The legacy of the dovish fed is set to continue this week

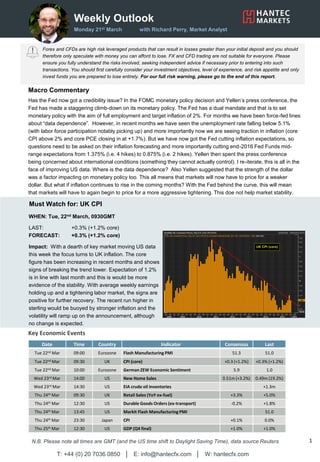

- 1. Weekly Outlook Monday 21st March with Richard Perry, Market Analyst Forex and CFDs are high risk leveraged products that can result in losses greater than your initial deposit and you should therefore only speculate with money you can afford to lose. FX and CFD trading are not suitable for everyone. Please ensure you fully understand the risks involved, seeking independent advice if necessary prior to entering into such transactions. You should first carefully consider your investment objectives, level of experience, and risk appetite and only invest funds you are prepared to lose entirely. For our full risk warning, please go to the end of this report. WHEN: Tue, 22nd March, 0930GMT LAST: +0.3% (+1.2% core) FORECAST: +0.3% (+1.2% core) Impact: With a dearth of key market moving US data this week the focus turns to UK inflation. The core figure has been increasing in recent months and shows signs of breaking the trend lower. Expectation of 1.2% is in line with last month and this is would be more evidence of the stability. With average weekly earnings holding up and a tightening labor market, the signs are positive for further recovery. The recent run higher in sterling would be buoyed by stronger inflation and the volatility will ramp up on the announcement, although no change is expected. Key Economic Events Date Time Country Indicator Consensus Last Tue 22nd Mar 09:00 Eurozone Flash Manufacturing PMI 51.3 51.0 Tue 22nd Mar 09:30 UK CPI (core) +0.3 (+1.2%) +0.3% (+1.2%) Tue 22nd Mar 10:00 Eurozone German ZEW Economic Sentiment 5.9 1.0 Wed 23rd Mar 14:00 US New Home Sales 0.51m (+3.2%) 0.49m (19.2%) Wed 23rd Mar 14:30 US EIA crude oil inventories +1.3m Thu 24th Mar 09:30 UK Retail Sales (YoY ex-fuel) +3.3% +5.0% Thu 24th Mar 12:30 US Durable Goods Orders (ex-transport) -0.2% +1.8% Thu 24th Mar 13:45 US Markit Flash Manufacturing PMI 51.0 Thu 24th Mar 23:30 Japan CPI +0.1% 0.0% Thu 25th Mar 12:30 US GDP (Q4 final) +1.0% +1.0% T: +44 (0) 20 7036 0850 │ E: info@hantecfx.com │ W: hantecfx.com 1N.B. Please note all times are GMT (and the US time shift to Daylight Saving Time), data source Reuters Macro Commentary Has the Fed now got a credibility issue? In the FOMC monetary policy decision and Yellen’s press conference, the Fed has made a staggering climb-down on its monetary policy. The Fed has a dual mandate and that is to set monetary policy with the aim of full employment and target inflation of 2%. For months we have been force-fed lines about “data dependence”. However, in recent months we have seen the unemployment rate falling below 5.1% (with labor force participation notably picking up) and more importantly now we are seeing traction in inflation (core CPI above 2% and core PCE closing in at +1.7%). But we have now got the Fed cutting inflation expectations, so questions need to be asked on their inflation forecasting and more importantly cutting end-2016 Fed Funds mid- range expectations from 1.375% (i.e. 4 hikes) to 0.875% (i.e. 2 hikes). Yellen then spent the press conference being concerned about international conditions (something they cannot actually control). I re-iterate, this is all in the face of improving US data. Where is the data dependence? Also Yellen suggested that the strength of the dollar was a factor impacting on monetary policy too. This all means that markets will now have to price for a weaker dollar. But what if inflation continues to rise in the coming months? With the Fed behind the curve, this will mean that markets will have to again begin to price for a more aggressive tightening. This doe not help market stability. Must Watch for: UK CPI

