We're turning from cash but demande for notes has never been higher

- 1. BUSINESS THE ECONOMY ORGANISED CRIME We're turning from cash, but demand for notes has never been higher Last December, Atlas the Labrador was added to the Australian Federal Police force’s Canine Wall of Excellence, honoured for his service as the country’s first cash detection dog. Atlas has sniffed out hundreds of thousands of dollars in his nine-year career, some hidden in stereo speakers or buried underground. And since he began work, Australian Customs and Queensland Police have followed the AFP’s lead, introducing canine squads focused on currency. The dogs have their work cut out for them. By Patrick Begley 11 May 2018 — 3:03pm A A A View all comments9 Subscribe Log In 0

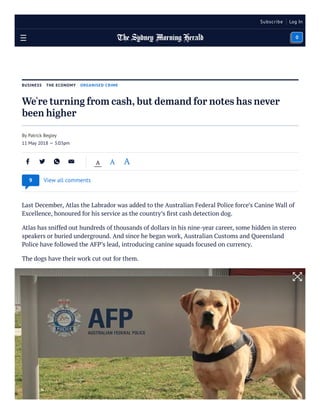

- 2. While Australians opt more and more for tap-and-go payments, the demand for cash has never been higher. It is a situation that suits organised criminals looking to disguise the profits of international drug crime as legitimate revenue. Treasurer Scott Morrison announced in the budget on Tuesday a $10,000 limit on business transactions using physical currency, a move designed to combat tax avoidance and money laundering. Others are much more ambitious. Richard Holden, a UNSW economics professor, is calling for cash to be completely phased out by 2020, describing it as a "lubricant” of organised crime. “Cash is a way of avoiding detection - it’s a way not to get caught,” he says. Former US treasury secretary Larry Summers wants an end to the $US100 bill while Harvard professor Kenneth Rogoff says cash is a “curse” - one that facilitates crimes from human trafficking to terrorism. In 2016, the European Union announced it would no longer print the €500 note (sometimes named the “Bin Laden” for its criminal associations) while India eliminated its two highest denominations in an anti-corruption drive. So should Australia rake back its cash? The 'cash paradox' Paying without cash has never been easier or more popular. According to the Reserve Bank of Australia, the proportion of cash payments made by Australian consumers dropped from 70 per cent in 2007 to 37 per cent in 2016. Over the same period, the value of the payments dropped $56 billion, down to $162 billion. Cash’s popularity has declined "faster than any of us anticipated", says Westpac chief executive Brian Hartzer, who predicted 95 per cent of payments would be electronic within a decade. Tap-and-go card payments are booming, while the New Payment Platform engineered by the RBA allows for instantaneous transfers between customers of different banks. Atlas served as Australia's first cash detection dog, working for the AFP. Photo: ACT Churchill Fellows' Association

- 3. And yet more cash flows through the Australian economy than ever before: about $74 billion in 1.5 billion notes. The ratio of physical currency to GDP has risen to a 50-year high as the commercial banks have demanded larger stocks of every note for a decade. As for the rarely-seen green $100, there are now 14 for every Australian. Why would banks demand more cash than ever if the majority of the customers are turning away from it? It is a puzzle sometimes known as the “cash paradox”. “Trends in cash demand across a range of countries cannot be easily reconciled with changes in consumer payment preferences,” RBA analysts wrote in a 2016 article. One possible driver of demand, they noted, was “the use of cash for unlawful purposes”. Central banks, which make profits by selling notes to commercial banks, have been accused by some media commentators of facilitating tax evasion and organised crime by pumping out so much money. The scale of the criminal demand for cash is hard to determine, though, and the RBA points to other drivers. About $74 billion in 1.5 billion notes flows through the economy. Photo: Chay Talanon

- 4. RELATED ARTICLE Some people hold large legitimate deposits of cash, especially after financial crises and when banks offer only low interest rates. International students and tourists often prefer cash, foreign governments hold stores and demand rises in line with population and economic growth. "Any kind of instrument that facilitates an exchange of value is likely, unfortunately, to attract nefarious activity,” assistant governor of the RBA Lindsay Boulton tells Fairfax Media. “That's true for cash and true for payment cards and other instruments, but the legitimate uses for those instruments are far more important and significant for the community.” 'Bucketloads of cash' Anonymous and ubiquitous, cash remains popular among high-level criminals, both as a means of transaction and a store of wealth. “Cash is definitely king at the moment,” says Scott Cook, acting director of criminal operations within NSW Police. “Crime groups and networks have bucketloads of cash.” Since April 2014, the NSW Police organised crime squad has seized $60 million in physical currency and Cook predicts it will retain its throne for the foreseeable future. “I can’t imagine the time when a street-level drug deal is going to be conducted using an electronic card, but you never know where technology will take us”. A NSW Crime Commission spokesperson said the agency had been detecting greater amounts of cash, in line with larger drug seizures. “It is usually detected as part of the process of moving the funds offshore to fund further drug importations or the repatriation of criminal profits." In the six months to June 2017, the Commission was able to seize $8 million in cash from one Sydney money-laundering syndicate but was aware the syndicate transferred $100 million in that time. Gangs, which tend to use “cash-intensive” businesses such as restaurants, brothels and casinos to launder funds, are not expected to run out of portals any time soon. Boulton of the RBA predicts a “steady walk rather than a quick sprint” towards a society with fewer notes. “I think it's a stretch to say that in the foreseeable future we would move to a cashless society." The end of the $100 bill? While some favour a complete phase-out, others are lobbying for the higher denominations - $100s and $50s - to be scrapped. $500,000 a pop: the price you pay in organised crime

