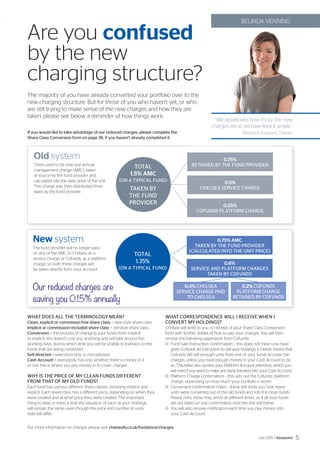

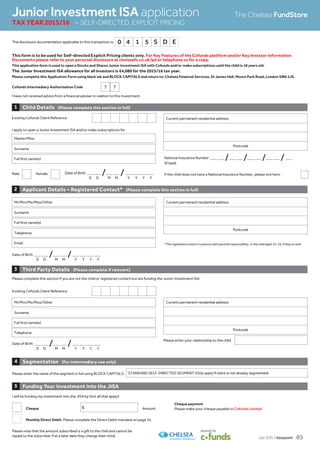

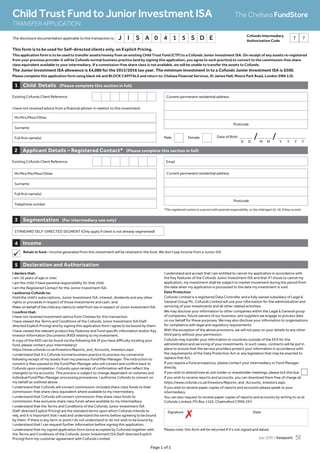

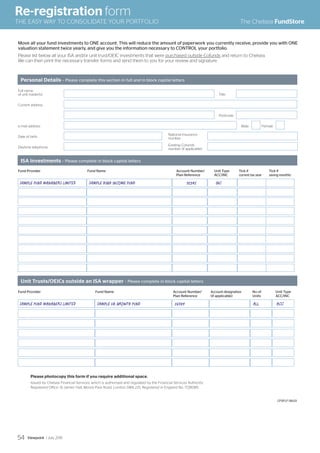

The article discusses the recent government decision to allow transfers from Child Trust Funds (CTFs) to Junior Individual Savings Accounts (Junior ISAs). It says Chelsea is offering the Junior ISA at 0% annual service charge and 0% platform charge for at least 12 months, which represents a great deal. The article encourages transferring CTFs to Junior ISAs to take advantage of wider investment choice, lower costs, and potentially greater returns compared to CTFs. It notes over six million children could benefit from being able to transfer CTFs to Junior ISAs.