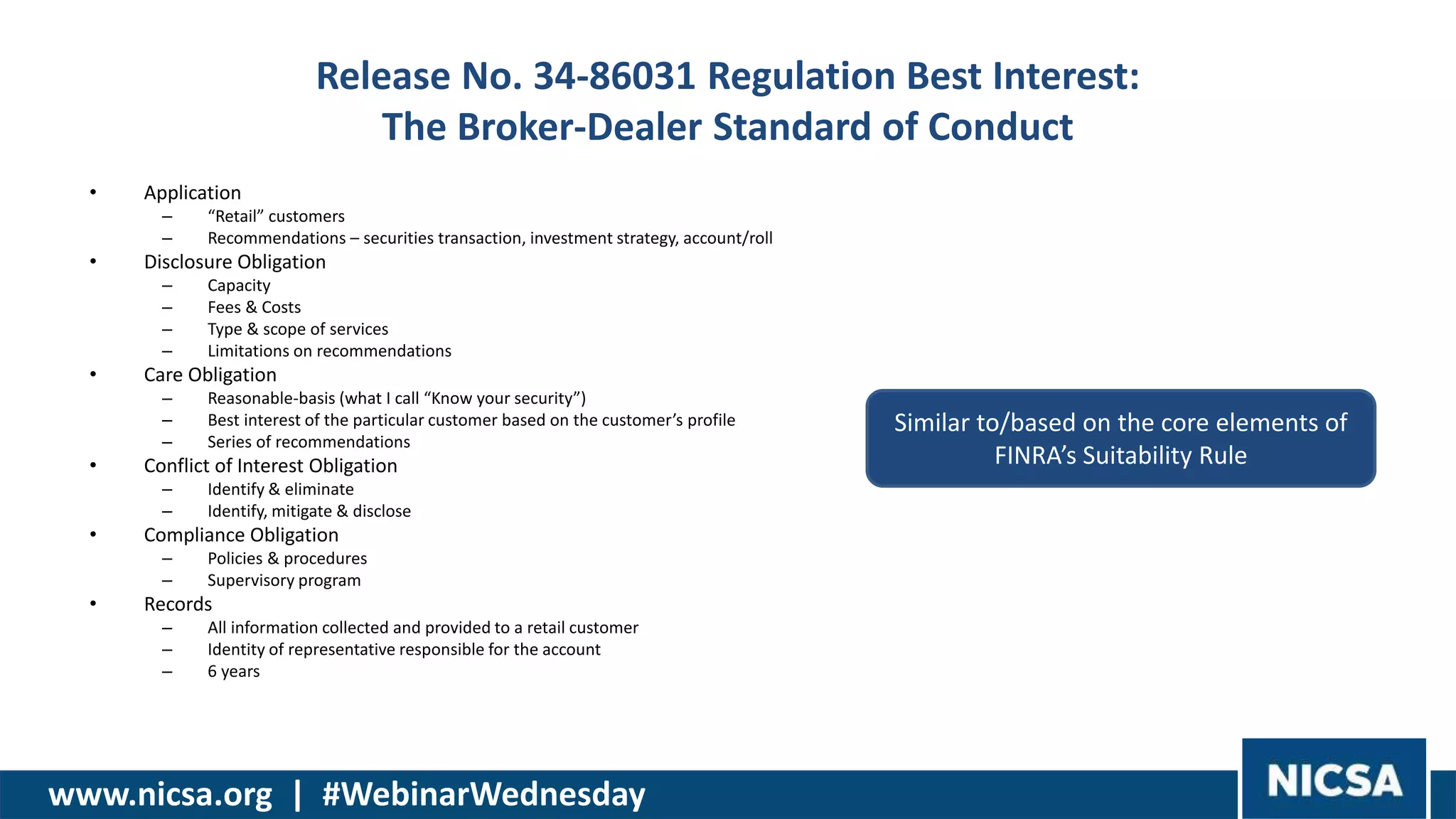

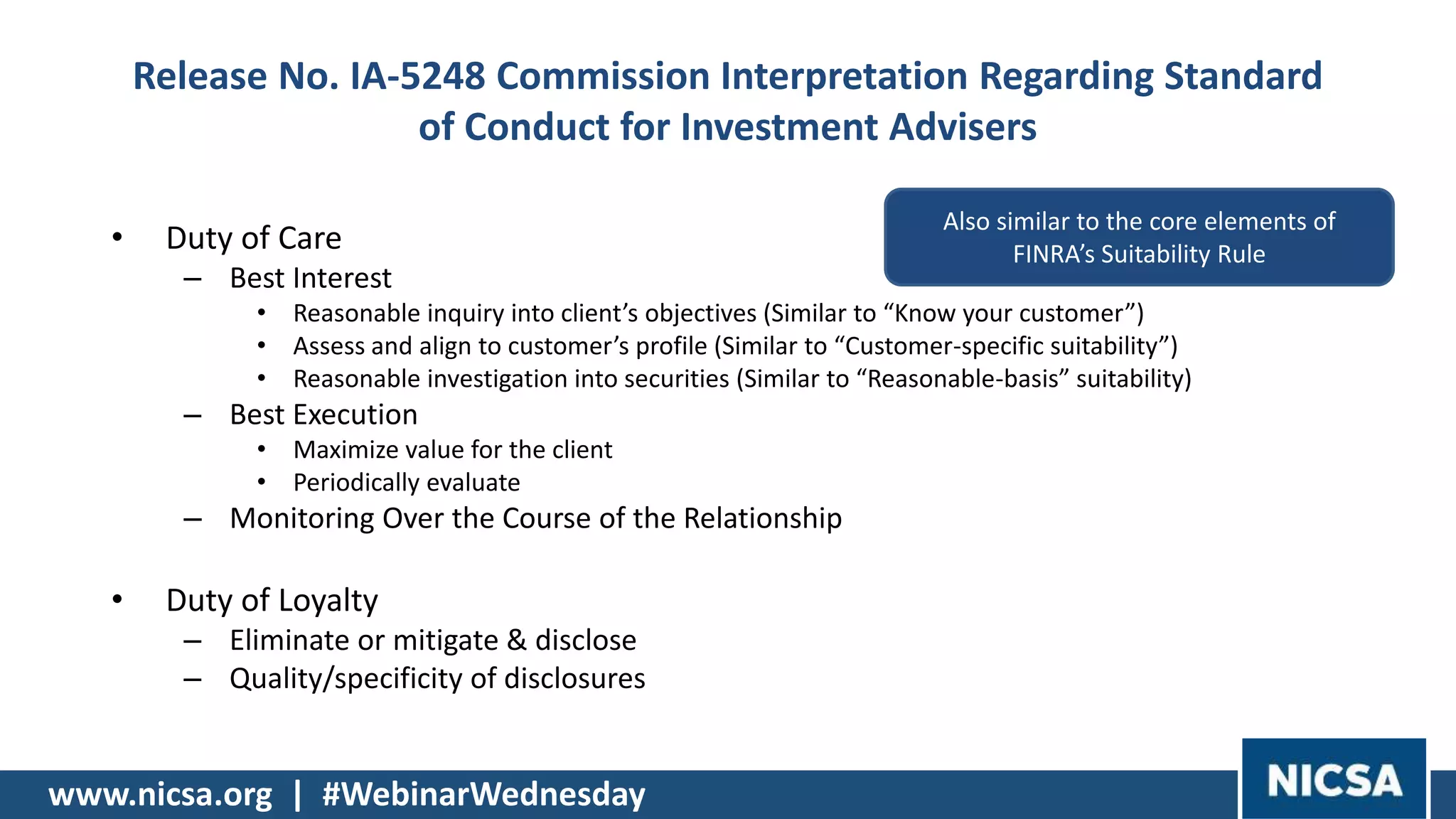

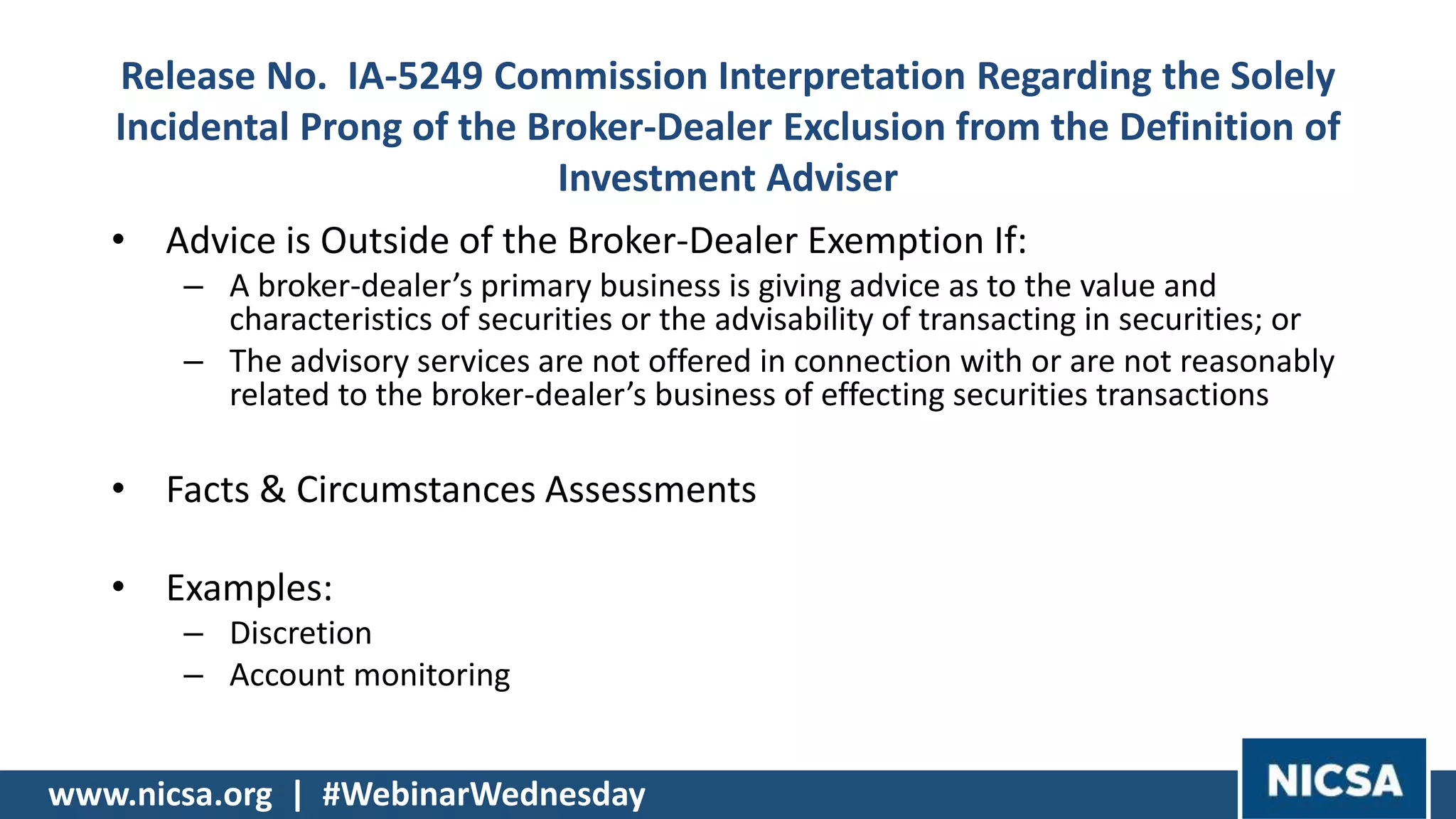

