Embed presentation

Download to read offline

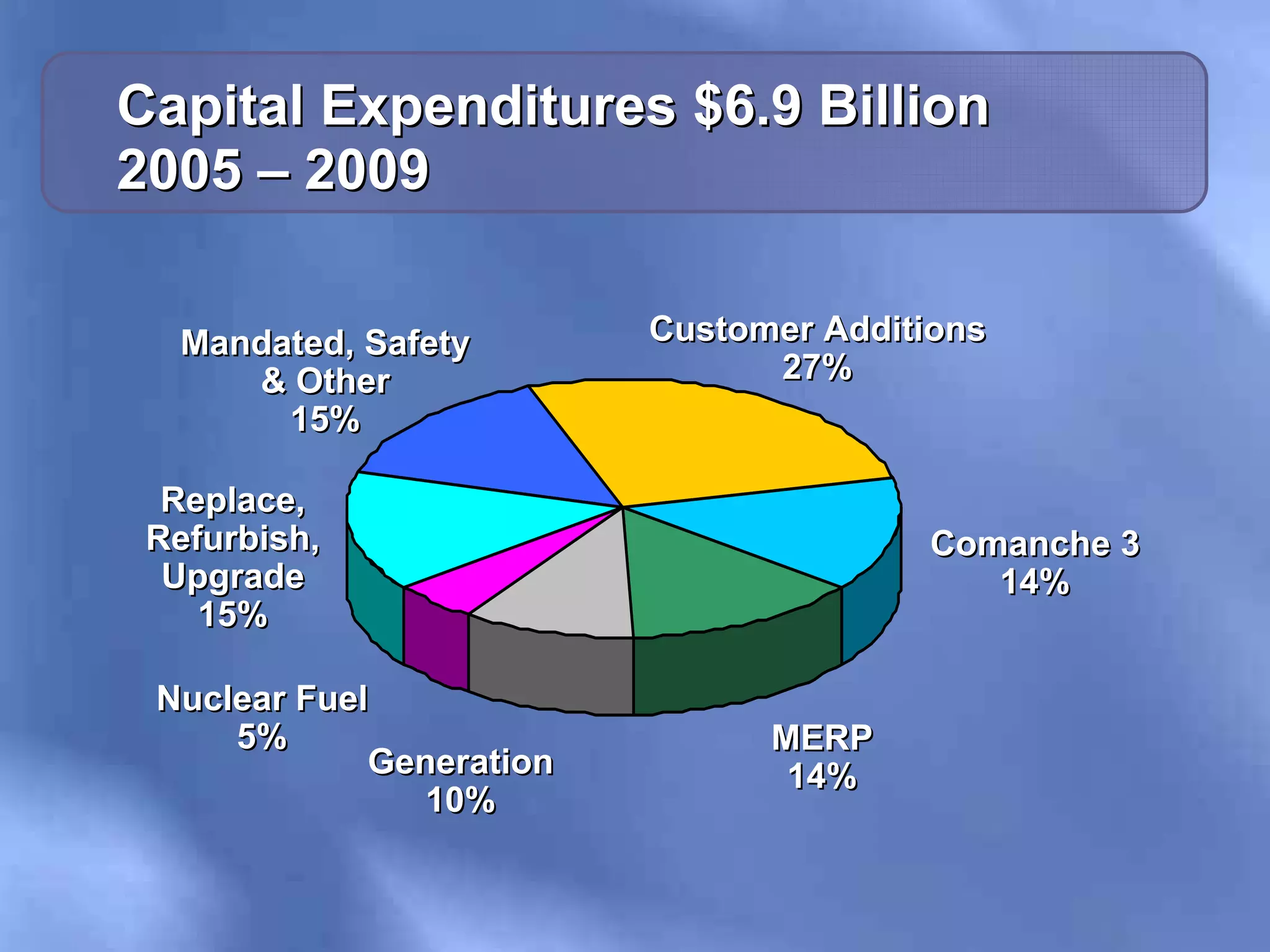

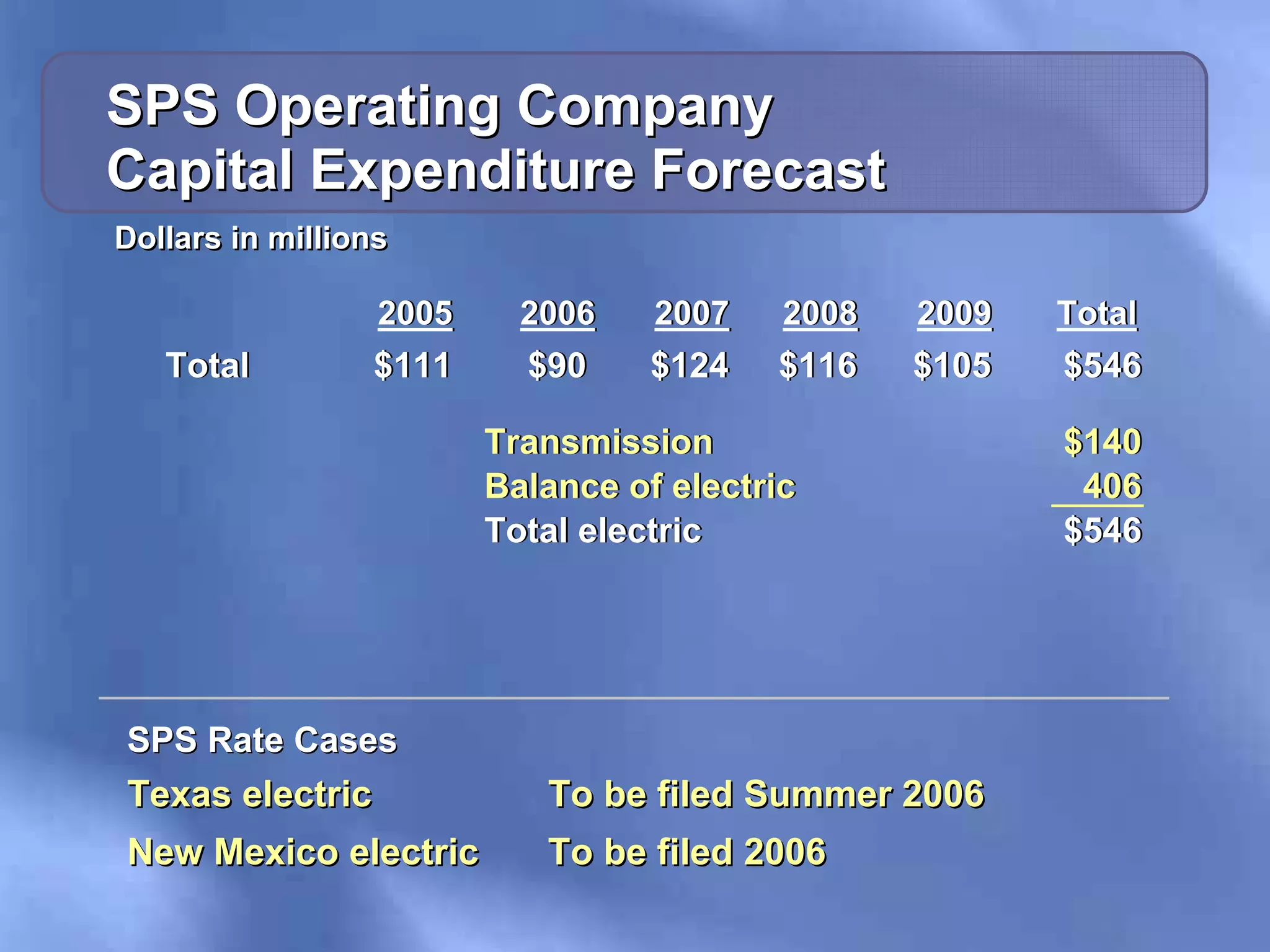

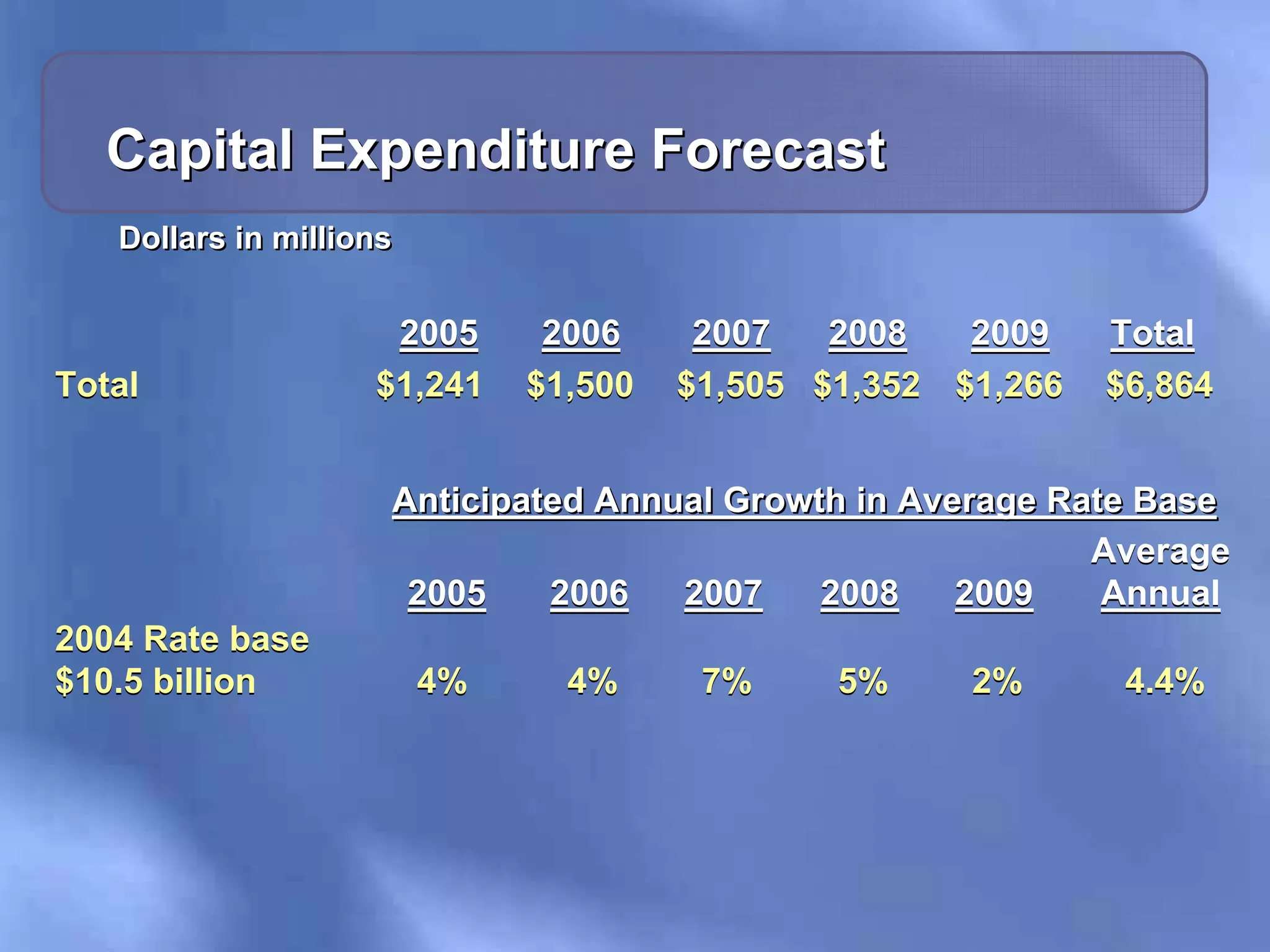

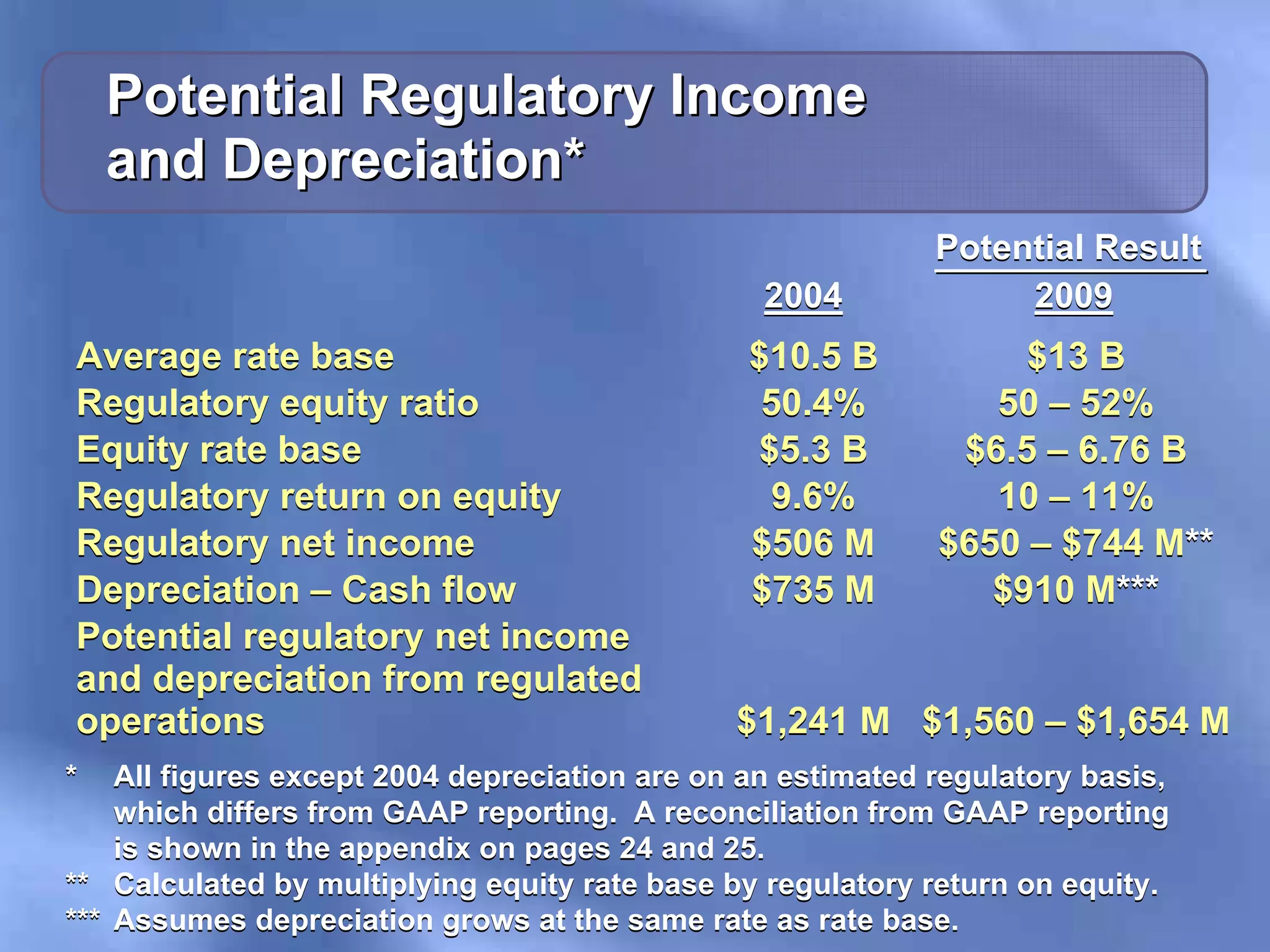

