What We Do

•Download as PPTX, PDF•

0 likes•53 views

This document describes two types of targeted equipment financing transactions: 1) Targeted equipment financing transactions that are true leases between $5M-$30M for essential hardware and software with terms of 3-5 years for B- to BBB+ rated customers. 2) Targeted vendor financing engagements that provide lease line facilities between $10M-$100M for manufacturers to offer their customers, which are structured as true leases for each takedown with terms of 3-5 years based on the equipment and customer's credit. The value added for both is structuring non-bank transactions and providing full financing and leasing infrastructure support.

Report

Share

Report

Share

Recommended

Build America Bonds

Qualified projects can use Build America Bonds for low cost A&D/Rehab financing. Shovel ready projects can be completed using this new stimulus financing.

MIRA Fiduciary Audit Introduction

MillenniuM Investment and Retirement Advisors, LLC (“MIRA”) is an unaffiliated ERISA defined independent fiduciary to 401(k) and other defined contribution plans.

In this posting they discuss their role in assisting Advsiors and Plan Sponsors with DOL and ERISA Compliance.

Streamline Business and Equipment Financing

In the dynamic landscape of business operations, financing stands as a pivotal element for growth and sustainability. Particularly, the acquisition of equipment and access to lines of credit are crucial components that enable businesses to thrive. Streamline Business Financing's recent presentation delved into these essential aspects, shedding light on strategies and opportunities for businesses to leverage equipment financing and lines of credit effectively. This discourse aims to dissect and explore the insights provided during this presentation, highlighting the significance and implications for businesses seeking to expand their operations.

Understanding Equipment Financing:

Equipment financing serves as a strategic avenue for businesses to acquire the necessary tools and machinery required for their operations. Whether it's upgrading existing equipment or investing in new technology, this form of financing offers flexibility and efficiency. Streamline Business Financing emphasized the diverse range of equipment financing options available, including leases, loans, and equipment financing agreements.

One notable advantage highlighted during the presentation is the preservation of capital. By opting for equipment financing, businesses can conserve their cash reserves for other critical expenses such as payroll, marketing, or unforeseen contingencies. Additionally, equipment financing often comes with tax benefits, allowing businesses to deduct interest payments and depreciation expenses, thereby reducing their overall tax liability.

Moreover, Streamline Business Financing emphasized the importance of tailored financing solutions. Recognizing that each business has unique requirements, they highlighted the significance of customizing financing packages to align with specific needs and budgets. Whether it's a startup seeking to acquire essential machinery or an established enterprise looking to scale operations, personalized financing solutions can catalyze growth and productivity.

Exploring Lines of Credit:

In addition to equipment financing, Streamline Business Financing elucidated the importance of establishing lines of credit for businesses. Unlike traditional term loans, lines of credit provide businesses with a flexible source of capital that can be accessed as needed. This dynamic financing tool empowers businesses to navigate cash flow fluctuations, seize growth opportunities, and mitigate short-term financial challenges.

During the presentation, Streamline Business Financing outlined the various types of lines of credit available, including secured and unsecured lines, revolving lines, and invoice financing. Each option carries its unique features and benefits, catering to different business models and objectives. By understanding the nuances of these financing instruments, businesses can make informed decisions that align with their strategic priorities.

Recommended

Build America Bonds

Qualified projects can use Build America Bonds for low cost A&D/Rehab financing. Shovel ready projects can be completed using this new stimulus financing.

MIRA Fiduciary Audit Introduction

MillenniuM Investment and Retirement Advisors, LLC (“MIRA”) is an unaffiliated ERISA defined independent fiduciary to 401(k) and other defined contribution plans.

In this posting they discuss their role in assisting Advsiors and Plan Sponsors with DOL and ERISA Compliance.

Streamline Business and Equipment Financing

In the dynamic landscape of business operations, financing stands as a pivotal element for growth and sustainability. Particularly, the acquisition of equipment and access to lines of credit are crucial components that enable businesses to thrive. Streamline Business Financing's recent presentation delved into these essential aspects, shedding light on strategies and opportunities for businesses to leverage equipment financing and lines of credit effectively. This discourse aims to dissect and explore the insights provided during this presentation, highlighting the significance and implications for businesses seeking to expand their operations.

