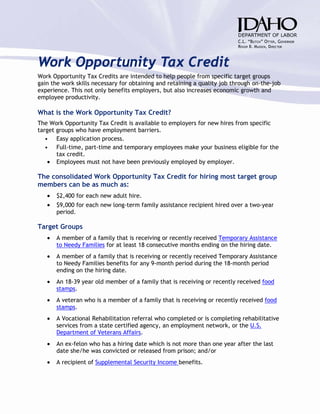

The Work Opportunity Tax Credit is a tax credit available to employers for hiring individuals from target groups that face employment barriers. It can provide up to $2,400 for each new adult hire and up to $9,000 for hiring a long-term family assistance recipient over two years. Eligible target groups include veterans, ex-felons, recipients of public assistance and food stamps, and vocational rehabilitation referrals. To receive the credit, employers must complete IRS forms 8850 and 9061 to certify new hires from target groups and submit them to their state workforce agency within 28 days of the hire date.