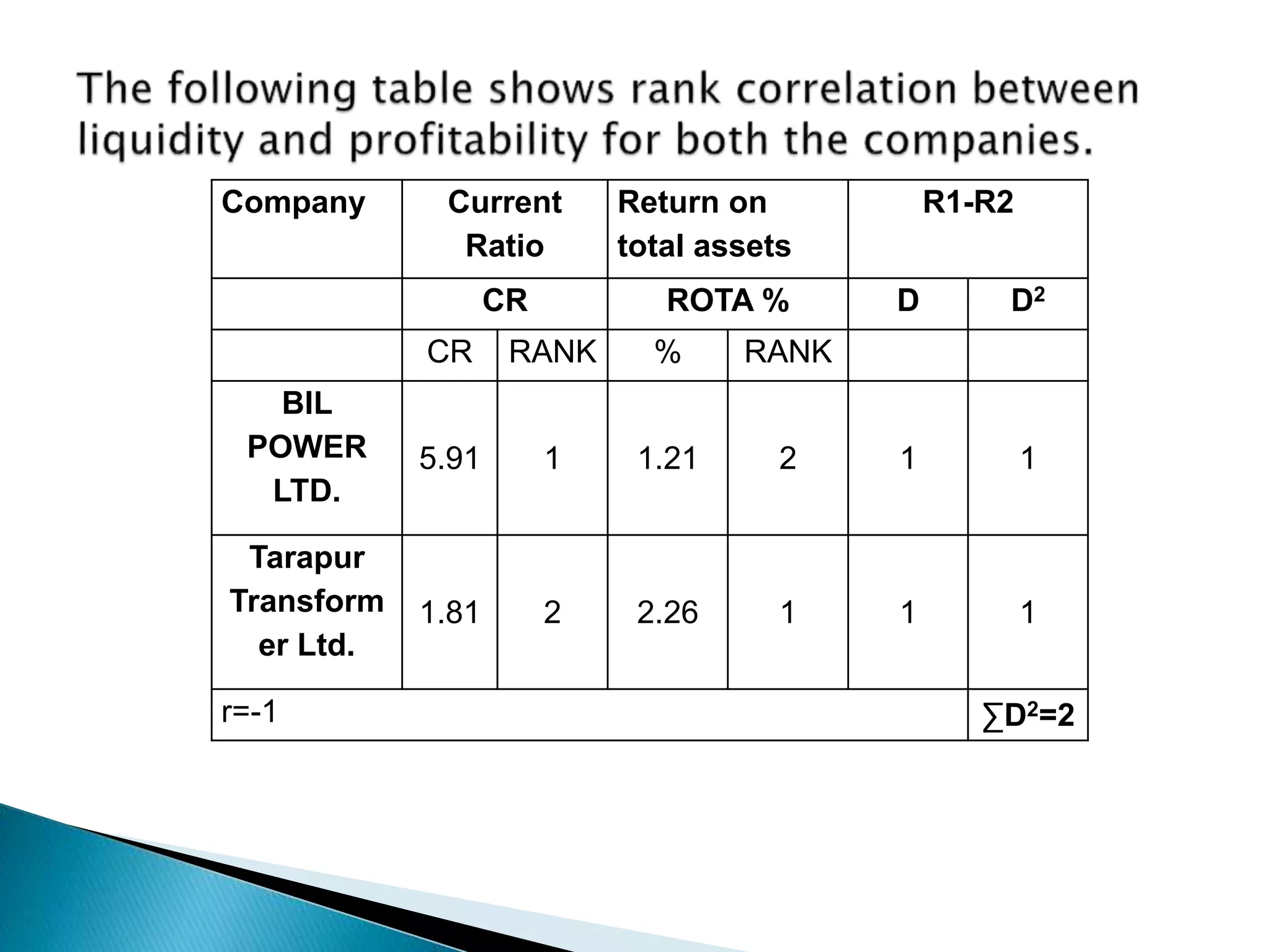

Working capital management involves managing a firm's short-term assets and liabilities. This study examines the working capital management of two firms, BIL ENERGY LTD and TRANSFORMER LTD, over two years to analyze the relationship between working capital management efficiency and firm profitability. Various working capital ratios were calculated and correlated with return on total assets using Spearman's rank correlation. A strong inverse relationship was found between current ratio and return on total assets, indicating that too much emphasis on liquidity can harm profitability. Therefore, firms must maintain an optimum level of working capital to maximize profits without compromising liquidity.