Understanding the Changing Customer Preference :EXPERIMENTAL MODELS

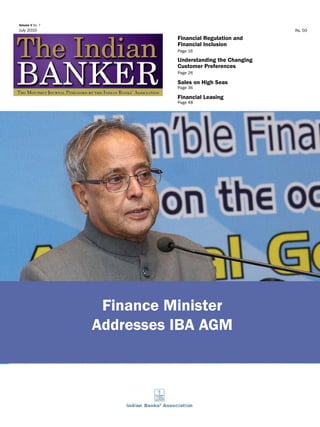

- 1. Volume V No. 7 July 2010 Rs. 50 Financial Regulation and Financial Inclusion Page 16 Understanding the Changing Customer Preferences Page 26 Sales on High Seas Page 36 Financial Leasing Page 48 Finance Minister Addresses IBA AGM

- 3. The Indian Banker 3 E D I T O R ’ S N O T E Editor’s Note K Ramakrishnan It was a unique honour to have the Union Finance Minister, Shri Pranab Mukherjee address the Annual General Meeting of IBA. While commending the role played by IBA and banks for their contribution to the economic growth of the country and remaining resilient during financial crisis and its aftershocks, the finance minister has spelt out his expectations from the banking industry, especially in the areas of business growth, NPA control, profitability, human resources and financial inclusion. Views expressed by him form the major part of the cover story of this issue. Another major highlight of this issue is based on the speech delivered by Smt Usha Thorat, deputy governor, RBI at the Tenth Annual International Seminar on Policy Challenges for the Financial Sector at Washington last month, which brings out the convergence between financial regulation and financial inclusion, and explains the rationale of various initiatives by RBI to ensure sustainable framework for financial inclusion. This issue carries further insights on how to deal with ‘Information Overload’, the cover story of our previous issue. Marketing of products has assumed critical importance in banking today. This issue carries a scholarly article on how to estimate customer preferences to various attributes of a product such as a home loan or a credit card using experimental design. On legal and taxation issues, we carry one article which discusses ‘sale on high seas’ as a tax saving mechanism; and the other one on service tax liability on financial leasing services. The importance of post sanction monitoring in containing non- performing assets and various tools of credit form the part of another article of this issue, while the other discusses the future roadmap of central banking in India. Other features include a list of initiatives undertaken by IBA during last year, and key takeaways from the meeting of bankers convened by the Secretary, Department of Financial Services, Ministry of Finance, on the roadmap for financial inclusion. Two book reviews, and the report of annual payment summit organised last month also find place in this issue. Vol V No. 7 - July 2010 Indian Banks’ Association Head Office: Blocks 2 & 3, Stadium House, 6th Floor, 81-83 Veer Nariman Road, Mumbai 400 020, India. Tel + 91-22-22824846 Editorial Office: Unit Nos 1, 2 & 4, 6th Floor, Centre 1 Building World Trade Centre Complex, Cuffe Parade, Mumbai 400 005, India. Tel : + 91-22-22174019 Fax: +91 -22-22184222 Website: iba.org.in, theindianbanker.co.in e-mail: malti@iba.org.in, shroff@iba.org.in Chief Executive & Editor Dr K Ramakrishnan Editorial Committee Manoranjan Sharma Chief Economist, Canara Bank Dr Rupa Rege Nitsure Chief Economist, Bank of Baroda Dr Brinda Jagirdar DGM, State Bank of India Ms Shubhada Rao Chief Economist, YES Bank T R S Trivedi Advisor, Andhra Bank Hari Misra MD, Finsight Media IBA Editorial Team Rema K Menon Sr Vice President Malti Ashar Vice President Suresh Shroff Manager Advertising: Finsight Media, amita@finsight-media.com Subscriptions: Subscription Rates (for 3 years) Bank Employees & Students* Rs. 600 Institutions Rs. 1000 Other Individuals Rs. 1000 Overseas subscriptions (US$) 125 p.a. * A certificate from the appropriate authority confirming the status should be enclosed. Printed by Dr K Ramakrishnan, published by Dr K Ramakrishnan on behalf of Indian Banks’ Association and printed at Thomson Press (India) Limited, 104, Kamanwala Chambers, Mughal Lane, Mahim (West), Mumbai 400 016, India, and published at Indian Banks’ Association, Stadium House, Block 3, 6th Floor, Veer Nariman Road, Mumbai 400 020. Editor: Dr K Ramakrishnan The views expressed in The Indian Banker are not necessarily the views of the Indian Banks’ Association or the bank/institution to which the author belongs. Design, Content and Marketing Support by Finsight Media.

- 4. The Indian Banker 4 Vision To work proactively for the growth of a healthy, professional and forward looking, banking and financial services industry, in a manner consistent with public good. COVER STORY Finance Minister 12 Addresses IBA AGM INSIGHT Financial Regulation and 16 Financial Inclusion Working Together Or At Cross-purposes? - Usha Thorat Members M V Nair S A Bhat Alok Kumar Misra Allen C A Pereira Albert Tauro K R Kamath J M Garg D L Rawal S Sridhar G S Vedi T Y Prabhu J P Dua Bhaskar Sen Office Bearers Chairman O P Bhatt Deputy Chairmen Aditya Puri M D Mallya A C Mahajan Honorary Secretary Rana Kapoor R Sridharan Ms Renu Challu Neeraj Swaroop Gunit Chadha Stuart Davis Pramit Jhaveri M Venugopalan Ms Chanda Kochhar N D Behere D K Mulmule Shrinivas D Joshi Ms Shikha Sharma Kevan Watts C O V E R S T O R Y Vol V No. 7 - July 2010

- 5. The Indian Banker 5 Vol V No. 7 - July 2010 NEWSROOM 8 INTERVIEW Ashvin Parekh 24 - Partner, National industry leader for global financial services, Ernst & Young EXPERT VIEW Understanding the Changing 26 Customer Preferences: Experimental Models - Dr Dinabandhu Bag ARTICLE Central Banking in India: The Road Ahead 32 - Dr Ashish Srivastava ARTICLE Sales on High Seas 36 - Vinoy Mathew Thomas ARTICLE Post Sanction Monitoring 40 - Dr J P Joshipura LEGAL OPINION Financial Leasing: Service Tax Liability 48 - Dr Sanjiv Agarwal BOOK REVIEWS 52 IBA NEWS 54 EVENT ROUNDUP 58 Contents

