More Related Content

Similar to Universal crisil rating_report_11dec06

Similar to Universal crisil rating_report_11dec06 (20)

Universal crisil rating_report_11dec06

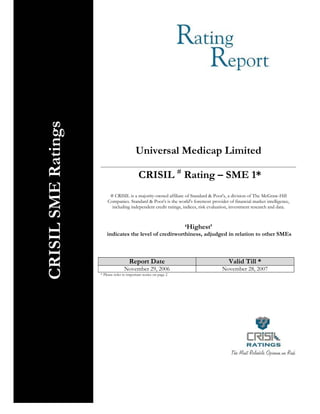

- 1. CRISIL SME Ratings

Universal Medicap Limited

CRISIL # Rating – SME 1*

# CRISIL is a majority-owned affiliate of Standard & Poor's, a division of The McGraw-Hill

Companies. Standard & Poor's is the world's foremost provider of financial market intelligence,

including independent credit ratings, indices, risk evaluation, investment research and data.

‘Highest’

indicates the level of creditworthiness, adjudged in relation to other SMEs

Report Date Valid Till *

November 29, 2006 November 28, 2007

* Please refer to important notice on page 2

© 2006 CRISIL Limited. All Rights Reserved 1

- 2. Important Notice

The rating is a one-time exercise and the rating will not be kept under surveillance. This rating is valid

for one year from the report date, subject to no significant changes/events occurring during this period

that could materially affect the business or financial parameters of the organisation as mentioned in the

report. CRISIL, however, recommends that the user of the rating seeks a review of the rating if the

organisation experiences significant changes/events during this period which could impact the

organisation / its rating.

The rating and this report are based on the information provided to CRISIL by the organisation

and/or obtained by CRISIL from sources it considers reliable including published annual reports,

management meetings, industry data and discussions with bankers, customers and suppliers. CRISIL

does not guarantee the accuracy, adequacy or completeness of any information on which the rating and

the report are based and is not responsible for any errors or omissions for the results/opinions

obtained from the use of the rating or the rating report. The rating does not constitute an audit of the

organisation by CRISIL. The rating is also not a recommendation to enter into or not enter into any

transaction with the organisation. CRISIL reserves the right to disclose the organisation’s rating and

the rating report to Government and / or Regulatory Authorities / Courts of Law if required to do so.

It is especially stated that CRISIL, its Directors, Rating Committee members, employees and others

associated with the rating assignment do not have any financial liability whatsoever including but not

limited to attorney’s or consultant’s fees to the users of this rating or this rating report. No part of this

report may be reproduced by any means without CRISIL’s prior written approval.

© 2006 CRISIL Limited. All Rights Reserved 2

- 3. INDEX

CRISIL SME RATING................................................................................................................. 4

FACT SHEET............................................................................................................................... 5

STRENGTH AND RISK FACTORS........................................................................................... 7

MANAGEMENT PROFILE ....................................................................................................... 9

BUSINESS STRATEGY..............................................................................................................11

OWNERSHIP PATTERN ......................................................................................................... 12

BUSINESS PROFILE ................................................................................................................ 13

PRODUCT PROFILE...................................................................................................................................13

CAPACITY UTILISATION:........................................................................................................................13

SUPPLIER INFORMATION ......................................................................................................................14

CUSTOMER INFORMATION ..................................................................................................................15

OTHER INFORMATION...........................................................................................................................17

INDUSTRY OVERVIEW .......................................................................................................... 18

BANK AND INSURANCE DETAILS ...................................................................................... 20

FINANCIAL PERFORMANCE................................................................................................ 21

PROFIT AND LOSS ACCOUNT ..............................................................................................................21

GRAPHS ..........................................................................................................................................................23

LIABILITIES...................................................................................................................................................24

ASSETS.............................................................................................................................................................26

KEY FINANCIAL RATIOS ........................................................................................................................28

AUDITORS .....................................................................................................................................................29

SITE VISIT INFORMATION................................................................................................... 30

PROMOTERS' DETAILS ......................................................................................................... 31

© 2006 CRISIL Limited. All Rights Reserved 3

- 4. CRISIL SME RATING

CRISIL SME Definition

Rating

SME 1 SME 1 Highest

indicates SME 2 High

'Highest' SME 3 Above Average

level of credit worthiness SME 4 Average

adjudged in relation to SME 5 Below Average

other SMEs SME 6 Inadequate

SME 7 Poor

SME 8 Default

© 2006 CRISIL Limited. All Rights Reserved 4

- 5. 1

FACT SHEET

Name of the company Universal Medicap Limited (Universal Medicap)

Year of incorporation 1989

Business Manufactures rubber and plastic products used in healthcare

applications.