Understanding Equipment Financing:

Equipment financing serves as a strategic avenue for businesses to acquire the necessary tools and machinery required for their operations. Whether it's upgrading existing equipment or investing in new technology, this form of financing offers flexibility and efficiency. Streamline Business Financing emphasized the diverse range of equipment financing options available, including leases, loans, and equipment financing agreements.

One notable advantage highlighted during the presentation is the preservation of capital. By opting for equipment financing, businesses can conserve their cash reserves for other critical expenses such as payroll, marketing, or unforeseen contingencies. Additionally, equipment financing often comes with tax benefits, allowing businesses to deduct interest payments and depreciation expenses, thereby reducing their overall tax liability.

Moreover, Streamline Business Financing emphasized the importance of tailored financing solutions. Recognizing that each business has unique requirements, they highlighted the significance of customizing financing packages to align with specific needs and budgets. Whether it's a startup seeking to acquire essential machinery or an established enterprise looking to scale operations, personalized financing solutions can catalyze growth and productivity.

Exploring Lines of Credit:

In addition to equipment financing, Streamline Business Financing elucidated the importance of establishing lines of credit for businesses. Unlike traditional term loans, lines of credit provide businesses with a flexible source of capital that can be accessed as needed. This dynamic financing tool empowers businesses to navigate cash flow fluctuations, seize growth opportunities, and mitigate short-term financial challenges.

During the presentation, Streamline Business Financing outlined the various types of lines of credit available, including secured and unsecured lines, revolving lines, and invoice financing. Each option carries its unique features and benefits, catering to different business models and objectives. By understanding the nuances of these financing instruments, businesses can make informed decisions that align with their strategic priorities.

Other Financial Services-Leasing and Hire Purchase; Debt Securitization; Hous...

Other Financial Services-Leasing and Hire Purchase; Debt

Securitization; Housing Finance.

Introduction to the Bondable Lease

Powerpoint slides of a presentation I originally gave in January 2010 at a Federated Press Seminar as an introduction to the bondable or credit tenant lease, as translated for representation in January 2010

What is asset finance?

Everything you need to know about asset finance, it’s benefits and how it works for businesses of all sizes.

Asset finance explained

Discover:

- What is asset finance & why use it?

- What assets can be financed?

- Understand the different types of asset finance

- Choosing the right type of asset finance for you

Understanding the basics of equipment leasing

Information about equipment leasing and financing for businesses that may be considering it as a financing option.

How to Package a Loan Request for Construction, Rehab, and Commercial Loans

SFR Ventures Inc. requires that a Financing Request Package accompany all loan requests. The suggested outline included in this packet is very comprehensive and may request information that is not relevant to a particular loan request. This template has been utilized by the principals of SFR Ventures Inc. to effectively raise $400M+ in debt and equity for various real estate investments over the years. This template focuses primarily on residential rehab, construction, and development loans and provides a consistent process for borrowers to streamline the financing process and accelerate the funding timeline to meet the closing deadlines. Timely submission of a completed Financing Request Package can mean funding in as little as 5–7 business days.

Please be advised, SFR Ventures Inc. receives a high volume of loan requests. We aim to review and respond to loan requests within 48 hours of receiving the Financing Request Package. SFR Ventures Inc. requires certain criteria for a loan request to be considered. If the following criteria are not met, your loan request will not be reviewed:

• Borrower must have real estate experience with a proven track record

• Borrower is required to have a minimum of 20% equity into the deal

• The loan-to-value (LTV) may not exceed 70%

About SFR Ventures Inc.

SFR Ventures Inc. seeks to establish long-term relationships with experienced real estate investors, owner operators, developers, and brokers that are built upon trust, client service, and executional efficiency.

Please submit your Financing Request Package or any specific questions related to your particular transaction to beau@sfrventures.com

Beau Eckstein

Managing Partner

Direct: 925.852.8261

More Related Content

Similar to What We Do

Other Financial Services-Leasing and Hire Purchase; Debt Securitization; Hous...

