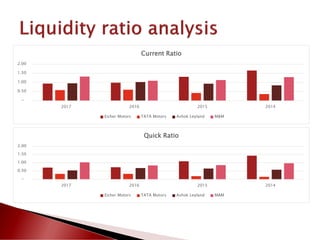

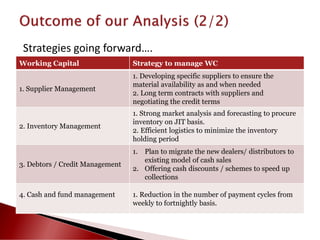

Eicher Motors, a significant player in India's automotive industry, focuses on expanding its market presence and enhancing production capacity, particularly in the mid-sized motorcycle segment. The company employs an aggressive working capital policy to optimize liquidity and reduce reliance on current assets while managing debt and credit efficiently. Key strategies include improving supplier relationships, inventory management, and cash flow optimization to adapt to growth and new product lines.