Products: Rubber closures for glass moulded/tubular vials, rubber

plungers for disposable syringes, rubber gaskets, rubber discs, rubber

stoppers, and other pharmaceutical packaging material.

All the products are available as:

• Bioclean – RFS (ready for sterilisation) rubber stoppers.

• Bioclean – RFU (ready for use) gamma radiated rubber

stoppers.

Legal history • Incorporated in 1989 as a partnership firm, Universal

Medicap was originally named Medicap and managed by three

families.

• In 1992, the families split amicably and the Patel family took

over the entire business. Following this, the firm was

converted into a closely held public limited company.

Legal status Public limited company (closely held)

Registered with Registrar of Companies, Gujarat

Registration number 18009

Administrative office UML House, Parag Park, near Ranoli Crossing,

At Dasrath – 391 740,

Baroda, Gujarat,

India

Tel.: (265) 2243055, 2240230, 2240004, 6540105/6,

Fax: (265) 2240507l:

E-mail: universal.medicap@sril.net, medicap@satyam.net.in

Website: www.umlindia.com

Registered and Village: Rania, Taluka: Savli,

manufacturing facilities District Baroda – 391 780,

Gujarat,

India,

Tel.: (2667) 244228, 244318, 244768

Mumbai office

Tel.: (022) 26128713

1DMF approvals were taken for the formulations of rubber closures. These were for the compatibility of the formulations

with preservatives and other ingredients of the products.

© 2006 CRISIL Limited. All Rights Reserved 5

- 6. Industry Pharmaceuticals

Chief executive Mr. Jagdish Bhagwanbhai Patel

Branch offices Nil

Number of employees Permanent: 150

Contractual: 80

Total: 230

Certifications/awards ISO 9001:2000

Approval of DMF (Drug Master File), USA for six products

Brands No

Statutory compliance Income tax returns filed on: July 31, 2006

Sales tax returns filed on: not applicable (NA)

(As informed by the Wealth tax filed on: September 9, 2006

management, not independently Excise duty: NA

verified) Employees Provident Fund dues paid on time

Key financials Year ended March 31, 2006 2005 2004

Net sales Rs.lakh 1,706.40 1,321.02 1,194.91

Profit after tax Rs.lakh 221.88 145.49 94.39

Net worth Rs.lakh 680.92 527.13 432.52

Total debt Rs.lakh 1,173.94 767.96 513.34

Gearing Times 1.72 1.46 1.19

Interest Cover Times 4.99 4.11 3.91

• Projected sales for 2006-07 (refers to financial year, April 1 to

March 31): Rs.30 crore.

• Sales registered till October 31, 2006: Rs.16 crore.

• Total debt as on March 31, 2006 includes Rs.2.03 crore of

unsecured loans taken from the promoters, their relatives and

friends.

DIVISION OF UNIVERSAL MEDICAP

Universal ISO-MED is a division of Universal Medicap, and was started in March 2006. The division

acts as a gamma radiation sterilization facility for agro, food, and healthcare products. Universal

Medicap utilises this facility for in-house sterilisation and also undertakes job work for other

pharmaceutical companies in a smaller proportion. As on March31, 2006, job work income constituted

0.11 per cent of Universal Medicap’s total turnover.

© 2006 CRISIL Limited. All Rights Reserved 6

- 7. STRENGTH AND RISK FACTORS

STRENGTHS RISK FACTORS

• Competent management with business • Faces stiff competition from international

experience of more than 20 years in the same players.

line of business. • High inventory levels at 187 days, 192 days,

• Experienced and qualified second line of and 193 days for the year ended March 31,

management. 2006, 2005, and 2004, respectively. The

• Diversified product and customer profile company maintains a high level of imported

enhance stability in revenues rubber stocks.

• Good growth prospects linked to:

o Growth of Indian pharmaceuticals

industry; domestic formulations market

is likely to grow at a 15 to 18 per cent

compounded annual growth rate

(CAGR); injectables (accounting for 9

per cent of the formulations market)

segment is expected to grow at a CAGR

of 15 per cent.

o Good order book position at Rs.177.88

lakh as in November 2006; sales of Rs.16

crore already registered in the current

year.

• The company has registered drug master files

(DMF) for six products, including different

polymers and formulations, which have

improved its export market.

• Strong marketing network with in-house team

and agents catering to various parts of the

globe.

• In-house research and development (R&D)

facility – developed a gamma radiation facility

in the division.

© 2006 CRISIL Limited. All Rights Reserved 7

- 8. • Forward contracts undertaken to cover

foreign exchange (forex) fluctuation risks.

• Strong financial risk profile characterised by a

high profitability margin at 13 per cent, return

on capital employed (RoCE) at 26.05 per cent,

net cash accruals/total debt at 20 per cent,

and interest cover at 4.99 times as on March

31, 2006.

