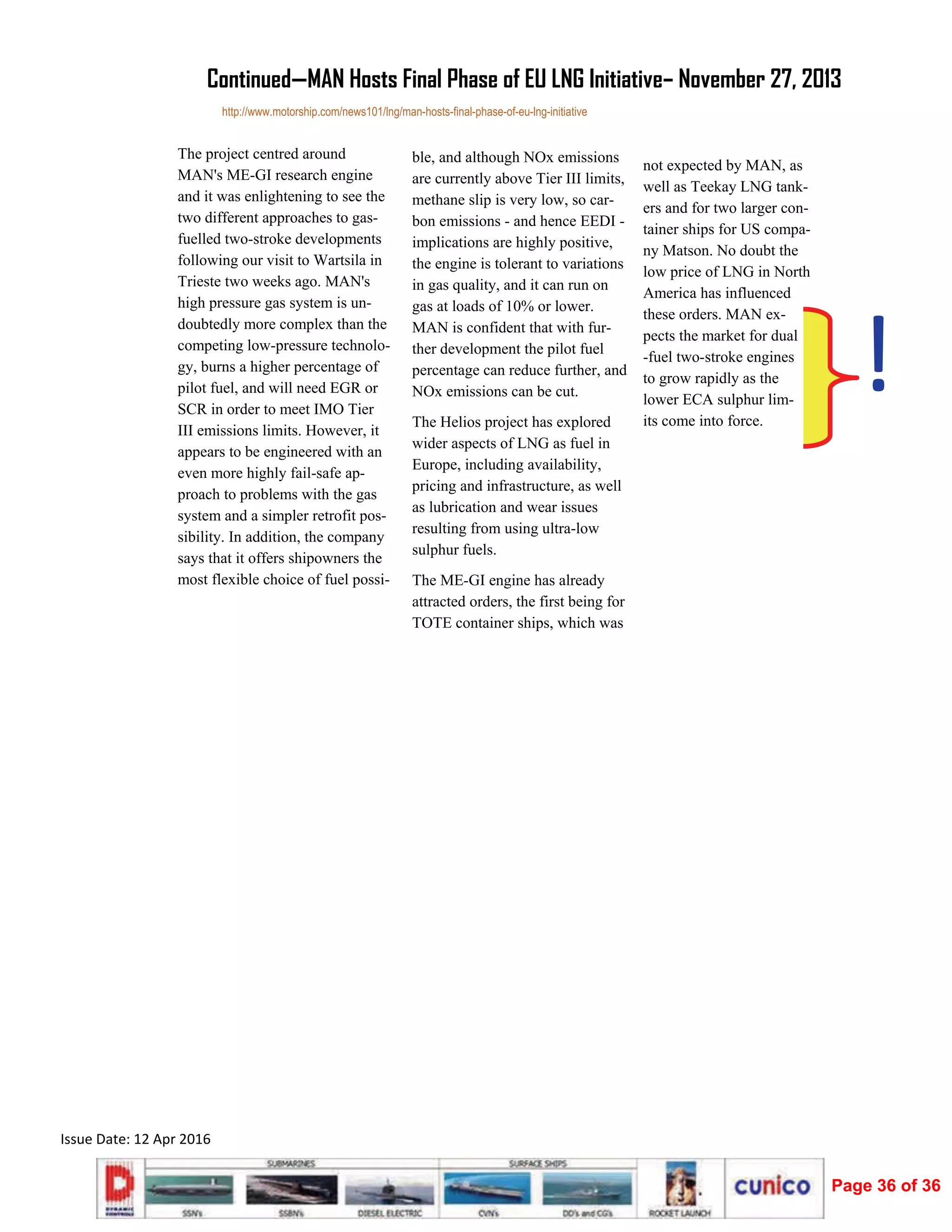

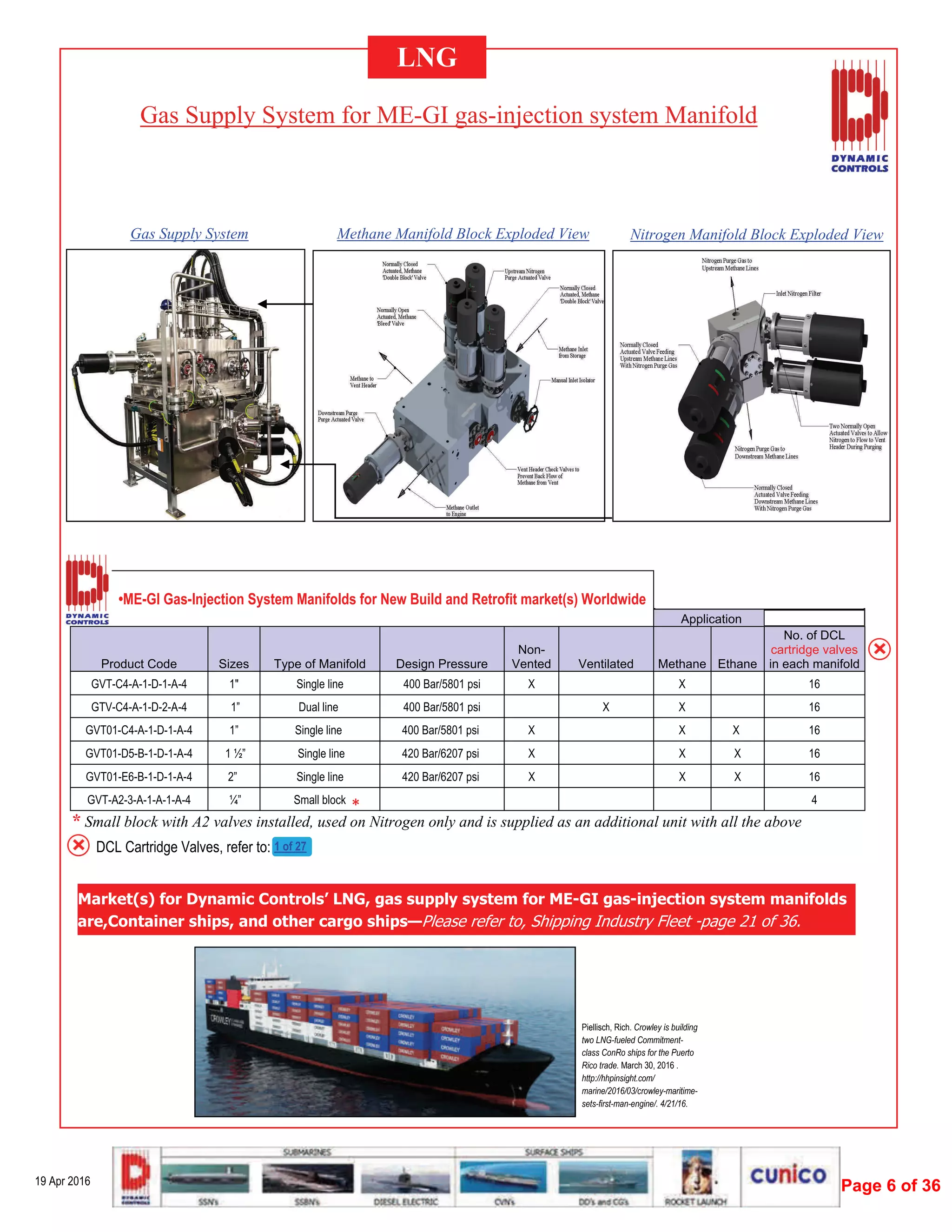

Within 10 years the majority of shipping vessels will run on LNG, a cleaner alternative fuel source. Environmental legislation is impacting the marine market to use cleaner fuels like LNG instead of heavy fuel oil. Dynamic Controls designs and manufactures gas supply systems for ME-GI gas injection system manifolds that optimize LNG engine performance on ships. The document then lists various news articles on pages 3 through 36 regarding LNG applications and developments in the shipping industry.

![Issue Date: 12 Apr 2016

MELBOURNE, Australia—Six years ago, Big Oil was so confident in the outlook for global energy demand that it bet tens

of billions of dollars to turn part of a remote Australian island known for its breeding grounds of rare sea turtles into a

vast gas‐export hub.

Now, the Chevron Corp.‐led Gorgon plant has become emblema c of how quickly the assump ons that underpinned

giant energy bets world‐wide have been shaken by falling energy prices.

