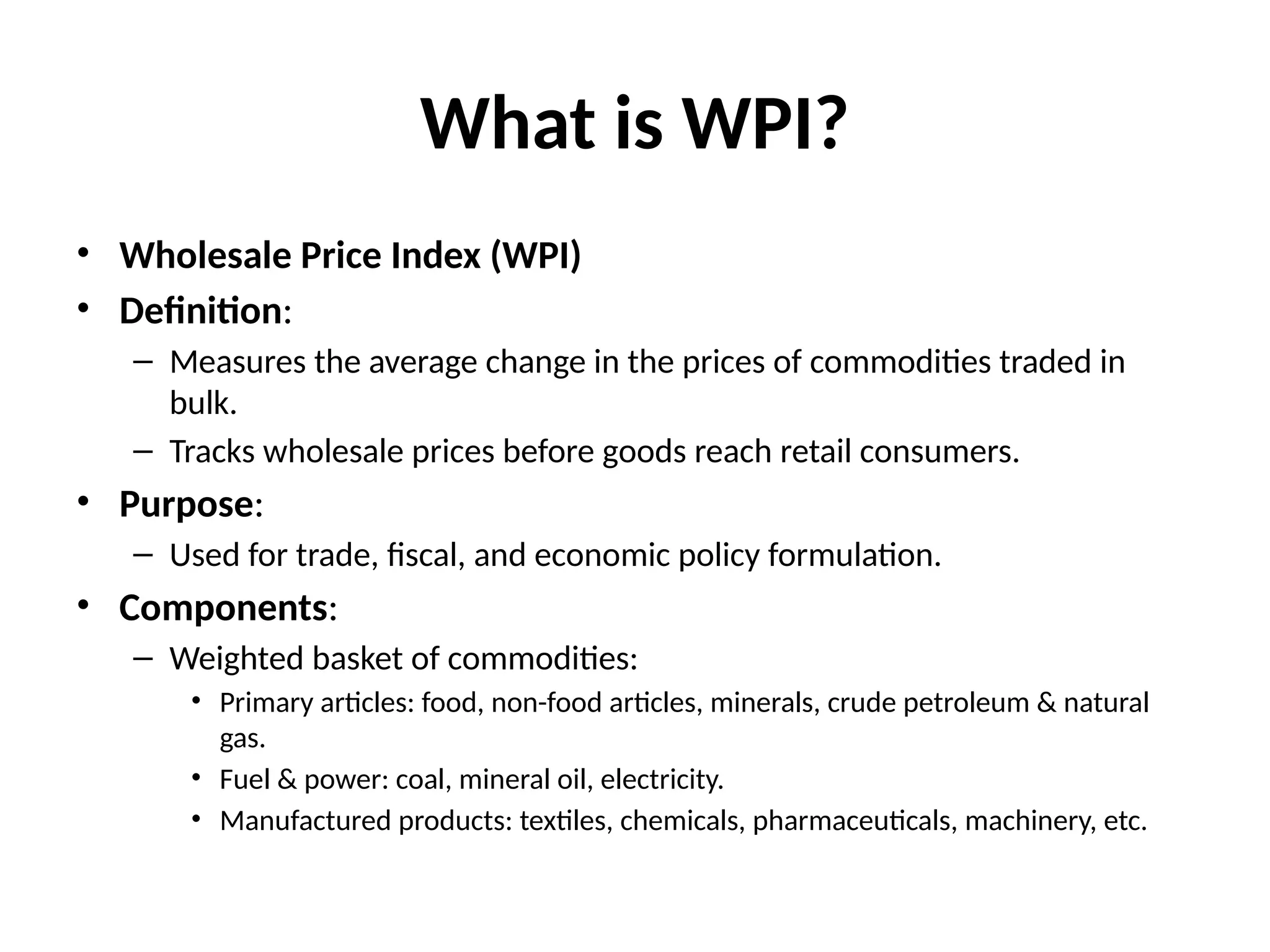

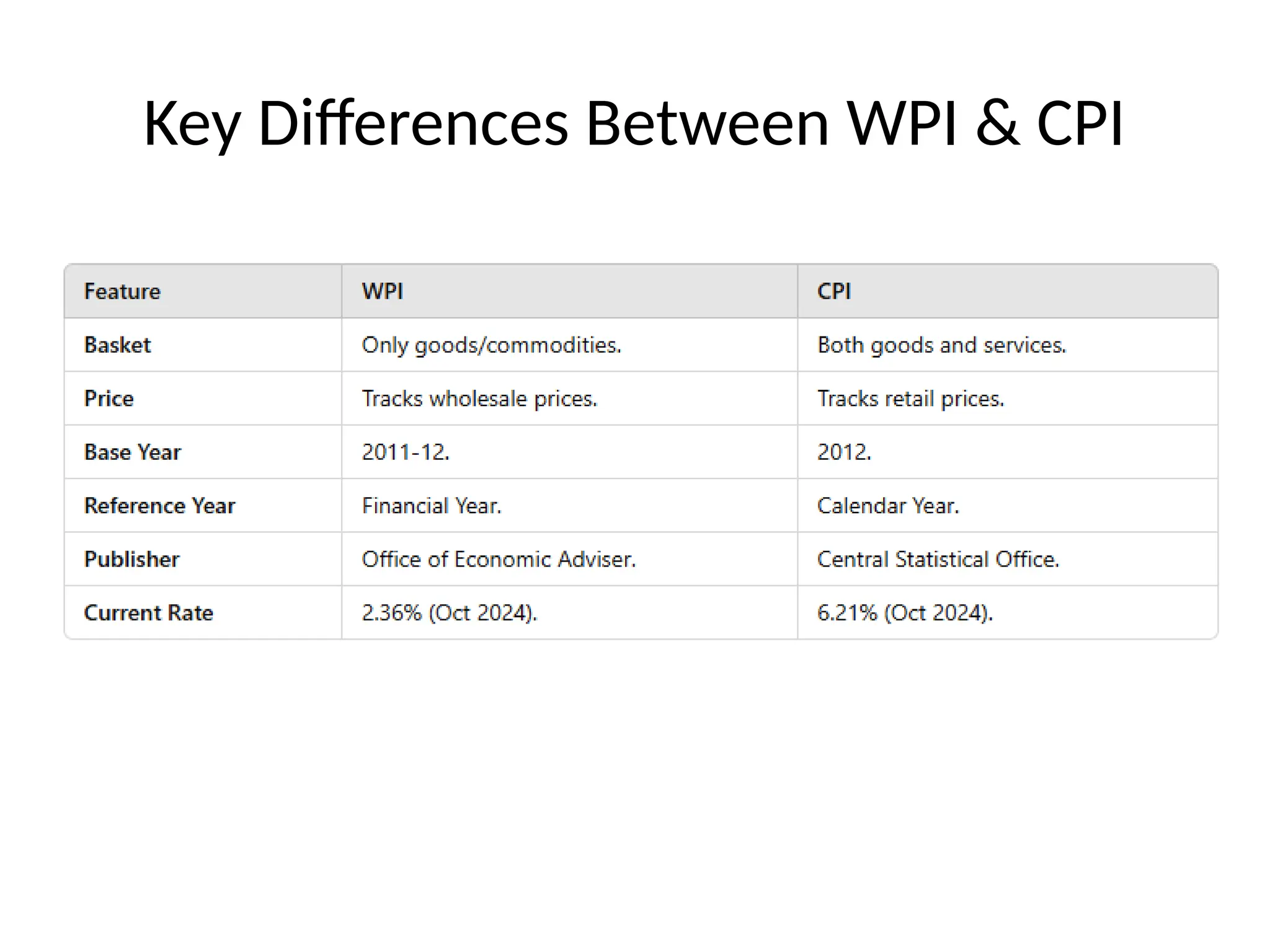

The document explains the difference between the Wholesale Price Index (WPI) and the Consumer Price Index (CPI), two important metrics for understanding inflation. WPI measures the average change in prices of commodities at the wholesale level, while CPI tracks price changes of goods and services at the consumer level. Current rates indicate moderate increases in wholesale prices (WPI at 2.36%) and significant increases in consumer prices (CPI at 6.21%), highlighting their respective impacts on trade policies and household budgets.