© 2006 CRISIL Limited. All Rights Reserved 8

- 9. MANAGEMENT PROFILE

(Promoters/Directors)

Name Mr. Jagdish Bhagwanbhai Patel

Designation Chairman and Managing Director

Current responsibilities Overall management

Age 47 years

Qualification BCom

Experience • Twenty nine years in the same line of

business

• Previously, Mr. Patel was a partner in

Nobel Rubber, a family-owned business

which manufactured rubber enclosures.

However, the firm is currently non-

operational.

Net worth* Rs.245.70 lakh as on March 31, 2006

Name Mr. Nilesh Ramanbhai Patel (cousin of Mr.

Jagdish Bhagwanbhai Patel)

Designation Director

Current responsibilities Overall management

Age 43 years

Qualification BCom

Experience Twenty years in the same line of business

Net worth* Rs.58 lakh as on March 31, 2006

* As informed by the management, not certified.

© 2006 CRISIL Limited. All Rights Reserved 9

- 10. Name Mr. Ileshkumar Bachubhai Patel (cousin of Mr.

Jagdish Bhagwanbhai Patel)

Designation Director

Current responsibilities Production management

Age 49 years

Qualification BCom

Experience Twenty years in the same line of business

Net worth* Rs.68.59 lakh as on March 31, 2006

Name Mr. Rameshbhai Gordhanbhai Patel (cousin of

Mr. Jagdish Bhagwanbhai Patel)

Designation Director

Current responsibilities Not active in day to day operations

Age 50 years

Experience NA

Net worth* Rs.1.31 lakh as on March 31, 2006

Name Mr. Ashwinibhai Maganbhai Patel (cousin of

Mr. Jagdish Bhagwanbhai Patel)

Designation Director

Current responsibilities Not active in day to day operations

Age 52 years

Experience NA

Net worth* Rs.3.38 lakh as on March 31, 2006

* As informed by the management, not certified.

© 2006 CRISIL Limited. All Rights Reserved 10

- 11. Name Mr. Bhanubhai Ramanbhai Patel (cousin of Mr.

Jagdish Bhagwanbhai Patel)

Designation Director

Current responsibilities Not active in day to day operations

Age 51 years

Experience NA

Net worth* Rs.56.62 lakh as on March 31, 2006

* As informed by the management, not certified.

BUSINESS STRATEGY

Universal Medicap plans to expand the facility by purchasing additional land adjacent to the existing

facility. Universal Medicap also plans to install machinery (three) in the new facility. The total cost of

land and building is about Rs.3 crore and the cost of installation is Rs.4.5 crore. The funding

requirement will be partly me through the company’s internal accruals (to the extent of 30 per cent)

and partly through bank loans (to the extent of 70 per cent). The company’s revised gearing is likely to

be 1.29 times, which has been factored in the rating. The proposed capital expenditure (capex) plan is

likely to materialise by 2006-07.

VISION

Universal Medicap’s objective is to achieve a turnover of Rs.500 crore by the end of 2016. The

company plans to grow at a rate of 20 per cent per annum. Further, the management plans to

undertake an additional investment of Rs.130 crore towards the expansion of its existing facility and

installation by the end of 2015-16.

© 2006 CRISIL Limited. All Rights Reserved 11

- 12. OWNERSHIP PATTERN

As on September 30, 2006

Authorised capital : Rs.200 lakh

Paid up capital : Rs.150 lakh

Per cent of shares

Name

held

Mr. Jagdish Bhagwanbhai Patel 8.10

Mr. Nilesh Ramanbhai Patel 6.21

Mr. Bhanubhai Ramanbhai Patel 3.65

Mr. Ileshkumar Bachubhai Patel 1.50

Mr. Ashwinibhai Maganbhai Patel 1.00

Mr. Rameshbhai Gordhanbhai Patel 0.23

Friends and relatives 29.16

Directors’ family 50.15

Total 100.00

Total number of equity shares stands at 15,00,000 at Rs.10 each

© 2006 CRISIL Limited. All Rights Reserved 12

- 13. BUSINESS PROFILE

PRODUCT PROFILE

Name of the product Application

• Rubber closures: Used as pharmaceutical

o for glass moulded/tubular vials packaging material

o for large volume, glass moulded/tubular vials,

o for blood collection tubes/vacutainers

• Special closures for freeze-fried lyophilised products

• Rubber plungers for disposable syringes and pre-filled syringes

• Rubber gaskets for bulk drugs

• Rubber discs for caps and bottles

• Special high technology formulations compatible with

preservatives and other ingredients of injectable products

• Rubber coated stoppers

Universal Medicap’s manufacturing facility offers RFU and RFS rubber closures and stoppers

(sterilized by gamma irradiation).