Other Financial Services-Leasing and Hire Purchase; Debt

Securitization; Housing Finance.

Introduction to the Bondable Lease

Powerpoint slides of a presentation I originally gave in January 2010 at a Federated Press Seminar as an introduction to the bondable or credit tenant lease, as translated for representation in January 2010

What is asset finance?

Everything you need to know about asset finance, it’s benefits and how it works for businesses of all sizes.

Asset finance explained

Discover:

- What is asset finance & why use it?

- What assets can be financed?

- Understand the different types of asset finance

- Choosing the right type of asset finance for you

Understanding the basics of equipment leasing

Information about equipment leasing and financing for businesses that may be considering it as a financing option.

How to Package a Loan Request for Construction, Rehab, and Commercial Loans

SFR Ventures Inc. requires that a Financing Request Package accompany all loan requests. The suggested outline included in this packet is very comprehensive and may request information that is not relevant to a particular loan request. This template has been utilized by the principals of SFR Ventures Inc. to effectively raise $400M+ in debt and equity for various real estate investments over the years. This template focuses primarily on residential rehab, construction, and development loans and provides a consistent process for borrowers to streamline the financing process and accelerate the funding timeline to meet the closing deadlines. Timely submission of a completed Financing Request Package can mean funding in as little as 5–7 business days.

Please be advised, SFR Ventures Inc. receives a high volume of loan requests. We aim to review and respond to loan requests within 48 hours of receiving the Financing Request Package. SFR Ventures Inc. requires certain criteria for a loan request to be considered. If the following criteria are not met, your loan request will not be reviewed:

• Borrower must have real estate experience with a proven track record

• Borrower is required to have a minimum of 20% equity into the deal

• The loan-to-value (LTV) may not exceed 70%

About SFR Ventures Inc.

SFR Ventures Inc. seeks to establish long-term relationships with experienced real estate investors, owner operators, developers, and brokers that are built upon trust, client service, and executional efficiency.

Please submit your Financing Request Package or any specific questions related to your particular transaction to beau@sfrventures.com

Beau Eckstein

Managing Partner

Direct: 925.852.8261

Similar to What We Do (20)

Other Financial Services-Leasing and Hire Purchase; Debt Securitization; Hous...

Other Financial Services-Leasing and Hire Purchase; Debt Securitization; Hous...

How to Package a Loan Request for Construction, Rehab, and Commercial Loans

How to Package a Loan Request for Construction, Rehab, and Commercial Loans

What We Do

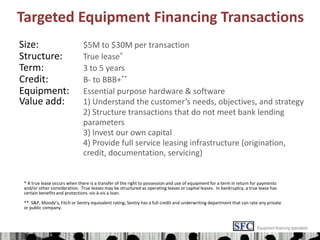

- 1. Targeted Equipment Financing Transactions Size:$5M to $30M per transaction Structure:True lease* Term:3 to 5 years Credit: B- to BBB+** Equipment:Essential purpose hardware & software Value add:1) Understand the customer’s needs, objectives, and strategy 2) Structure transactions that do not meet bank lending parameters 3) Invest our own capital 4) Provide full service leasing infrastructure (origination, credit, documentation, servicing) * A true lease occurs when there is a transfer of the right to possession and use of equipment for a term in return for payments and/or other consideration. True leases may be structured as operating leases or capital leases. In bankruptcy, a true lease has certain benefits and protections vis-à-vis a loan. ** S&P, Moody’s, Fitch or Sentry equivalent rating; Sentry has a full credit and underwriting department that can rate any private or public company. Equipment financing specialists

- 2. Targeted Vendor Financing Engagements Vendors:Manufacturers (U.S. or foreign) of capital equipment and software Structure:Lease line facility The vendor provides its targeted customers with a lease line facility that can be drawn down over a term typically from 6 to 12 months Size:$10M to $100M per customer Takedowns: Each takedown (funding) is structured as a true lease Each lease has a term from 3 to 5 years based on the equipment and credit of the lessee Equipment: Hardware, software and services (total solution) Value add:Manufacturers are able to: 1) offer “one-stop shopping” 2) increase total solution sales 3) strengthen customer relationships Equipment financing specialists