On Tuesday, Chevron said it had started producing liquefied natural gas—natural gas cooled to a liquid form so it can

be transported by ship—from the Gorgon project and the company expects to send its first cargo to customers in Asia

next week. However, the plant is becoming opera onal at a me when investors are more ski sh about the health of

China’s economy, amid an oversupply of major commodi es.

Last month, Chevron, which owns nearly 50% of Gorgon, was among 10 U.S. oil companies whose credit ra ngs were

cut by Standard & Poor’s due to the oil‐price rout. Another of Gorgon’s big investors— Exxon Mobil Corp.—had its

triple‐A corporate ra ng placed on watch by S&P for a possible downgrade.

Many experts say Gorgon, now es mated to cost $54 billion to build versus an original budget of $37 billion as site

construc on progresses, offers a scant return on the huge investment with energy prices at current levels. Oil prices

were at around $60 a barrel—and rising—in September 2009, when Chevron, Exxon and Royal Dutch Shell PLC signed

off on the project’s construc on. That is roughly 60% above where oil prices sit now.

Gas sales from LNG projects in the Asia‐Pacific region

such as Gorgon are linked to swings in oil prices,

meaning returns on investment are more vulnerable

to vola lity in commodity markets than export‐

oriented facili es in the U.S. In 2015, LNG prices in

Asia roughly halved.

Energy companies say shareholders will benefit from

a guaranteed revenue stream from Australia, backed

up by a stable regulatory regime. Chevron es mates

gas output from Gorgon will last at least 40 years.

Also, Chevron and its partners have locked Asian

customers including China into deals linked to oil

prices that last up to 20 years, meaning they must

pay for natural gas supply whether they need it or

not.“We expect legacy assets such as Gorgon will

drive long‐term growth and create shareholder value

for decades to come,” John Watson,Chevron’s chief

execu ve, said. Spokespeople for Exxon and Shell,

which own about 25% of Gorgon each, declined to

comment.

Last year, China’s LNG imports fell 1% as the econo‐

my cooled. At the same me, rapid growth in North

American shale‐gas produc on sparked fears of a

global energy glut that is likely to take years to clear.

“We’re looking at a world of significantly lower

returns compared to the old days of the LNG indus‐

try,” said Michelle Neo, a Singapore‐based analyst at

energy consultancy FGE.

Gorgon is Chevron’s biggest global bet on LNG and it will produce up to 15.6 million metric tons of LNG a year, plus

enough gas to generate electricity for 2.5 million Australian homes.

Gorgon, along with seven other gas‐export facili es in Australia and neighboring Papua New Guinea, promised to help

redraw the energy map by moving the epicenter of the global gas trade away from the poli cally vola le Middle East.

About $180 billion was commi ed by companies including Chevron,ConocoPhillips and France’s Total SA to Australia’s

gas‐export industry between 2009 and 2012.

As well as concerns raised by the impact of falling prices on margins, onshore LNG projects are costly because they

require refrigera on tanks and a network of transporta on pipelines, while in many cases sea channels need to be

created for LNG tankers to arrive at ports and load up.

In addi on, Gorgon’s checkered record since star ng construc on has undermined confidence in its returns.

The project “is the poster child of rampant cost infla on gone wrong in the Australian LNG industry,” said Neil Beve‐

ridge, a Hong Kong‐based senior analyst at Sanford C. Bernstein. He es mated that the project’s overall cost could

come in at close to $60 billion, or roughly $4,000 a ton of capacity—about twice the current break‐even es mate based

