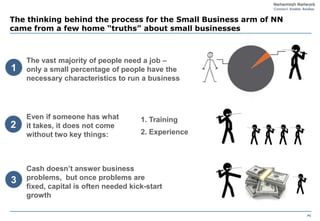

1) The Small Business Incubator of the Nehemiah Network aims to help disadvantaged individuals start and grow sustainable businesses by providing training, mentoring, and investment capital.

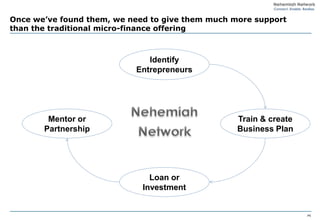

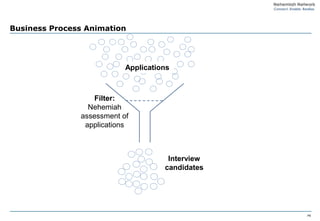

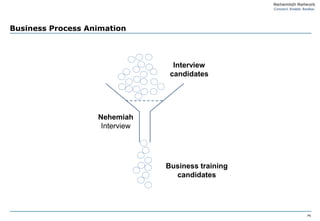

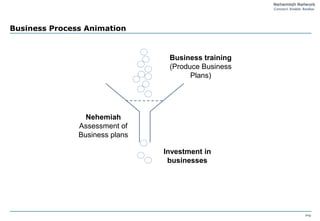

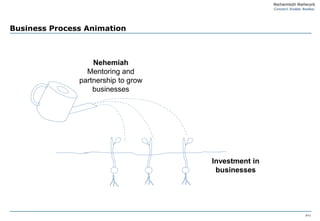

2) The incubator identifies entrepreneurs with viable business ideas and assesses their plans before providing training and creating formal plans. Successful candidates then receive an investment and ongoing support through mentoring and partnerships.

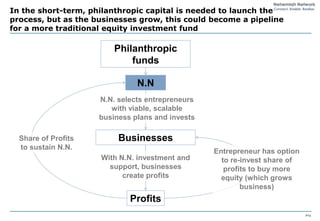

3) This intensive level of support is costly but aims to create real impact by establishing scalable businesses. The incubator is exploring an equity investment model where it takes an ownership stake in businesses to be more focused on growth and make the model financially sustainable long-term.