- 6. D A S H B O A R D Dashboard 1. Banking and Money: All Scheduled Commercial Banks (INR Crores) Outstanding on % Variation Over May 28, May 22, Last Last End March 2010 2009 Month Year 27.03.2010 Aggregate Deposit 4562451 3967995 1.24 14.98 1.69 1. Demand 605387 509968 4.05 18.71 -5.28 2. Time 3957065 3458027 0.82 14.43 2.85 Bank Credit 3243775 2735750 0.90 18.57 0.10 1. Food 50592 57483 5.45 -11.99 4.34 2. Non-food 3193183 2678268 0.83 19.23 0.04 Cash in Hand 28202 25714 9.04 9.68 11.33 Balance with RBI 310326 214854 12.19 44.44 10.28 Investment 1437373 1258305 0.00 14.23 3.96 Money Supply 21.05.2010 22.05.2009 M3 (a+b+c+d) 5672224 4931213 0.89 15.03 1.59 a. Currency with Public 824692 694940 3.29 18.67 7.10 b. Demand Dep with Banks 638421 563107 -1.37 13.37 -10.60 c. Time Dep with Banks 4205291 3668459 0.77 14.63 2.73 d. Other Dep with RBI 3820 4707 7.39 -18.84 -30.96 2. Price % Variation Over 2010 2009 Month Year WPI:1993-94=100 (May 2010) 258.1 234.3 1.73 10.16 CPI: 2001=100 (April 2010) 170 150 0.00 13.33 3. Major Stock Market Indices (as on 28.05.2010) Close Net Change Asia Pacific 114.93 2.09 Australia 4379.17 71.97 China 24004.08 373.76 Hong Kong 19431.37 234.92 India 16666.40 278.56 Indonesia 2713.923 17.143 Japan 9639.72 117.06 Malaysia 1269.16 20.22 Singapore 2739.70 43.68 4. Forex Reserves As on A year ago (Including Gold & SDR) 28.05.2010 29.05.2009 INR Crore 1261852 1240441 US$ million 271970 262306 5. Bank Rate Percent Effective i. Bank Rate 6.00 29-04-2003 ii. IDBI Minimum Term Lending Rate 10.25 30-01-2004 6. Deposit Rates A. TERM DEPOSITS 7 days and above deregulated w.e.f .01.11.2004 B. SAVING 3.5% per annum w.e.f. 01.03.2003 7. Lending Rates per annum w.e.f. 01.07.2010 Amount Percent i. Upto INR 2,00,000 Banks to fix ii. Over INR 2,00,000 Banks to fix 8. Ratios Percent 1. CRR 6.00 w.e.f. 24.04.2010 2. SLR 25.00 w.e.f. 27.10.2009 3. Repo Rate 5.25 w.e.f. 20.04.2010 4. Reverse Repo Rate 3.75 w.e.f. 20.04.2010 5. Cash Dep Ratio 7.42 as on 28.05.2010 6. Investment Dep Ratio 31.50 as on 28.05.2010 7. Credit Dep Ratio 71.10 as on 28.05.2010 9. World Markets - Interest Rates (as on 28.05.2010) (Gov 10 yr) US UK Germany Japan Price 101.56 109.28 102.68 100.36 Yield 3.31 3.62 2.69 1.26 10. Capital Markets (INR Billion) Feb-10 Mar-10 Apr-10 May-10 Capital Issue 302.2 455.5 270.6 123.8 Public Issue 130.9 115.1 41.5 0.0 Rights Issue 18.5 7.0 26.3 1.6 Private Placements 152.7 333.3 202.8 122.1 Call Money rates as on 28.05.2010 - 4.00 - 4.10 % 11. Prime Lending Rates as on 28.05.2010 (% p.a) US CANADA ECB JAPAN SWISS BRITAIN HONG KONG 3.25 2.25 1.00 1.475 0.52 0.50 5.00 (As lending practices vary widely by location, these rates are not comparable) Sources: 1, 4, 8 - RBI Weekly Supplement; 2-RBI Weekly Supplement, CMIE, Mumbai; 5, 6 - RBI, 10 - CMIE; 3 & 11- The Asian Wall Street Journal; 9 - Financial Times Real GDP of Agriculture 5.2 3.7 4.7 1.6 0.2 5.8 0 1 2 3 4 5 6 7 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 Year Percent Source: CMIE The Indian Banker 6 Vol V No. 7 - July 2010

- 7. You can. SAS gives you The Power to Know.® SAS software is used by more than 3,100 financial institutions worldwide, including 96% of banks in the FORTUNE Global 500. ® SAS and all other SAS Institute Inc.product or service names are registered trademarks or trademarks of SAS Institute Inc.in the USA and other countries.® indicates USA registration.Other brand and product names are trademarks of their respective companies.© 2010 SAS Institute Inc.All rights reserved.53659US.0310 SAS® for Banking Credit Risk Management | Credit Scoring | Fair Banking | Fraud Management | Anti-Money Laundering Market Risk Management | Operational Risk Management What if you could join the 33% of financial institutions poised to come out of this economic crisis stronger and more resilient? www.sas.com/resilient for a free special report for more information please contact jaydeep.deshpande@sas.com

- 8. one capital, the basic measure of bank capital. It also wants banks to hold enough liquid assets to survive a short- term market crisis and reduce their reliance on short-term wholesale funding. The IIF estimates that banks will need to raise $700 billion of common equity and issue $5,400 billion of new long-term wholesale debt over the period 2010-15 to meet the new requirements. Their study does not attempt to measure the effect of other potential reforms, such as forcing banks to spin off proprietary trading or capping total leverage. The IIF has not yet calculated the effect on the UK. It has found that the impact of the new rules would ease significantly over time, forecasting that they would cut less than 0.1 percent off the three areas' combined GDP between 2015 and 2020. The figures suggest that the annual impact could be reduced by spreading out the transition period, as some G20 finance ministers proposed recently. The bankers warned that the current failure to harmonise accounting standards in the US and Europe could hamper regulatory reform. They also criticised Basel's ‘net stable funding’ rule, which would force banks to reduce their reliance on wholesale funding. Japan unveils ¥3,000 billion lending package The Bank of Japan (BoJ) unveiled the framework of its new ¥3,000 billion lending programme in its latest effort to try to spur economic growth to help end deflation. The new temporary lending programme, to be introduced by the end of August, will supply one- year loans at the bank's overnight rate, against eligible collateral, to financial institutions, for lending to companies with the objective of raising productivity and creating consumer demand. The initial plan was announced in May. The loans will be able to be rolled over a maximum of three times, in effect extending the funds for a maximum of four years at the policy rate, which stands at 0.1 percent. The central bank kept interest rates at 0.1 percent, as expected, after the end of its two-day monetary policy meeting. It is unusual for the BoJ to introduce such a programme and the move reflects its view that boosting Japan's potential growth rate through structural reform is the way to rid the country of its entrenched deflation. Structural reform lies within the government's responsibility. The new programme is likely to be seen as a measure to appease Tokyo, which, with the July upper house elections coming near, has been putting pressure on the central bank to do more to end falling prices. The BoJ's plan also comes ahead of a government announcement, expected this month, outlining a new economic growth strategy. Many strategists remain skeptical as to the extent to which the plan will stimulate lending. Weak lending has left banks with a huge gap between their loans and deposits, the vast majority of which has been invested in Japanese government bonds. Banks will have to submit a plan on how the funds they borrow through the programme will be used. The central bank has suggested growth areas, including health, agriculture and the environment, in Basel rules and banking growth Economic growth in the Eurozone, the US and Japan will be cut by three percentage points between now and 2015 if current proposals to force banks to hold more capital and liquid assets go forward unchanged, the world's leading banking industry group, Institute of International Finance (IIF) stated recently. As a result, 9.7 million fewer jobs would be created in those areas over the period. The group is pushing hard for the Basel Committee on Banking Supervision (BCBS) to rewrite or at least delay the implementation of the proposals, known as Basel III, which are slated to be voted on later this year. According to the IIF, the Eurozone would feel the largest impact from the new Basel proposals, with growth cut by 0.9 percentage points per year, resulting in a cumulative reduction in gross domestic product of $920 billion (€765 billion, £631 billion), or 4.3 percent, by 2015. The US would see a cumulative reduction of 2.6 percent or $951 billion, and Japan would see a 1.9 percent or $130 billion cut. The BCBS, which sets global standards implemented by national regulators, has proposed tightening the definition of what can be counted as core tier N E W S R O O M Newsroom The Indian Banker 8 Vol V No. 7 - July 2010

