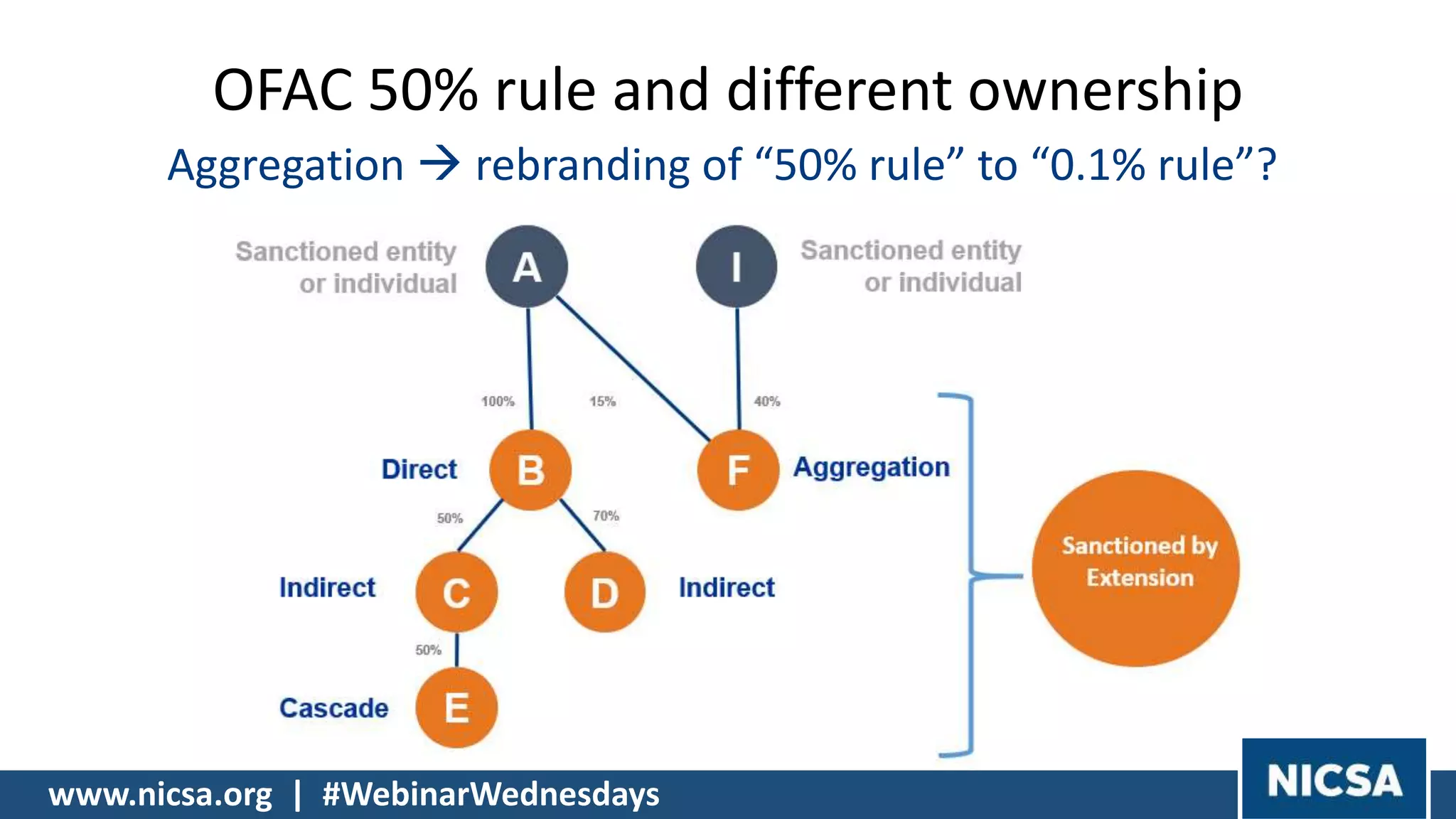

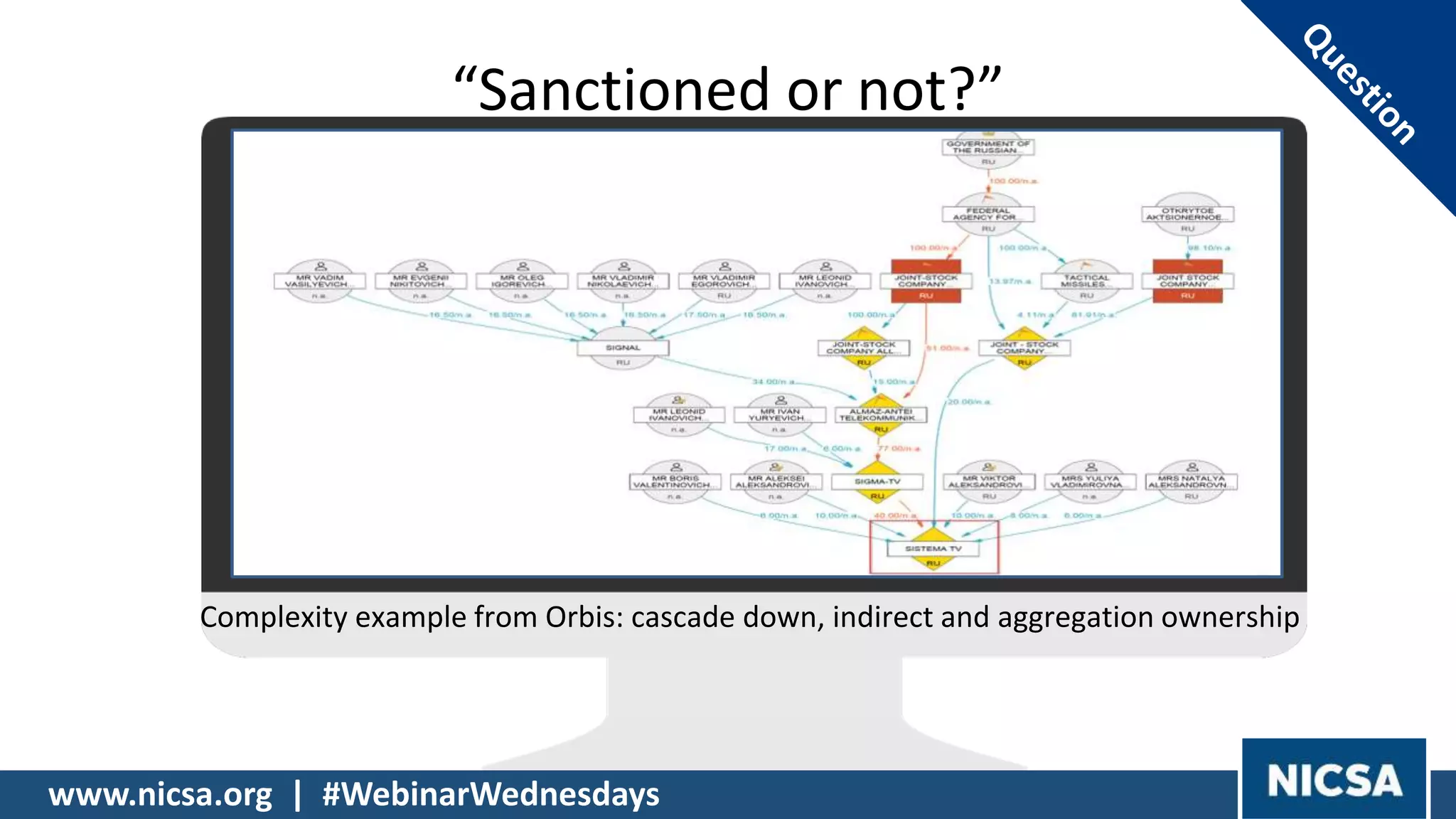