Chevron plans more capital spending cuts– March 9, 2016

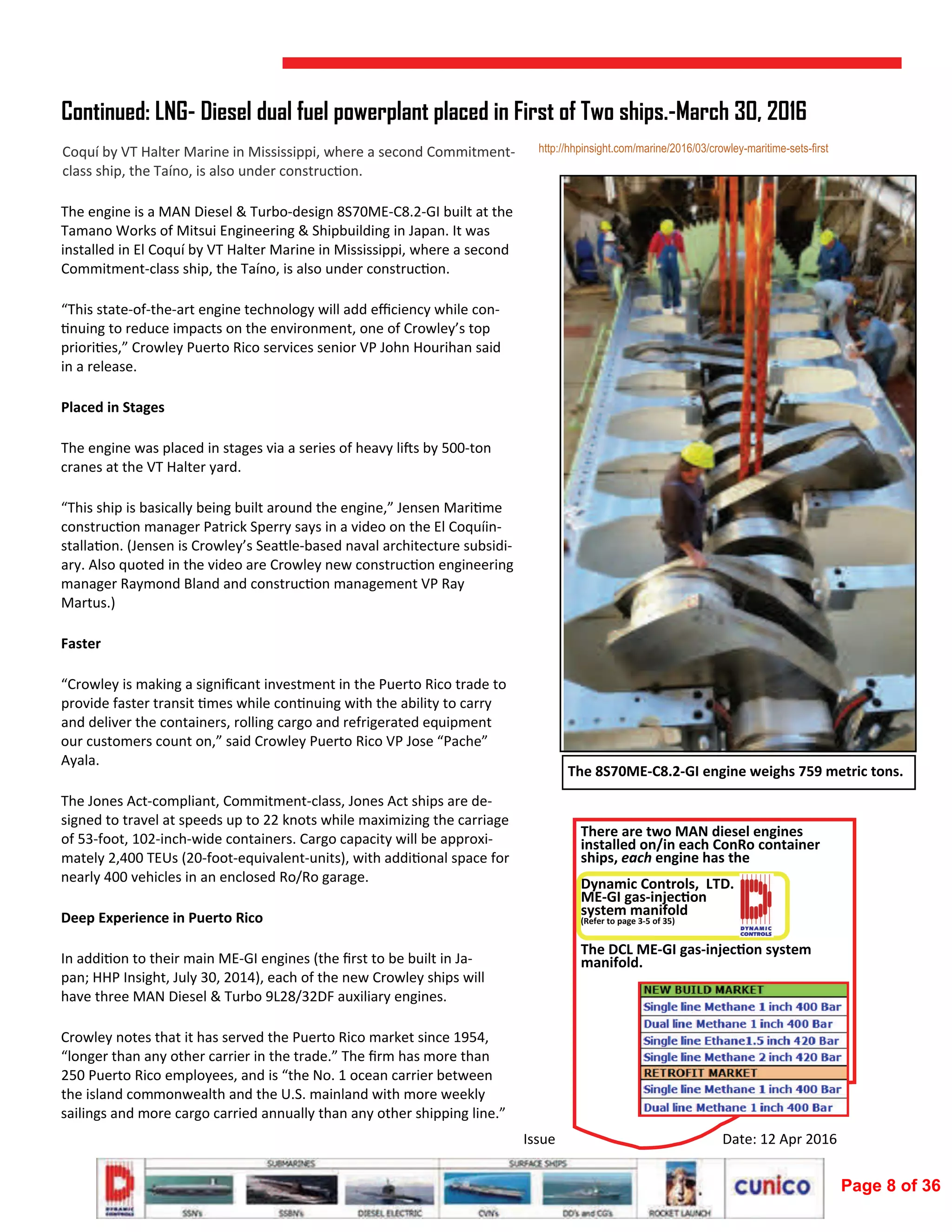

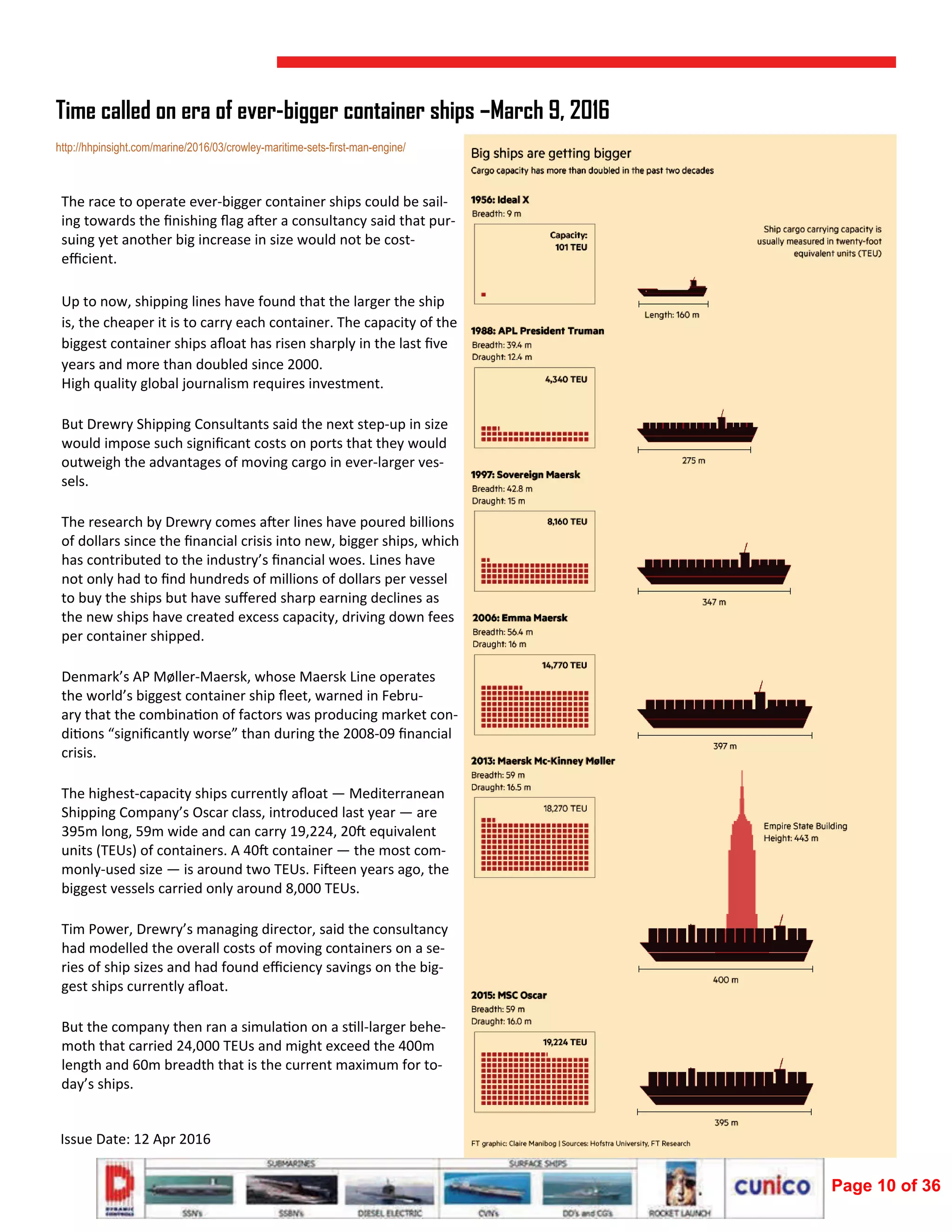

http://hhpinsight.com/marine/2016/03/crowley-maritime-sets-first-man-engine/

on current prices.

Gorgon’s construc on on isolated scrubland off Australia’s northwestern coastline coincid‐

ed with a parallel investment boom in other resources such as iron

ore and gold.

The result was that Chevron had to pay more to hire people—from

pipe fi ers to welders—while the construc on frenzy helped to

drive up the cost of raw material imports such as steel. A strength‐

ening Australian currency inflicted more pain for Chevron, which

had calculated its costs in U.S. dollars.

Barrow Island’s status as a government‐protected nature reserve

since 1910 also brought complica ons. Chevron and its partners

had to comply with strict environmental condi ons, ranging from

shrouded lights to avoid disturbing the nigh me ma ng of marine turtles to some of the

world’s toughest quaran ne procedures to cut the risk of invasive species being brought in

by workers.

Chevron expects the project to add a little more than 200,000 barrels a day to its

produc on when fully opera onal. That compares with the company’s output of 2.67

million barrels a day in the final three months of 2015. Gorgon and another Australian LNG

project, known as Wheatstone, together accounted for nearly half the US$15.4 billion that

Chevron invested in oil and gas in 2014.

However, such LNG projects will welcome long‐term cargo revenue and analysts recognize

their future poten al, despite current price concerns.

“If you look from the point when the investment decisions were taken, back between 2009

and 2011, then the project economics are pre y marginal and have suffered,” Giles Farrer,

a research director at consultancy Wood Mackenzie Ltd. in London, said. “[But] if you look

at the point where we are now, the projects are going to deliver fantas c revenue.”

Page 11 of 36](https://image.slidesharecdn.com/lng-dcl-updated-160914111535/75/Working-of-LNG-Gas-Supply-System-11-2048.jpg)