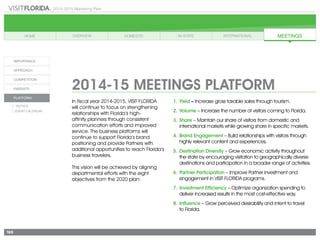

This document is VISIT FLORIDA's 2014-2015 marketing plan. It outlines VISIT FLORIDA's strategic goals, marketing principles, and planned marketing initiatives for the year. VISIT FLORIDA is the official tourism marketing organization for Florida that was created as a public-private partnership in 1996. The plan was developed with input from Florida's tourism industry and identifies eight objectives for 2020, including increasing tourism revenue, visitation numbers, and Florida's market share. It also describes VISIT FLORIDA's role in cooperative marketing programs and content creation to promote travel to Florida.

![2014-2015 Marketing Plan

14

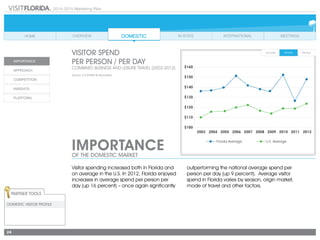

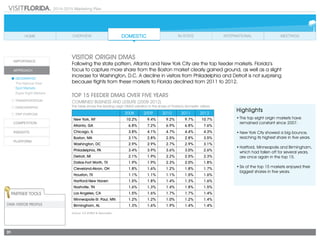

MARKETING EFFECTIVENESS

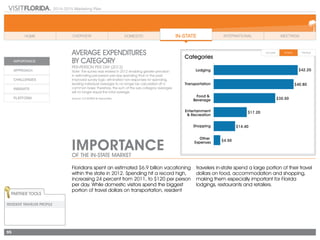

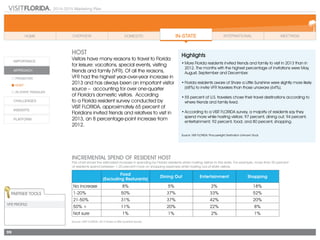

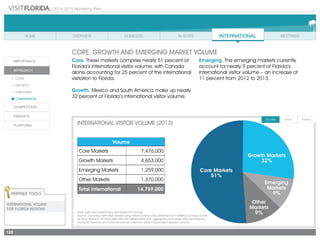

VISIT FLORIDA measures its ability to influence visitors through an annual independent third-party

survey that began in 2008. In 2013, VISIT FLORIDA marketing materials and initiatives influenced

38 percent of the people who visited the state.

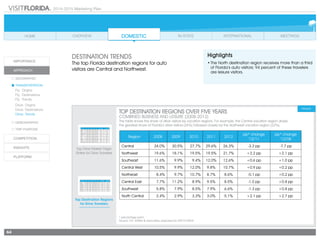

VISIT FLORIDA INFLUENCE ON VISITORS [2009-2013]

This graph shows the percentage of visitors to the state each year who acknowledged being influenced by VISIT FLORIDA

marketing efforts. In 2009, VISIT FLORIDA campaigns and materials influenced over 27 percent of Florida’s visitors; in 2013,

VISIT FLORIDA influenced 38 percent of Florida’s visitors.

Source: VISIT FLORIDA](https://image.slidesharecdn.com/visitflorida2014-140604033347-phpapp02/85/Visit-Florida-2014-2015-Marketing-Plan-15-320.jpg)