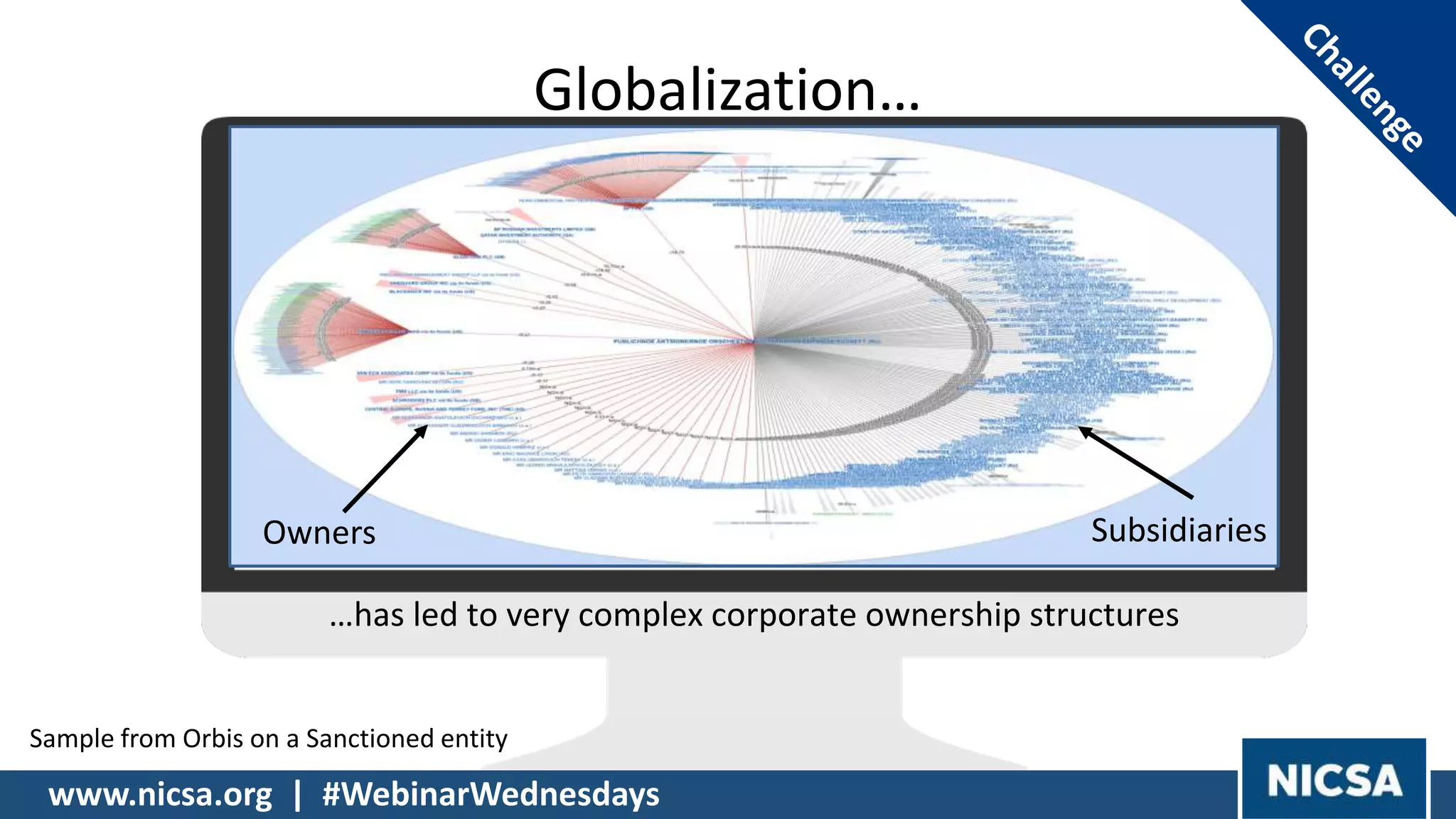

