Embed presentation

Download to read offline

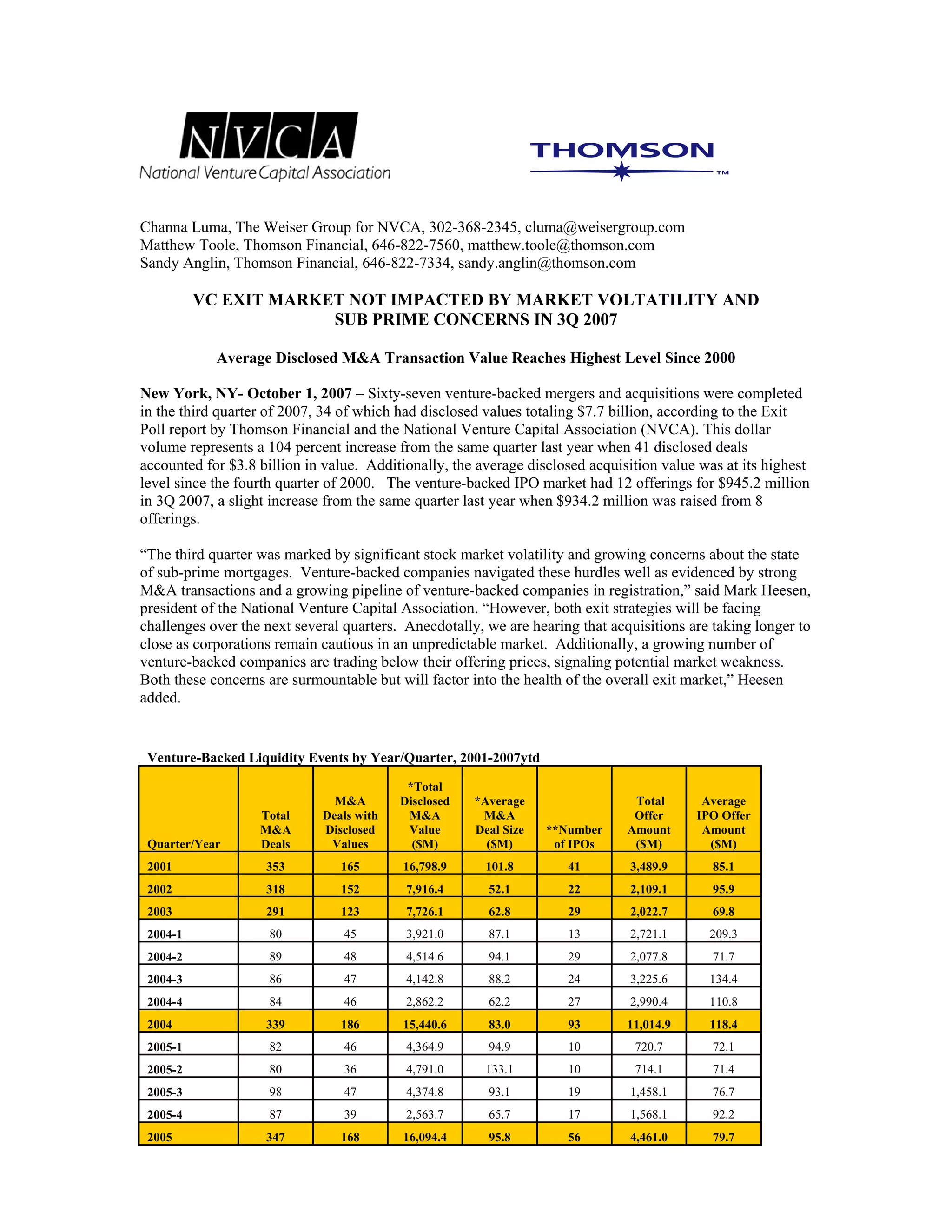

The venture capital exit market remained strong in the third quarter of 2007 despite stock market volatility and concerns about subprime mortgages. There were 67 M&A deals totaling $7.7 billion, with the average deal size the highest since 2000. Additionally, there were 12 IPOs that raised $945.2 million. While exits face challenges in the coming quarters as acquisitions take longer to close and some IPOs trade below offering prices, the third quarter exit market demonstrated resilience.