The Union Budget 2015 proposed several key reforms including:

(a) Reducing the corporate tax rate to 25% over the next four years while withdrawing exemptions, (b) Introducing a goods and services tax (GST) planned for April 2016, and (c) Enacting a new bankruptcy code and financial sector reforms such as a public debt management agency. The budget also aimed to boost investment, ease business regulations, and increase spending on infrastructure and social programs through measures like setting up a national investment fund. However, the budget faced some criticism for not providing enough relief for individuals and leaving many still wanting more substantial reforms.

![Wealth Vistas | Budget Special Feb 2015 | www.agroy.com

DirectTaxes:

Ÿ Corporate Tax Rate reduced to 25% for

over next four years, simultaneously

exemptions to corporates to be

withdrawn.

Ÿ No change in income tax slabs for

Individuals. Exemptions For Individual

Tax Players To Continue. Overall tax

deduction benefits to individual

investorsat4.44lacs.

Ÿ Wealth Tax abolished. But 2%

surchargeonincometaxforsuperrich.

Ÿ To Enact New Law For Black Money.

Concealment of foreign income and

assets will attract 10 yrs of rigorous

imprisonmentandpenaltyof300%

Ÿ Benami Property Transaction Bill to

tackle black money transaction in real

estatesoon

Ÿ Foreign Exchange Management Act to

be ammended suitably to allow for

seizure of equivalent assets in India in

case of Foreign Assets created using

blackmoney.

Ÿ To Tighten Reporting Of Cash

transactions. Quoting PAN a must for

allpurchasesaboveOneLakh.

Ÿ Tax pass through to be allowed in

alternative investment funds to boost

smallfirms,startups

Ÿ Proposes to rationalise capital gains

tax regime for real estate investment

trusts. Rental Income from REITS to

havepassthroughfacility.

Ÿ 100% deduction allowed for all

contributions in Swachh Bharat

Abhiyan[exceptcontributioninCSR].

Ÿ To defer GAAR by 2 years.

Retrospecive tax provisions will be

avoided.

Ÿ Income Tax On Royalty Fees For

Technical Reduced To 10%. Reduced

taxes on Technical Services to 10%

from25%

Ÿ Deduction on Health insurance u/s 80D

increased from 15000 to 25000. For

senior citizens to 30000. Additional

deduction of Rs.50000 u/s 80CCD

towards New Pension Scheme. No

changeinlimitsu/s80C.

Ÿ Transport Allowance exemption

increasedfrom800pmto1600pm

Ÿ Domestic Transfer Pricing limit

increasedfrom5croresto20crores

Ÿ Introduction of Tax Free Infra Bonds for

road,railandirrigationprojects

Ÿ No MAT for FPIs and FIIs. This comes as

a big boon for Foreign Investors in Indian

Equities market who were being taxed

under MAT despite Nil tax on Long Term

CapitalGains.

IndirectTaxes:

Ÿ GSTrolloutby1stApril2016

Ÿ ServiceTaxincreasedto14%

Ÿ ToreduceCustomDutyon22items

Ÿ Excise reduced to 6% for footwear above

1kperpair

Otherhighlights:

Ÿ Merger of Commodity Regulator FMC

withSEBI

Ÿ Infrastructure investment push by 70000

croreonpubliccapexexpenditure

Ÿ Subsidy rationalisation by cutting

leakages through Jan Dhan-Aadhaar-

Mobile

Ÿ States get almost 62% of total resources

allocation

Ÿ Employee’s contribution to EPF below an

income threshold will be optional without

reducingemployer’scontribution.

Ÿ Contribution to ESI to be made optional

againstprivatehealthinsurance

Ÿ Ammendment to RBIAct and constitution

ofaMonetaryPolicyCommittee

Ÿ Bankruptcy law reform has been

identified as a key to ease of doing

business. Bring comprehensive

Bankruptcycodein2015-16.

Ÿ Visa on Arrival scheme extended to 150

countries

Ÿ Introduction of Gold Bonds and Indian

GoldCoinswithAshokaemblem

Ÿ FM proposes to do away with different

types of foreign investment and replace

themwithcompositecaps.

Ÿ Proposed a “plug and play” model, where

all clearances will be put in place before a

project is auctioned. 5 new ulta mega

power plants at investment of approx. 1

laccroreinplugandplaymode

Ÿ SettingupaFinancialRedressalAgency

Ÿ Setting up of Atal Innovation Mission

(AIM) to nurture innovation culture, R&D

andScientificResearch

Ÿ Setting up of National Skill Mission to

consolidate all skill development

initiatives

Ÿ Benefits for MSME sector – setting up of

Mudhra Bank, electronic bill discounting

systemandfundfortechnologystartups.

BUDGET 2015 - HIGHLIGHTS

Warren Buffet

WoWwords of wisdom

“If you buy things you

do not need, soon

you will have to sell

things you need.”