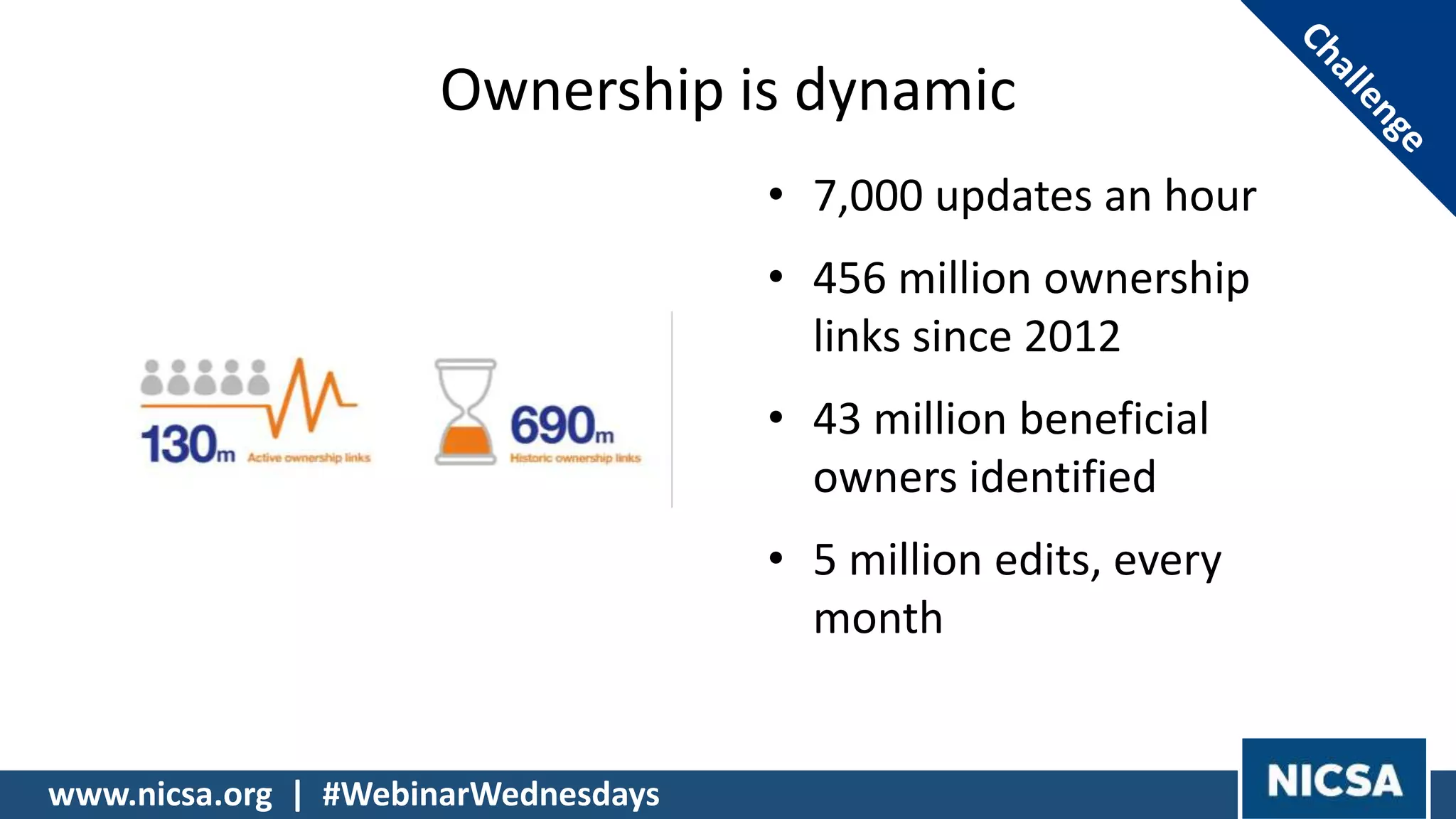

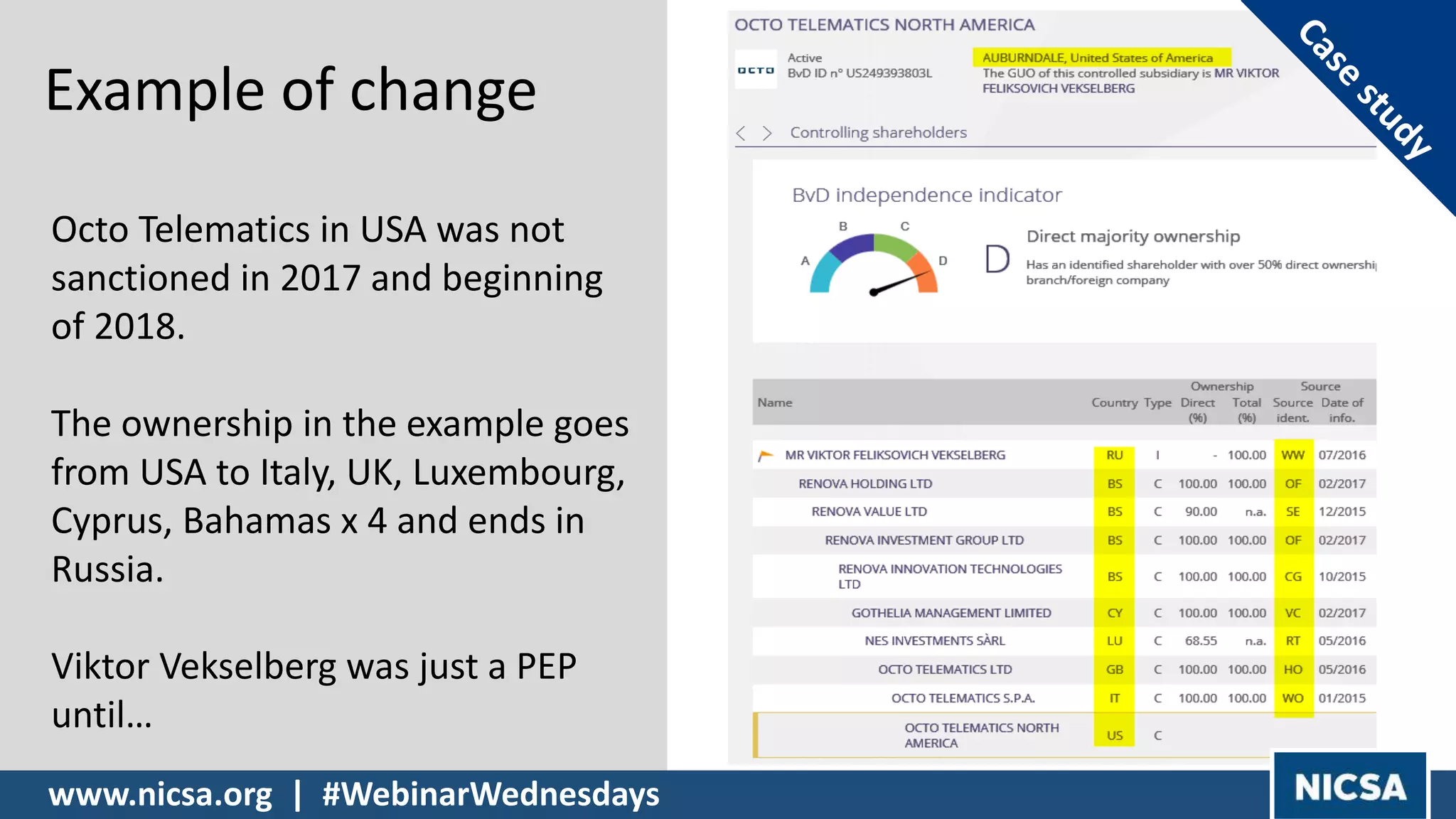

