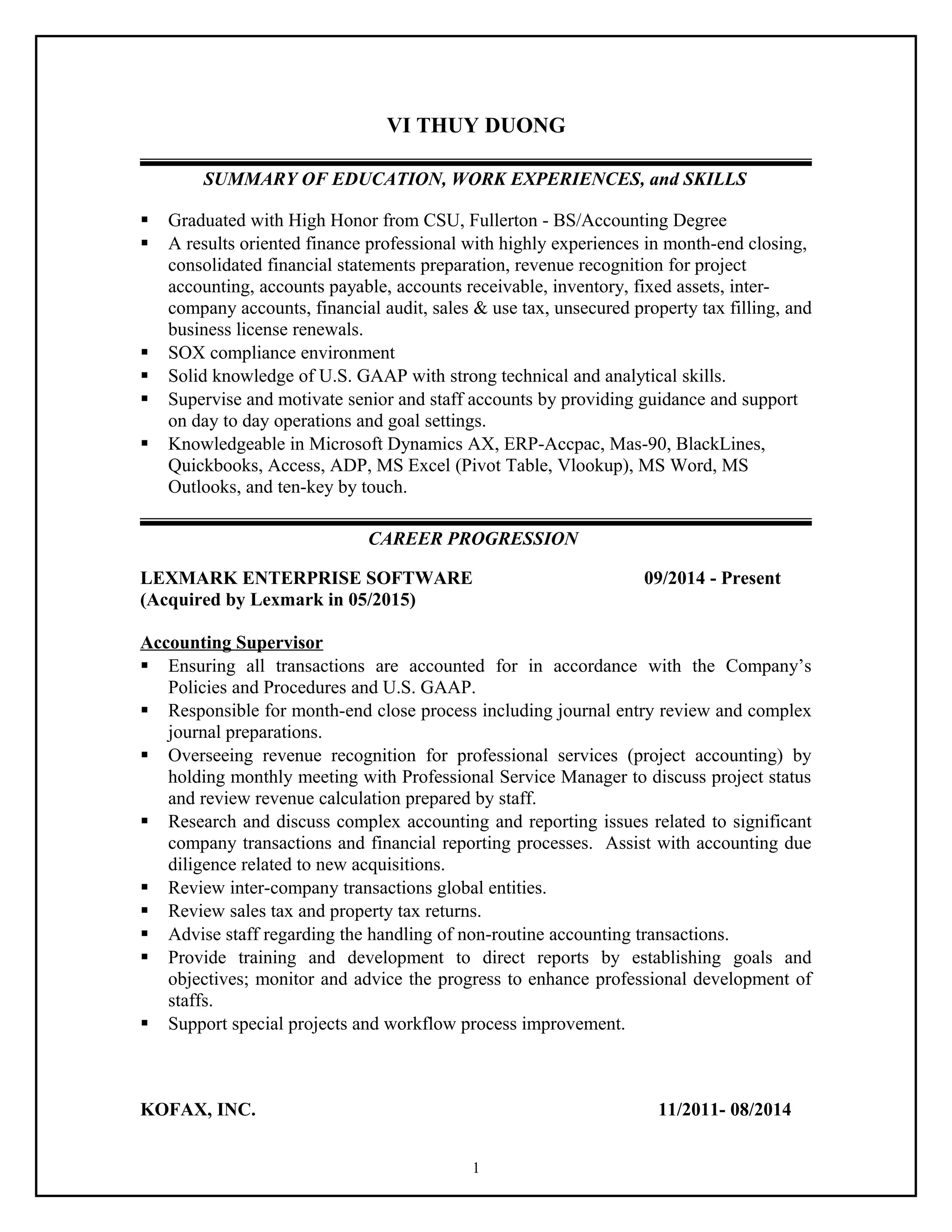

Vi Thuy Duong has over 20 years of accounting experience, including roles as an Accounting Supervisor, Senior Accountant, and Accounting Manager. She graduated with high honors in accounting from CSU Fullerton and has extensive experience in financial reporting, month-end closing processes, revenue recognition, and accounting system management. Duong also has a proven track record of training and supervising accounting staff.