- 2. Weekly Outlook Monday 21st March with Richard Perry, Market Analyst Foreign Exchange The massively unexpected dovish move from the Fed has changed the game at least for the next few weeks. The interest rate differentials coming closer together means that the dollar is now on a corrective path against the major currencies. Yellen said that the “strength of the US dollar is transitory”, meaning that the Fed is looking to pursue a policy that drives a weaker dollar. Despite ECB economist Praet’s suggestion on Friday that the ECB could further cut the deposit rate, this should merely be a near term blip as the EUR/USD pair looks set to pull back towards the range highs again. This would certainly not be putting a smile on Mario Draghi’s face, but with the Eurozone economic indicators slowly picking up (Eurozone PMIs are again expected to tick higher this week) there is an underlying euro strength now. Cable too could now be on a more positive near to medium term path. In the wake of the dovish Fed, the Bank of England painted a more positive picture of the UK’s own economic recovery (growth in private domestic demand and support for wage growth) despite the Brexit threat. The selling pressure on Dollar/Yen could also give the Bank of Japan a decision to make as its own move to a negative deposit rate looks to have bee hugely undermined. Already there have been suggestions of the BoJ looking to intervene as the market dropped to multi-month lows below 111.00. WATCH FOR: Lots of data to update on the Eurozone recovery on Tuesday with flash PMIs, German Ifo and ZEW. UK inflation will drive sterling volatility as will retail sales. Us data is mostly housing based. T: +44 (0) 20 7036 0850 │ E: info@hantecfx.com │ W: hantecfx.com 2 FX Outlook USD/JPY Watch for: Breaking down with a close below 111.00 opens the downside Outlook: The key support around 111.00 is creaking on Dollar/Yen. In the wake of the dovish Fed decision the support was broken on an intraday basis but as yet there has not been a closing breakdown. A close below 111.00 would end the month long consolidation pattern and result in the continuation move for the sell off. This would then imply a move down towards 107.50 in the coming month. The next downside support comes in around 110.00 and then around 108.00. The momentum indicators also suggest downside potential for the move. For now though we wait for the confirmation. Resistance is around 112.15/112.60 early this week and expect rallies to be sold into. EUR/USD Watch for: The bull flag points towards further gains this week. Outlook: A dovish Fed is a bullish driver of EUR/USD, especially as Eurozone economic data continues to improve. The near term blip lower from Friday is likely to find traders using corrections as a chance to buy now as the outlook seems to be suggesting pressure on the February high and ultimately towards a bull flag target of $1.1450 which is towards the top of the long term range at $1.0450/$1.1460. Momentum indicators are bullish and the technicals are all pointing towards upside in the coming days. Whether the euro has the momentum for an upside breakout of the range remains to be seen but once again the $1.1050/$1.1100 pivot has been key.

- 3. Weekly Outlook Monday 21st March with Richard Perry, Market Analyst Equity Markets Can equity markets now push on in their recovery now that the Fed has turned out top be unexpectedly more accommodative in its monetary policy than had been previously expected? A weaker dollar should help to support Wall Street as it will improve the translation of US foreign earnings. However, the impact on risk appetite should also be felt positively, with the feedthrough of the beneficial impact on commodity prices (both in base metals and oil). Looking at the MSCI World Index, there has been a rally of over 12% in global equities since the bottom back in mid-February. The move is the biggest one month rally of the past few years, but the move is now up to some significant technical resistance. A big 10 month downtrend looms overhead, whilst the falling 200 day moving average is also a barrier. The chart of the MSCI reflects global equities are at a crossroads now. Whilst sentiment in emerging markets should be helped due to the easing of the funding pressures on their huge pile of US denominated debt, the major markets do not face such as bullish impact. There is a strongly negative correlation between the strength of the yen and the Nikkei, and also the strength of the euro and the DAX. This could mean that major markets feel the negative impact of the accommodative Fed through the pressures of local currency strength. The reaction of the DAX in the day following the Fed was sharp selling pressure even though Wall Street was pulling higher. There could be a relative strength play for Wall Street. On the plus side though, remember that the strong oil price remains positive for equities. WATCH FOR: Eurozone data releases on Tuesday will certainly be an impact on the DAX, whilst FTSE 100 will move off the UK retail sales data. US housing has tended to be supportive in recent months. T: +44 (0) 20 7036 0850 │ E: info@hantecfx.com │ W: hantecfx.com 3 DAX Xetra Watch for: Volatile gains still are being seen Outlook: The DAX remains a volatile market. Looking at the technicals though shows two massive bearish candles in the past couple of weeks. One on the ECB day and one on the day after the Fed, and both have been on the fears of the euro strength. Still though the improved risk appetite from a dovish Fed is helping to usher the DAX higher and the rising 21 day moving average which was a basis of resistance on the way down has now become the basis of support on the way up (currently c. 9710). Overhead resistance remains in the band 10,122/10,165, with 9753 the support. FTSE 100 Watch for: My concerns over the RSI once again failing at 60 remain Outlook: Wall Street may be pushing into positive ground for 2016 as a whole, but the FTSE 100 is still struggling to find the upside traction. I am still concerned by the persistent failure of the RSI up at 60 over the past 11 months and whilst this remains the case the bulls will need to be wary. There resistance of the December high at 6315 still looms overhead and the bulls are having to fight hard for every point it seems now. A minor correction would probably be healthy after a 13% rally in recent weeks. There is good support at 6036. The big resistance remains the 6487 high from October. Index Outlook

