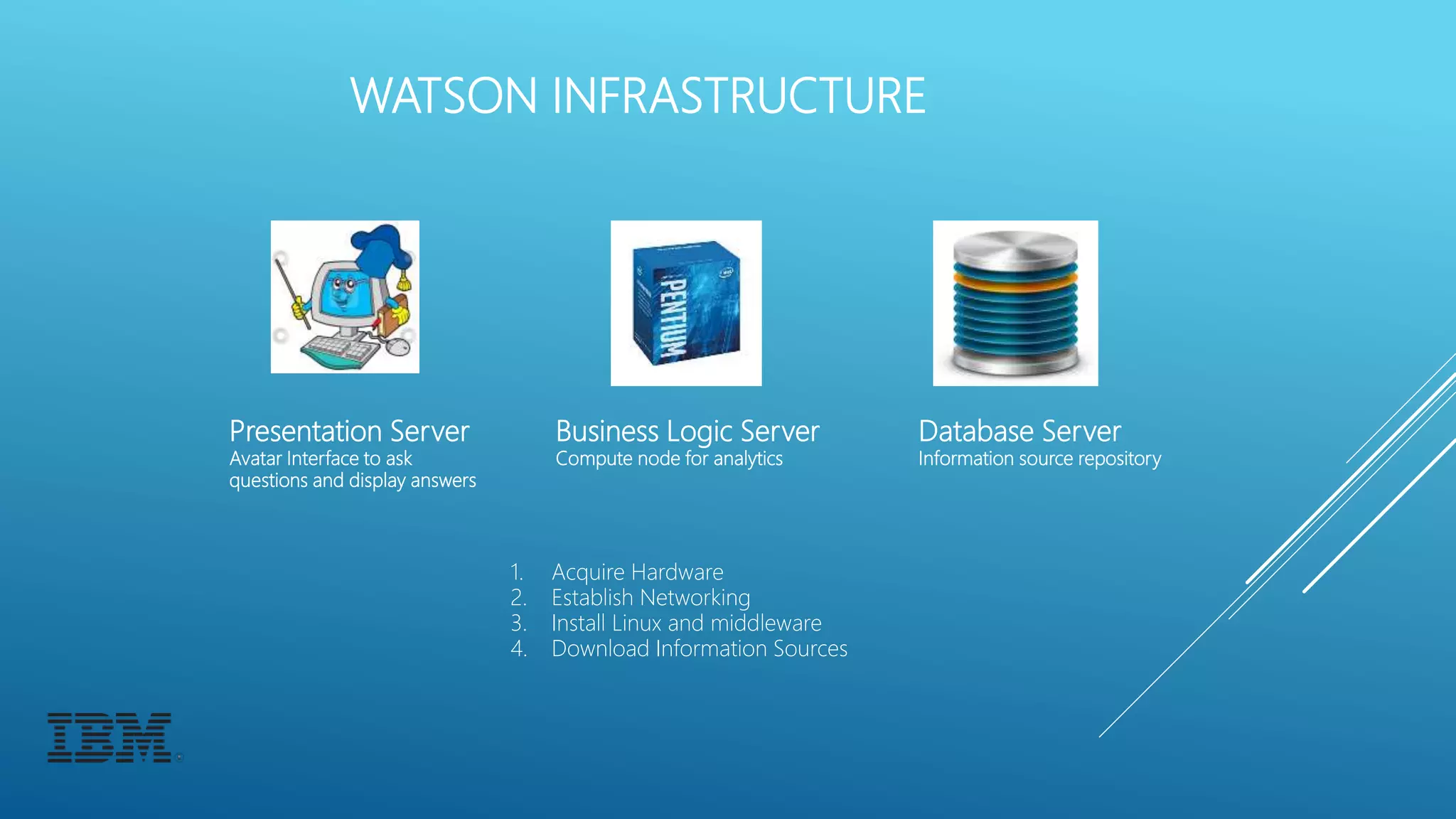

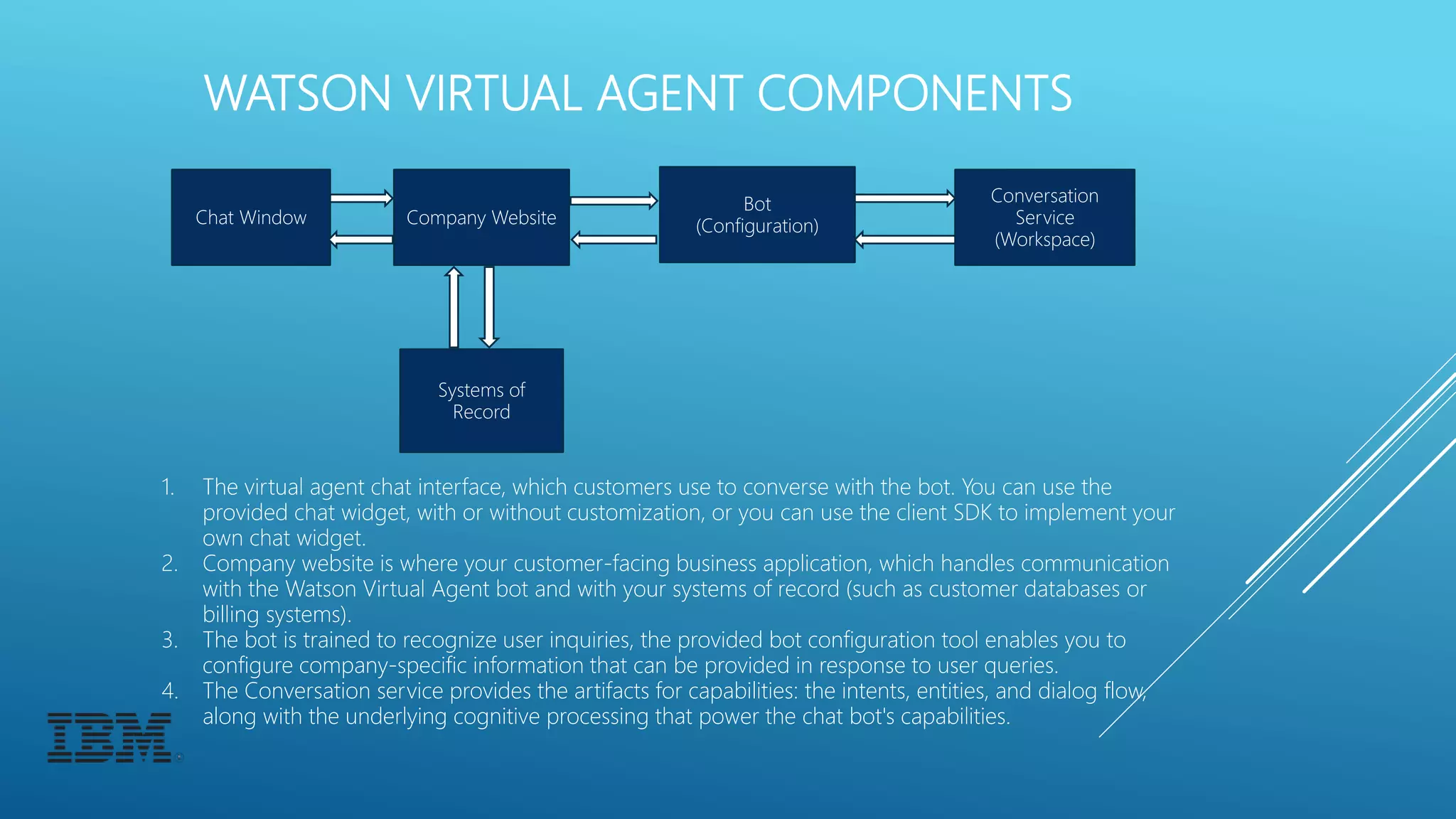

The document discusses the potential of cognitive computing, particularly IBM's Watson, in transforming financial services by addressing the challenges posed by unstructured data. It outlines how Watson can enhance customer service, improve decision-making, and streamline operations through advanced analytics and natural language processing. Recent implementations of Watson in various sectors, including banking and healthcare, demonstrate its effectiveness in providing rapid, personalized solutions and insights.