CAPACITY UTILISATION:

Universal Medicap manufactures a wide range of products which cater to the customers’ requirements.

Hence, capacity utilisation is not applicable.

© 2006 CRISIL Limited. All Rights Reserved 13

- 14. SUPPLIER INFORMATION

Domestic sourcing in 2005-06 (per cent) : 22.00

Imports in 2005-06 (per cent) : 78.00

CIF value of imports ( Rs. lakh) : 2005-06 Rs.409.41 lakh

2004-05 Rs.380.30 lakh

Name of the supplier Product Length of Per cent share in State/country

relationship total purchases

(years) (2005 - 06)

20 Microns Ltd. Rubber 11 2.10 Gujarat

chemicals

Indian Petrochemicals Rubber 11 3.16 Gujarat

Corporation Ltd. (IPCL)

Darshanik Mktg. & Rubber and 12 7.57 Gujarat

Services P. Ltd. (agent of rubber

IPCL) chemicals

Trigon Gulf FZCO Rubber 11 28.04 Russia

Exxonmobil Chemical 10 32.89 Europe

Asia Pacific

Terms - domestic : Credit for 30 to 45 days

Terms - imports : Letter of credit for 60 days, payment against documents

Suppliers' feedback

: Payment is on time. Suppliers are satisfied with the relationship.

on the rated entity

© 2006 CRISIL Limited. All Rights Reserved 14

- 15. CUSTOMER INFORMATION

Domestic sales in 2005-06 (per cent) : 84.00

Exports in 2005-06 (per cent) : 16.00

FOB value of exports( Rs. lakh) : 2005-06 Rs.298.14 lakh

2004-05 Rs.220.42 lakh

Name of the Product Length of Per cent share City State/country

customer relationship in total sales*

(years)

Fresenius Kabi Rubber 10 3.83 Pune Maharashtra

India Private closures,

Limited stoppers, and

Cadila other products 25 4.43 Ahmedabad Gujarat

Healthcare

Limited

Strides Arcolab 10 4.84 Bangalore Karnataka

Limited

Nicholas 10 5.26 Mumbai Maharashtra

Piramal India

Limited

Ipca 10 7.45 Mumbai

Laboratories Ltd

ANB 9 25.00 per cent of - Thailand

Laboratories the total exports

Renata 8 30.00 per cent of Bangladesh

Acme 9 the total exports

Laboratories

Libra 9

* The per cent share in total sales of all customers keeps fluctuating every year.

Terms - domestic : Credit for 30 to 70 days

Terms - exports : Letter of credit for 45 days

Customers' feedback :

Product quality is good. No delays in the delivery.

on the rated entity

© 2006 CRISIL Limited. All Rights Reserved 15

- 16. ORDERS IN HAND

The total order book position was at Rs.177.88 lakh as in November, 2006

Sales registered till October 31, 2006 was at Rs.16 crore.

MARKETING ARRANGEMENT

• Universal Medicap has a dedicated sales team of four personnel based in Baroda. The team

conducts personal visits to the target customers. The company develops new customers

through product development and sales promotion.

• Universal Medicap also participates in various pharmaceutical fairs and exhibitions held in

Thailand, Malaysia, Taiwan, and Bangladesh.

• The company has developed an agent network spread across the globe. Universal Medicap has

six exclusive agents, based in South Africa, Thailand, Malaysia, Bangladesh, and Jordan. The

company pays a commission of about 5 to 10 per cent to these agents.

COMPETITORS

Universal Medicap faces limited competition from the domestic market. A few of the domestic players

are Bharat Rubber, Jamnadas, and Paragon. The prices of Universal Medicap’s stoppers are 25 to 30

per cent higher as compared to other domestic players. The company, in technical collaboration with

Naniwa, Jaipan, has developed internationally acknowledged products.

Universal Medicap has to compete with international players, a few of them being Helvoet, Belgium

and West Pharma, Singapore. However, Universal Medicap is able to compete with the international

players due to the superior quality of its products.

© 2006 CRISIL Limited. All Rights Reserved 16

- 17. OTHER INFORMATION

1) Availability of raw materials : Ample

2) Price fluctuation in raw materials : High

3) Product range : Diversified

4) Marketing network : Adequate

5) Competition risk : Average

6) Power availability : Stable

7) Research and development : Undertaken

8) Ability to raise funds : Good

9) Expansion/diversification plan : Yes

TECHNICAL COLLABORATION

In 1996, Universal Medical had entered into a technical collaboration with Naniwa Rubber Company

Limited (Naniwa). Established in 1996, Naniwa is a leading Japanese company engaged in the

manufacturing of rubber packaging products and other rubber and plastic healthcare products.

Universal Medicap has already assimilated the technology, and hence the company has not renewed the

agreement, which was dissolved in 2005.

