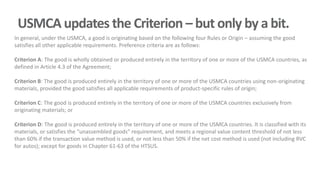

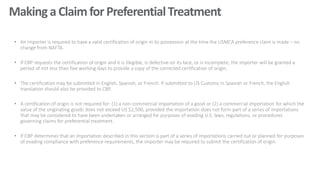

The document provides information on key aspects of the USMCA trade agreement between the US, Mexico, and Canada as it relates to commercial transport. It notes that USMCA aims to reset trade relations to a fair environment, integrate emerging technologies, and counter non-market practices. For commercial transport specifically, it is expected to lead to faster market access and entry, lower transaction costs, and continued investment in rail infrastructure across North America with a focus on improving border crossing facilities. The rules of origin and certification of origin process under USMCA are also summarized.