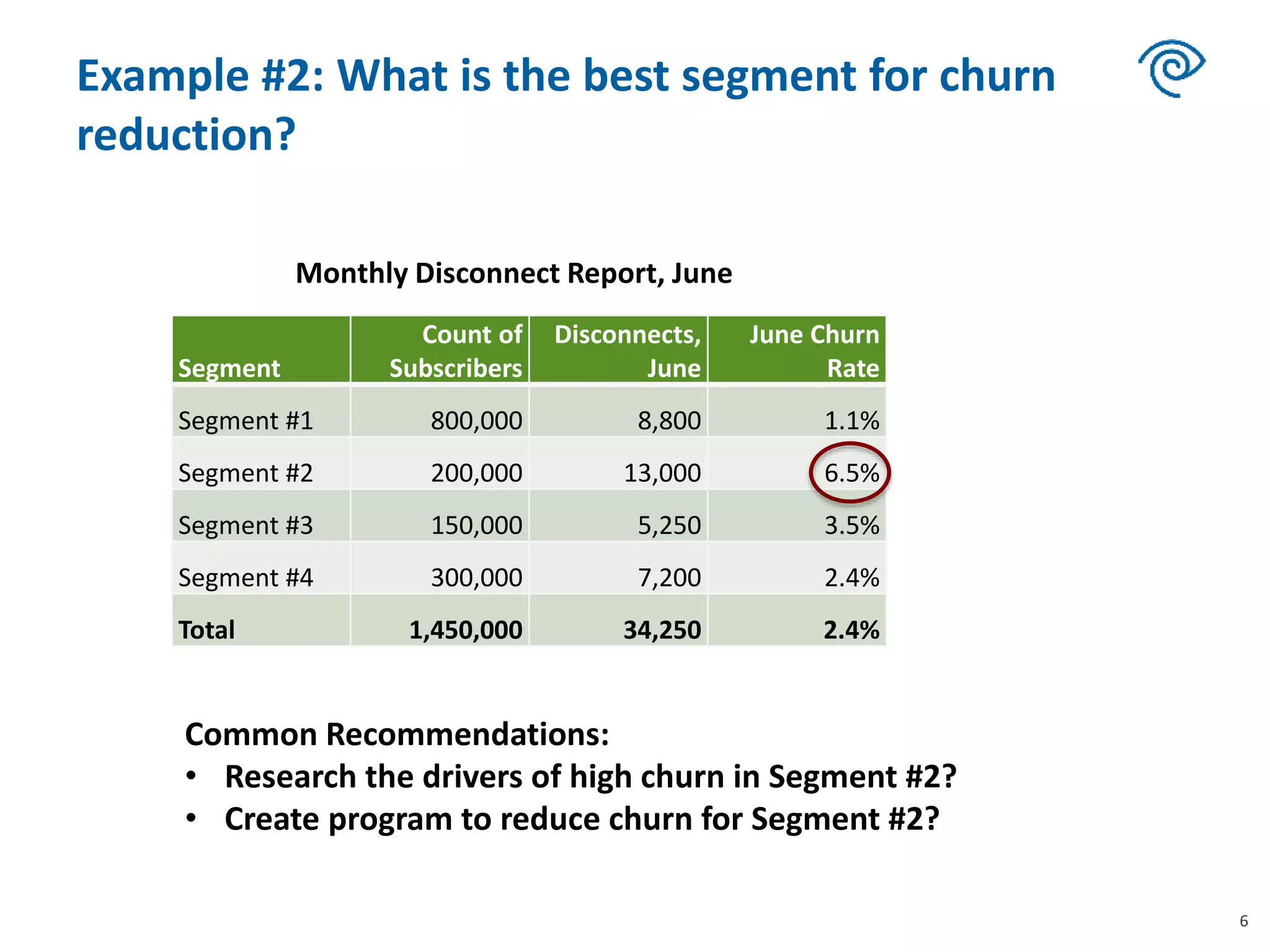

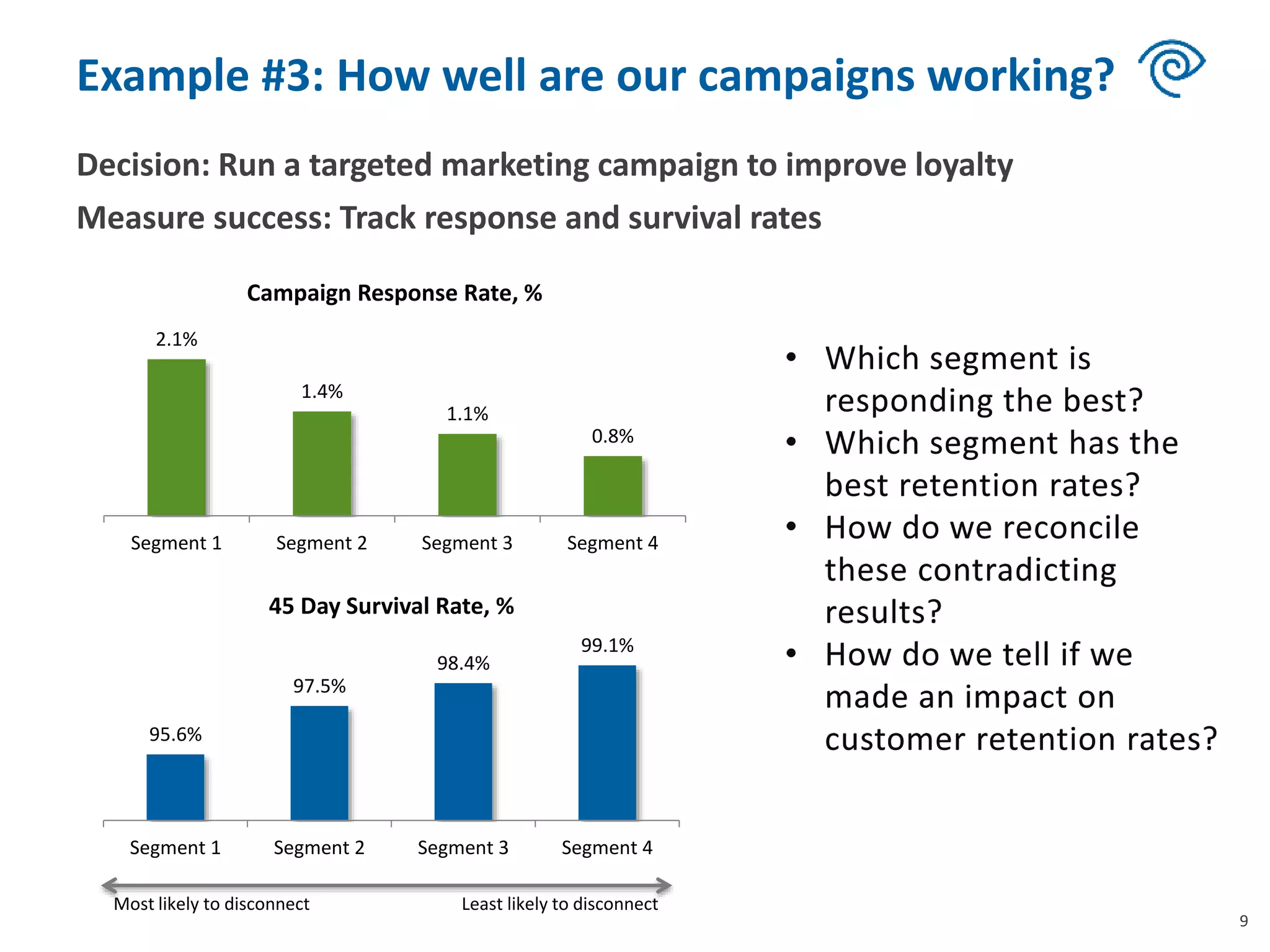

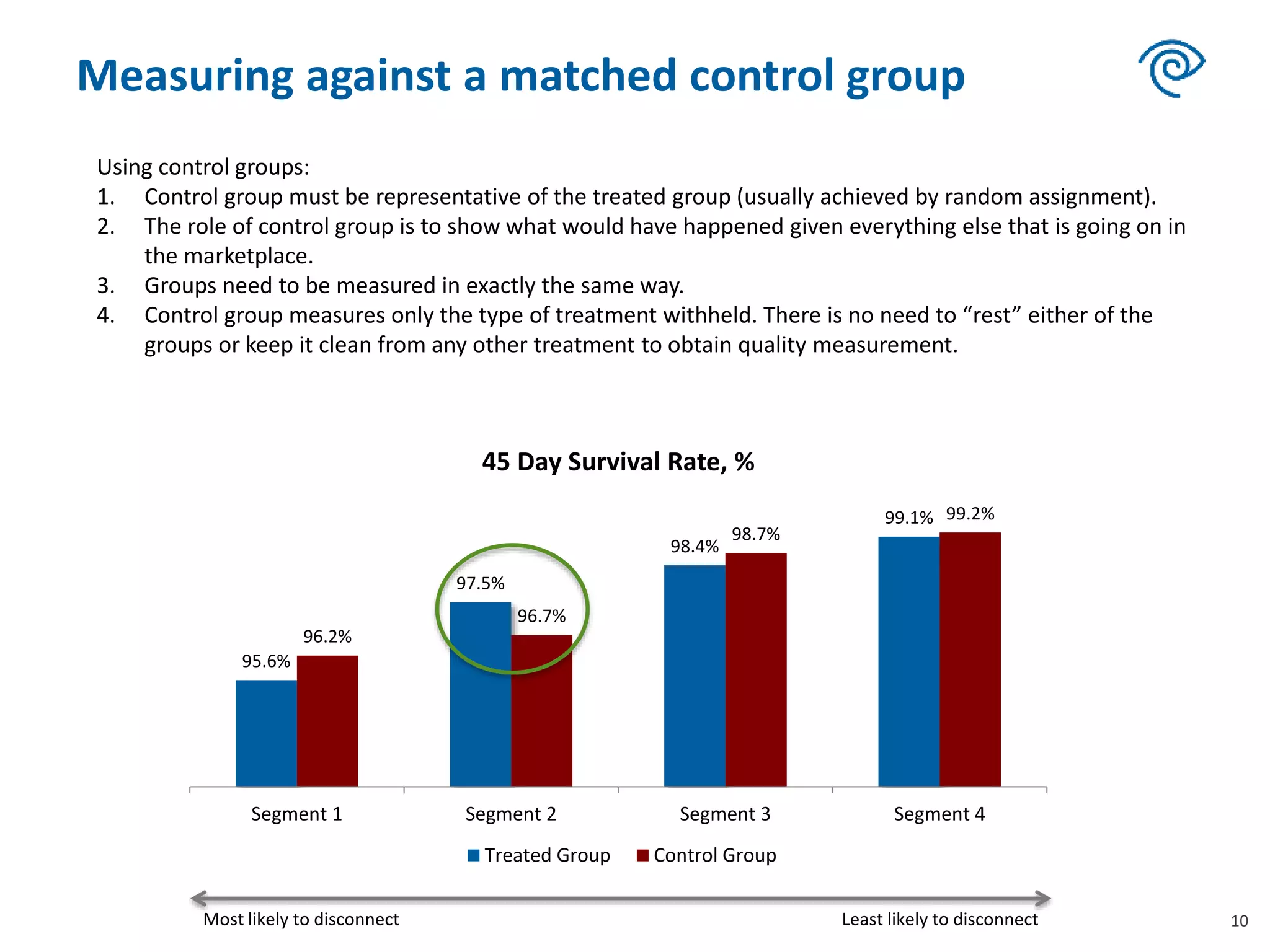

The document discusses how to use data effectively to understand subscriber lifecycle and reduce churn in subscription businesses. It emphasizes the importance of correctly interpreting data to make informed decisions and highlights common misconceptions that can lead to poor outcomes. Recommendations include exploring churn drivers in high-risk segments and applying targeted marketing strategies, all while tracking performance against control groups to measure campaign effectiveness.