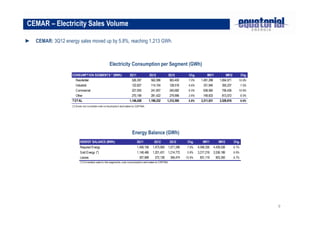

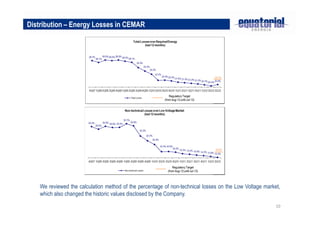

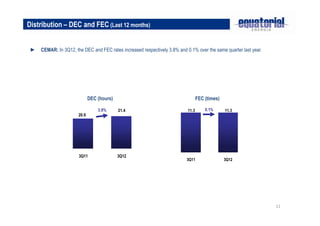

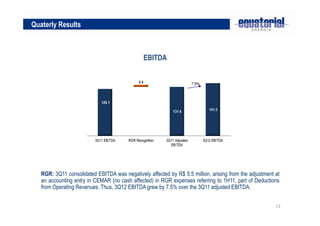

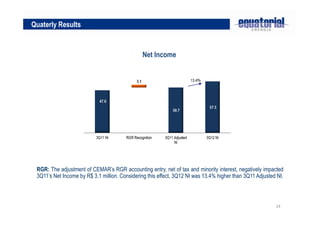

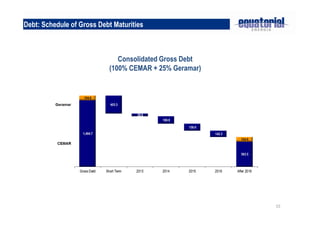

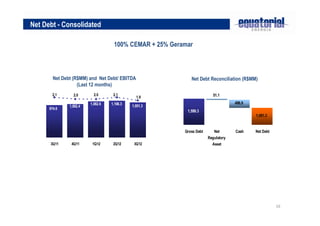

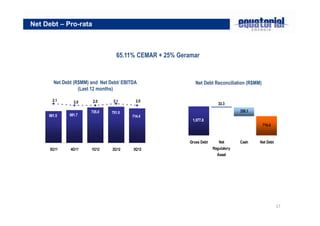

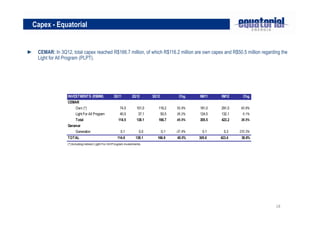

The document provides an overview of operating and financial results for 3Q12. It discusses highlights such as a 5.8% increase in CEMAR's billed energy volume and a 7.5% increase in EBITDA compared to the prior year. The financial results section notes a 30.4% increase in net operating revenues and a 13.4% rise in net income versus the adjusted figures for 3Q11. The document also reviews debt levels, capex spending, and energy losses at CEMAR.