The company, in technical collaboration with Bhabha Atomic Research Centre, developed a gamma

irradiation system. This has enabled the company to provide value addition to its customers by

providing sterilised products, thereby saving time and cost for the customers.

TECHNOLOGY – COMPUTER AIDED DESIGN (CAD) CENTRE

The company has a computerised cell that creates custom-made designs for its customers. Using the

latest CAD technology, optimal design solutions are used to meet the specific requirement of the

customers.

© 2006 CRISIL Limited. All Rights Reserved 17

- 18. INDUSTRY OVERVIEW

• The Indian pharmaceutical market is growing at an annual rate of 8-9 per cent per annum and

a CAGR of 20 per cent, and is expected to rise to Rs.390 billion by the end of 2009. India’s

healthcare expenses, one of the lowest in the world, constitute 0.8 per cent of the country’s

gross domestic products (GDP).

• The pharmaceuticals sector comprises active pharmaceutical ingredients (API) and

formulations manufacturers. The formulations market is growing at a CAGR of 15-18 per cent.

The domestic formulations market is estimated to grow at a moderate 5-7 per cent over the

medium term, driven largely by a growth in lifestyle segments like cardiovascular, diabetes and

neurology. Injectables account for 9 per cent of the formulations market, and are likely to grow

at a CAGR of 15 per cent.

• Universal Medicap manufactures a wide range of rubber stoppers and rubber closures:

o Considering the growth in injectables and formulations, the market for rubber stoppers

is likely to grow at a CAGR of 15 per cent for the next five years. The future demand

for rubber stoppers are likely to grow to 2,400 million in 2009-10 from 1,203 million

(numbers) in 2004-05. Further, the demand for RFS stoppers is likely to grow to 420

million in 2009-10 from 208 million in 2004-05. Ninety four per cent of the domestic

demand for rubber closures is catered to by the domestic market and about 6 per cent

is sourced from the international market.

• Given the increasing trend of outsourcing by global pharmaceutical majors of their API

requirement, the global contract manufacturing market is estimated to grow at a CAGR of 22

per cent to US$5 billion (about Rs.22,500 crore) by 2009-10 (Source: CRIS INFAC- a research

arm of CRISIL). While India currently accounts for a fraction of this large pie, it is expected to

garner a higher share over the medium term. Low cost of manufacturing, reverse engineering

skills, and expertise in process chemistry are the main drivers of this expected growth.

© 2006 CRISIL Limited. All Rights Reserved 18

- 19. Competition Scenario:

• The organised sector can be classified into multinational companies (MNCs) and Indian

companies. The share of MNCs declined over a period of time. Sixty one per cent of industry

sales are generated by the Indian firms, 38 per cent comes from the multinational firms and the

remaining 1 per cent is generated from the public sector. A part from Universal Medicap, some

of the domestic manufacturers of rubber stoppers are Jamnadas Industries, Paragon Industries,

Bharat Rubber, Rubber Industries India, and others. The international players are Helvoet,

Belgium, West Pharma, Singapore, and Stelmi France.

• The unorganised sector accounts for 30 per cent of the total industry sales. The unorganised

sector is mainly involved in formulation manufacturing, with a fragmented production base

across the country.

• Success in this competitive market is determined by strong R&D capabilities and large

capacities to cater to the huge demand. Certification of facilities and manufacturing processes

by independent agencies (USFDA, WHO-GMP) is the basic requirement for players to be

meaningful exporters to the regulated markets.

© 2006 CRISIL Limited. All Rights Reserved 19

- 20. BANK AND INSURANCE DETAILS

Bank Details

Facilities Loan/limit Rate of interest Length of

Name of the

availed (Rs. lakh) (per cent) relationship

bank

(Years)

State Bank of Cash credit/ 575.00 9.50 1

India Working credit

Standby line of 100.00

credit

Term loan 750.00

Corporate loan 100.00

Open term loan 50.00

Letter of credit 150.00 0.25 per cent

Bank guarantee 25.00 commission

Until 2005, Universal Medicap was banking with HDFC Bank Ltd. The company shifted to State Bank

of India for a better localised service facility. The company had a term loan and cash credit facility

with its former bank at a rate of 10 per cent.

Feedback: The account’s performance is excellent.

Insurance Details

Insurer Date of Sum insured

Asset insured

validity (Rs. lakh)

Analytical Bajaj Allianz General Insurance Co. Ltd September 562.04

Laboratory 14, 2007

Building, furniture 1,065.60

and fixtures, plant

and machinery,

stocks, electrical

installations,

transformers, diesel

generator sets, and

control system

Total 1,627.64

All policies are in force; information as provided by the management.