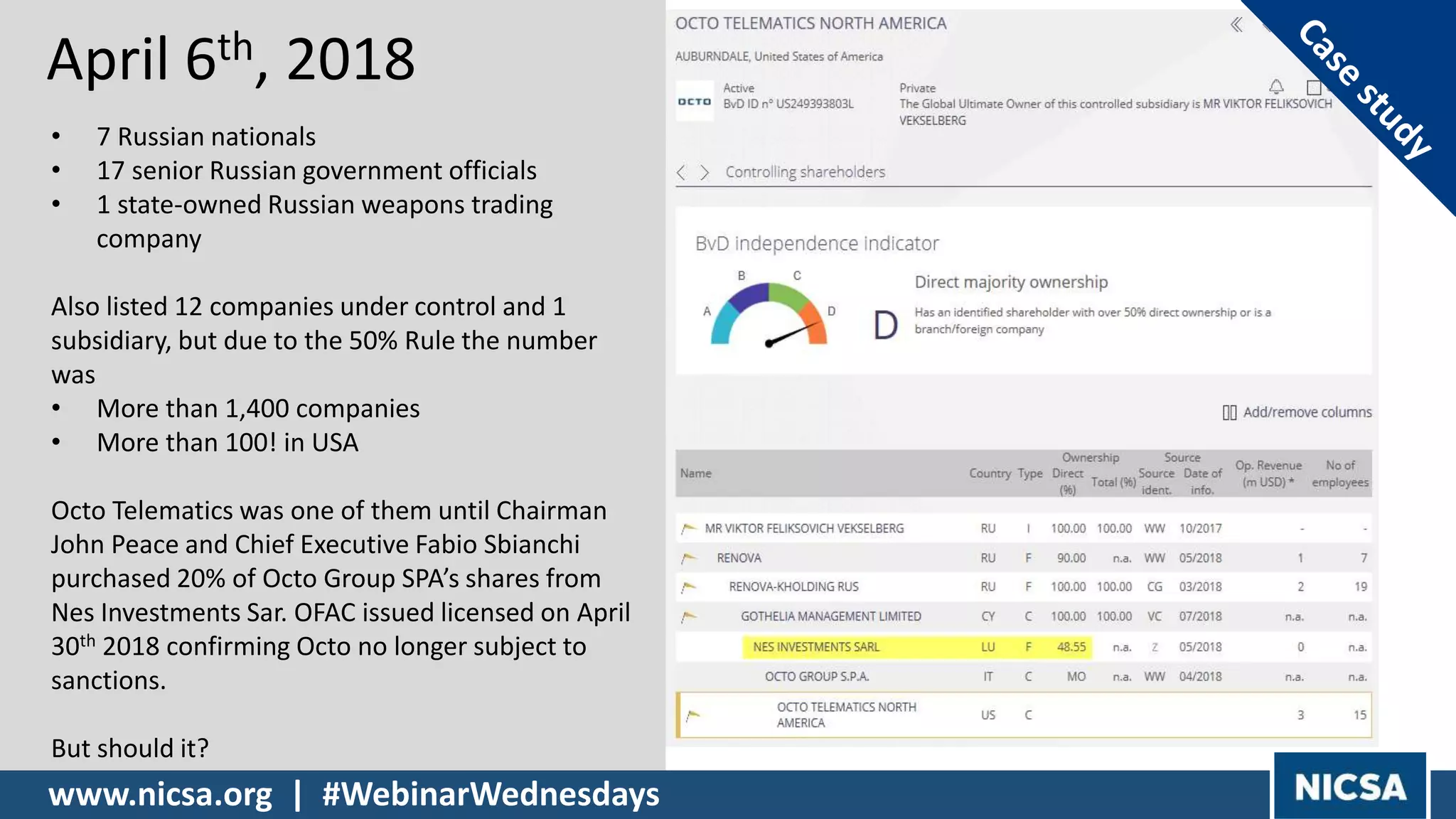

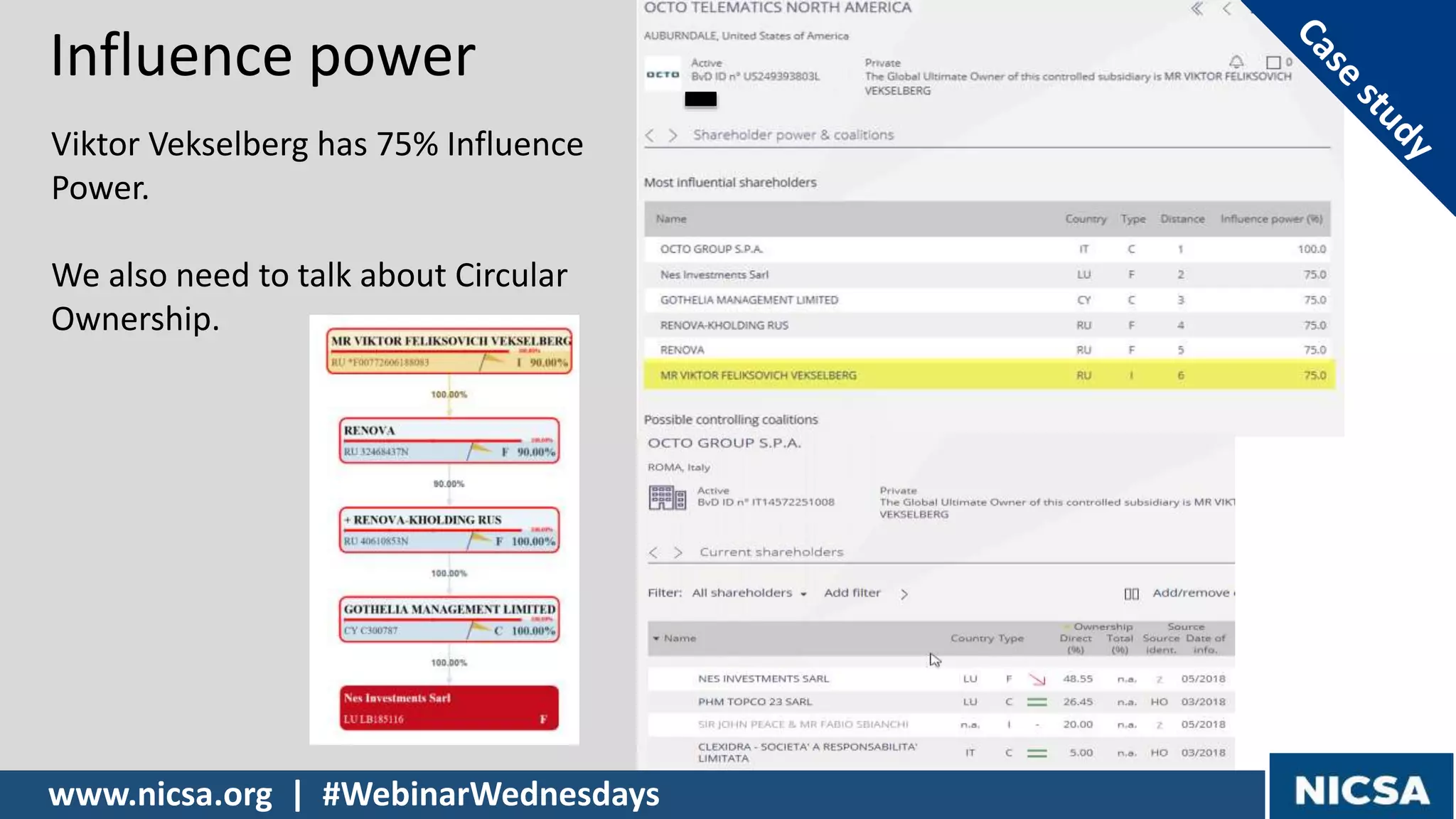