![2014-2015 Marketing Plan

130

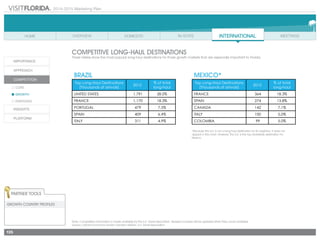

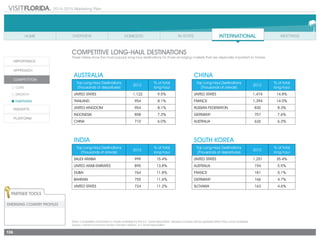

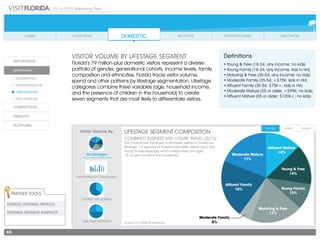

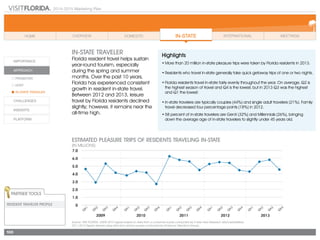

Two-Year Comparisons

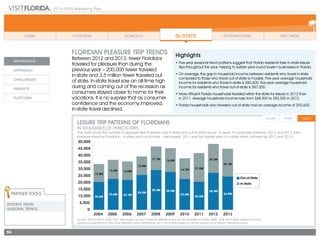

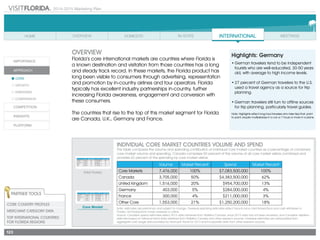

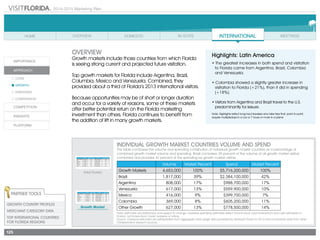

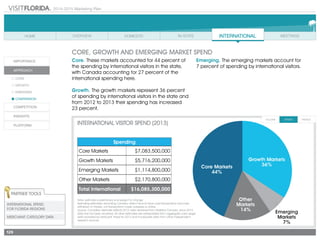

This table shows [two-year] changes in volume and spending by key core, growth and emerging markets. Between 2012

and 2013, the number of international visitors increased 6 percent while spending by these visitors increased 8 percent.

Note: estimates are preliminary and subject to change

Source: Canadian visitation estimate derived using trend data obtained from Statistics Canada and the spending estimate reflects 2012 data,

since 2013 data has not been received. All other international estimates are extrapolated from aggregate card usage data provided by

VisaVue® Travel for the 2013 and incorporate data from other independent research sources.

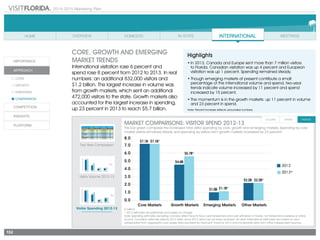

CORE, GROWTH AND EMERGING

MARKET TRENDS

International visitation rose 6 percent and

spend rose 8 percent from 2012 to 2013. In real

numbers: an additional 832,000 visitors and

$1.2 billion. The largest increase in volume was

from growth markets, which sent an additional

472,000 visitors to the state. Growth markets also

accounted for the largest increase in spending,

up 23 percent in 2013 to reach $5.7 billion.

Two Year Comparison

Visitor Volume 2012-13

Visitor Spending 2012-13

Volume Change '13/'12 Spending Change '13/'12

Total International 14,759,000 6% 16,085,300,000 8%

Core Markets 7,476,000 3% 7,083,500,000 0%

Canada 3,705,000 4% 4,383,500,000 0%

Europe 3,771,000 1% 2,700,000,000 0%

Growth Markets 4,653,000 11% 5,716,200,000 23%

South America 4,237,000 12% 5,316,500,000 25%

Mexico 416,000 7% 399,700,000 5%

Emerging Markets 1,259,000 11% 1,114,800,000 15%

Other Markets 1,370,000 3% 2,170,800,000 1%

Volume Change '13/'12 Spending Change '13/'12

Total International 14,759,000 6% 16,085,300,000 8%

Core Markets 7,476,000 3% 7,083,500,000 0%

Canada 3,705,000 4% 4,383,500,000 0%

Europe 3,771,000 1% 2,700,000,000 0%

Growth Markets 4,653,000 11% 5,716,200,000 23%

South America 4,237,000 12% 5,316,500,000 25%

Mexico 416,000 7% 399,700,000 5%

Emerging Markets 1,259,000 11% 1,114,800,000 15%

Other Markets 1,370,000 3% 2,170,800,000 1%

Highlights

• In 2013, Canada and Europe sent more than 7 million visitors

to Florida. Canadian visitation was up 4 percent and European

visitation was up 1 percent. Spending remained steady.

• Though emerging markets at present contribute a small

percentage of the international volume and spend, two-year

trends indicate volume increased by 11 percent and spend

increased by 15 percent.

• The momentum is in the growth markets: up 11 percent in volume

and 23 percent in spend.

Note: Percent increase reflects unrounded numbers.](https://image.slidesharecdn.com/visitflorida2014-140604033347-phpapp02/85/Visit-Florida-2014-2015-Marketing-Plan-131-320.jpg)