© 2006 CRISIL Limited. All Rights Reserved 20

- 21. FINANCIAL PERFORMANCE

PROFIT AND LOSS ACCOUNT

For the year ended March 31 2006 2005 2004

(Rs. lakh) Audited Audited Audited

Net sales 1,706.40 1,321.02 1,194.91

which includes exports of 298.11 220.43 161.98

Other operating income - - -

Total operating income 1,706.40 1,321.02 1,194.91

Raw materials, stores, and spares consumed 709.21 583.01 536.57

Power and fuel 78.12 66.83 60.35

Direct labour 41.04 33.73 27.68

Other manufacturing expenses 60.62 60.14 62.27

General and administration expenses 113.64 128.32 101.11

Selling and distribution expenses 107.00 75.37 68.06

Employee expenses 105.07 81.89 75.72

Cost of sales 1,214.70 1,029.29 931.76

OPBDIT 491.70 291.73 263.15

Interest expense 76.28 60.86 59.97

Other finance charges 21.36 18.45 7.45

Total finance cost 97.64 79.31 67.42

OPBDT 394.06 212.42 195.73

Depreciation (net) 80.56 58.54 60.39

OPBT 313.50 153.88 135.34

Interest income 0.77 0.81 1.26

Other income/expense (including gain/loss on asset sales) 16.42 52.10 6.45

Total nonoperating income/(expense) 17.19 52.91 7.71

Profit before tax 330.69 206.79 143.05

Extraordinary income/(expenses) 0.60 10.69 0.45

Tax provision 109.41 71.99 49.11

Profit after tax 221.88 145.49 94.39

© 2006 CRISIL Limited. All Rights Reserved 21

- 22. Dividends 60.00 45.00 -

Transferred to reserves 161.88 100.49 94.39

Notes to the Profit and Loss Account:

• Other non-operating income mainly includes revenues from trading of imported raw materials,

namely, rubber (Rs.8.13 lakh in 2005-06, Rs.53.87 lakh in 2004-05, and Rs.7.46 lakh in 2003-04)

in the domestic market, exchange rate fluctuation, bad debts recovered, and dividend received.

There were also some intangibles written off and loss on sale of assets.

• Selling and distribution expense for the year ended March 31, 2006 has increased as the

company undertook huge investment in sales promotion activities such as conducting an

exhibition for scientists and participating in trade exhibitions.

© 2006 CRISIL Limited. All Rights Reserved 22

- 23. GRAPHS

Turnover trends Margin trends

1,800 1,706.4 35.0

30.0 28.8

1,600

1,321.0

1,400 1,194.9 25.0

22.0

Per cent

1,200 20.0 22.1

Rs. lakh

1,000 15.0

13.0

800 10.0 11.0

600 5.0 7.9

400 -

200 2003-04 2004-05 2005-06

0

2003-04 2004-05 2005-06 OPBDIT margin (%) PAT margin (%)

Where a rupee is spent

Direct Other

labour

Gen. and

Power mfg.

3% admin.

and fuel exps.

exps.

6% 5%

9%

Selling

and

distn.

Raw exps.

materials 9%

59% Employe

e exps.

9%

Total outside liabilities/Tangible net Capital employed

worth

100

2.5

2.2 80

54 59

2.0 2.0 63

60

1.6

%

Times (x)

1.5 40

1.0 20 46 41 37

0.5 0

31-Mar-04 31-Mar-05 31-Mar-06

- Debt/Capital employed (%)

31-Mar-04 31-Mar-05 31-Mar-06

Net worth/Capital employed (%)

© 2006 CRISIL Limited. All Rights Reserved 23

- 24. LIABILITIES

As on March 31, 2006 2005 2004

(Rs. lakh) Audited Audited Audited

Equity share capital 150.00 150.00 150.00

Preference share capital - - -

Reserves and surplus 530.92 377.13 282.52

Reported net worth 680.92 527.13 432.52

Less: intangible assets - - -

less: revaluation reserve - - -

Less: miscellaneous expenditure not - - -

written off

Tangible net worth 680.92 527.13 432.52

Deferred tax liability (Net) 73.28 69.49 73.10

Long-term debt

Loans from banks 322.06 259.09 95.86

Borrowings from group 202.67 189.90 140.32

companies/promoters.

Other term debt - - -

Total long-term debt 524.73 448.99 236.18

Short-term debt

Cash credit loans from banks 620.01 305.84 225.34

Borrowings from group - - -

companies/promoters

Other short-term loans 29.20 13.13 51.82

Total short-term debt 649.21 318.97 277.16

Total debt 1173.94 767.96 513.34

Other current liabilities

Accounts/notes payable 119.50 72.19 129.29

Net tax provision - - -

Dividends payable 68.08 50.88 -

Advances from customers - - -

Others 165.04 175.41 68.78

Total other current liabilities 352.62 298.48 198.07

Total liabilities 2280.76 1663.06 1217.03

© 2006 CRISIL Limited. All Rights Reserved 24

- 25. Notes to the Liabilities:

• Reserves include subsidies of Rs.23.01 lakh received from the state government for setting up

the unit in a backward area.