- 4. Weekly Outlook Monday 21st March with Richard Perry, Market Analyst Other Assets: Commodities & Bonds The accommodative shift in Fed monetary policy should be positive for commodities. Gold performs well in a negative real interest rate environment and with US inflation rising whilst the Fed appears to be reluctant to raise rates, this is supportive for gold. It is strange then that the gold price has struggled in the past few days since the Fed announcement. It is possible that the medium term technical tiredness could be catching up on gold. However, the oil price is also a positive beneficiary from the Fed move, and with investor risk appetite improving this should continue to be positive for oil. Breaking and holding above $40 on WTI is a strong move for the bulls and is one which opens the key November high at $43.50. With lower than expected EIS inventories, a date set for the OPEC/Non-OPEC meeting in Doha on 17th April and although an unexpected uptick in the Baker Hughes has induced a minor correction it should just be a near term move. An incredible move by the Fed has seen a flood back into bonds (both Treasuries and other sovereign debt). A falling front end of the US curve will now be priced in the coming days. It is also interesting that the Japanese 10 year JGB has fallen to its lowest ever level on Friday, whilst the German 10 year Bund yield has also sharply fallen back again having jumped higher following the ECB decision a couple of weeks ago. WATCH FOR: The EIA oil inventories report is a driver of volatility on oil, whilst the strength of the dollar is also set to have an impact across commodities. T: +44 (0) 20 7036 0850 │ E: info@hantecfx.com │ W: hantecfx.com 4 Gold Watch for: Despite the positive reaction to the Fed, the bearish divergences are still a concern Outlook: With a dovish Fed now in place again, fundamentals for gold should be positive, but the technicals show a tired medium term trend. The momentum indicators continue to bearishly diverge, whilst the negative reaction of gold on Thursday and Friday last week was somewhat disappointing. The ongoing problem I have is that divergences can take weeks if not months to play out, and this could mean that a retest of the $1283.50 high and possibly even towards the big overhead resistance at $1305, but ultimately I still see this as a tired trend and therefore I’m a very cautious bull medium term. Markets Outlook Brent Crude oil Watch for: The bullish recovery looks set to continue to test $43.15/$46.50 Outlook: Corrections are being bought into as the break higher on the oil price continues. On Friday Brent crude hit its highest level since early December and has retraced more than 50% of the big October/January sell off from $54.05 to $27.10. This now opens the 61.8% Fibonacci retracement at $43.75 which is also the next resistance band $43.15/$46.50. Medium term momentum indicators remain very strong but also show further upside potential. The key reaction low is now in place at $38.30. Also, having previously acted as the basis of resistance, the rising 21 day moving average (c. $38.20) is now the basis of support.

- 5. Weekly Outlook Monday 21st March with Richard Perry, Market Analyst T: +44 (0) 20 7036 0850 │ E: info@hantecfx.com │ W: hantecfx.com 5 Risk Warning for Financial Promotions This report is issued by Hantec Markets Limited, who is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, No. 502635. The report is prepared and distributed for information purposes only. Trading in Foreign Exchange (FX), Bullion and Contracts for Differences (CFDs) is not be suitable for all investors due to the high risk nature of these products. Forex, Bullion and CFDs are leveraged products that can result in losses greater than your initial deposit. The value of an FX, Bullion or CFD position may be affected by a variety of factors, including but not limited to, price volatility, market volume, foreign exchange rates and liquidity. You may lose your entire initial stake and you may be required to make additional payments. Please ensure you fully understand the risks involved, seeking independent advice if necessary prior to entering into such transactions. Before deciding to enter into FX, Bullion and/or CFD trading, you should carefully consider your investment objectives, level of experience, and risk appetite. You should only invest in FX, Bullion and/or CFD trading with funds you are prepared to lose entirely. Therefore, only your excess funds should be placed at risk and anyone who does not have such excess funds should completely refrain from engaging in FX and/or CFD trading. Do not rely on past performance figures. If you are in any doubt, please seek further independent advice. This report does not constitute personal investment advice, nor does it take into account the individual financial circumstances or objectives of the clients who receive it. All information and research produced by Hantec Markets is intended to be general in nature; it does not constitute a recommendation or offer for the purchase or sale of any financial instrument, nor should it be construed as such. All of the views or suggestions within this report are those solely and exclusively of the author, and accurately reflect his personal views about any and all of the subject instruments and are presented to the best of the author’s knowledge. Any person relying on this report to undertake trading does so entirely at his/her own risk and Hantec Markets does not accept any liability. Trust Through Transparency Hantec House, 12-14 Wilfred Street, London SW1E 6PL T: +44 (0) 20 7036 0850 F: +44 (0) 20 7036 0899 E: info@hantecfx.com W: hantecfx.com