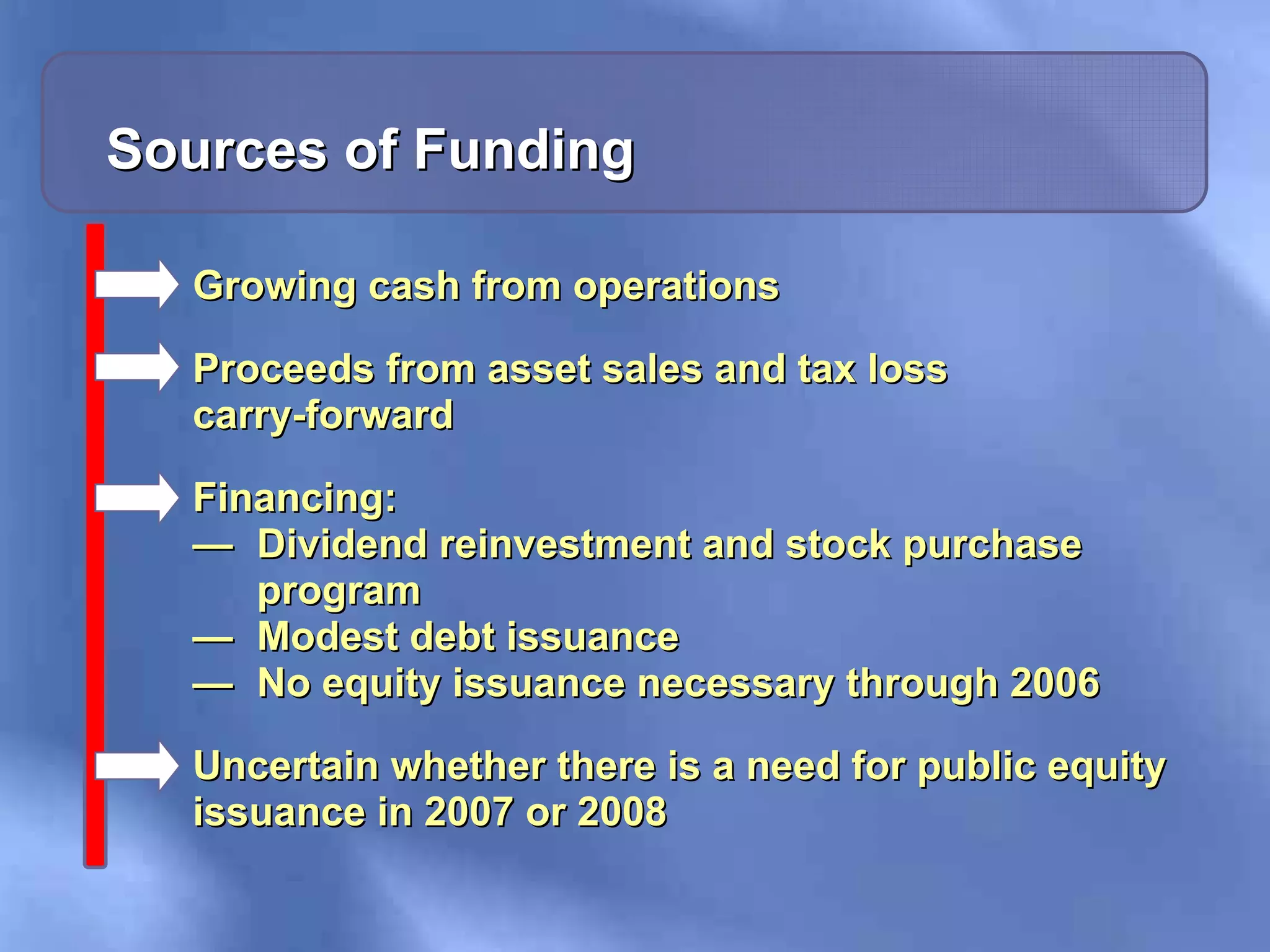

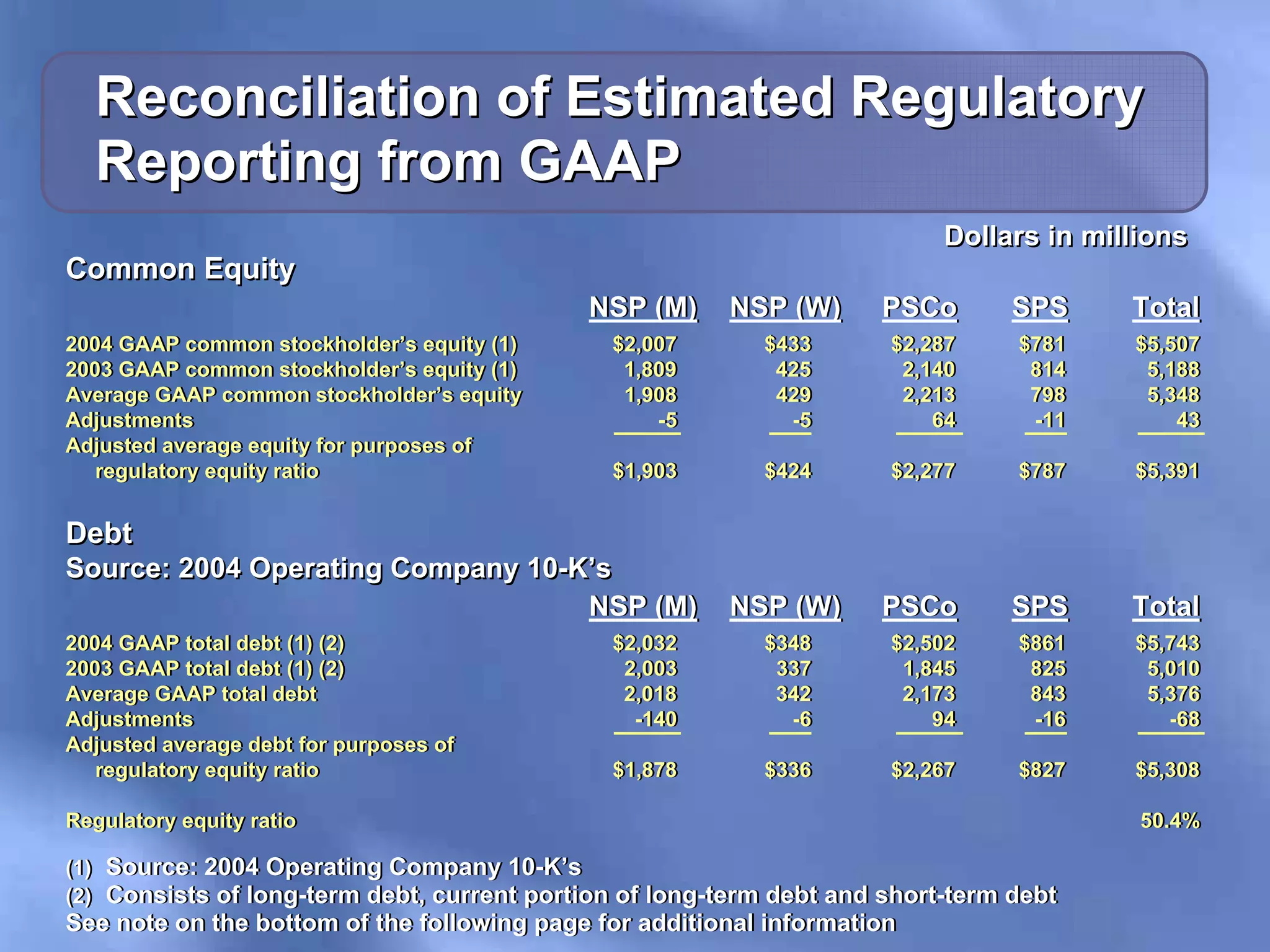

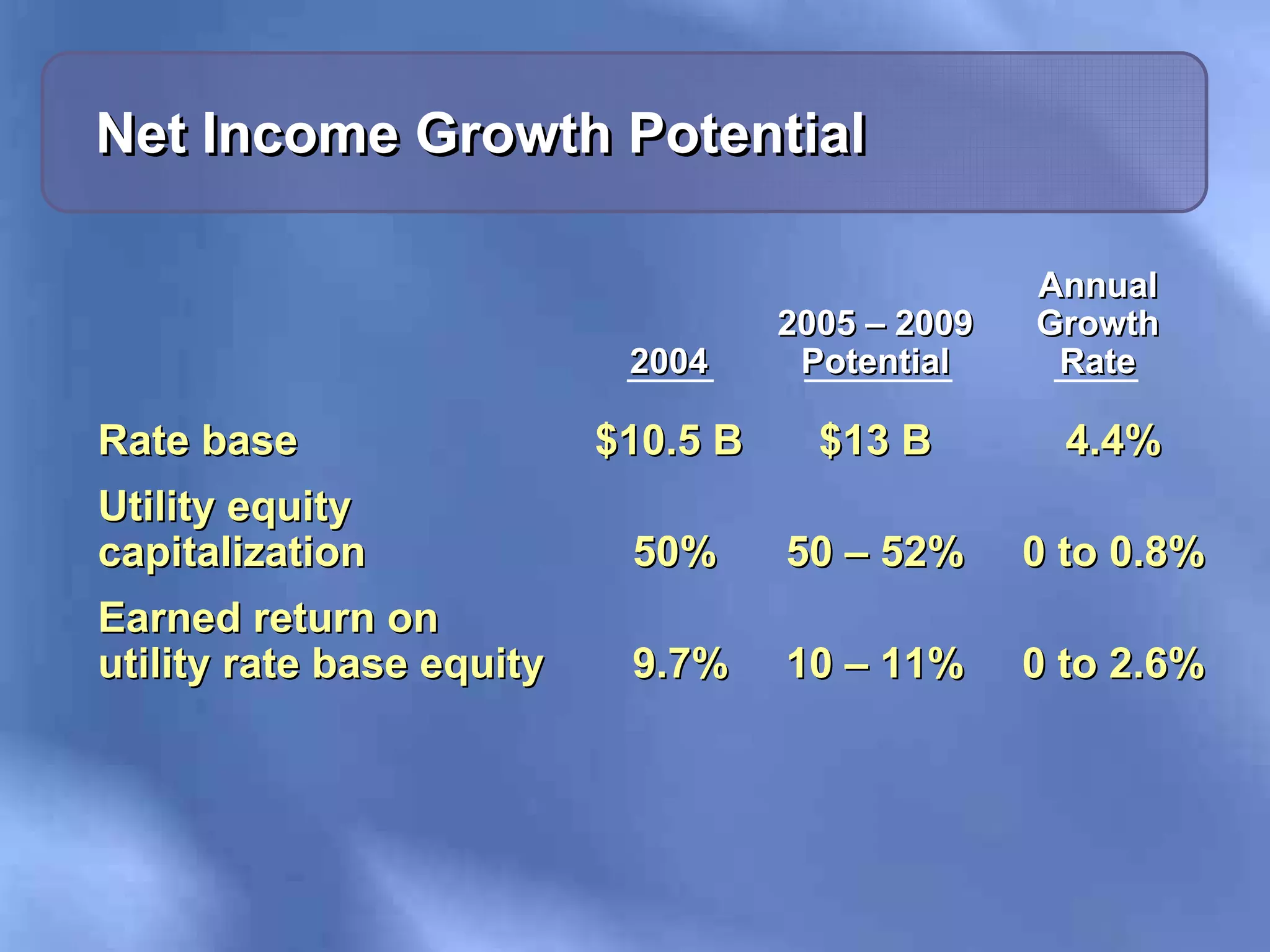

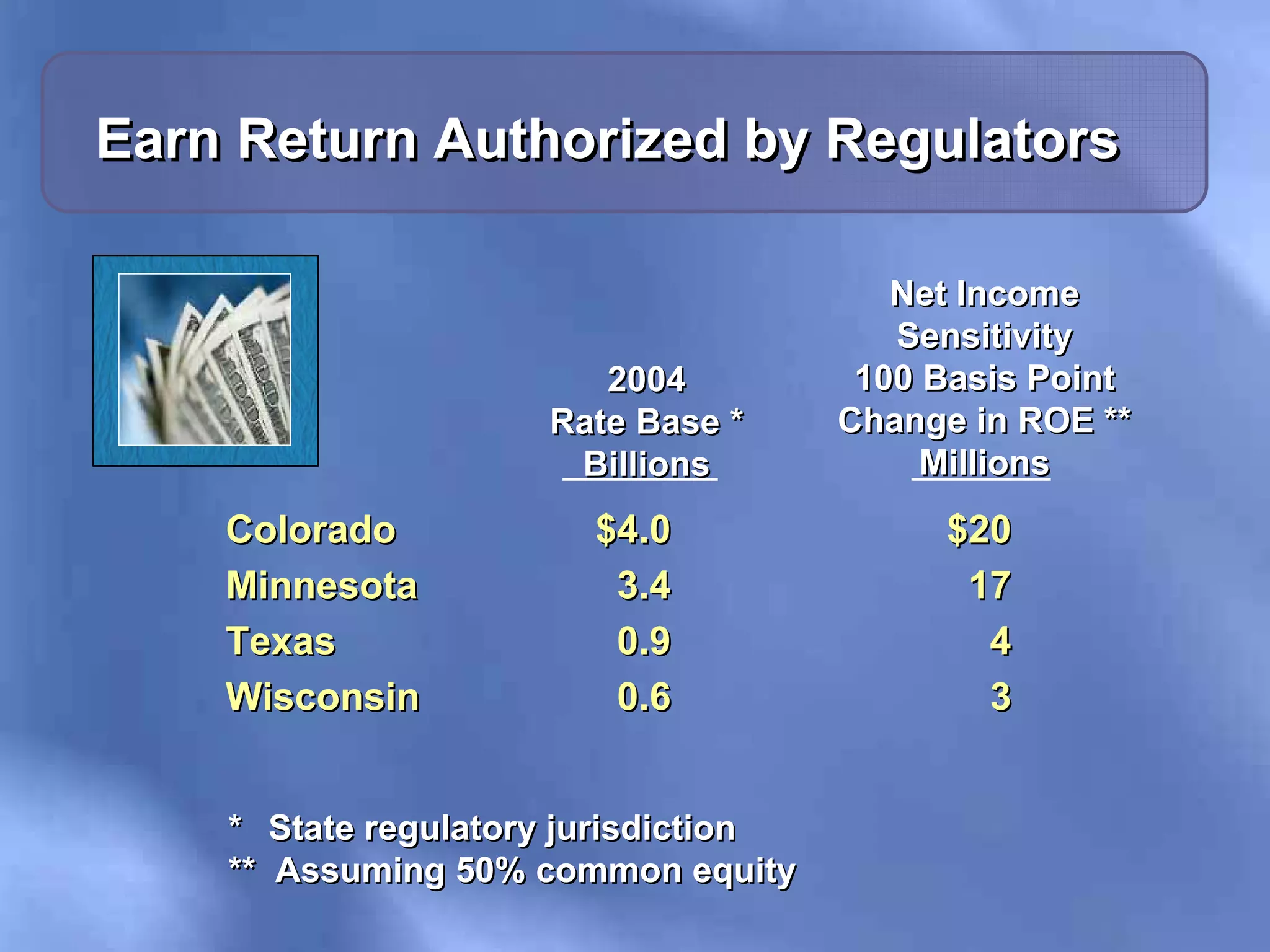

