Weekly Derivatives Report :13 August 2019

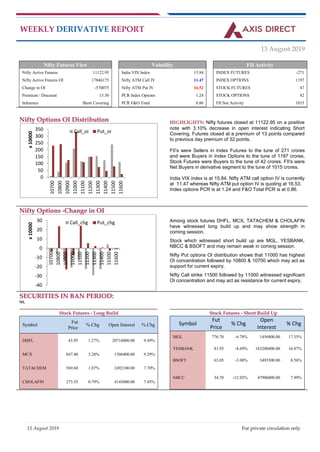

- 1. 13 August 2019 For private circulation only WEEKLY DERIVATIVE REPORT 13 August 2019 Nifty Futures View Volatility FII Activity Nifty Active Futures 11122.95 India VIX Index 15.84 INDEX FUTURES -271 Nifty Active Futures OI 17846175 Nifty ATM Call IV 11.47 INDEX OPTIONS 1197 Change in OI -570075 Nifty ATM Put IV 16.52 STOCK FUTURES 47 Premium / Discount 13.30 PCR Index Options 1.24 STOCK OPTIONS 42 Inference Short Covering PCR F&O Total 0.86 FII Net Activity 1015 NNiiffttyy OOppttiioonnss OOII DDiissttrriibbuuttiioonn HIGHLIGHTS: Nifty futures closed at 11122.95 on a positive note with 3.10% decrease in open interest indicating Short Covering. Futures closed at a premium of 13 points compared to previous day premium of 32 points. FII's were Sellers in Index Futures to the tune of 271 crores and were Buyers in Index Options to the tune of 1197 crores, Stock Futures were Buyers to the tune of 42 crores. FII's were Net Buyers in derivative segment to the tune of 1015 crores. India VIX index is at 15.84. Nifty ATM call option IV is currently at 11.47 whereas Nifty ATM put option IV is quoting at 16.53. Index options PCR is at 1.24 and F&O Total PCR is at 0.86. NNiiffttyy OOppttiioonnss --CChhaannggee iinn OOII Among stock futures DHFL, MCX, TATACHEM & CHOLAFIN have witnessed long build up and may show strength in coming session. Stock which witnessed short build up are MGL, YESBANK, NBCC & BSOFT and may remain weak in coming session. Nifty Put options OI distribution shows that 11000 has highest OI concentration followed by 10800 & 10700 which may act as support for current expiry. Nifty Call strike 11500 followed by 11000 witnessed significant OI concentration and may act as resistance for current expiry. SSEECCUURRIITTIIEESS IINN BBAANN PPEERRIIOODD:: NNIILL __________________________________________________________________________________________________________________ SSttoocckk FFuuttuurreess -- LLoonngg BBuuiilldd ______________________________________________________________________________________________________________ SSttoocckk FFuuttuurreess -- SShhoorrtt BBuuiilldd UUpp Symbol Fut Price % Chg Open Interest % Chg DHFL 43.95 1.27% 20716000.00 9.49% MCX 847.40 3.28% 1506400.00 9.29% TATACHEM 569.60 1.07% 2492100.00 7.70% CHOLAFIN 273.55 0.79% 4145000.00 7.45% Symbol Fut Price % Chg Open Interest % Chg MGL 776.70 -4.78% 1456800.00 17.35% YESBANK 81.95 -8.69% 163200400.00 16.87% BSOFT 63.05 -3.00% 3493500.00 8.56% NBCC 34.70 -12.92% 47906000.00 7.99% 0 50 100 150 200 250 300 350 10700 10800 10900 11000 11100 11200 11300 11400 11500 11600 x10000 Call_oi Put_oi -40 -30 -20 -10 0 10 20 30 10700 10800 10900 11000 11100 11200 11300 11400 11500 11600 x10000 Call_chg Put_chg

