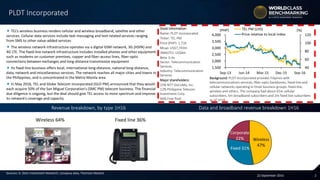

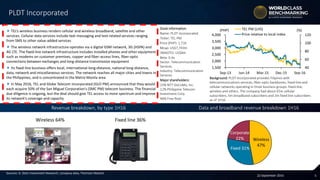

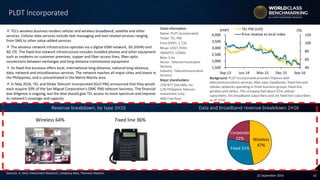

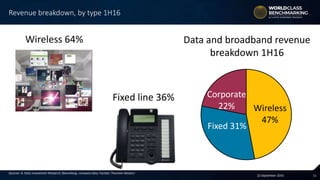

PLDT Incorporated offers telecommunications services in the Philippines, operating through fixed-line, wireless, and other business groups, with about 65 million cellular subscribers and a focus on the Metro Manila area. The company is in the process of acquiring a 50% stake in San Miguel Corporation's telecom business to enhance network coverage and capacity. As of September 2016, PLDT's stock is valued at PHP 1,716 with a market capitalization of approximately US$7.7 billion.