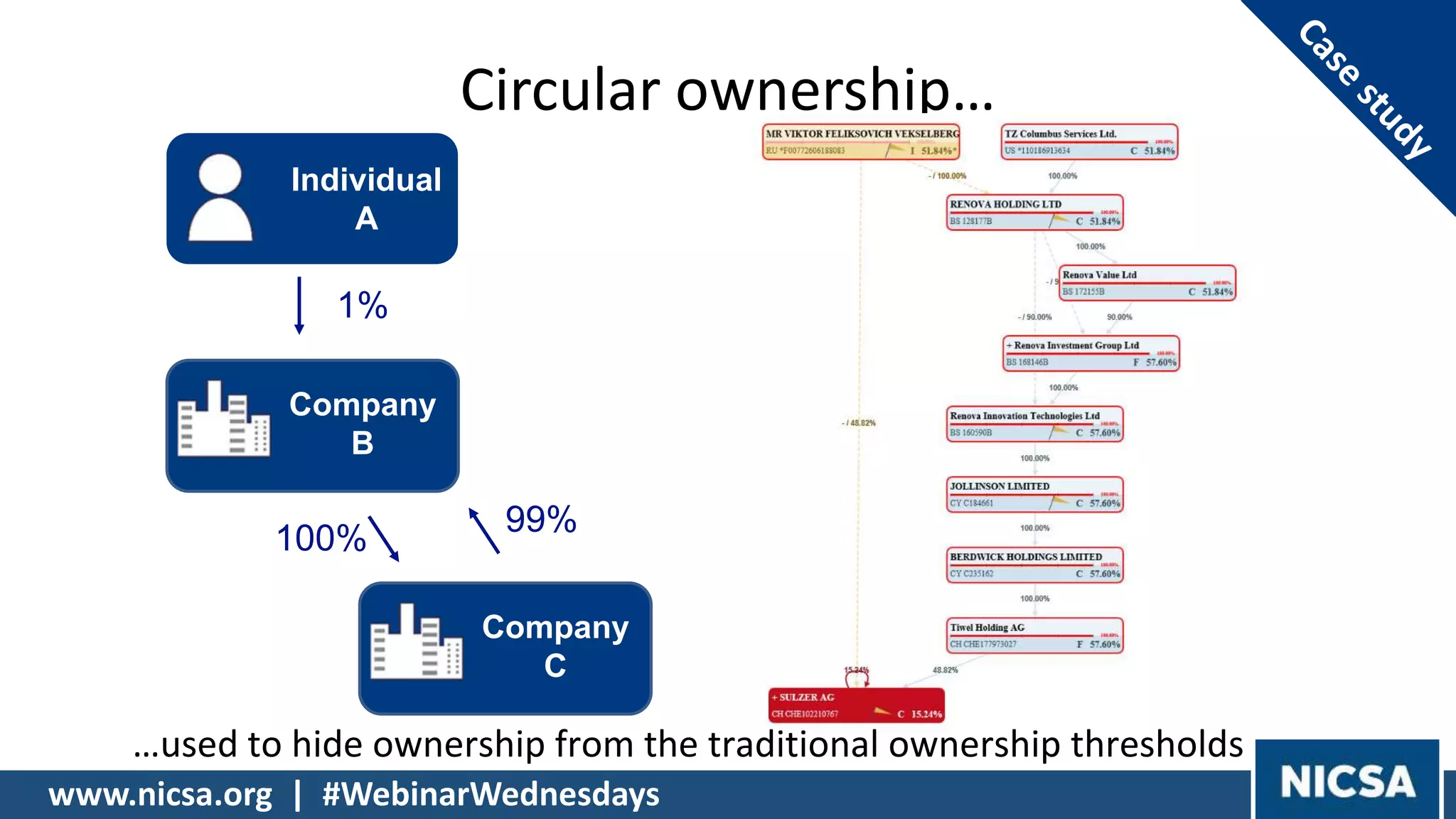