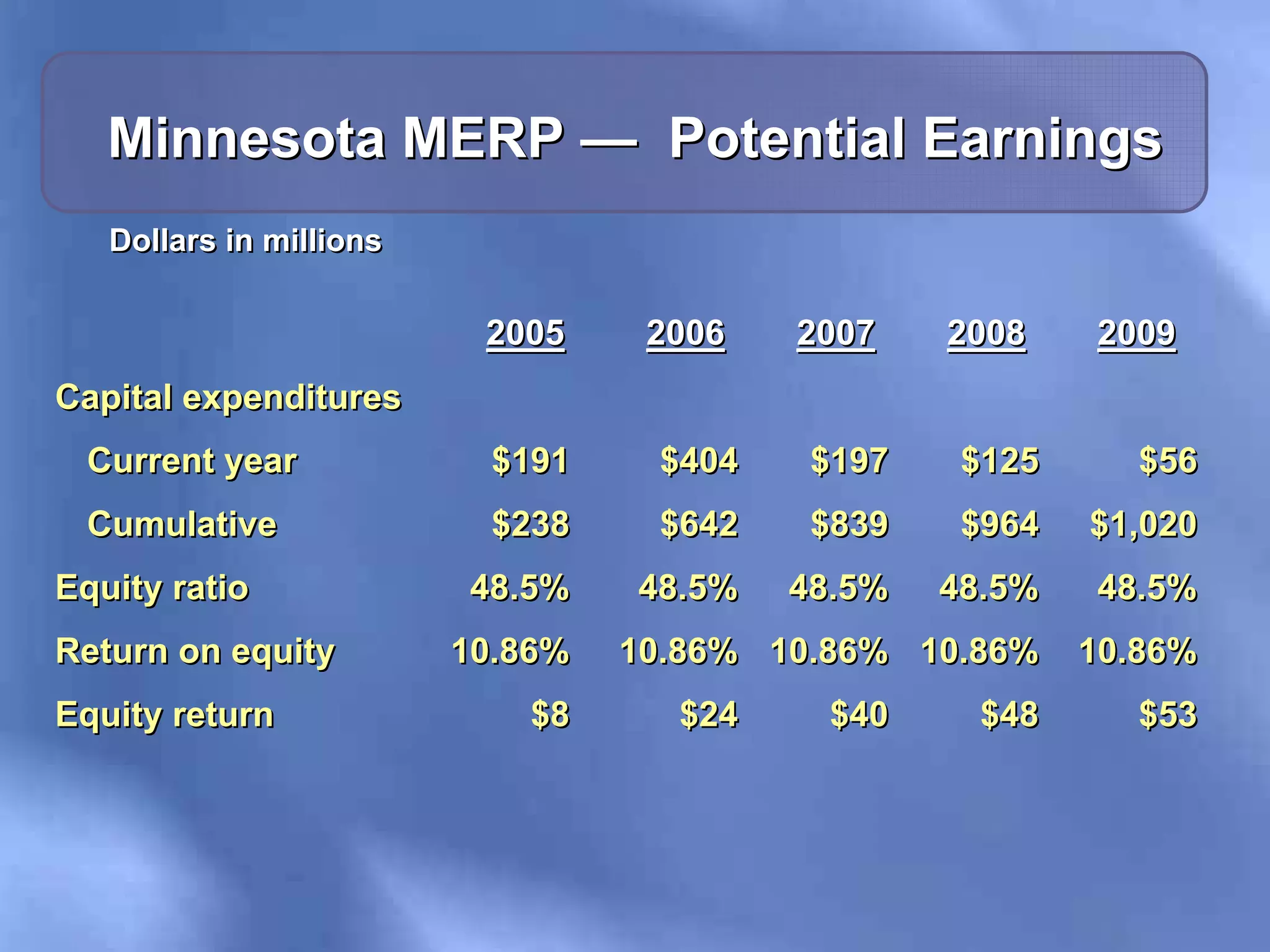

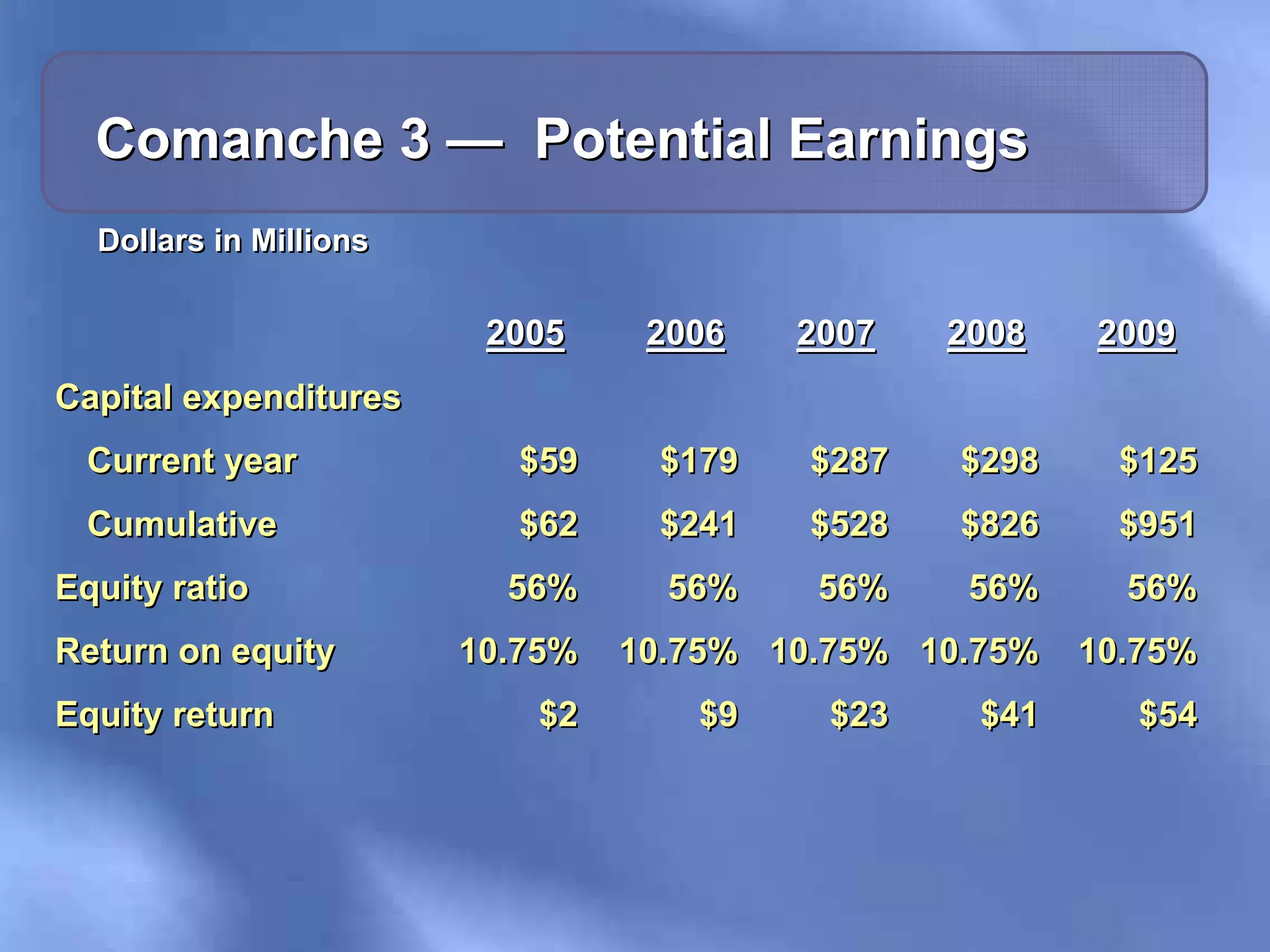

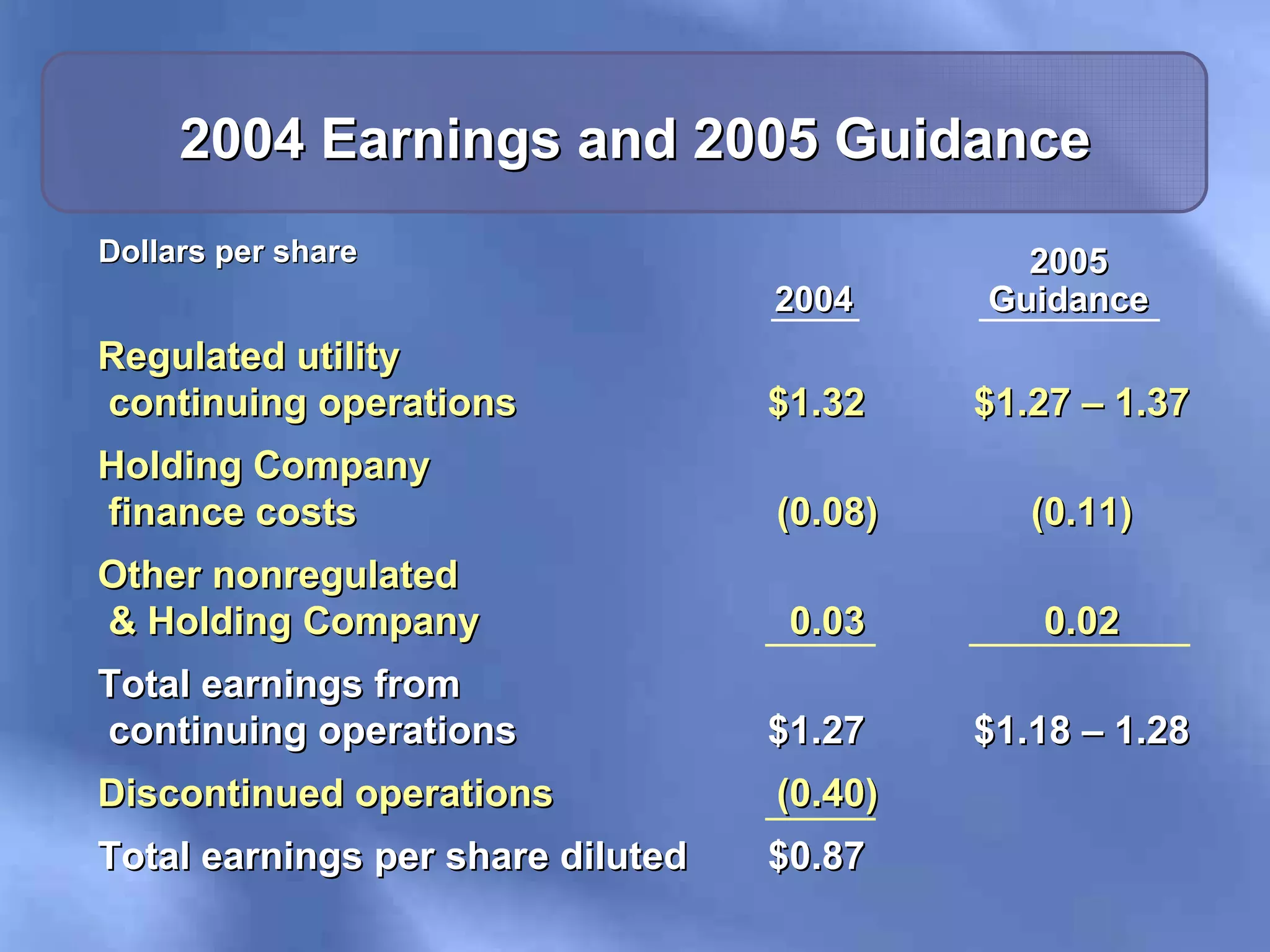

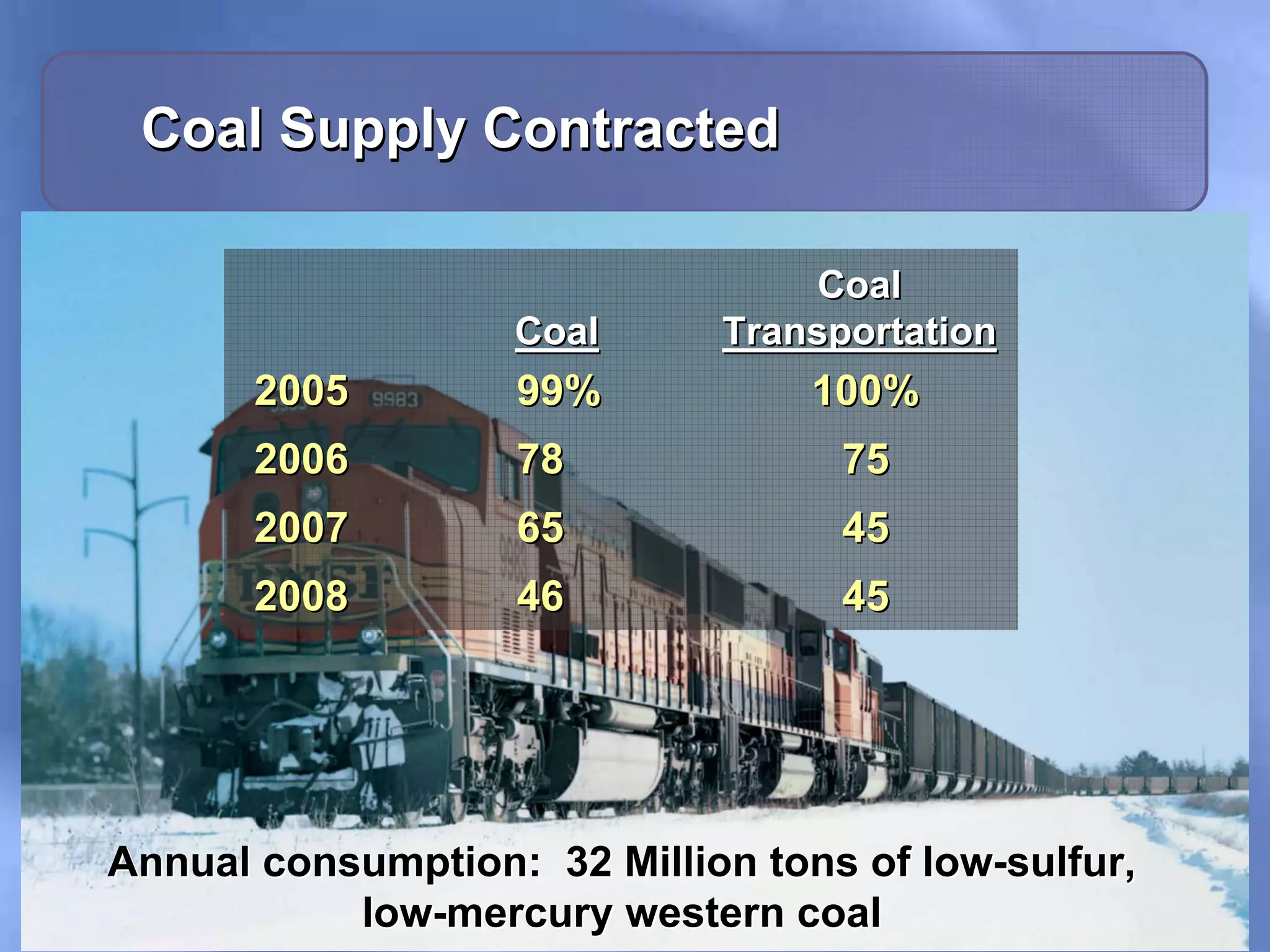

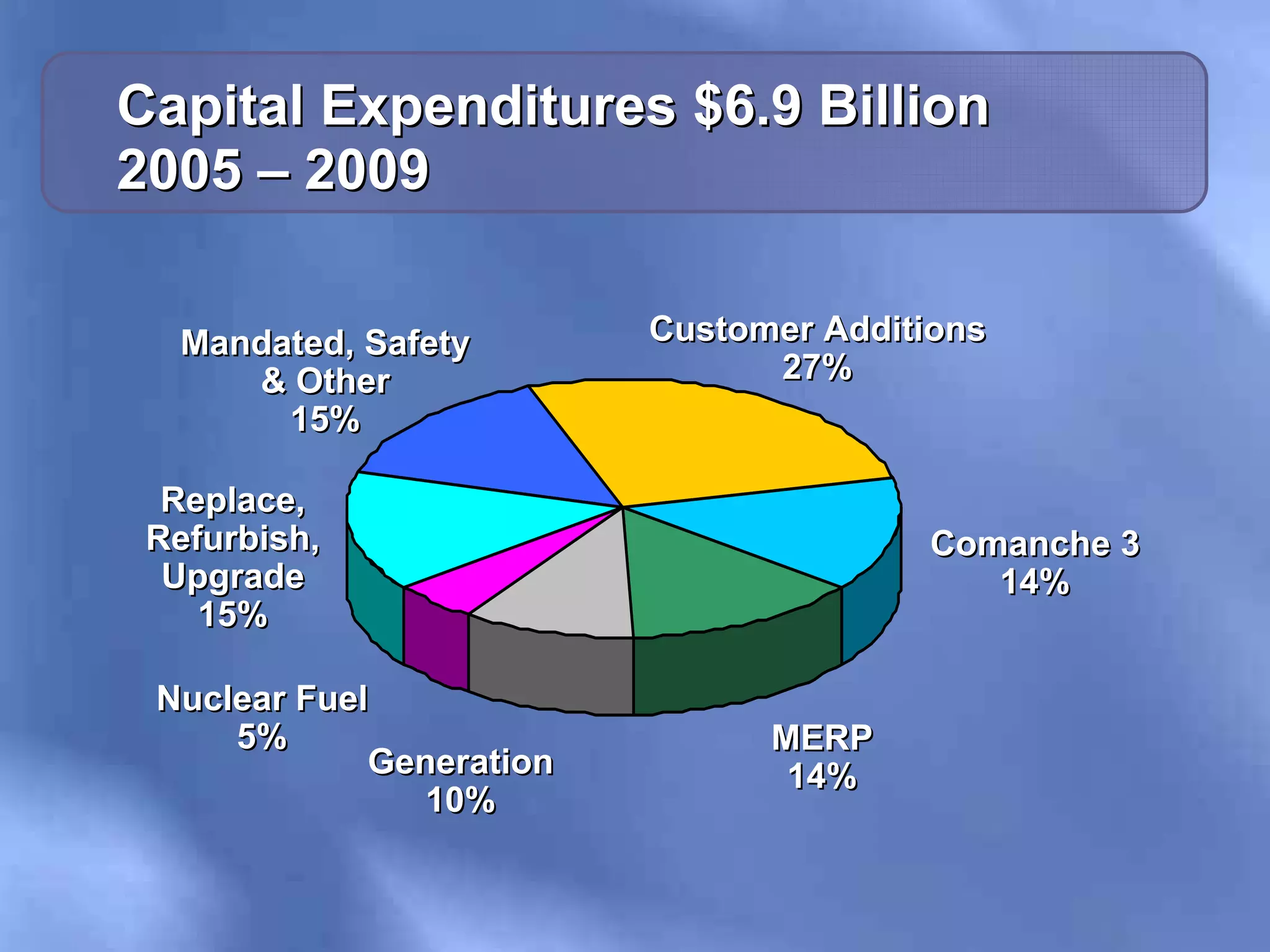

