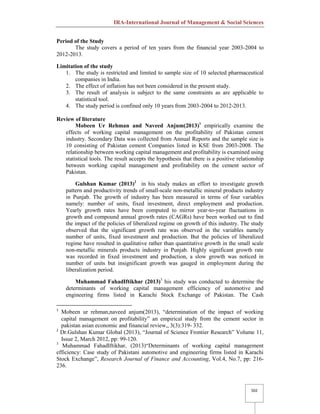

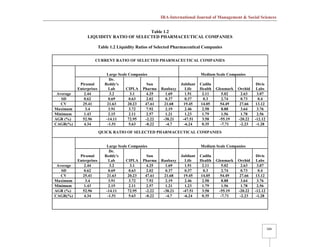

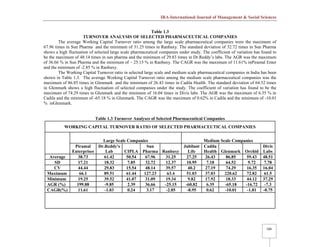

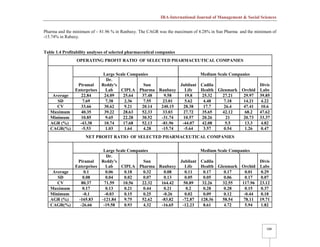

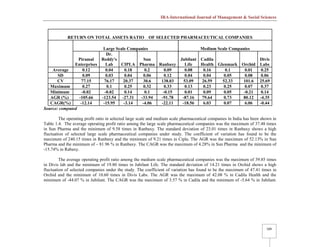

This document presents a comparative study on working capital management of selected pharmaceutical companies in India from 2003-2004 to 2012-2013. It analyzes liquidity, activity, and profitability ratios of 10 large and medium-sized pharmaceutical companies. The results show that high investment in inventories and receivables led to lower profitability for most companies. Current assets to total assets ratios were positively associated with profitability. Overall, the study finds a strong relationship between working capital management and the financial performance of the selected pharmaceutical firms in India.