• Loans from bank included term loan for the purchase of machinery and vehicles.

• Borrowings from group companies/promoters are paid an interest of 11.25 per cent per

annum.

• Other short-term loans are the bills payable/discounted against personal guarantees of

directors.

• Other current liabilities include sundry creditors for expenses and capital goods, provision for

expenses, and other outstanding liabilities.

© 2006 CRISIL Limited. All Rights Reserved 25

- 26. ASSETS

As on March 31, 2006 2005 2004

(Rs. lakh) Audited Audited Audited

Fixed assets

Land and building 569.07 387.91 222.66

Plant and machinery 510.52 331.52 321.81

Other fixed assets 438.17 277.08 235.79

Less: revaluation reserve - - -

Gross block 1,517.76 996.51 780.26

Less: accumulated depreciation 425.89 345.33 299.68

Net block 1,091.87 651.18 480.58

Capital work in progress 69.71 222.83 24.63

Net fixed assets 1,161.58 874.01 505.21

Deferred tax asset (Net) - - -

Current assets

Total inventory 464.34 418.06 365.06

Receivables 441.39 323.88 281.82

of which receivables greater than 6 months are 11.19 6.96 13.08

Cash and bank 12.53 3.14 2.90

Investments in liquid instruments - - -

(including gilts)

Advances to suppliers - - -

Others 43.35 19.33 22.46

Total current assets 961.61 764.41 672.24

Non current assets

Investment in group companies - - -

Loans and advances to group companies - - -

Other loans and advances 143.08 14.74 15.43

Other non current assets 14.49 9.90 24.15

Total non current assets 157.57 24.64 39.58

Total assets 2,280.76 1,663.06 1,217.03

Notes to the Assets:

• In 2005 and 2006, Universal Medicap has been acquiring land, which reflects in the additions to

its existing land and building.

• Capital work-in-progress (WIP) as on March 31, 2006 reflects the installation of new plant and

machinery for manufacturing rubber closures. As on March 31, 2005 and 2004, it was the

© 2006 CRISIL Limited. All Rights Reserved 26

- 27. installation of gamma radiation plant.

• Receivables greater than six months are considered to be good.

• Other current assets include DEPB license, balance with central excises, public bodies, and

others.

• Other loans and advances include advance tax, and other advances.

• Other non-current assets include margin money and fixed deposits with bank.

© 2006 CRISIL Limited. All Rights Reserved 27

- 28. KEY FINANCIAL RATIOS

2006 2005 2004

For the year ended

Audited Audited Audited

Performance growth

Net sales growth (per cent) 29.17 10.55 -

OPBDIT growth (per cent) 68.55 10.86 -

PBT growth (per cent) 59.92 44.56 -

Profitability

OPBDIT/Net sales (per cent) 28.82 22.08 22.02

PBT/Net sales (per cent) 19.38 15.65 11.97

PAT/Net sales (per cent) 13.00 11.01 7.90

PAT/Total assets (ROA) (per cent) 11.25 10.10 7.76

PAT/Tangible net worth (RONW) (per cent) 36.73 30.32 21.82

ROCE (per cent) 26.05 24.90 20.70

Depreciation/Average gross block 0.06 0.07 -

Activity

Asset conversion cycle (days) 217 232 188

- Days inventory (on COP) 187 192 193

- Days receivable (on gross sales) 89 82 80

- Days payable (on materials) 59 42 86

Working capital turnover 2.80 2.84 2.52

Gross block turnover 1.12 1.33 1.53

Total asset turnover 0.75 0.79 0.98

Coverage

PBDIT/Interest 4.99 4.11 3.91

Dividend cover (PAT/Dividend) 3.70 3.23 -

Debt cover 4.10 3.60 3.30

Average cost of borrowing (per cent) 7.86 9.50 -

Balance sheet structure

(Total outside liabilities + DTL)/Tangible net worth 2.35 2.15 1.81

Current ratio 0.95 1.23 1.39

Quick ratio 0.49 0.55 0.62

Long-term debt/Tangible net worth 0.77 0.85 0.55

Total debt/Tangible net worth 1.72 1.46 1.19

Total outside liabilities/Tangible net worth 2.24 2.02 1.64

Without considering unsecured loans as debt:

Total debt/Tangible net worth 1.42 1.09 0.86

© 2006 CRISIL Limited. All Rights Reserved 28

- 29. Notes:

Universal Medicap maintains high inventory level (imported rubber) to cover the exchange fluctuation

risks. The company’s inventory also includes goods-in-transit.