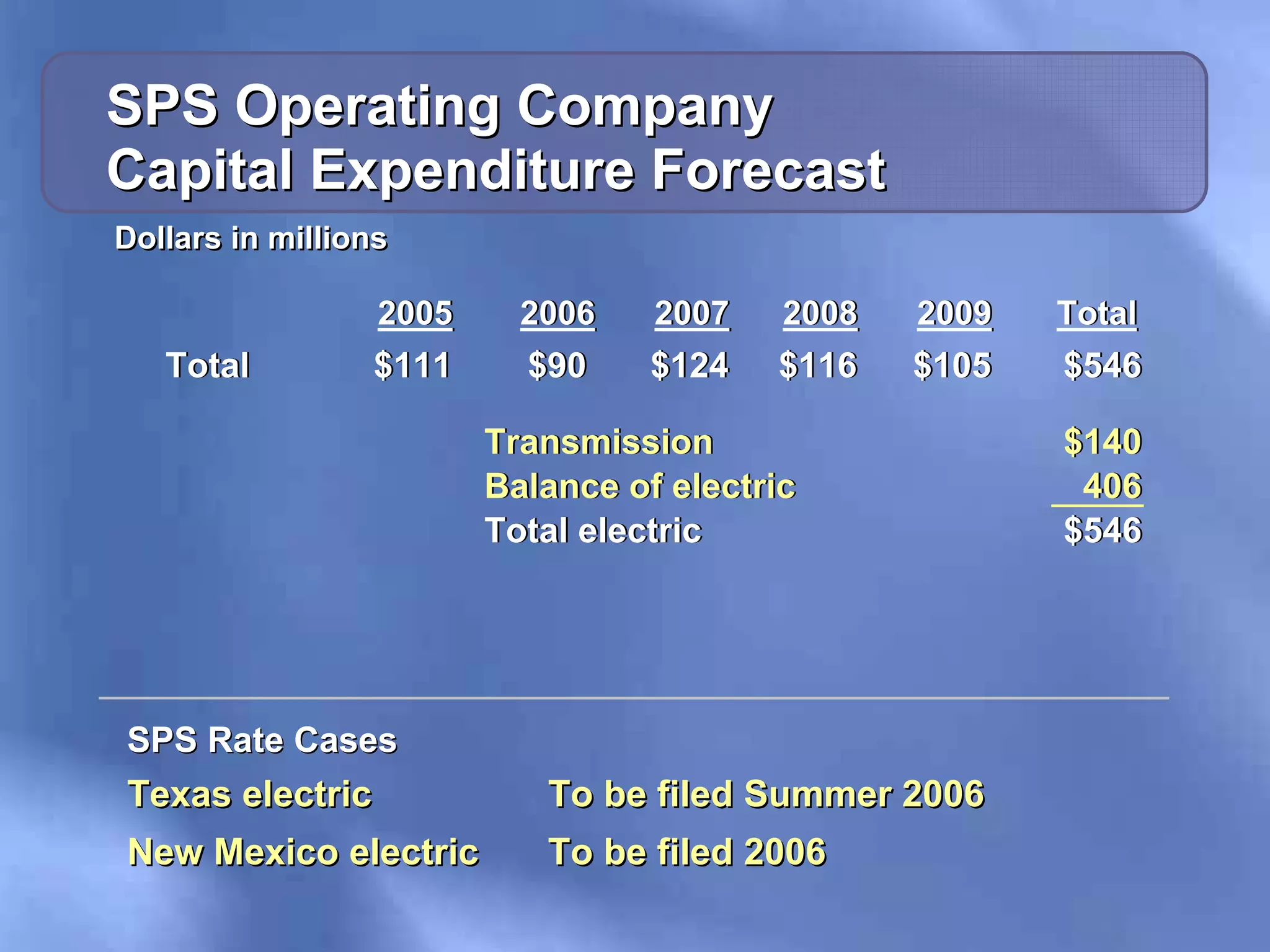

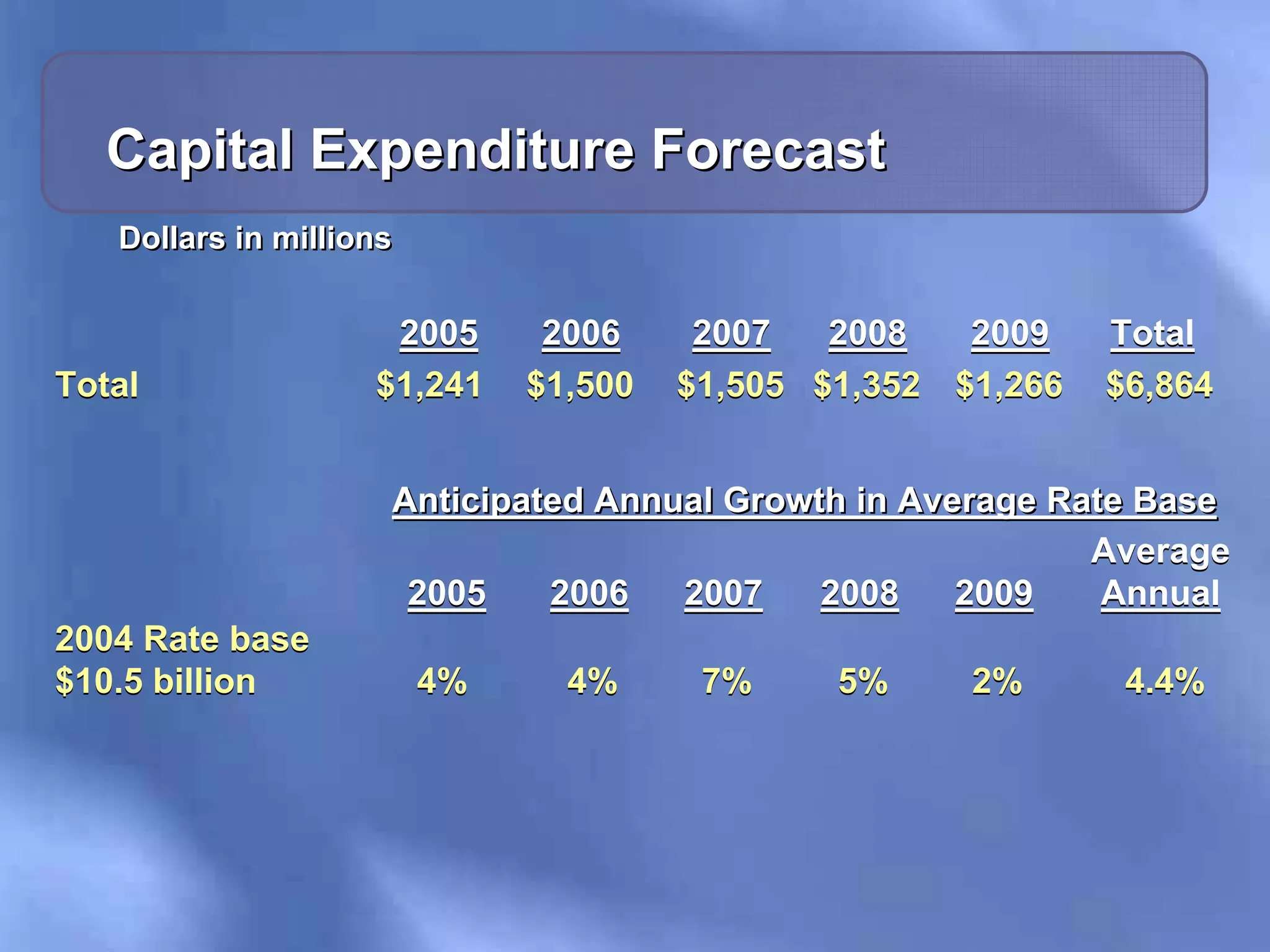

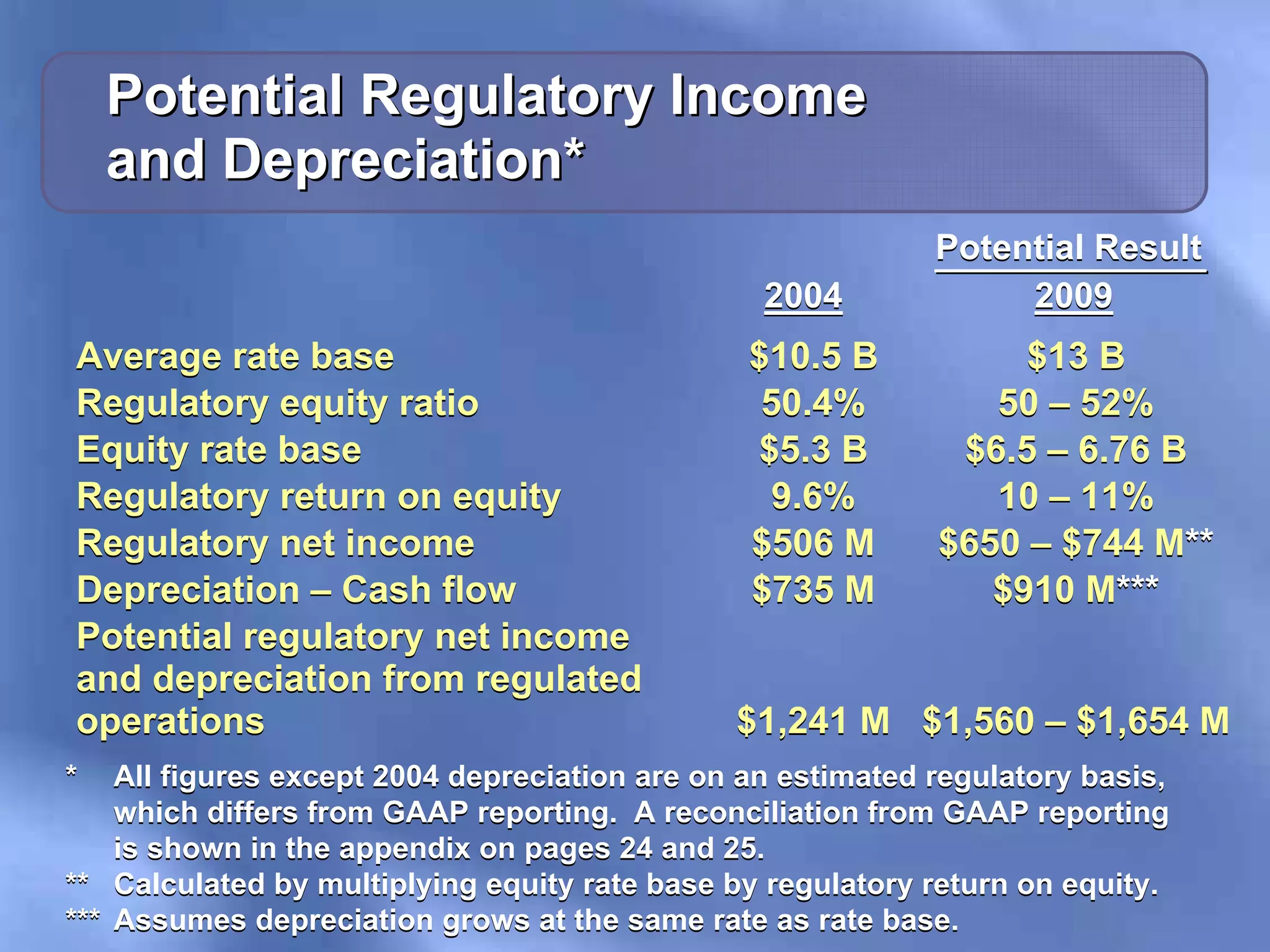

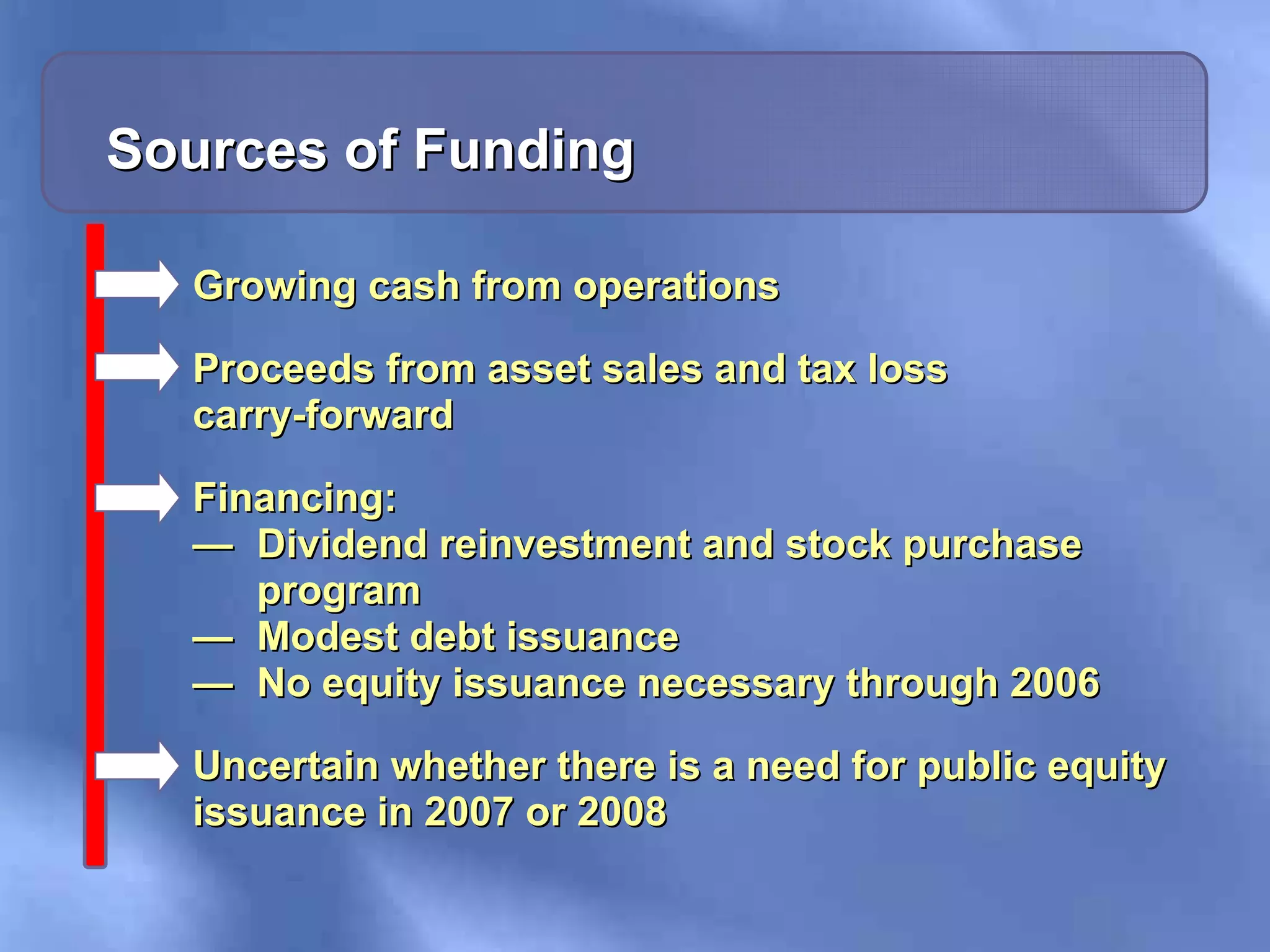

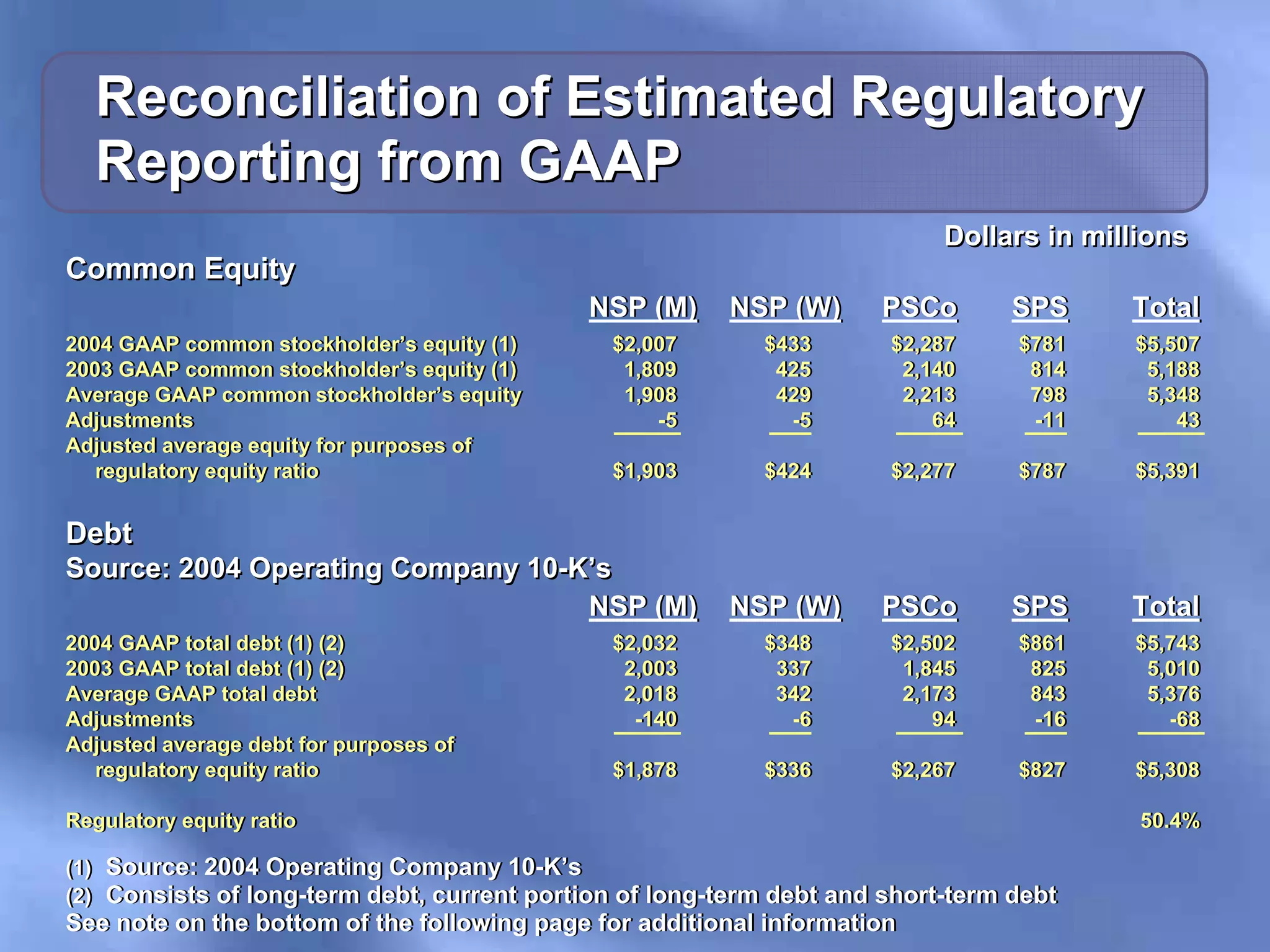

