- The document lists various goods and services and the applicable VAT (value added tax) rates in the UK, which can be exempt, 0%, or 5%.

- Items like education, health services, charities, and welfare are often exempt from VAT. Necessities like food, children's clothing, and domestic utilities generally have a reduced VAT rate of 0%.

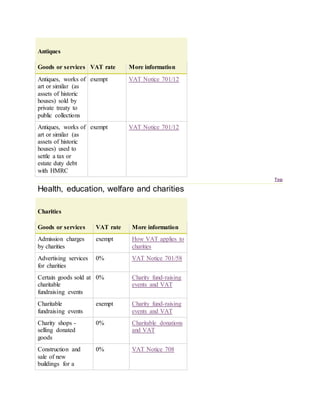

- Leisure activities such as sports, betting, bingo, and lotteries are also commonly exempt from VAT. Admission to certain cultural events and antiques from historic houses can be exempt.

- Certain energy efficient materials and installations are subject to the reduced 5% VAT rate when used to improve residential buildings. Heating equipment for