- 2. 13 August 2019 For private circulation only WEEKLY DERIVATIVE REPORT Week ended 10 August 2019 NNIIFFTTYY HHIIGGHHLLIIGGHHTTSS:: Nifty Futures has increased by 0.90% to close at 11,122 from previous week close of 11,024. Nifty annualized volatility index India Vix has increased to 15.85% from 15.19% up by 4.33%. The total open interest (OI) in the Nifty stood at Rs 14,068cr.Where as stock futures OI is at 52,390cr. The open interest position of FII in Index Futures is at Rs 21,550Cr and in Stock futures is at Rs 91,615Cr. Nifty PCR OI PCR OI has come up from low of 0.98 to making high of 1.24 and closed at high on weekly basis at 1.24 levels. PCR OI currently is at 1.24 levels which is above the median line indicating that we will see Nifty continue its ongoing momentum from current levels with a cautious bias. OOppeenn IInntteerreesstt AAnnaallyyssiiss Options Built up Shows that for now nifty has strong support at 11,000 followed by 10,800 and resistance at 11,300 levels followed by 11,500. 11,000 & 11,500 strike call and 11,000 put followed by 10,800 put has highest open interest concentration which suggests that Nifty is likely to remain &trade between this levels. CChhaannggee iinn OOppeenn IInntteerreesstt This week major addition was seen on the Put front with 10,700 and 10,800 strikes adding 8.87 and 7.71 lakh in OI respectively. On the Call front we have seen addition at 10,900 strike with increase in OI of 6.99 lakh shares, while addition of 4.41 lakh shares was witnessed in 11,000 strike. 0.80 1.00 1.20 1.40 1.60 1.80 3.00 3.50 4.00 4.50 5.00 5.50 6.00 29-Jul 30-Jul 31-Jul 1-Aug 2-Aug 5-Aug 6-Aug 7-Aug 8-Aug 9-Aug PUTCALLRATIO OIincr. Call OI Put OI 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 10500 10600 10700 10800 10900 11000 11100 11200 11300 11400 11500 11600 11700 OpenInterest Open Interest Put OI Call OI -1,000,000 -500,000 0 500,000 1,000,000 10500 10600 10700 10800 10900 11000 11100 11200 11300 11400 11500 11600 11700 OpenInterest Change in Open Interest Call OI Put OI

- 3. 13 August 2019 For private circulation only WEEKLY DERIVATIVE REPORT VVoollaattiilliittyy AAnnaallyyssiiss IV differential between call and put has significantly increased from last week level, which implies that nifty, will be cautious at higher levels & might trade with negative bias. Call IV’s currently at 14.05%, while Put IV’s are at 16.29%. Implied Volatility of option for the current series is at 15.16% and has seen an increase from lower level in this week. WWeeeekkllyy PPaarrttiicciippaanntt WWiissee OOppeenn IInntteerreesstt Participant FUT IDX Long (contracts) Net Chg FUT IDX Short (contracts) Net Chg Client 179,029 -4,371 123,372 -43,518 DII 65,646 -2,563 6,628 -1,382 FII 68,728 8,984 204,173 42,395 Pro 38,218 -10,702 17,448 -6,147 Participant FUT STK Long (contracts) Net Chg FUT STK Short (contracts) Net Chg Client 760,552 -53,408 203,400 2,915 DII 23,623 4,469 1,003,512 -19,397 FII 951,152 47,011 601,687 21,556 Pro 159,874 9,797 86,602 2,795 FFIIII IInnddeexx FFuuttuurreess FII activity in the index futures had been sellers during this week. FII have been net sellers in Index future to the tune of 2679 crore during this week. FFIIII SSttoocckk FFuuttuurreess FII activity in Stock futures had been mostly on the Buy side during the last week. This week FII have been net buyers in stock future segment to the tune 2930 crore. 9.00 10.00 11.00 12.00 13.00 14.00 15.00 16.00 17.00 18.00 19.00 29-Jul- 19 30-Jul- 19 31-Jul- 19 1-Aug- 19 2-Aug- 19 5-Aug- 19 6-Aug- 19 7-Aug- 19 8-Aug- 19 9-Aug- 19 Implied volatility(IV) IV Call Iv Put Historic volatility 225,000 250,000 275,000 05-Aug 06-Aug 07-Aug 08-Aug 09-Aug -1,500 -1,000 -500 0 500 InCrores NET AMT OI IN CONTRACT 1,500,000 1,515,000 1,530,000 1,545,000 1,560,000 05-Aug 06-Aug 07-Aug 08-Aug 09-Aug 0 200 400 600 800 1,000 1,200 1,400 InCrores NETAMT OI IN CONTRACT