- 9. N E W S R O O M which borrowing companies could use funds, but stressed it would not be involved in their allocation. The BoJ also stated faster growth in emerging economies provided an ‘upside risk’ for economic activity, but that attention needed to be paid ‘to the effects of developments in fiscal conditions in some European economies on international finance and the global economy’. Price rise fuel food crises fears Food commodity prices will increase more than previously expected in the next decade because of rising energy prices and developing countries’ rapid growth, according to the annual agricultural outlook of United Nations’ Food and Agriculture Organisation (FAO) and the Organisation for Economic Cooperation and Development (OECD). Higher crude oil prices would add force to rising agricultural commodities prices, particularly in those regions – including Europe and the US – where energy inputs such as fertilisers were used intensively. For the next 10 years the FAO and OECD forecast that significant food prices, with the exception of pork, would remain above the 1996-2007 average, in both nominal and real terms – adjusted for inflation. The forecast of high prices is likely to exacerbate concerns about global food security. Since the food crisis and the number of chronically hungry people surging above the 1 billion mark last year, agriculture has drawn more attention from policymakers – particularly in the US. The OECD earlier this year organised its first ministerial meeting on agriculture for 12 years. The prospect of higher prices could prompt those nations dependent on food imports – such as Saudi Arabia and South Korea – to try to secure long-term food supplies by accelerating their investment in overseas agriculture in so-called farmland grabs. Developing countries would provide the main source of growth for world agricultural production, consumption and trade, said the report. As incomes rise, diets are expected to slowly diversify away from staple foods towards increased meats and processed foods. In turn, with increasing affluence and an expanding middleclass, food consumption in developing countries would become less responsive to price and income changes. In real terms, the report projected cereal prices to rise around 15-40 percent relative to the 1997-2006 average, up from last year’s forecast of 10-20 percent. Vegetable oils are expected to be more than 40 percent higher, against last year’s forecast of a 30 percent increase. Meat and dairy products will also be more expensive in the next decade, reversing last year’s forecast that pointed to lower prices. China acts to head off currency showdown China tried to preempt a potential showdown at the upcoming G20 Summit when it warned the other large economies not to use the Toronto meeting as a platform to criticise its currency policy. In other words, it does not want to encourage other countries to point a finger towards it on currency matters at the G-20 meet. China feels that the G20 Summit should be about coordinating policy, not criticising individual countries. In addition to the US and Brazil, India has also recently voiced criticism towards China’s currency policy. It is generally believed that a stronger Chinese currency would benefit both China and the rest of the G20 and at the same time G20 needs to be careful not to put too much direct pressure on China. EU leaders give go-ahead for publication of bank stress tests Europe's leaders made a fresh attempt to restore confidence in its financial system with a decision to publish detailed results of tests on the health of 25 big European banks. The so- called ‘stress tests’ initiative was approved at a European Union (EU) summit in Brussels where the leaders united behind a call for a general levy on European banks to ensure they contributed to the cost of overcoming the financial crisis. The leaders of the 27-nation bloc also set out plans for stronger economic governance of the Eurozone, involving stricter mutual surveillance of national budgets, closer attention to debt levels and the development of a scoreboard for assessing competitiveness. The decision to publish the results of stress tests follows weeks of turmoil in financial markets. Fears about banking stability have kept European government bond yields high, in spite of the EU-led €110 billion (£92 billion) emergency rescue of Greece and creation of a €500 billion back-up facility. The stress test results would be published in the second half of July. Of the 25 banks, five will be British, and the UK officials feel that it was important that the tests were conducted simultaneously and with support immediately available for any bank that failed the test. Before the summit, the most vocal opposition to publication of results came from Germany's public sector regional banks as well as from Austria. However, the German government indicated its support for publication afterwards. Banks and financial inclusion Usually financial exclusion is seen as a purely developing world problem. But it is not correct. In some developing countries, almost three quarters of the population is unbanked and the access to financial services is confined to the urban middleclasses. But the number of people in mature economies who remain outside the financial system is also shocking. In the US, 7.8 percent of The Indian Banker 9 Vol V No. 7 - July 2010

- 10. N E W S R O O M the adult population (17 million) does not have a bank account. In the UK, this applies to 4 percent of the population (1.75 million adults). Other developed economies are also having similar statistics on financial exclusion. In the developing world, the need is dramatic. A recent survey by CGAP, the independent policy and research organisation that aims to improve financial access to the world’s poor, indicates that about 70 percent of adults in developing countries are excluded from the regulated financial system, despite years of growth in the financial sector and multiple programmes championed by the World Bank and regional development banks. The banking system’s failure to enfranchise the low waged begins in the remittance sector. The World Bank estimates that remittances totaled $44.3 billion in 2008, of which $33 billion were sent to developing countries, involving about 192 million migrants that make up a staggering 3 percent of the world’s population. According to remittance experts, as much as 40 percent of this traffic bypasses the regulated banking sector’s remittance operations. Many are critical about the failure of the banking world to capture a greater percentage of the remittance market, as well as the failure to convert those remittance customers who do use banks into account holders. Now banks do seem to be finally waking up to the potential of remittances as the first step in establishing a banking relationship. Many are undertaking research to develop a product suitable to the requirements of new class of customers who are doing only remittances. The failure to bank the poor has historically been driven by the perceived lack of profitability in this client segment. But evidence from the UK proves that this need not be the case. The Santander, a growing force in UK retail banking, has been successful in offering basic bank account to the low waged. It has also seen migration of these accounts into intermediate products. The bank says that 40 percent of basic bank account customers have moved to accounts with some access to credit and other services. The bank also underlines the importance of government and regulatory efforts in encouraging banks and ensuring that those who increase financial inclusion do not end up paying a disproportionate cost. For financial inclusion, microfinance also plays a critical role. The success of Bangladesh is one such example which is quoted everywhere. Technology also plays an effective role in helping the microfinance institutions reach masses. Financial inclusion has come a long way, but as the figures of the unbanked reveal, it still has a long way to go. Banking the poor and making a profit remains an emotive subject. However, the attitude that financial inclusion is charity or philanthropy needs to exit first. Discussion paper on Direct Taxes Code The draft Direct Taxes Code (DTC) released in August 2009 has been revised and a discussion paper has been released by the government on June 16, 2010 with the last date for reaction set at June 30. While the discussion paper along with the draft Direct Taxes Code has listed 24 subjects with each subject covering a number of proposals chosen for discussion, the revised paper deals with only 11 subjects. The only major change is the dropping of the proposal for tax on gross assets but that too only because of ‘practical difficulties’ and ‘unintended consequences particularly in the case of loss making companies and companies having long gestation period’. It is for this reason it is stated that Minimum Alternate Tax (MAT) will be computed on the basis of book profits with no other better reason for its continuance. The revised discussion paper stands committed to the Exempt Exempt Tax (EET) scheme, which was generally unwelcome. But the clarification that the proposed EET scheme will be only prospective and that the contributions can happen only after the Direct Taxes Code comes into force is welcomed by the public. In respect of salary taxation, there is hardly any change from the code, except for the assurance that the annual value of rent-free accommodation need not be on the basis of market value for the reason that it will create ‘high tax burden in the case of government employees, if market rent is adopted’. In the computation of property income, there is assurance of continuation of deduction of interest, subject to a ceiling of INR 1.50 lacs against nil income from one self-occupied property. The changes that are proposed for capital gains, especially in respect of transactions in listed securities through a stock exchange now exempt, but for securities transaction tax, sends alarming signal for long-term investors in listed shares. For non-profit organisations, there is hardly any material change from the treatment in the draft code. Loss of exemption for income of those trusts and institutions with income from source, which is construed as business, even where it is incidental to the objects of general public utility in the present law from assessment year 2009-10, will continue. For other trusts and institutions, capital expenditure will be treated as utilised only if it is for acquiring a business capital asset incidental to its charitable objects. Amount applied for charities through any other institutions will not be treated as utilised. Unutilised income subject to 15 percent tolerance limit will be taxed at 15 percent. Wealth tax will remain but the threshold limit will be suitably calibrated. The General Anti- The Indian Banker 10 Vol V No. 7 - July 2010