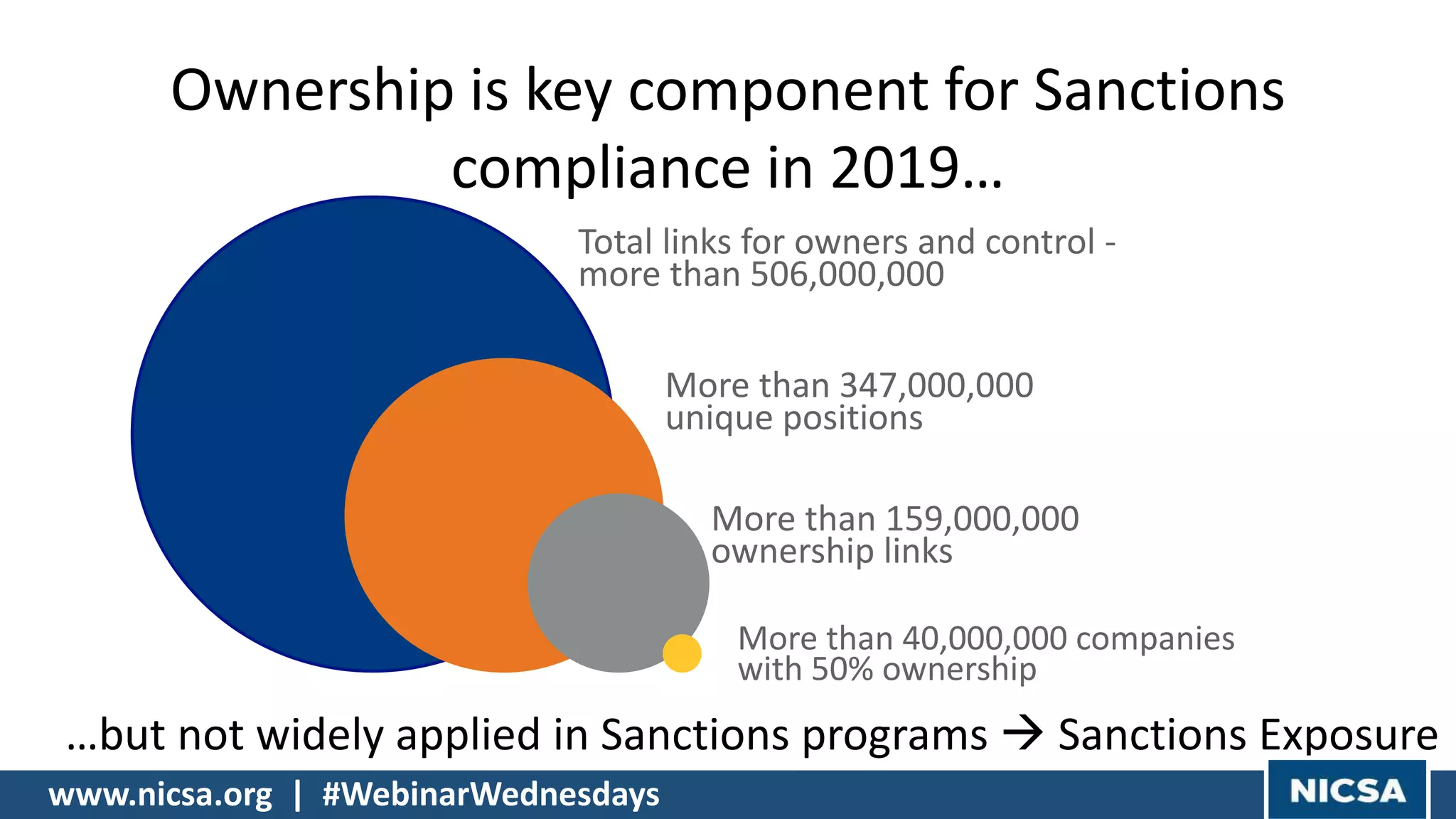

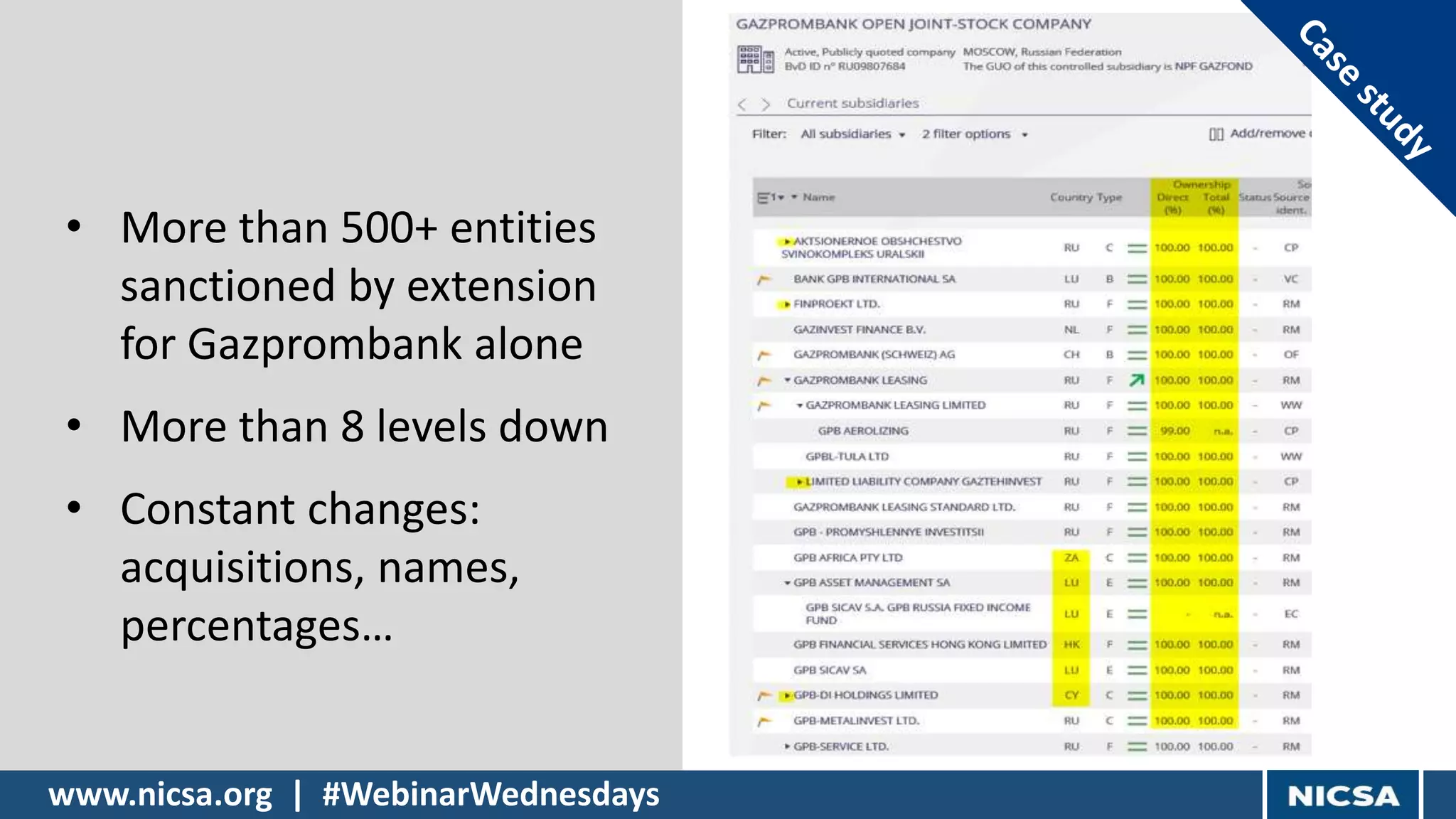

