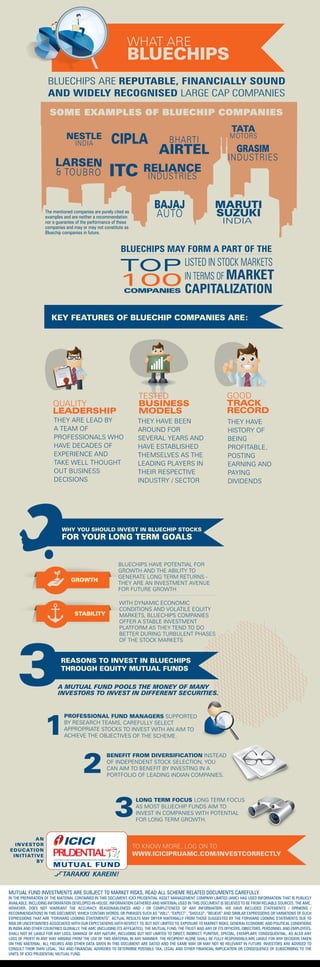

Bluechips are large, reputable companies that are leaders in their industries. They have a long track record of success, stability, and profitability. Some examples of Indian bluechip companies mentioned are Tata, Reliance Industries, ITC, and HDFC Bank. Investing in bluechip stocks through equity mutual funds provides benefits like diversification, professional management, and a long-term focus on companies with growth potential.