- 11. The Indian Banker 11 Avoidance Rule (GAAR) is sought to be justified with promised remedy against its indiscriminate application by way of guidelines, prior approval, minimum exemptions limit and hearing before Dispute Resolution Panel (DRP). The preamble to the revised discussion paper clearly states that there could be reduction of tax base as a result of revision of the proposals apparently because of dropping of the proposal of gross assets tax so that it would be necessary that tax slabs, tax rates and monetary limits for exemption would all require to be ‘calibrated accordingly while finalising the legislation’. Government, RBI take measures to infuse INR 20,000 crores to ease liquidity The government of India in consultation with the Reserve Bank of India (RBI) has announced measures to infuse INR 20,000 crores into the system to manage the ongoing tight liquidity situation. The notification issued by the government would repurchase 12.25 percent government stock in 2010 and 6.57 percent government stock in 2011 for their cash management operations. The repurchase of government stocks to the amount of INR 20,000 crores is to be undertaken in one or multiple tranches. The repurchase operations are purely ad-hoc in nature and will be funded through the current surplus cash balances of the government. Recently, in a bid to ensure enough liquidity in the banking system, the central bank had allowed banks to maintain a lower statutory liquidity ratio (SLR), by 0.50 percent for a short period till July 2, 2010. The RBI now conducts two liquidity adjustment facility (LAF) operations daily, allowing banks access to funds. The central bank has also reduced the size of the treasury bill auction for June to INR 15,000 crores from INR 22,000 crores. The tightness of liquidity in the system was largely due to advance tax collection and 3G licence payments. Telecom companies have paid the government INR 67,719 crores for 3G spectrum and another INR 38,500 crores for broadband wireless access spectrum auctions. Most of these payments have been funded by banks. Similarly, the advance tax outflows have drained out close to INR 35,000 crores from the system. TRAI, RBI agree on roles in rollout of m-banking In an attempt to ensure a smooth rollout of mobile banking in the country, the Telecom Regulatory Authority of India (TRAI) and the Reserve Bank of India (RBI) have reached an understanding on its regulation. Early rollout of mobile banking will speed up the government’s plans towards financial inclusion. TRAI will deal with all interconnection issues while RBI will look into banking aspects like the maximum amount of transactions per day, know-your-customer guidelines and verification criteria etc. The development comes as a relief for telecom operators who feared getting caught in a possible regulatory crossfire despite their excitement about the prospects for mobile banking. Such fears had gained currency following the recent controversy between capital market regulator, Securities and Exchange Board of India (SEBI) and the Insurance Regulatory and Development Authority (IRDA) over regulating unit-linked insurance products. Interconnection is an important aspect in mobile banking since telecom networks would need to connect with bank networks. Charges payable on these counts and the number of points of interconnection need to be worked out in a manner which leaves no room for dispute. TRAI has been mandated with this exercise since it has the required expertise in the area. TRAI will also be in charge of setting tariffs which consumers would pay for mobile banking access. Mobile banking promises new revenue streams for telecom operators, at the same time expanding banks’ reach in rural areas where mobile telephony has made giant strides. Today, there are more mobile users in rural areas than bank account holders, leading to a situation where people have better access to telecommunications and less to financial services. The scope of mobile banking can be gauged from the fact that every year, around INR 25,000 crores is transacted on the network of the country’s largest mobile operator Bharti Airtel alone, by way of recharge coupons. Once mobile banking takes off, people will be able to withdraw cash and transfer funds using their mobile phones. The government has already approved the framework for introduction of such facilities by the banks. In fact, banks have been advised to start mobile banking services in rural areas by July 31, 2010 and complete the rollout by the end of next year. This happened after the government accepted the report of an inter-ministerial group led by a committee of secretaries. The mobile banking model envisioned for rural areas will enable mobile phone users to deposit and draw cash instantly into or from their mobile- linked no-frills bank accounts through a business correspondent having a mobile phone in the village. A significant feature of the proposed framework is that funds remain within the banking system throughout and the intermediary does not have custody of the funds even momentarily. Jayasree Menon Vice President Department of Research & Statistics Indian Banks’ Association N E W S R O O M Vol V No. 7 - July 2010

- 12. Finance Minister Addresses IBA AGM year to discuss operational issues in payment systems, last year also we had set up ‘India Pavilion’ at Hong Kong on the theme ‘Vibrant India-Promising Future’. We are happy to note that National Payment Corporation of India (NPCI), the umbrella organisation for retail payment system, set up by IBA during last year, is fully functional now. Now IBA is fully focused on the formation of Credit and Operational Risk Data Exchange (CORDEx). This company is expected to provide a common data exchange for pooling of risk data and operational loss data among the banks, which in turn would help them to fine-tune their risk management practices and also to meet the requirements for Basel II compliance. Similarly, we are engaged in setting up of Central Electronic Registry as per the provisions of the SARFAESI Act, 2002. We are grateful to our FM for entrusting this responsibility to IBA and for allocating INR 25 crores for this purpose in the Union Budget. Banks in India are fine- tuning their risk management capabilities in their run-up to adopt Basel II Advanced Measurement Approach (AMA) towards risk management. IBA with the support of Ernst & Young completed a survey on the preparedness of Indian banks for migrating to AMA. Financial inclusion has been a critical issue not only for the government and the RBI, but for our member banks also. Welcoming the hon’ble union finance minister (FM) Pranab Mukherjee, M V Nair, chairman, IBA and chairman and managing director, Union Bank of India said that ‘the FM has been taking interest in understanding the concerns of the banking industry and possesses a knack of dealing with any issue in his inimitable style. We are privileged to have him in our midst today.’ Nair also welcomed Shri Gopalan acknowledging his keen interest in interacting with IBA on policy and operational matters. ‘Successful implementation of financial inclusion, HR challenges in public sector banks are issues close to his heart,’ said Nair. Here are the edited excerpts of the talks delivered in this meeting.. M V Nair During the economic downturn, IBA was actively involved with banks in implementing the various policy prescriptions arising out of the stimulus package announced by the government related to export sector, SME sector, housing etc and providing a lifeline to mutual fund industry. We had quite a few delegations visiting us from Italy, Germany and Australia with a view to explore various means to foster mutual cooperation and coordination. During the year, we also had the opportunity to organise India-China Financial Conference aimed to strengthen trade ties with China. Encouraged by the good response received for ‘India Pavilion’ at SIBOS, where over 8,000 bankers meet every The Indian Banker 12 Vol V No. 7 - July 2010 M V Nair welcomes Hon’ble Finance Minister Pranab Mukherjee C O V E R S T O R Y The 63rd Annual General Meeting of IBA held on June 8, 2010 at Hotel Trident, Bandra Kurla Complex, Mumbai was addressed by hon’ble finance minister, Pranab Mukherjee, who was the chief guest. R Gopalan, secretary, financial services, government of India also graced the occasion.

- 13. that he grappled with during his tenure and the most important one was the recently concluded industry-wide wage settlement. The IBA has a solution-centric approach. So, even as members compete with each other in the marketplace, they collaborate with each other in finding solutions to issues of common interest. Often many of these issues are flagged to the IBA by the RBI or by the government. Today the leaders of this country have been saying that the growth which the economy is having this year, 8 percent plus, is only the beginning. It could clock 9 or 10 percent or even greater. For any modern economy to continue to grow at such a rate would require a very healthy, smart and in sync banking system. While I will continue with all the current projects such as risk management, Basel II, IFRS, financial inclusion, education, agriculture etc in which IBA is involved, I am also keen on exploring new areas, which are very critical to the banking industry. One such area is of human resources. In the next 3 to 5 years lacs of people are going to retire from the Indian banking industry collectively. So, not only we need to recruit lacs of people as replacement but I believe we need to recruit lacs of more people to serve the growing financial and banking needs of this major economy growing at 9 to 10 percent. There are issues with regard to skills, recruitment, training, and more importantly with regard to leadership pipeline. Also, Indian banking industry is heterogeneous - we have got large banks, medium banks and small banks. Some banks by virtue of their size are in a better position to invest in technologies, utilities and procedures which make for greater efficiency and greater cost containment whereas others are not able to do that. Is it possible to develop common utilities or common infrastructure for smaller banks or medium sized banks which they could share? This could be in the area of pensions, cheque collection, cheque truncation, storage, archival, retrieval of documents, and a host of other such areas which will improve efficiency and reduce cost. I propose to engage the IBA in many of these areas. IBA is coordinating with the Unique Identification Authority of India (UIDAI) on financial inclusion, as the project would be mutually beneficial to UIDAI and banks. We have brought out a report on Micro ATM Standards for facilitating financial inclusion. This document is hosted on the website of IBA and UIDAI. Another IBA committee had earlier stipulated standards for use of smartcards for financial inclusion. Banks are also playing a crucial role in the field of infrastructure financing. IBA has lobbied with the government and RBI to obtain some relaxation to enable banks to lend more to infrastructure. From IBA’s side, we have worked along with India Infrastructure Finance Company Limited (IIFCL) to develop an appropriate scheme for take-out financing to help banks to have more resources to finance infrastructure. We could conclude the 9th bipartite settlement with the unions in this year, after two and half years of negotiations. We considered the demands of the unions for the second option of pension for the state–owned bank employees. Another important highlight of the settlement was the introduction of New Pension Scheme (NPS) for the new recruits and this would certainly remove the uncertainty about pension cost in future. We are also contemplating the idea of introduction of variable pay to the bank employees as a means of improving the motivational aspect of the state-owned bank employees. Government has set up a committee to study HR issues of public sector banks and IBA is closely associated with this committee. I have a very pleasant announcement to make today. Mr O P Bhatt, chairman, State Bank of India, will be the new chairman of IBA. He has been elected to this post in the management committee meeting held this evening. O P Bhatt I am happy and honoured to have been elected as the new chairman of IBA. My predecessor has handled this position with great aplomb and grace. Numerous were the issues The Indian Banker 13 Vol V No. 7 - July 2010 C O V E R S T O R Y