AUDITORS

Shah Mehta & Bakshi, Chartered Accountants

Prasanna House, Associated Society, opposite to Radhakrishna Park, Baroda – 390 020, Gujarat.

The auditors had made no adverse comments in the past three financial years.

© 2006 CRISIL Limited. All Rights Reserved 29

- 30. SITE VISIT INFORMATION

Address of the site visited : Village Rania, Taluka Savli, District Baroda

391780

Size of the premises : 46,070 sq. mt.

Locality : Industrial

Location area : Semi-urban

Office/Factory location : Side lanes

Distance from railhead : 20 km

Distance from highway : 12 km

Proximity to the consumption centre : Yes

Proximity to raw material source : No

Proximity to centre supplying manpower : Yes

Infrastructure development state : Satisfactory

Building type : Permanent structure

Ownership of office/factory/works : Owned

Owned by whom : Universal Medicap Limited

Group companies located in the same : No

premises, if any

Number of employees at the location : Permanent: 23

Contractual: 80

Competitors located nearby, if any : Bharat Rubber and Jamnadas Rubber

Industries

Factory layout : Spacious and well-organised

Facilities available at the site : • Telephones

• Fax

• Internet

• Generators

• Security guards

• Name/Sign boards

• Fire extinguishers

• Drinking water facility

• Drainage/Sewers

• Pantry/Canteen facility

• Transport

• Boundary wall

© 2006 CRISIL Limited. All Rights Reserved 30

- 31. PROMOTERS' DETAILS

Name Mr. Nilesh R. Patel

Panch Bangla, At: Dashrath, District.: Baroda -

Residential address

391 740

Whether the residence is owned or rented Owned

If owned, whether it is mortgaged No

Vehicle used Toyota Corolla

Any default with credit cards No

Any litigation against promoters No

Name Mr. Jagdish B. Patel

4 - Vasudha Society, Near Shrinathji's Haveli,

Residential address

Nizampura, Baroda - 390 002

Whether the residence is owned or rented Owned

If owned, whether it is mortgaged No

Vehicle used Hyundai Sonata and Chevrolet Tavera

Any default with credit cards No

Any litigation against promoters No

Name Mr. Ilesh B. Patel

Near Shankar Villa, Vallabh - Vidyanagar - 388

Residential address

120

Whether the residence is owned or rented Owned

If owned, whether it is mortgaged No

Vehicle used Skoda Octavia

Insurance value of assets Rs.8.33 lakh

Any default with credit cards No

Any litigation against promoters No

Information as provided by the management.

© 2006 CRISIL Limited. All Rights Reserved 31

- 32. CRISIL OFFICES

Head Office:

CRISIL House,

121-122, Andheri-Kurla Road,

Andheri (East),

Mumbai – 400 093, India.

Tel.: +91 (022) 66913142

Fax: +91 (022) 66913030

Contact: Mr. Rakesh Pingulkar

Branch Offices :

Ahmedabad Kolkata

301, Paritosh, ‘Horizon’, Block – B,

Usmanpura, 4th floor, 57, Chowringhee Road,

Ahmedabad – 380 013 Kolkata – 700 071

Tel.: (079) 27550317 / 1533 Tel.: (033) 22823541

Fax: (079) - 27559863 Fax: (033) 22830597

Contact: Mr. Nitin Mahajan Contact: Mr. Arnab Chanda

Bangalore New Delhi

W-101, 1st floor, Sunrise Chambers, Hindustan Times Building, 9th floor,

22, Ulsoor Road, 18-20, K. G. Marg,

Bangalore – 560 042 New Delhi – 110 001

Tel.: (080) 25580899 / 25594802 / 6708 Tel.: (011) 23721603 / 23320980 / 23736541

Fax: (080) 25594801 Fax: (011) 23721605

Contact: Mr. Sudhir Narayan Contact: Ms. Sangeeta Rao

Chennai Pune

Mezzanine floor, Thapar House, 1187/17, Ghole Road,

43/44 Montieth Road, Shivajinagar,

Egmore, Pune – 411 005

Chennai – 600 008 Tel.: (020) 25539064-67

Tel.: (044) 28546205 / 06 / 28546093 Fax: (020) 25539068

Fax: (044) 28547531 Contact: Mr. Pramod Bang

Contact: Mr. B. Venugopal

Hyderabad

Uma Chambers, 3rd floor,

Banjara Hills,

Near Punjagutta Cross Roads,

Hyderabad – 500 082

Tel.: (040) 23358103 / 8105

Fax: (040) 23357507

Contact: Mr. Rahul Deshpande

© 2006 CRISIL Limited. All Rights Reserved 32