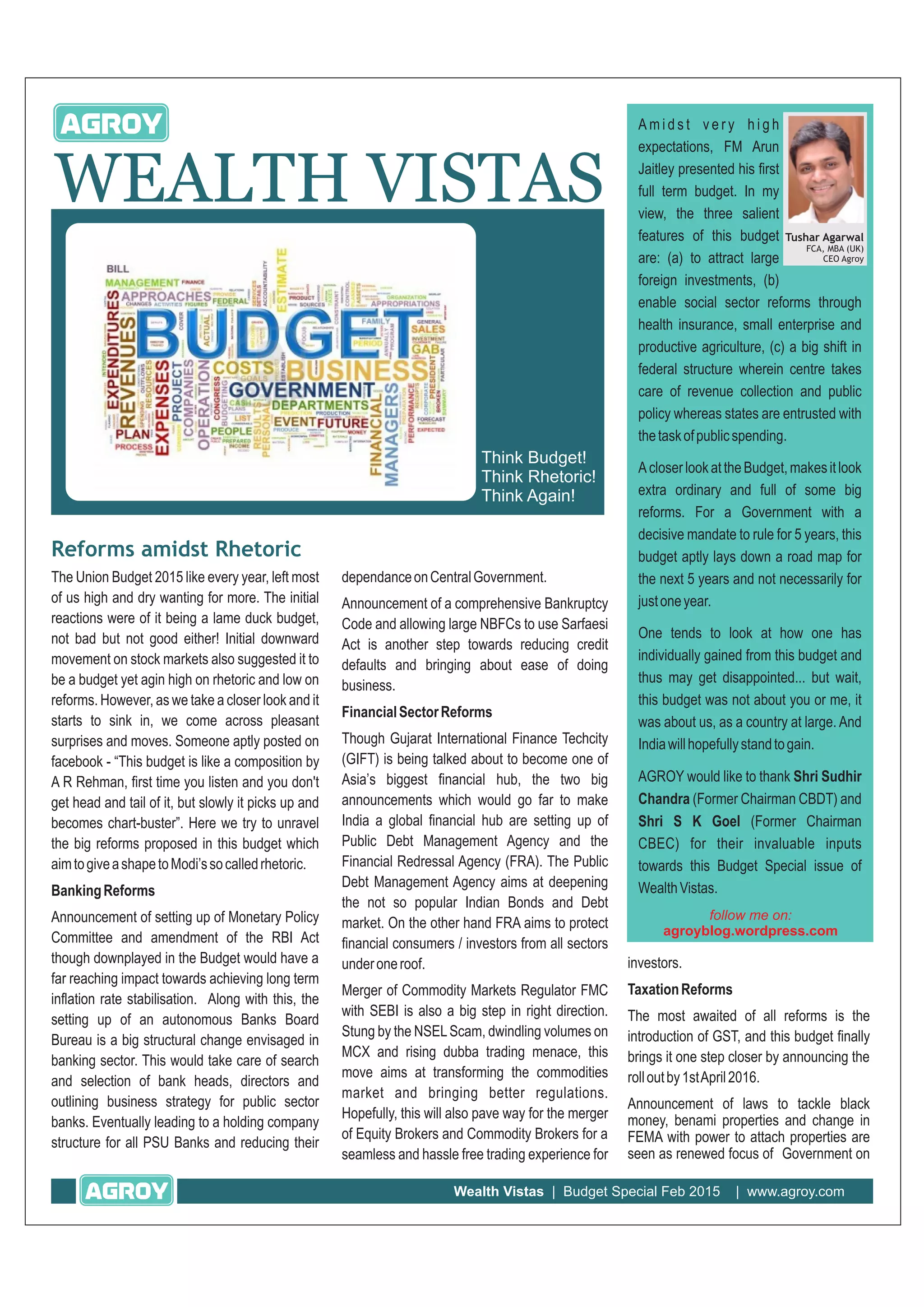

Key Indices CMP

Sensex 29220.12 -461.65 -1.6%

Nifty 8844.60 -107.75 -1.2%

DJIA 18132.70 715.85 4.1%

NASDAQ 4963.53 280.12 6.0%

Nikkei 18797.94 1191.72 6.8%

Hang Seng 24823.29 227.44 0.9%

Gold ($/oz) 1213.28 -72.62 -5.6%

Silver ($/oz) 16.59 -0.36 -2.1%

Brent Crude ($) 62.21 13.18 26.9%

USD / INR 61.67 -0.28 -0.5%

EUR / INR 69.04 -1.02 -1.5%

CMP Change

27.50 69.7%

72.90 48.5%

1128.60 47.8%

158.80 39.3%

1649.50 36.7%

Monthly Change

Rs. In Crore

11476

12919

1036

99254

Net FII Investment

Monthly Gainers (A Grp)

Suzlon Energy

Piavav Defence

79708

Feb-2015

Jan-2015

Dec-2014

Fin Year to Month

Last Fin Year

Tata Elxsi

Fortis Healthcare

Wockhardt

-10.0 -5.0 0.0 5.0 10.0

Nifty

Auto

Bank

Energy

Finance

FMCG

IT

Media

Metal

Pharma

Realty

Sectoral Performance - Feb 2015

(Source: IISL sectoral indices)

% Change from previous month

MARKET INDICATORS AS ON 27-FEB-2015](https://image.slidesharecdn.com/wv-budget-150305041651-conversion-gate01/85/Wealth-Vistas-Budget-Special-Issue-3-320.jpg)