- 14. The Indian Banker 14 C O V E R S T O R Y Hon’ble FM Pranab Mukherjee First of all, I would like to congratulate M V Nair for very successfully leading IBA in a very critical hour and I would like to congratulate O P Bhatt who has assumed the responsibility of presiding over this organisation for the coming year. One thing, which appeals my mind about IBA, is its adaptability to the ever-changing banking landscape. Recently, IBA has performed actively in the settlement of critical HR issues like wage revision and second pension option for bank employees. I congratulate Nair for his apt handling of these sensitive and critical issues. The Indian banking system has been relatively in good health, and I believe that changes in policy and regulation have helped strengthen the Indian banking sector. As a result significant financial deepening has taken place in Indian economy over the years as seen from the credit-GDP, M3-GDP ratios as well as flow of funds indicators. Despite developments in the global scenario, contribution of the banking sector to the economy in India has grown and Indian banks have outperformed in share indices. However, challenges still remain. For instance, the cost of intermediation remains high and bank penetration is low. Financial deepening has to be accelerated else it could constrain the full potential of the Indian economy. This is essential if we are to maintain India's high GDP growth trajectory. My first area of concern is that despite a higher than anticipated GDP and manufacturing sector growth during 2009-10 compared to the previous year, both credit and deposit growth were much lower at around 17 percent. Credit growth for the current year is projected at 20 percent by the RBI and banks will have to step up their performance to ensure that this is achieved. Furthermore, the sectoral flow of credit should be such that the productive requirements of growing sectors of the economy are adequately taken care of while maintaining the quality of assets. Secondly, it is imperative that banks maintain profitability. Many banks have posted good balance sheet results during 2009-10 and I congratulate them for this. However, in order to meet the needs of one of the fastest growing economies of the world, banks will have to constantly augment their capital base. The challenges before banks during the current year include an uncertain pace of global recovery, exit policy, containment of NPA levels, higher provisioning norms and reduction in operational costs and cost of funds. Furthermore, banks may no longer enjoy windfall treasury gains that the decade-long secular decline in interest rates had earlier provided. This may expose the weaker banks. An issue that demands immediate attention by Indian banks is containment of NPA levels. The recent balance sheet results show that the NPAs of some banks have risen notably. The increase in the level of NPAs has a number of negative consequences. From the banking system's point of view, high loan loss provisions reduce net profits and tend to put pressure on the lending rates. High real lending rates discourage new and creditworthy borrowers from seeking loans from banks, with negative consequences for real economic activity. From a macroeconomic policy point of view, rigidities in lending rates that result from the large stock of NPAs dampen the effectiveness of monetary policy. In addition, to the extent that the public sector banks have to be recapitalised by the government because of the credit losses, the NPAs represent a source of quasi- fiscal liabilities. I am hopeful that banks will focus on this aspect while expanding future business. However, perhaps the most daunting task for banks in my opinion is going to be the management of human resources in the coming years. The market is seeing growth driven by new products and services that include opportunities in credit cards, consumer finance and wealth management on the retail side, and in fee-based income and investment banking on the wholesale banking side. These require new skills in sales and marketing, credit and operations. Public sector banks need to fundamentally strengthen institutional skill levels especially in sales and marketing, service operations, risk management and the overall organisational performance ethic. There is a need for a large number of recruitments of the right quality in the next few years to bridge the gap likely to be caused by a large number of retirements as has been pointed out by the new chairman of IBA. The skills of the existing manpower need to be urgently upgraded in view of the changed job roles in the technology driven environment. Employees need training in risk management, foreign exchange management, treasury management, branches/credit appraisal, infrastructure project appraisal and a host of things. The performance appraisal system also needs to be made more effective and systematic and initiatives for employee retention need to be worked out. I would now like to turn to a subject close to my heart, ie, financial inclusion. This is an important priority of the government as only 37.2 percent of bank branches of scheduled commercial banks are in rural areas and only 40 percent of the country’s population has bank accounts. As you are aware financial inclusion provides an avenue to the poor for bringing their savings into the formal financial system, an avenue to remit money to their families in villages besides weaning away the poor from the clutches of the usurious moneylenders. It is thus essential to extend Vol V No. 7 - July 2010

- 15. forward. Financial services offered with the help of ICT should ideally be standardised, interoperable and cost effective. One of the major reasons for the slow progress in providing banking services in the hinterland is the high transaction costs associated with the low value large volume transactions. Technology can to a great extent reduce the cost of transactions. I am happy to note that for any policies of the government, whether it be financial inclusion or adoption of technology or ways to tackle HR issues, banks are open to new ideas. M D Mallya On behalf of IBA, I take this opportunity to express my sincere gratitude to our chief guest, hon’ble union finance minister Pranab Mukherjee, for making available his time to grace this occasion. I also thank Shri R Gopalan, secretary, financial services, for the cooperation extended by him on various occasions. On this occasion, I would also like to acknowledge the cooperation extended by the RBI governor, Dr D Subbarao, all deputy governors and the senior officials of RBI to IBA. Our sincere thanks also go to member banks that are ever willing to support us in all our activities and also for deputing their senior executives to participate in various working groups and committees constituted by IBA. banking services to the rural hinterland at the earliest in order to include these regions in India’s growth story. You would recall that I had in my budget speech for this year announced that appropriate banking facilities would be provided to habitations having population in excess of 2,000 by March 2012. I had also proposed to extend insurance and other services to the targeted beneficiaries. These services would be provided using the business correspondent and other models with appropriate technology backup. By this arrangement, it is proposed to cover around 60,000 habitations. In this regard the banks were directed to make their financial inclusion plans for covering those villages with a population over 2,000 as per 2001 census by March 31, 2010. I have written to the chief ministers of all states informing them of these financial inclusion plans for their states and requesting them to support the banks’ efforts in reaching banking services to these villages. I exhort the IBA and its member banks to come forward and take on this challenging task wholeheartedly so that this objective is achieved by March 2012. Your efforts to reach banking to the 'aam aadmi', if successfully implemented will become a model for financial access for the global banking community. Even as the achievements of IT in the banking sector in India are impressive, there is a big agenda on the way The Indian Banker 15 C O V E R S T O R Y Vol V No. 7 - July 2010

- 16. The case for financial inclusion is not based on the principle of equity alone – access to affordable banking services is required for inclusive growth with stability. Achieving financial inclusion in a country like India with a large and diverse population with significant segments in rural and unorganised sectors requires a high level of penetration by the formal financial system. Even in areas that are well covered by banks, there are sections of society excluded from the banking system. Political and social stability also drive financial inclusion. In the recent period, the Indian government has been encouraging opening of bank accounts by providing government benefits through such accounts. Information and Communication Technology (ICT) solutions have made such initiatives possible at relatively low cost. Defining financial inclusion Financial inclusion is not merely providing reliable access to an efficient payments system. Many discussions - especially in the context of mobile phone-led retail payments system - seem to focus on this aspect of financial inclusion. Financial inclusion is also not just microfinance. Financial inclusion represents reliable access to affordable savings, loans, remittances and insurance services. It primarily implies access to a bank account backed by deposit insurance, access to affordable credit and the payments system. The key question is what kind of regulatory and supervisory mechanism will ensure that the formal financial system delivers affordable financial services to the excluded population with greater efficiency without compromising on acceptable levels of safety and reliability? Financial regulation and financial inclusion – Is there a trade off? During several outreach activities by the RBI at remote unbanked areas last year, cases of people having been Financial Regulation and Financial Inclusion Working Together Or At Cross-purposes? Usha Thorat The Indian Banker 16 Vol V No. 7 - July 2010 This is an abridged version of the speech delivered by Smt Usha Thorat, deputy governor, Reserve Bank of India at the Tenth Annual International Seminar on Policy Challenges for the Financial Sector co-hosted by the Board of Governors of the Federal Reserve System, the International Monetary Fund, and the World Bank at Washington, in June 2010, reproduced with permission from the Reserve Bank of India. For full text, please visit www.rbi.org.in - Ed.