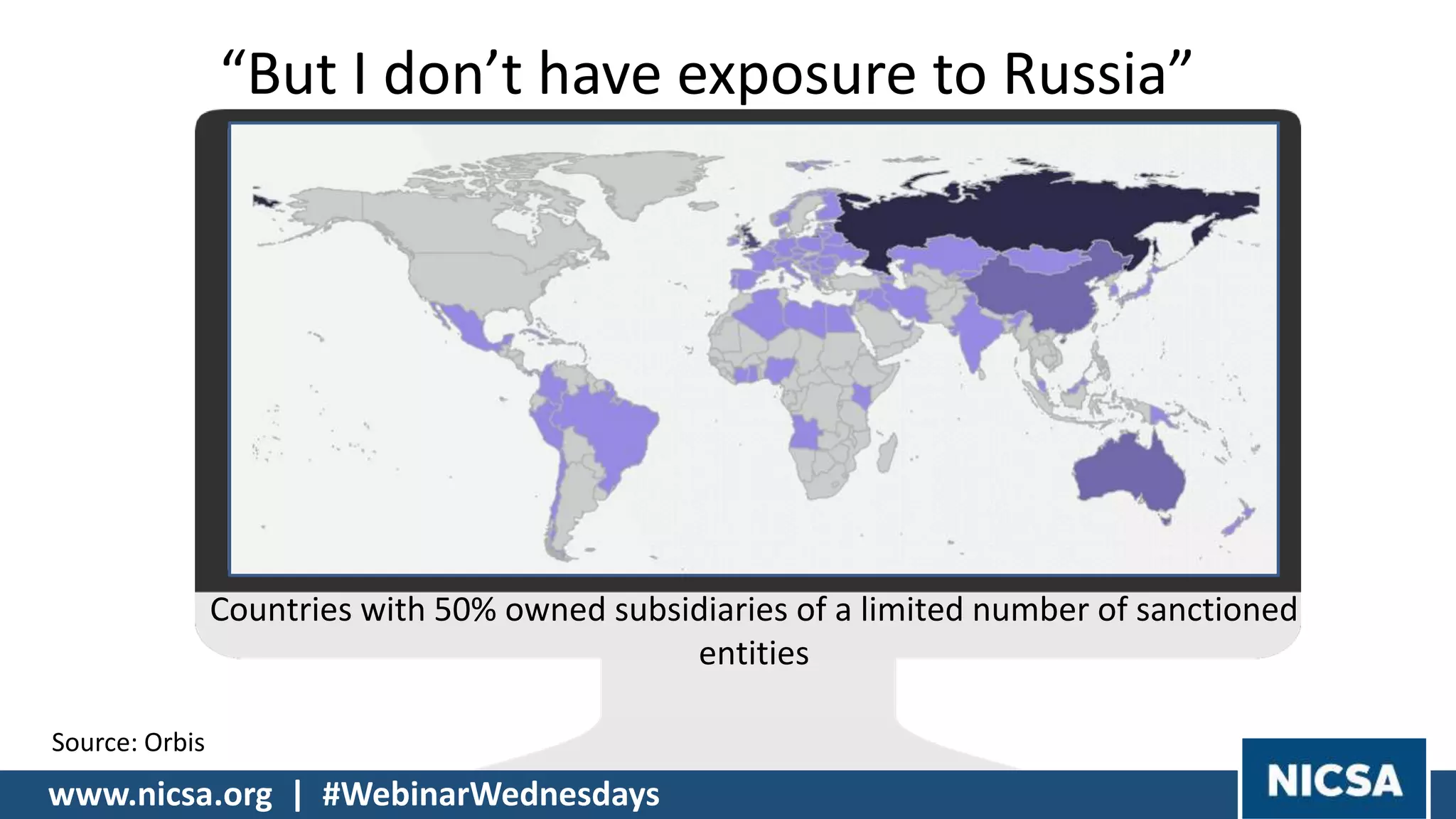