- 4. 13 August 2019 For private circulation only WEEKLY DERIVATIVE REPORT SSeeccttoorr WWiissee OOppeenn IInntteerreesstt AAnndd PPrriiccee DDaattaa WWeeeekkllyy PPrriiccee CChhaannggee WWeeeekkllyy OOII CChhaannggee WWeeeekkllyy PPCCRR CChhaannggee WWeeeekkllyy OOppeenn IInntteerreesstt GGaaiinneerr WWeeeekkllyy OOppeenn IInntteerreesstt LLoosseerr Script ID Price % Chg OI Futures % Chg BERGEPAINT 360.6 7.59% 2948000 48.72% TORNTPOWER 289.9 -3.75% 4731000 33.08% BALKRISIND 772.95 8.81% 2486400 32.09% CONCOR 477.75 -3.65% 2621151 31.74% NBCC 34.7 -19.40% 47906000 29.77% Script ID Price % Chg OI Futures % Chg MANAPPURAM 123.25 8.83% 11652000 -22.38% APOLLOTYRE 161.9 7.50% 7380000 -18.89% TORNTPHARM 1679.6 0.27% 562500 -16.97% AMARAJABAT 630.2 -4.08% 1474200 -16.69% NIFTYIT 15857 2.15% 11700 -15.22% WWeeeekkllyy PPrriiccee GGaaiinneerr WWeeeekkllyy PPrriiccee LLoosseerr Script ID Price % Chg OI Futures % Chg SRF 2903.4 10.18% 1065750 15.00% BATAINDIA 1431.3 9.25% 2759350 9.54% HEROMOTOCO 2632.6 9.07% 2440400 -2.92% L&TFH 104.3 8.93% 31783500 0.37% MANAPPURAM 123.25 8.83% 11652000 -22.38% Script ID Price % Chg OI Futures % Chg NBCC 34.7 -19.40% 47906000 29.77% JINDALSTEL 99.8 -16.97% 35763200 -0.50% IDEA 5.4 -14.96% 466284000 9.16% BSOFT 63.05 -13.21% 3493500 26.62% TATASTEEL 363.6 -11.55% 33757837 7.14% 1.05% 3.48% 0.62% 2.33% 0.98% -6.06% -0.47% 1.83% 4.91% -1.79% 3.74% 1.52% 3.81% -1.05% -0.61% 0.87% -0.88% -3.33% -1.67% Wkly Price change Textile Fertilisers Oil_Gas Cement Capital_Good s Media FMCG Pharma Automobile Infrastructure Finance Others Power Metals Technology Realty Banking Telecom Index -1.08% -0.01% 0.57% 6.03% -0.02% -6.37% -4.07% -1.78% 6.50% -0.64% -0.75% -0.20% 3.83% -5.71% -2.43% 3.45% -1.48% 4.60% 7.46% Wkly OI change Textile Fertilisers Oil_Gas Cement Capital_Good s Media FMCG Pharma Automobile Infrastructure Finance Others Power Metals Technology Realty Banking Telecom Index 1.90% 2.35% 1.06% 0.52% 1.19% 1.06% 0.57% 0.37% 1.24% 1.81% 1.08% 0.85% 0.87% 0.46% 1.09% 0.58% 0.79% 0.82% 0.57% Wkly Roll Over change Textile Fertilisers Oil_Gas Cement Capital_Good s Media FMCG Pharma Automobile Infrastructure Finance Others Power Metals Technology Realty Banking Telecom Index