- 17. duped by ‘fly by night’ operators who had vanished with their life savings came to light. The distress to people and the damage to public confidence caused by such unscrupulous operators are something that no regulator can ignore. Sound and reliable deposit-taking entities, backed by deposit insurance for small deposits, accessible to all are, therefore, essential for financial inclusion. It is not possible to have sound and reliable deposit-taking entities and a deposit insurance system without financial regulation. Hence, in my mind, there is no doubt that financial regulation and financial inclusion work together - the former is a must for the latter. Another reason why there is convergence between financial regulation and financial inclusion is that if financial intermediaries have to deliver affordable services they need to take advantage of technology and economies of scale. This requires them to grow to some optimal size. Such growth is not possible without capital. Investors and lenders are comfortable with providing more funds only if such entities are regulated. This has been our experience with microfinance institutions (MFIs) wanting to be registered as non-banking financial companies (NBFCs) with RBI, but wanted RBI to reduce the minimum capital requirement below what had been prescribed for NBFCs in general. The RBI allowed them to register, on fulfilling the prescribed norms, without lowering the minimum capital requirement. The dramatic growth of MFIs in the recent period on account of support by lenders and investors owes in no small measure to their being registered with RBI as NBFCs. More recently, in the context of the global crisis, it is observed that undue reliance on borrowed funds can be a source of risk and a more stable retail base of deposits is good for both the bottom-line and resilience. Similarly, a diversified asset portfolio leads to less volatility in earnings. Thus financial inclusion which can promote such a retail and diversified portfolio - in assets and liabilities - also promotes financial stability. Regulatory interventions for facilitating financial inclusion I would like to highlight here the various regulatory measures taken by the RBI to facilitate financial inclusion. The key message here is that the regulatory approach has not compromised with prudential norms for deposit-taking entities. We are of the firm view that only sound and strong institutions can deliver financial inclusion. Within the overall traditional prudential framework, what we have tried to do is to have a system of incentives and disincentives that further the financial inclusion objective and while doing so, we have tried to balance the degree of the risk with the ability to achieve greater penetration. Is small beautiful? Looking at the success of credit unions and community banks worldwide in providing financial services to local communities, it could be argued that smaller regional banks could be the answer for financial inclusion. However, our experience with local entities such as cooperative banks, deposit-taking NBFCs and regional rural banks highlighted the risks of poor governance, connected lending, geographic concentration leading to vulnerability to natural calamities and downturns. Small entities also tend to absorb disproportionate share of supervisory resources. Besides, the adoption of ICT solutions that are essential for accessing mainstream payments system requires larger investments and these often prove to be too onerous for small entities and render them uncompetitive. We have encouraged merger of non-viable entities and growth of banks that meet regulatory requirements. We have also followed a three tiered regulatory approach – ‘non-Basel’ approach for regional rural banks and rural cooperatives with the objective of ensuring positive net worth, ‘Basel-I’ for urban cooperative banks and ‘Basel II’ for commercial banks. For non-banking deposit taking entities, that do not enjoy deposit insurance or offer savings/checking accounts, we have adopted a simpler regulatory framework albeit with higher capital ratios. I N S I G H T The Indian Banker 17 Vol V No. 7 - July 2010 Smt Usha Thorat

- 18. Allowing banks to open accounts for Self Help Groups An important regulatory dispensation that facilitated financial inclusion was given in the early 90s, when banks were allowed to open savings accounts for Self Help Groups (SHGs), which were neither registered nor regulated. National Bank for Agriculture and Rural Development (NABARD) launched the SHG–Bank Linkage programme in 1992 to forge the synergies between formal financial system and informal sectors. Under this programme, banks provide loans to the SHGs against group guarantee and the quantum of loan could be several times the deposits placed by such SHGs with the banks. The recovery rates of such loans have been good and banks have found that the transaction cost of reaching the poor through SHGs is considerably lower as such cost is borne by the SHG rather than the bank. Interest earned from group members is retained in the group. The penetration achieved through SHGs has been very significant. As per NABARD’s report on status of microfinance (2008-09), about 86 million poor households are covered under the SHG-Bank Linkage programme with over 6.1 million saving-linked SHGs and 4.2 million credit-linked SHGs as on March 31, 2009. The initial phase of SHG movement saw concentration of SHGs in the southern parts of the country, but now the SHGs have spread more to the eastern and north-eastern regions where the extent of financial exclusion is greater. The government of India has also been using the SHGs for subsidy linked credit schemes for the poor. NABARD offers grant assistance to NGOs that promote SHGs and link them to banks. Mandated priority sector lending Priority sectors broadly include agriculture and allied activities, micro and small enterprises, education, housing and micro-credit. All domestic commercial banks are required to allocate 40 percent of their lending to the priority sectors. For foreign banks, the requirement is 32 percent and export credit is also included in their case. Credit extended by banks to SHGs, MFIs, NBFCs for on- lending to priority sector and to regional rural banks for agriculture and allied activities have been included in the definition of priority sector. Investments made by banks in securitised assets, representing loans to various categories of priority sector which are originated by banks and financial institutions, are also included in priority sector. A bank can also purchase priority sector lending from another bank through participatory notes. Any shortfall in priority sector lending is required to be deposited in special funds maintained by NABARD or Small Industries Development Bank of India (SIDBI) or National Housing Bank (NHB), which are used for funding rural infrastructure/micro- enterprises/housing sectors. As on March 31, 2009, the coverage under priority sector was to the tune of 51 million loan accounts. It could be argued that mandated credit distorts allocative efficiency of the banking system, but I would like to emphasise that no subvention is involved as interest rates are deregulated and all the usual prudential norms for income recognition, asset classification and provisioning, as also standard risk weights are applicable, which ensures that such loans do not add undue risk to the bank’s balance sheet. Linking branch licensing approvals to penetration in under-banked areas Banks in India are required to obtain a licence from RBI for opening a branch. This requirement has been used as a regulatory tool for furthering financial inclusion. Statutory approvals for branch licences in more lucrative centres are linked to the number of branches opened in under-banked districts and states, as also other factors such as fulfilling priority sector obligations, offering no-frills accounts and other parameters to gauge achievements in financial inclusion and in customer service. Opening of no-frills accounts by banks Taking the view that access to a bank account can be considered a public good, in 2005 RBI directed all banks to offer at all branches the facility of ‘no frills’ account to any person desirous of opening such an account. These The Indian Banker 18 I N S I G H T Vol V No. 7 - July 2010 THE PENETRATION ACHIEVED THROUGH SHGS HAS BEEN VERY SIGNIFICANT. AS PER NABARD’S REPORT ON STATUS OF MICROFINANCE (2008-09), ABOUT 86 MILLION POOR HOUSEHOLDS ARE COVERED UNDER THE SHG- BANK LINKAGE PROGRAMME WITH OVER 6.1 MILLION SAVING-LINKED SHGS AND 4.2 MILLION CREDIT-LINKED SHGS AS ON MARCH 31, 2009.

