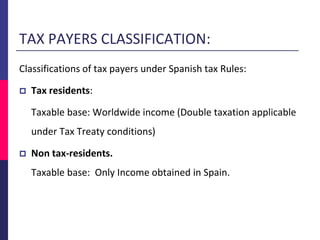

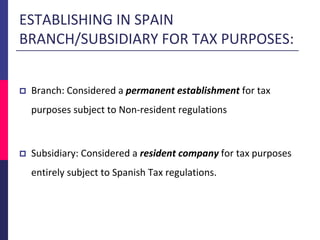

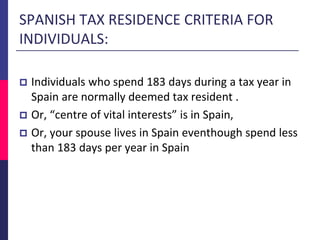

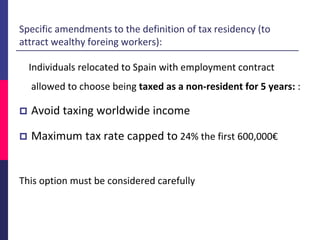

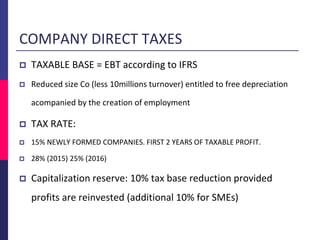

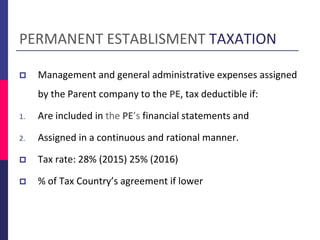

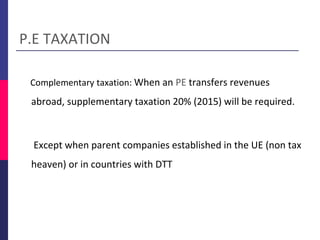

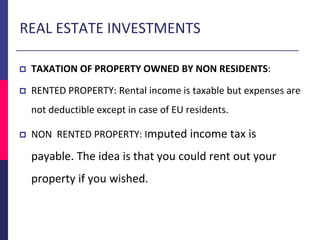

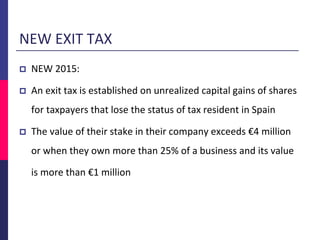

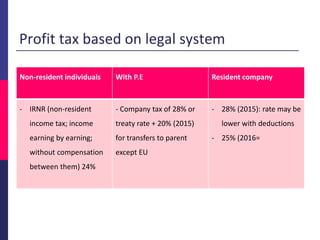

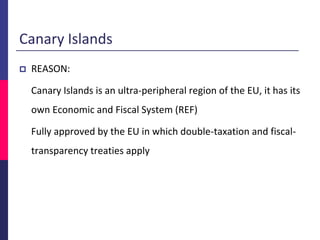

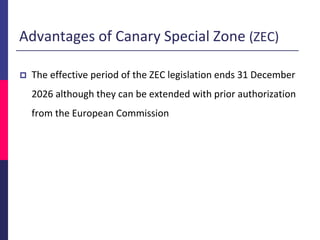

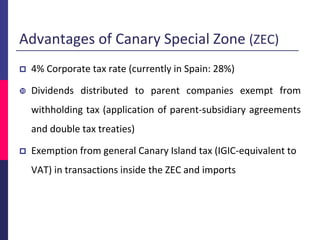

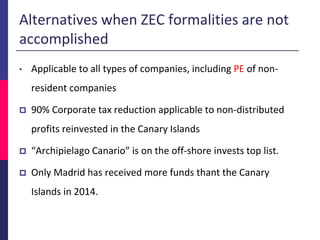

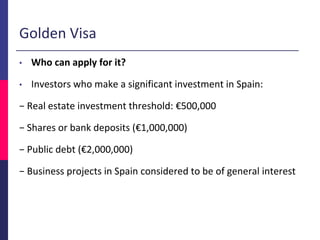

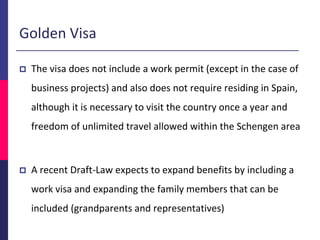

This document summarizes key information for foreign investors looking to invest in Spain in 2015. It outlines the regulated sectors for foreign investment, classifications of tax residents and non-residents, and considerations for establishing a branch or subsidiary. It also provides an overview of corporate and individual taxation, real estate investments, VAT rules, and advantages of the Canary Islands Special Zone for reduced corporate tax rates. Finally, it summarizes Spain's "Golden Visa" program which provides residence permits for foreign investors making certain minimum investments in Spain.