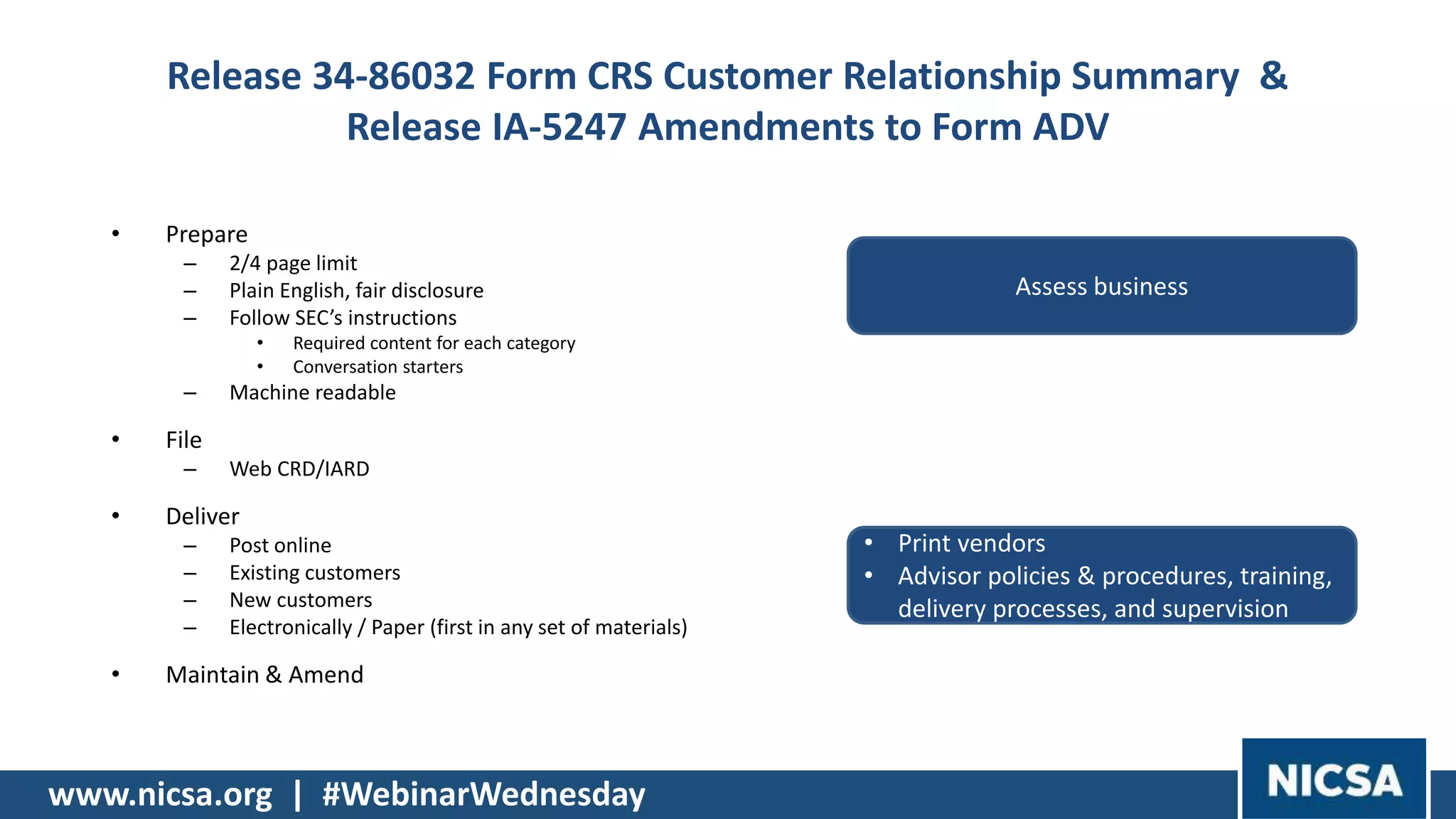

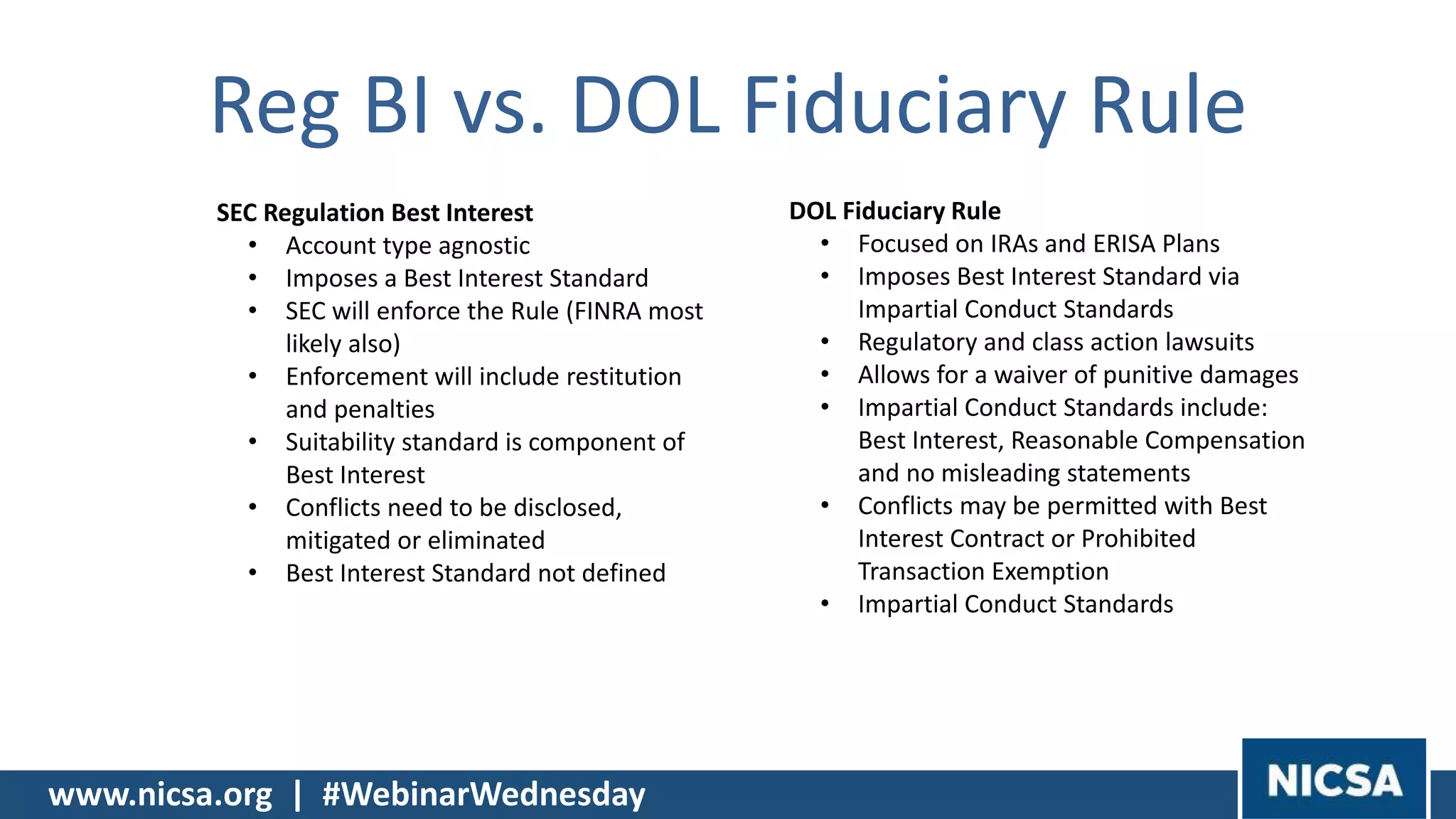

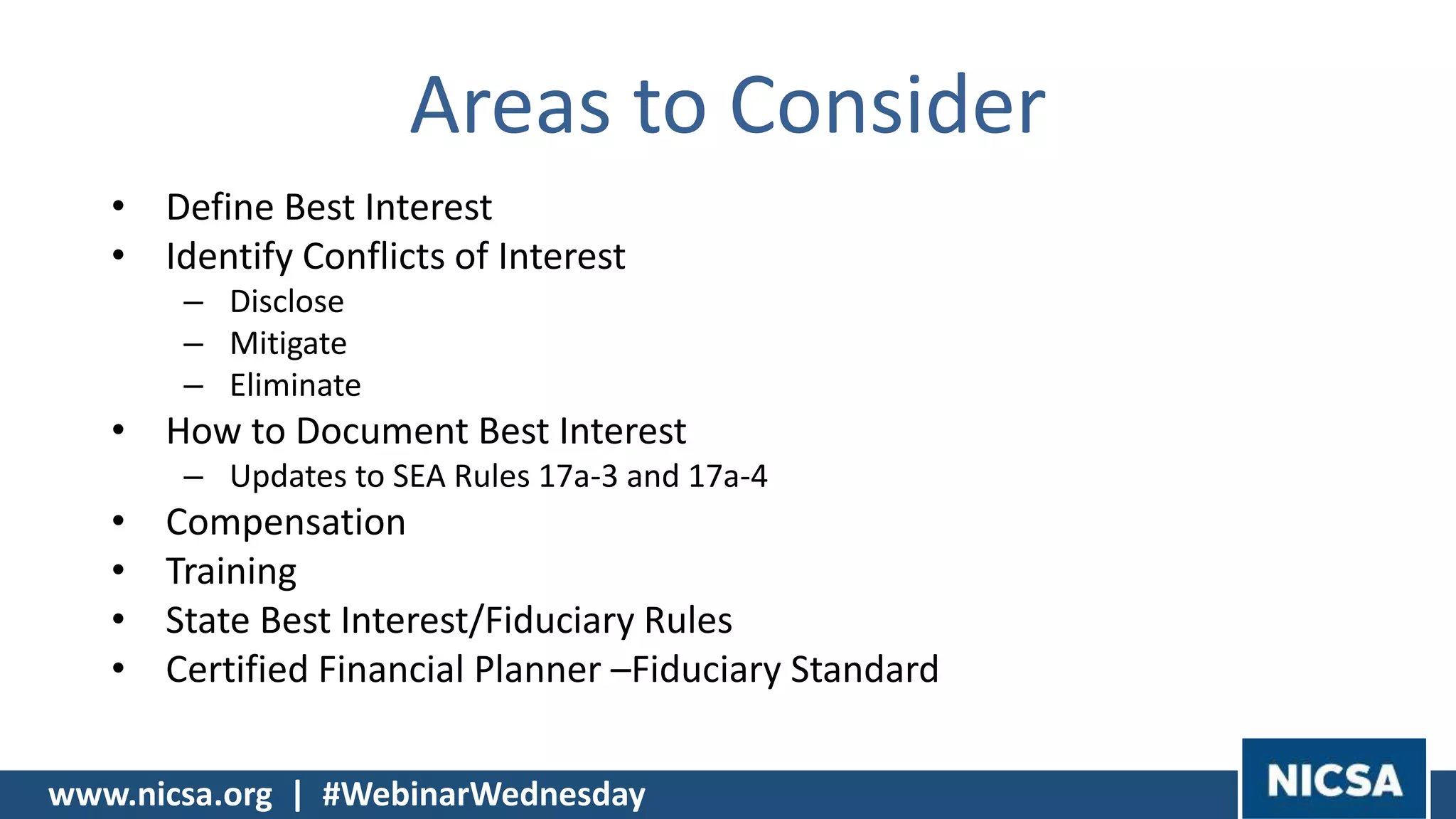

The document discusses the SEC's Regulation Best Interest, which sets a standard for broker-dealers to act in the best interest of retail customers, including obligations related to disclosure, care, and conflicts of interest. It also outlines the differences between this regulation and the Department of Labor's fiduciary rule, emphasizing enforcement and compliance requirements. Key topics include the importance of client assessments, record-keeping, and the standards for evaluating the best interest of customers.