- 20. The Indian Banker 20 Vol V No. 7 - July 2010 a boost to financial inclusion while ensuring the integrity of financial transactions. Branchless banking With 6,00,000 villages in the country, it is impossible to provide access to a bank account for every household through branch banking. At the same time, electronic banking for such a populace where cash forms the dominant payment mechanism, is unlikely to become a reality for quite some time. Keeping in view these ground realities, the RBI issued the business correspondent guidelines in 2006, which paved the way for branchless banking through agents. The guidelines allowed, for the first time, commercial banks to offer simple savings loan and remittance products through agents, who were allowed to undertake banking transactions, including ‘cash in cash out’ transactions at locations close to the customer. Banks were advised as part of risk management to adopt ICT solutions including biometric identification of the customer. The agents are required to deposit bank’s cash balances beyond certain limits with the bank’s branches by end of day or the next day. Initially, the regulations restricted the entities that could act as business correspondents to ‘not for profit’ entities such as NGOs/cooperatives/post offices etc. This was because we were concerned about the risk of reckless pushing of products by agents whose sole incentive was earning commission, and we also felt that local community based organisations and NGOs had the trust and confidence of the local population. Over the last few years, the list of persons who can be appointed as business correspondents has been relaxed to include individuals such as retired government officials, school teachers, defence personnel as also ‘for profit’ local ‘mom and pop’ shops, petrol pumps/public call offices operators etc that usually deal in cash in the villages. Another regulatory requirement was that the business correspondents appointed for direct contact with the customers should be within 30 km from a designated base branch of the bank to ensure proper oversight of such agents and minimise agency risk. The distance criteria can accounts have nil or low minimum balances and charges, and have limited facilities. Since 2005, over 39 million no- frills accounts have been opened. However, there are certain barriers that inhibit the active operation of such accounts like the time and cost involved in reaching the nearest branch where the accounts have been opened. Hence, we have allowed branchless banking to ensure that these accounts are more accessible to their holders. KYC regulations for small value clients and transactions One significant area, where we found that regulation could be a challenge in achieving greater financial inclusion is in regard to Know Your Customer (KYC) norms. In a country where most of the low income and poor people do not have any document of identity or proof of address it is very difficult to have KYC norms that insist on such documents. At the same time, to ensure integrity of financial transactions, it is necessary that each customer is properly identified before accounts are opened. In rural areas, this is addressed by asking for identification by local officials and requiring a photograph of the account holder. In big towns and cities where there are a large number of migrants who do not have any documents, fulfilling KYC norms and opening a bank account continue to be a challenge. As a proportional regulatory dispensation having regard to the degree of risk, RBI has simpler KYC norms for small value accounts where the balances in the account and the annual credits are below respective specified prudent limits. The Unique Identification Authority of India (UIDAI) will be issuing a Unique Identification Number (UID) with biometric recognition to every resident of the country. It is expected that by latter part of this year, the UIDAI will begin issuing UIDs and roll out 600 million UIDs in a phased manner by 2014. UID enrolment would be done with the help of state government machinery and other registrars. Using UID for fulfilling KYC for small value accounts will facilitate financial inclusion. In a country with deep penetration of mobile phones, this is expected to give IN A COUNTRY WHERE MOST OF THE LOW INCOME AND POOR PEOPLE DO NOT HAVE ANY DOCUMENT OF IDENTITY OR PROOF OF ADDRESS IT IS VERY DIFFICULT TO HAVE KYC NORMS THAT INSIST ON SUCH DOCUMENTS. AT THE SAME TIME, TO ENSURE INTEGRITY OF FINANCIAL TRANSACTIONS, IT IS NECESSARY THAT EACH CUSTOMER IS PROPERLY IDENTIFIED BEFORE ACCOUNTS ARE OPENED. I N S I G H T

- 21. I N S I G H T The Indian Banker 21 Vol V No. 7 - July 2010 be increased in consultation with the district consultative committee, a forum for bankers and government officials that meets each quarter. Initially there was a restriction on the bank in recovering any charge from the customer for such doorstep service as it was expected that the savings in cost of setting up a branch would be sufficient incentive. Subsequently, following a comprehensive review of the business correspondent guidelines, we have relaxed this condition and banks are now allowed to recover reasonable charges from the customer for providing the service. Approach towards non-banking entities involved in financial inclusion Non-banking entities can be either non-banking non-financial entities or non-banking financial entities. In case of non-banking financial entities, we have had to deal with two issues. The first is the question of allowing non-deposit taking financial companies registered with the RBI, especially microfinance companies, to provide savings facilities and deposit products for their clients. The argument put forth is that these entities are innovative and nimble footed and have shown their ability to provide loan products to the poor. Considering the difficulties in ensuring effective supervision of large number of small deposit-taking entities and the constraints in extending deposit insurance to such entities, the regulatory approach in India has been to restrict deposit- taking activity to banks while promoting the branchless banking model for areas not served by bank branches. Hence fresh approvals to NBFCs for accepting deposits are not considered, while capital, liquidity and leverage requirements have been tightened for those already permitted to do so. The second issue is that of allowing NBFCs especially microfinance companies to act as business correspondents of banks for branchless banking. The argument put forward is that this would enable their clients to access insured deposits, national payments system and remittance services. There have also been demands that large ‘for profit’ companies having a wide network of outlets especially in rural areas could be allowed to act as business correspondents of banks as there could be significant synergies if such networks are leveraged upon. This issue is currently under examination and in doing so the possible risks such as conflicts of interest, co-mingling of funds, misrepresentation and other agency related risks would need to be weighed against possible safeguards for consumer protection. Non-banking non-financial entities have emerged as active players in financial inclusion in that they have helped banks in offering customised payments and remittance services to their customers based on innovative ICT solutions. Any role enhancement of non-banks to become principals in provision of financial services implies that these non- banking entities would have to be brought under financial regulation and this could inhibit their other activities. Combining financial and non-financial business is also something the regulator may not be comfortable with as there could be conflicts of interest. Our concerns have also been on the access to and the use of float funds by such non- banking entities in the process of providing such payments services. Many jurisdictions have dealt with this issue by asking the service provider to maintain 100 percent liquidity against float funds held by them and restricting the value of transactions. Whether the escrowed funds/investments will be protected in the event of bankruptcy of the service provider depends on the legal provisions and there could be risks in such arrangements. In addition, there has to be clear regulatory authority over such companies. Hence, our preference is to have a bank-led system with non-banking players as partners and service providers, so that regulatory resources are focused on banks. Banks in turn take responsibility for their partners and agents as part of their risk management processes. Subsequent to the notification of Payment and Settlement Systems Act, 2007, the payment services have been opened up for non-banking service providers also. The broad regulatory approach of RBI towards non-banks has been to permit these entities to provide payment services which are fee-based without access to funds of the customers. Keeping in view the penetration of mobile telephony in the country, telecom operators have been permitted to enable ‘m-wallet’ facilities up to INR 5,000 in the interest of small retail payments. OUR PREFERENCE IS TO HAVE A BANK-LED SYSTEM WITH NON-BANKING PLAYERS AS PARTNERS AND SERVICE PROVIDERS, SO THAT REGULATORY RESOURCES ARE FOCUSED ON BANKS. BANKS IN TURN TAKE RESPONSIBILITY FOR THEIR PARTNERS AND AGENTS AS PART OF THEIR RISK MANAGEMENT PROCESSES.