- 5. 13 August 2019 For private circulation only WEEKLY DERIVATIVE REPORT SSttoocckk wwiissee OOppeenn IInntteerreesstt DDiissttrriibbuuttiioonn iinn BBaannkkiinngg SSeeccttoorr BBaannkk NNiiffttyy OOppeenn IInntteerreesstt ffoorr PPSSUU BBaannkkss VV//ss PPrriivvaattee BBaannkkss BBaannkk NNiiffttyy SSttrriikkee wwiissee ooppeenn iinntteerreesstt ddiissttrriibbuuttiioonn ICICIBANK, KOTAKBANK and HDFCBANK can see some POSITIVE move in this week. Bank Nifty has a very strong support at 28,000 with 28,000 PE strike having highest OI concentration followed by 27,500 and on the call front 29,000 CE strike has highest OI concentration indicating strong resistance level followed by 29,500. AXISBANK BANKBARODA BANKINDIA CANBK FEDERALBNK HDFCBANK ICICIBANK IDBI IDFCFIRSTB INDUSINDBK, 1% KOTAKBANK PNB, 11% RBLBANK SBIN UNIONBANK YESBANK 45% 55% Open Interest Psu Bank Private Bank 0 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 500,000 27500 27600 27700 27800 27900 28000 28100 28200 28300 28400 28500 28600 28700 28800 28900 29000 29100 29200 29300 29400 29500 OpenInterest Open Interest Call OI Put OI

- 6. 13 August 2019 For private circulation only WEEKLY DERIVATIVE REPORT Disclaimer: Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to the recipient’s specific circumstances. The securities and strategies discussed and opinions expressed, if any, in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This report may not be taken in substitution for the exercise of independent judgment by any recipient. Each recipient of this report should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this report (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. Certain transactions, including those involving futures, options and other derivatives as well as non-investment grade securities involve substantial risk and are not suitable for all investors. ASL, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc. Past performance is not necessarily a guide to future performance. Investors are advise necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice. ASL and its affiliated companies, their directors and employees may; (a) from time to time, have long or short position(s) in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities or earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or investment banker, lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account before interpreting this document. ASL and / or its affiliates do and seek to do business including investment banking with companies covered in its research reports. As a result, the recipients of this report should be aware that ASL may have a potential conflict of interest that may affect the objectivity of this report. Compensation of Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. ASL may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Neither this report nor any copy of it may be taken or transmitted into the United State (to U.S. Persons), Canada, or Japan or distributed, directly or indirectly, in the United States or Canada or distributed or redistributed in Japan or to any resident thereof. If this report is inadvertently sent or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ASL to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. The Disclosures of Interest Statement incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the report. The Company reserves the right to make modifications and alternations to this document as may be required from time to time without any prior notice. The views expressed are those of the analyst(s) and the Company may or may not subscribe to all the views expressed therein. Copyright in this document vests with Axis Securities Limited. Axis Securities Limited, SEBI Single Reg. No.- NSE, BSE & MSEI – INZ000161633, ARN No. 64610, CDSL-IN-DP-CDSL-693-2013, SEBI- Research Analyst Reg. No. INH 000000297, SEBI Portfolio Manager Reg. No.- INP000000654, Main/Dealing off.- Unit No. 2, Phoenix Market City, 15, LBS Road, Near Kamani Junction, Kurla (west), Mumbai-400070, Tel No. – 18002100808, Reg. off.- Axis House, 8th Floor, Wadia International Centre, Pandurang Budhkar Marg, Worli, Mumbai – 400 025.Compliance Officer: Anand Shaha, E-Mail ID: compliance.officer@axisdirect.in,Tel No: 022-42671582.