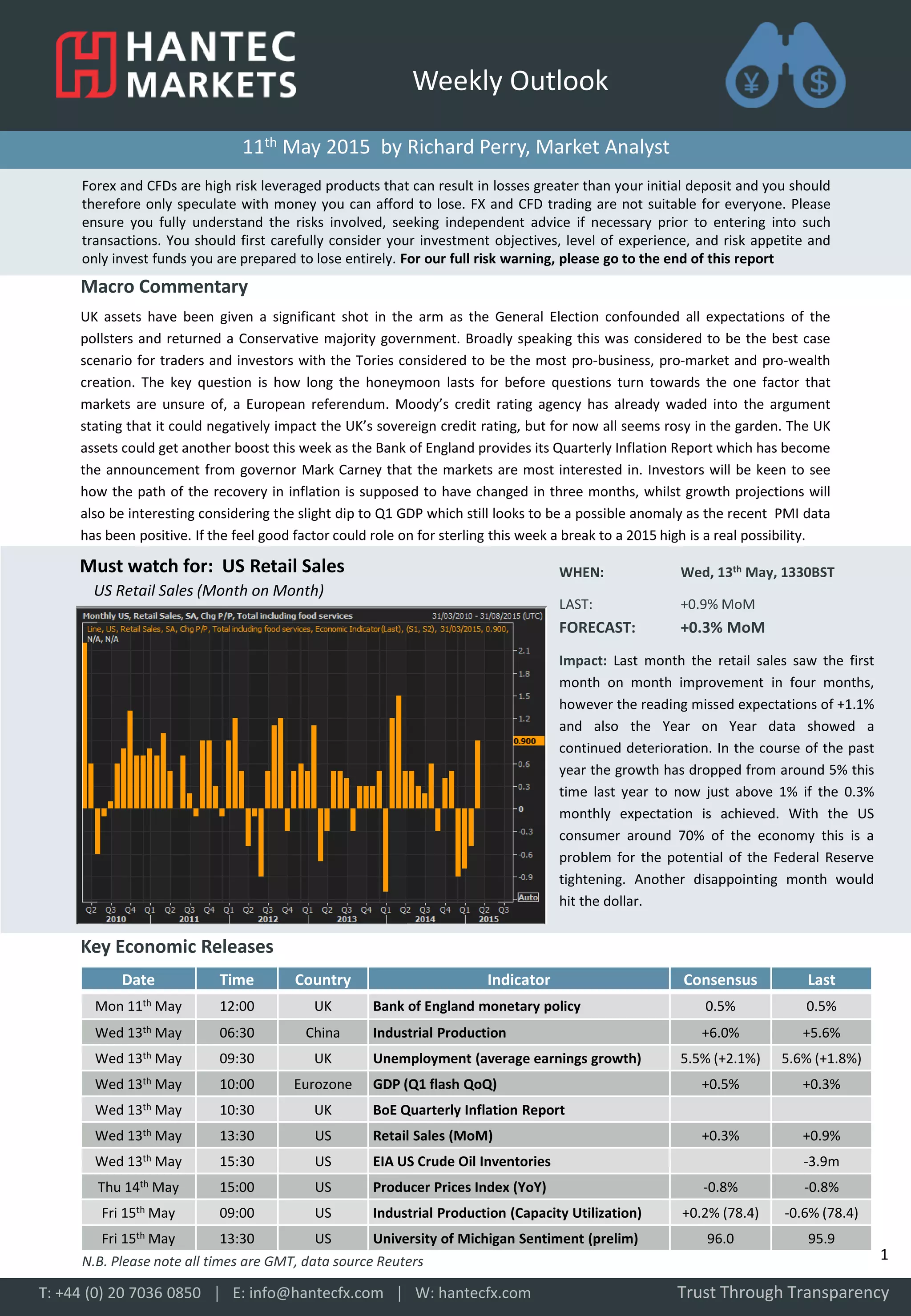

The document provides a weekly market outlook and commentary. It summarizes that UK assets received a boost from the general election results returning a Conservative majority seen as pro-business. It notes the key question is how long the positive sentiment lasts before questions around a European referendum. It also previews important upcoming economic data releases that could impact markets this week, including US retail sales and inflation reports from the Bank of England.