- 22. Ombudsman for the region and the major controlling offices of banks attend such meetings and perhaps even hold on-the-spot conciliation meetings for complaint redressal. Ultimately, responsible borrowing facilitated by financial literacy and responsible lending by financial institutions are essential for consumer protection and financial stability. Summing up Financial inclusion primarily represents access to a bank account backed by deposit insurance, access to affordable credit and the payments system. The Indian experience demonstrates that financial inclusion can work within the framework of mainstream banking within a sound regulatory framework. Regulations have been used to facilitate financial inclusion without subventions or compromising on prudential and financial integrity norms. Regulations have been proportional to the risks. Innovative solutions like SHG-Bank Linkage, branchless banking have been adopted after careful assessment of risks to the banks as also to customers. The preference has been to restrict deposit-taking to banks and NBFCs are encouraged to focus on innovative approaches to lending under a lighter regulatory framework, with additional regulations for systemically important NBFC entities. Non-banking non- financial players are encouraged to be partners and agents of banks rather than principal providers of financial services. Fair and transparent code of conduct enforced through an effective grievance redressal system and facilitated by financial literacy and education are the cornerstones for ensuring consumer protection which is an overarching objective of financial regulation in the context of financial inclusion. Consumer protection issues Amongst the various objectives of regulation, consumer protection should take priority in the context of financial inclusion. In 2005, RBI took the initiative of setting up the Banking Codes and Standards Board of India (BCSBI) in order to ensure that comprehensive code of conduct for fair treatment of customers was evolved and adhered to. The BCSBI is registered as a separate society and functions as an independent and autonomous body. The BCSBI has evolved two voluntary codes - one which is a code of commitment setting out minimum standards of banking practices in dealing with individual customers. The other is a code of commitment to micro and small enterprises. Individual complaints about non-adherence to the code fall within the jurisdiction of the Banking Ombudsman who also investigate individual complaints of non-adherence to the various RBI guidelines on customer service. Other areas of consumer protection are related to excessive interest rates and harsh recovery practices. In particular the high rates of interest charged by non-banking microfinance companies have attracted attention. Views have been expressed that with the lending to MFIs included in the priority sector, there should be a cap on the interest rates charged to the ultimate borrower. Efforts at financial inclusion can be sustained only if the delivery models are viable and interest rate caps can be a deterrent. From a regulatory perspective, we emphasise transparency, creating better awareness, customer education and effective grievance redressal systems. Financial literacy has to be an integral part of financial inclusion and consumer protection. In fact, it should accompany and even precede the provision of financial services. Several countries have a very clearly articulated vision and programmes for financial literacy with initiative from the central banks and regulators. We too have a comprehensive financial literacy programme. At the grassroots level, financial literacy and grievance redressal is best delivered by arranging regular meetings of communities with people’s representatives, local officials and bankers, NGOs and other stakeholders. The Banking The Indian Banker 22 I N S I G H T Vol V No. 7 - July 2010 Attention Subscribers Starting from September 2010 issue, the subscription rates would be revised as under: Price per copy : INR 60 Annual Subscription 1 Year 3 Years Bank employees and students* INR 400 INR 1,000 Institutions and Other Individuals INR 600 INR 1,500 Overseas Subscriptions US$ 80 US$ 200 * A certificate from the appropriate authority confirming the status should be enclosed.

- 24. TIB (The Indian Banker): Do you agree that ‘information overload’ has become an issue which needs to be addressed? Parekh (Ashvin Parekh): ‘Information overload’ has often been identified as the culprit, which takes away most of the office time. The issue to be addressed is not so much the incessant information bombardment, but the necessity to determine the relevance of the information to each person/organisation in a faster way. Each of the new information might bring something of relevance to you. If the information’s meaning was clearer, it would have been easier to deal with incessant information bombardment. Another issue that needs to be addressed is overshooting – the movement in a given direction continues even when need is satisfied. TIB: What are the major causes of information overload? Parekh: The major causes according to me are: • Difficulty in finding the relevance of the information in a faster way • Contradictions and inaccuracies in available information lead to overshooting The Indian Banker 24 Vol V No. 7 - July 2010 • The ease of duplication of data • The increase in the number of incoming channels – email, phone, instant message – have caused the incessant information flow and also lead to overshooting • Increasing rate of new information production TIB: What are the effects of information overload on efficiency? Parekh: As mentioned before, each of the new information might be of relevance to you. Some could provide you the breakthrough, while most would take away your precious work time. If the relevance is not found faster it will impact the efficiency negatively. Also, the overshooting inertia would delay other tasks and impact efficiency. TIB: Is this overload a result of inappropriate, incomplete and at times not-of-any-use information? Parekh: Yes and also because of contradictory information. TIB: How does your bank (organisation) cope or deal with information overload? Parekh: We have created standard data repositories/database across the organisation to manage any overload issues. TIB: What actions or steps do you consider necessary for the Indian banking industry to undertake to avoid this problem? Parekh: The Indian banking industry after core banking solution (CBS) implementation is now trying to swim through data cleansing and mining activities. Hence we see lot of clients implementing tools for data intelligence and warehousing. TIB: Despite the fact that there is information overload, do you think there is certain element of information illiteracy? I N T E R V I E W Information Overload More Insights We publish here the responses received from Ashvin Parekh, partner-national industry leader for global financial services, Ernst & Young in an email interview with The Indian Banker. We could not incorporate these responses in our cover story on the topic in June 2010 issue-Ed.

- 25. Parekh: Yes, to a certain extent because information does not always reach the right person/decision maker at the right time. Information illiteracy is the main reason why information overload is so stressful and impacts the efficiency. TIB: Some people say that ‘We are drowning in information but starved for knowledge’. Do you concur with this statement? And how can this be remedied? Parekh: Yes, because of the lack of information literacy we are not able to handle information overload. The uncontrolled, unorganised and contradictory information is more harmful than useful. Distraction because of non- relevant information takes the focus away from gaining knowledge about relevant things. Information literacy is the remedy for this. TIB: Do you think that technological development and deployment of technology in the Indian banking industry have kept pace with information to effectively handle information overload? Parekh: No, the adoption of information literacy has been lagging behind as compared to the adoption of new technology in the Indian banking industry. TIB: Do you think there is a need for a focused information audit? Parekh: Yes, focused information audit would result into effective management of information and let information achieve its true purpose of increasing productivity. TIB: Does your bank (organisation) measure the ‘value of information’ or assign an economic value to information. If so, could you briefly explain the methodology followed for such valuation? Parekh: We measure knowledge sharing and hence information contribution by each individual during the performance development process every year. I N T E R V I E W The Indian Banker 25 Vol V No. 7 - July 2010

- 26. customer or customer segments. The entire process of determining product attributes and mapping them to the behavioural needs of a customer can be called value building. Thus, there exists a need to test for an expected customer response rather than simply designing a product offer in the hope that someone would buy it. This could improve efficiency and provide rollout opportunities for greater benefits within the bank. For example, the rapid rollout demand for banking products within the customer base of current accounts and savings accounts (CASA) or credit cards would also require testing to understand the value of both the bank and its customer accurately. This article intends to highlight the issue of customer preferences in credit markets and proposes to adopt a test based approach to credit markets using experimental design. How does a bank go about testing its products to understand customer preferences? Traditional testing by direct marketer has involved split groups (solicitations) to compare customers’ reaction to different offers. For example, for one attribute of two levels, say home loan fixed rate 12 percent versus fixed rate 14 percent, we need two test groups when a base group is given a 12 percent offer versus the other a 14 percent offer to conclusively say that 14 percent gives how much lower value to customers as compared to 12 percent. Thus, split groups are simple to understand and implement. There could be 3 split groups where one group is offered floating 8.25 percent, another 9.25 percent and the third one 10.25 percent. As the levels of an attribute increase the bank needs a much larger number of test groups to establish the value preferences due to change in rates. Banks have the flexibility to offer their products through multiple channels such as branch, web and direct selling agents (DSAs) or direct mail which are the customer touch- points. There exist few gaps in the existing practice of understanding customer preferences from the manner in which these are used to derive customer expectations. The banks’ market testing involves randomly making product offers to customers through a branch or through the DSAs. The bank has little control over what to offer to which customer and so on. Such testing methods could be impractical and may not result in robust value proposition for the bank. The test and control method which is the basis of banks’ market testing today starts with a control cell for a base offer and test cells for higher and lower prices. To test five price points and six promotions, one needs a Introduction Credit marketing has come a long way in today’s economy of hard-hitting competition and diminishing customer loyalty. With the increasing level of cut-throat competition, decreasing customer loyalty and the increasing commoditisation of banking products, it has become essential for banks to proactively understand the changing customer preferences to build a value proposition since banks are flexible enough to align their products towards the value needs of their customers. This would need some effort from the bank’s marketer in terms of understanding the response behaviour of their customers against the features of a given product offer. A bank typically offers a variety of products and each of these individual products can have multiple features. Such offers could vary by maturity, interest rate or other conditional rewards etc. Behavioural psychologists explain that human beings are highly influenced by the external competitive offers which are available in the market. Human behaviour is to make rational economic decisions based on how much value is sought to be derived from a bank’s product terms as compared to the outside world. Therefore the bank needs to determine what to offer to its Understanding the Changing Customer Preferences Experimental Models Dr Dinabandhu Bag The Indian Banker 26 Vol V No. 7 - July 2010 E X P E R T V I E W