- 5. The Australian Criminal Intelligence Commission notes organised crime’s preference for the bigger bills, which “take up less space than lower-denomination notes of the same value and allow for easy handling, transportation, and storage”. Banks UBS and HSBC have called for the top bill to be abolished, partly to crack down on crime. Likewise, economist-turned-politician and assistant shadow treasurer Andrew Leigh says Australia should start talking about a transition away from large denominations. “The convenience and privacy benefits of cash are just one side of the coin,” Leigh said. “The other side is the very extensive use of cash for nefarious purposes.” But proposals to abolish the $100 bill only are complicated by the fact that many criminal groups prefer $50s, possibly because they are so commonplace. The RBA has no plans to get rid of any notes. If the $100 bill were banned, demand for the $50 would likely surge, leading to greater printing costs for the RBA. And there is some concern the $50 - already the most counterfeited note - would be faked even more. Deakin University economist Pasquale Sgro predicts that even if some physical currency were eliminated, criminals would simply adjust. “Whatever notes we have around, criminals will deal in them,” he says. Proceeds of crime seized in Sydney by NSW police. Photo: NSW Police

- 6. RELATED ARTICLE Cook, the NSW Police commander, agrees it would not stop crime. “It would only mean that they have to carry bigger bags.” The rise - or not - of cryptocurrencies Virtual or cryptocurrencies, meanwhile, have been touted as revolutionary technology for organised crime, one that could offer cheap and fast transactions outside the traditional banking system. Investigators from the NSW Crime Commission and NSW Police Organised Crime Squad last year detained a self-described Bitcoin seller who received a large amount of cash in a suspicious transaction. It was the first transaction the agencies had seen involving Bitcoin. “It is unlikely to be the last,” the commission said in its annual report. But law enforcement agencies say that while cryptocurrencies may be popular among lower-level operators, the professional money- laundering syndicates catering to transnational crime gangs have shown limited appetite. Cryptocurrencies are often volatile and can be hard to cash out. “Bitcoin is not the most efficient mechanism for them to use,” says Krissy Barrett, an AFP national manager focused on money laundering. “We are talking about networks that have incredible reach and access to huge funds. They make a commission and profit from currency exchanges as well, as this money moves through multiple countries.” Cash may be a relatively primitive technology but its laundering has reached a sophistication that has sometimes taken law enforcement by surprise. Gangs turn to figures such as Altaf Khanani, the global money-launderer Australian authorities helped catch, who funnelled funds to al-Qaeda and bikie gangs using a “shadow” operation of his legitimate money-changing business. “We often see that the organised crime groups don’t have the kind of reach that these professional money-laundering groups do,” Barrett says. A cashless future Despite criminals’ fondness for the folding stuff, an economy in which customers start paying for drugs using cards or phones would have its advantages. Gangs currently have to source “smurfs”, often overseas students or tourists with no criminal records, who visit branches to deposit less than the $10,000 threshold for automatic alerts to CRYPTOCURRENCIES The underground bunkers where 'Patient Zero' helps the ultra-rich hide billions in bitcoin

- 7. criminal intelligence agencies. Less cash would mean fewer visits to the bank, fewer opportunities for detection. “A cashless society will eliminate the need for smurfs to move cash but it will create digital smurfs or mules,” says Chris Douglas, an anti-money-laundering consultant and former AFP officer. “People will receive funds into their account, extract a fee and send the balance onto another account.” And as Australians continue to embrace contactless payments, criminal intelligence bodies such as the Australian Criminal Intelligence Commission predict rises in card and other electronic frauds - the proceeds of which are beyond any dog’s nose. Patrick Begley Patrick Begley is an investigative reporter for The Sydney Morning Herald. By signing up you accept our privacy policy and conditions of use License this article Recent comments Xavier 3 DAYS AGO there are many legitimate reasons to keep and trade in cash. many do not trust Banks, fees and charges are greater than... BETTER WAY 3 DAYS AGO A lot of cash is never ever banked so you can't measure that cash. It just goes around & around View all comments ORGANISED CRIME 9 MORNING & AFTERNOON NEWSLETTER Delivered Mon–Fri. Your email address SIGN UP

- 9. COMPARE & SAVE Copyright © 2018 OUR SITES CLASSIFIEDS THE SYDNEY MORNING HERALD PRODUCTS & SERVICES FAIRFAX MEDIA