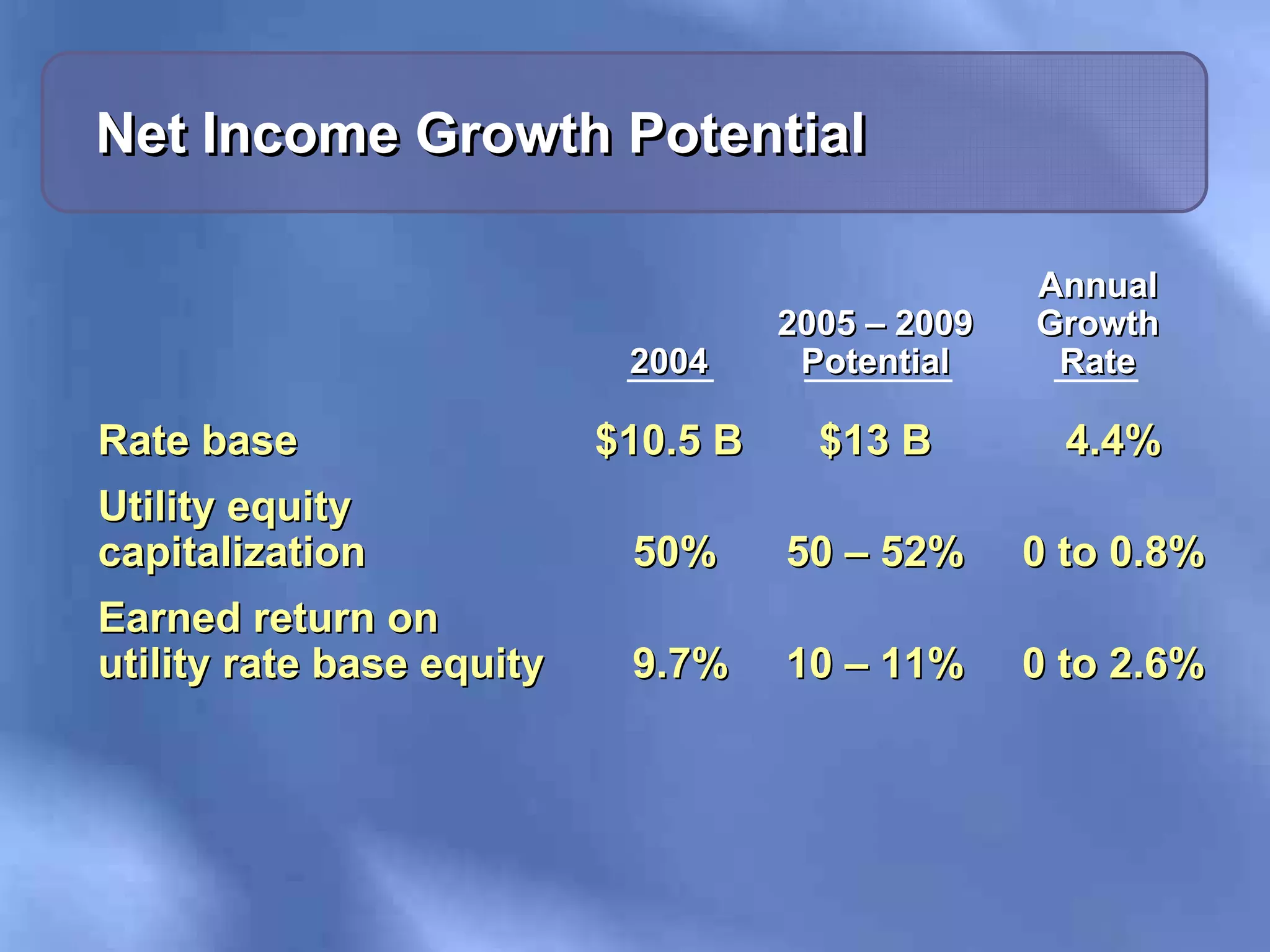

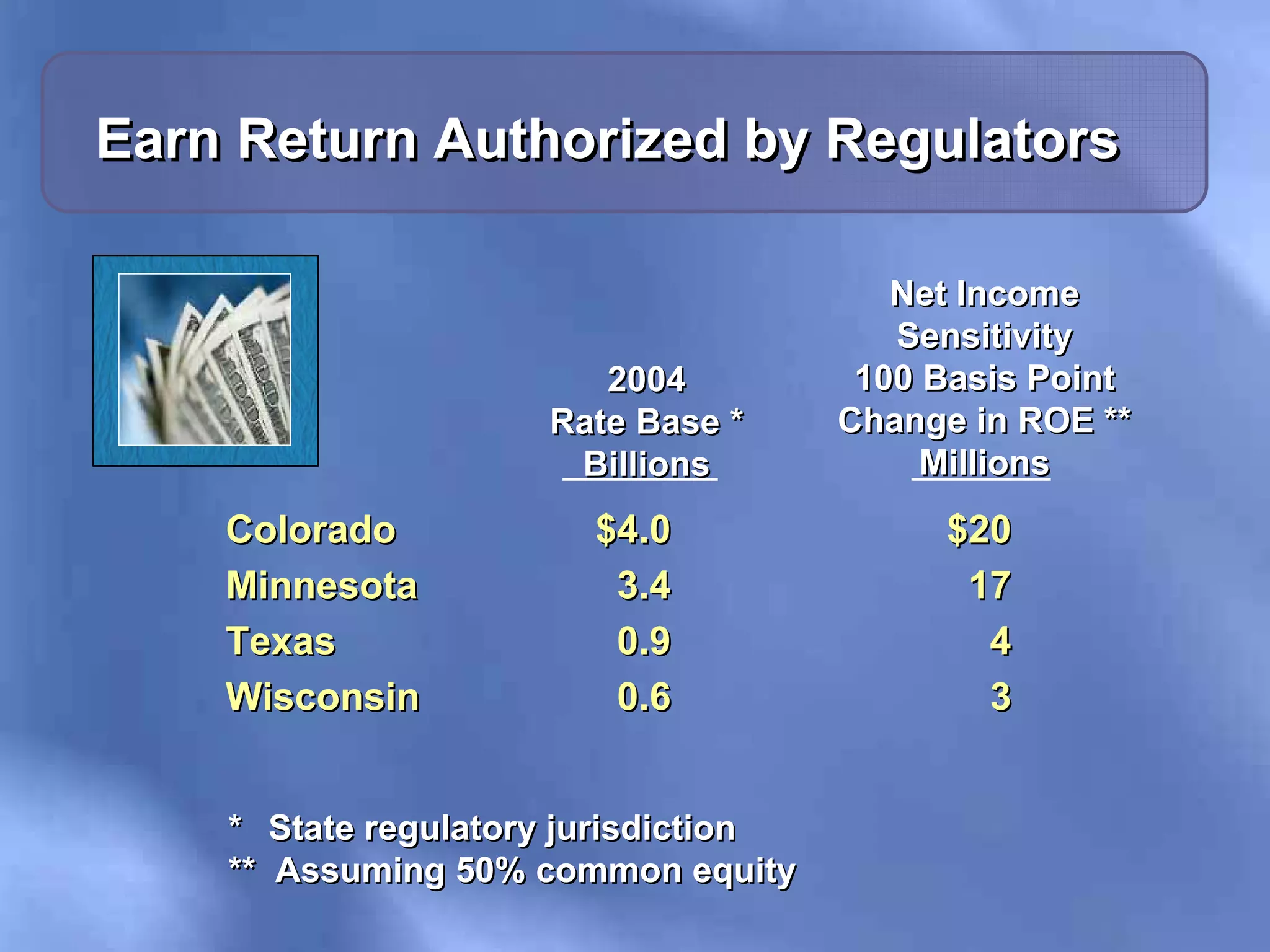

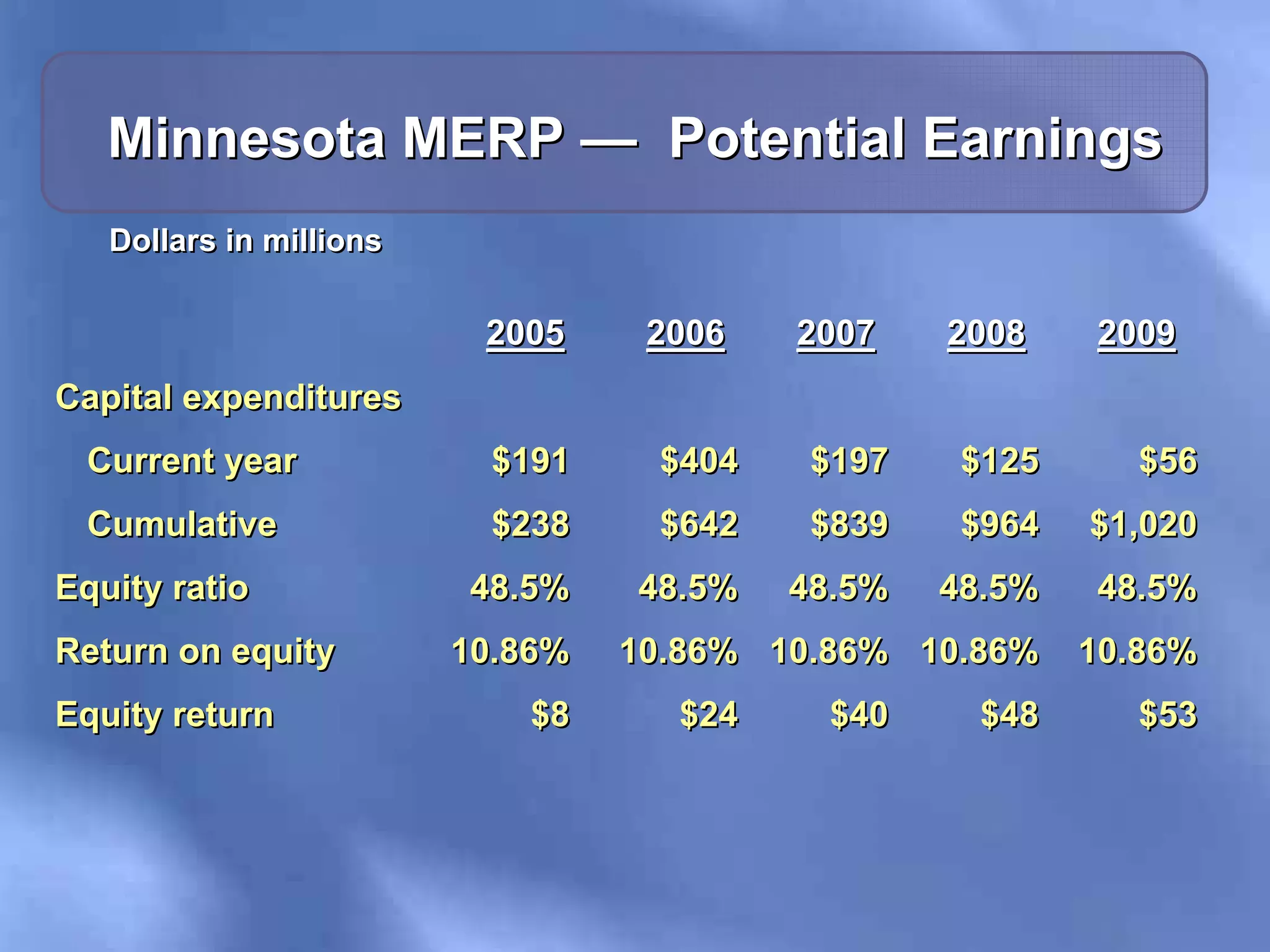

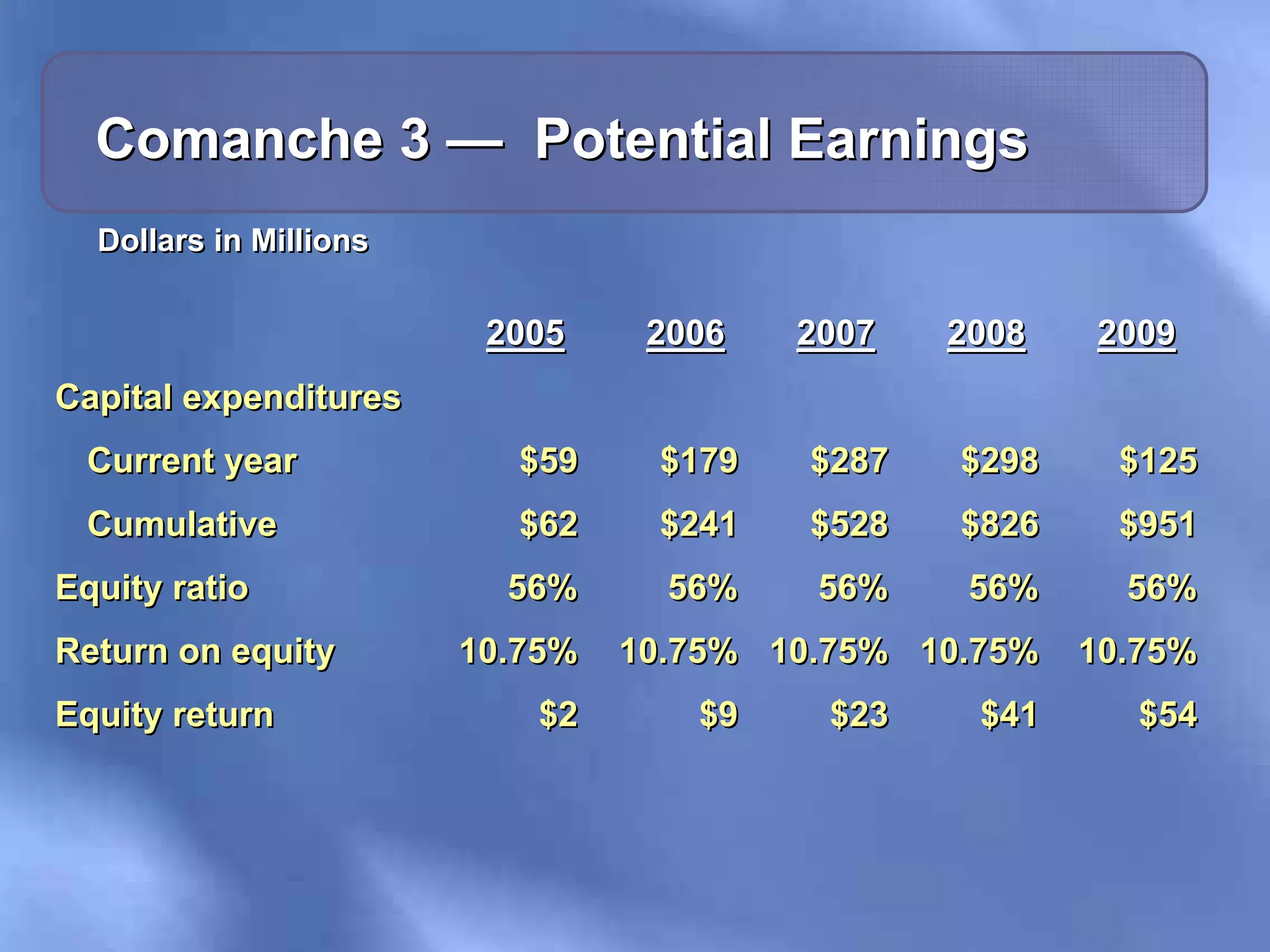

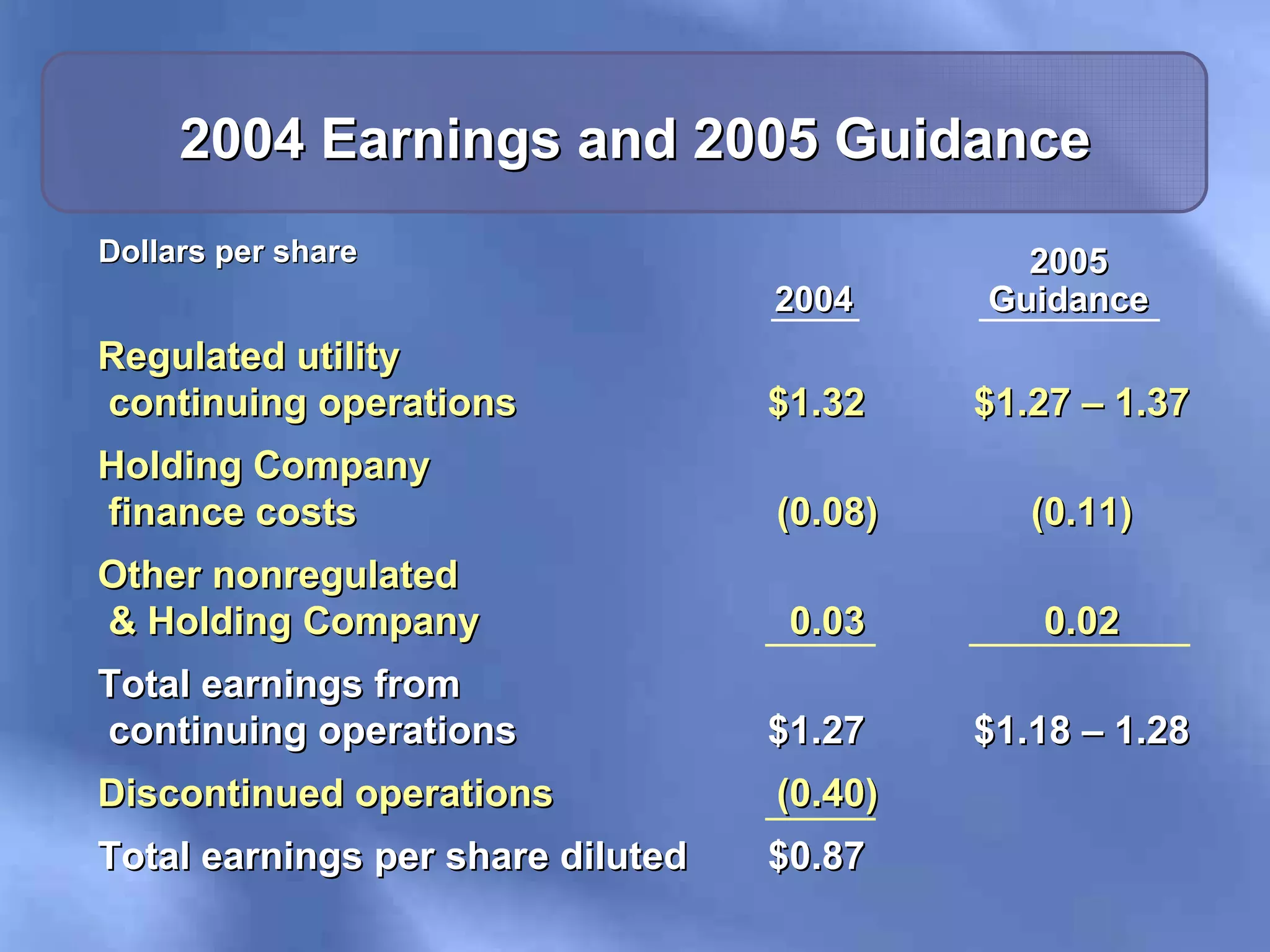

