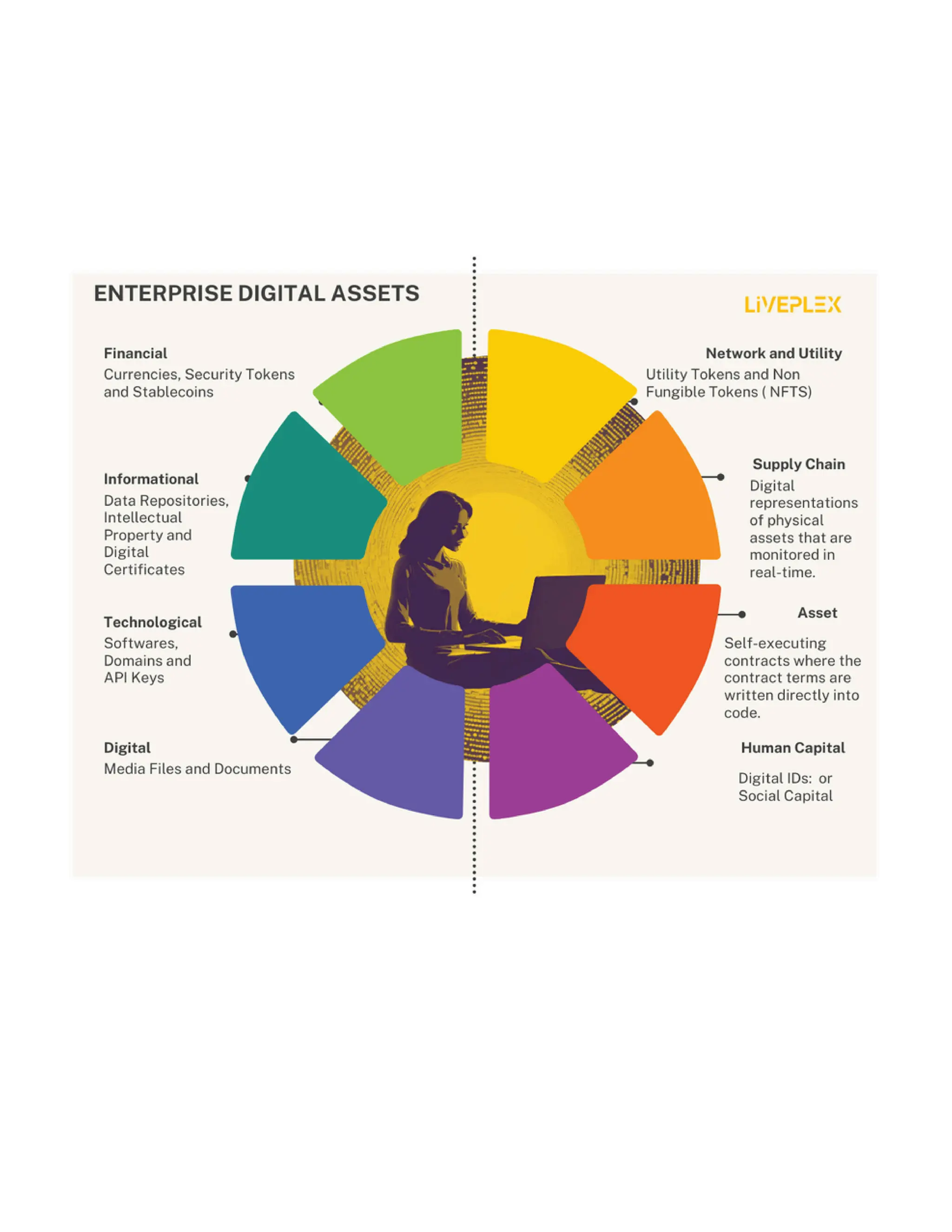

The document discusses the transformative potential of Web 3.0-based digital asset management (DAM) for enterprises, highlighting key components such as smart contracts, tokenization, and interoperability. It emphasizes benefits like enhanced security, transparency, and scalability, and explores real-world applications in industries such as media, real estate, and supply chain management. Despite the advantages, businesses face challenges related to regulatory compliance, scalability, and the integration of existing systems.