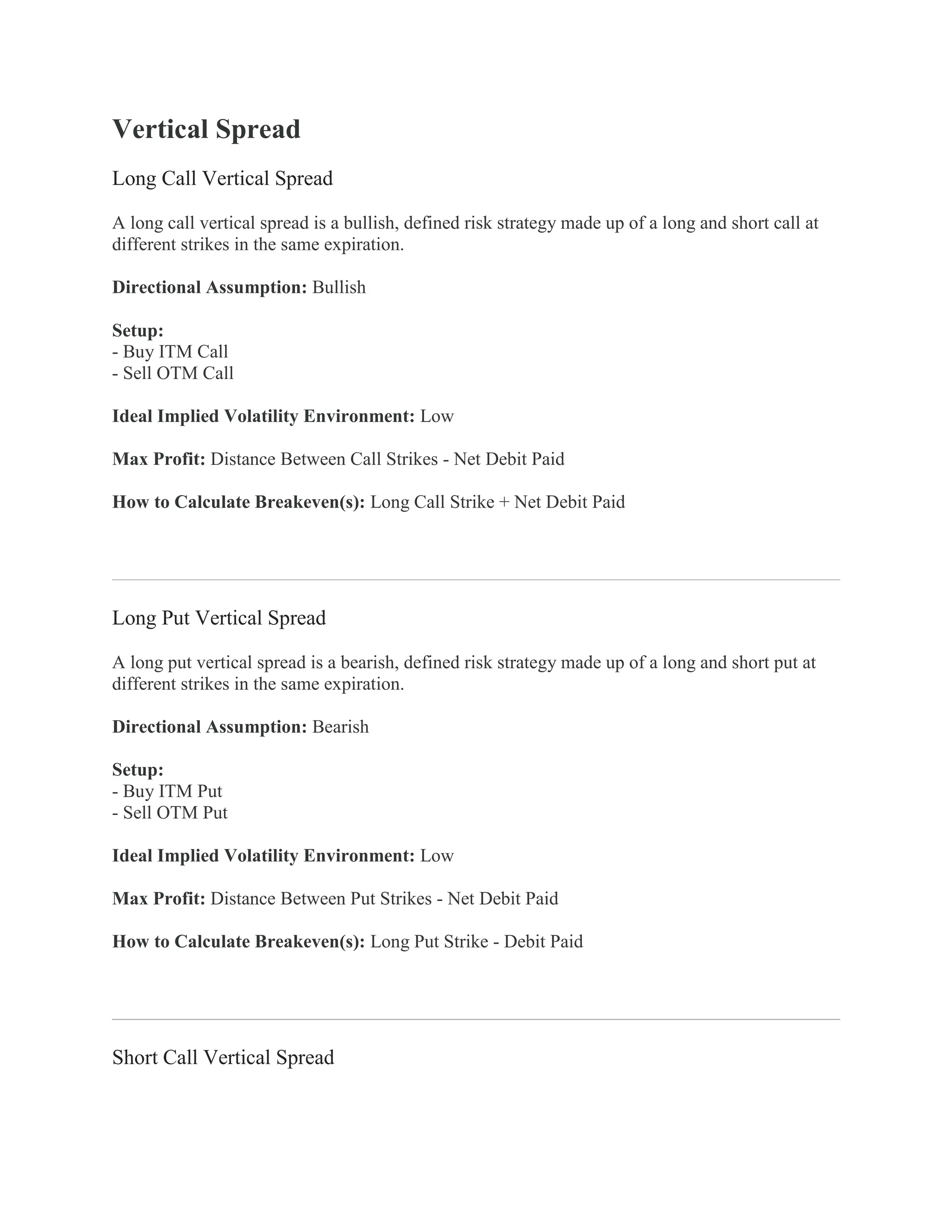

The document discusses four types of vertical spreads: long call vertical spreads, long put vertical spreads, short call vertical spreads, and short put vertical spreads. Each type involves buying and selling an option at different strike prices in the same expiration. The document outlines the directional assumption, ideal volatility environment, maximum profit/loss, and breakeven calculations for each spread. It also discusses the tastytrade approach to using vertical spreads for defined risk directional trading and when to close or manage the positions.