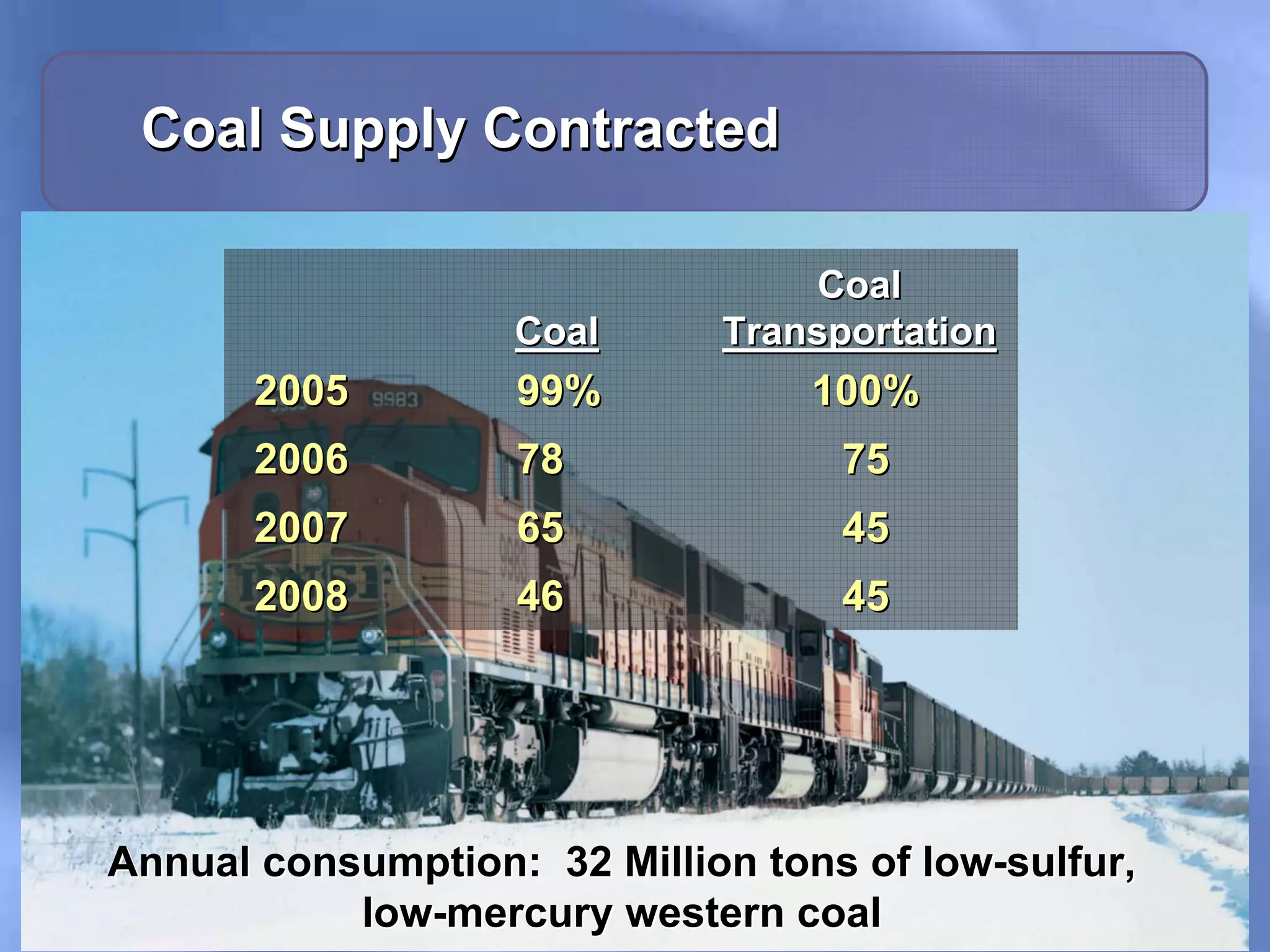

This document summarizes Deutsche Bank's Electric Power Conference held on June 14-15, 2005. It outlines Xcel Energy's $6.9 billion capital expenditure plan from 2005-2009, which is focused on building core utility assets. Key areas of investment include transmission infrastructure, nuclear fuel, and generation projects like Comanche 3 and Minnesota Energy Resource Plan. The plan aims to deliver earnings growth and stronger credit metrics while earning allowed returns. Regulatory support for cost recovery mechanisms was also discussed.