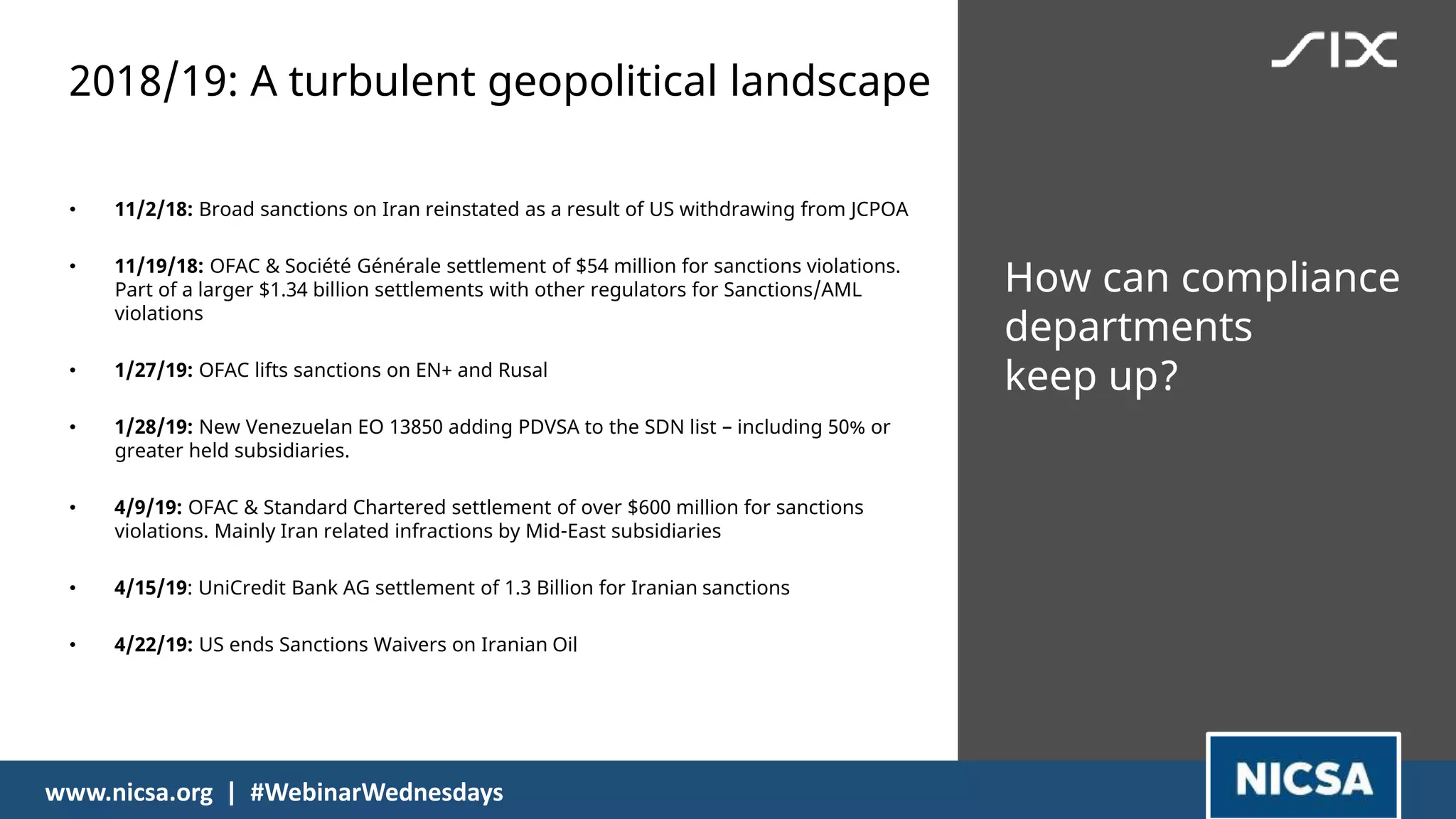

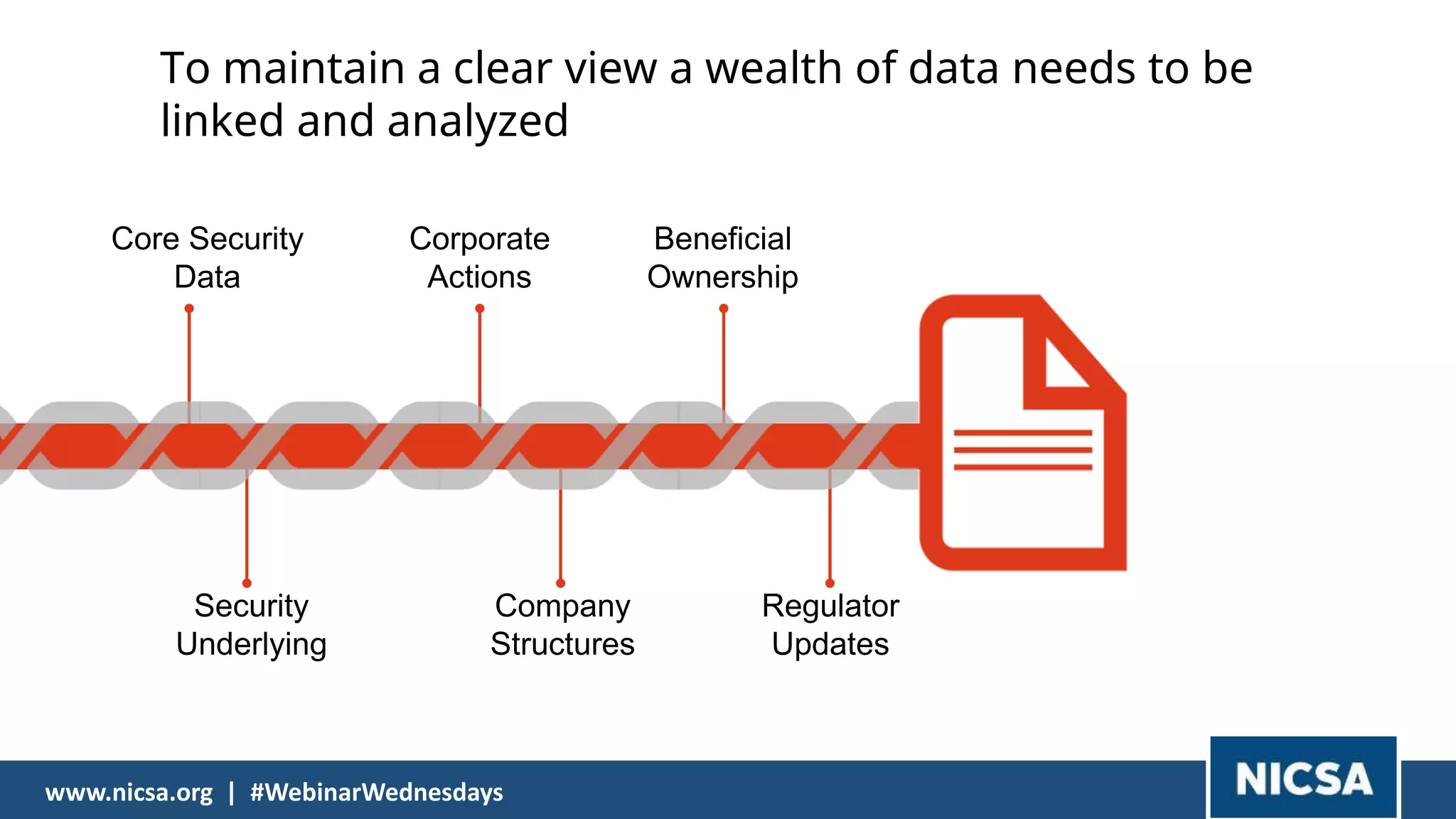

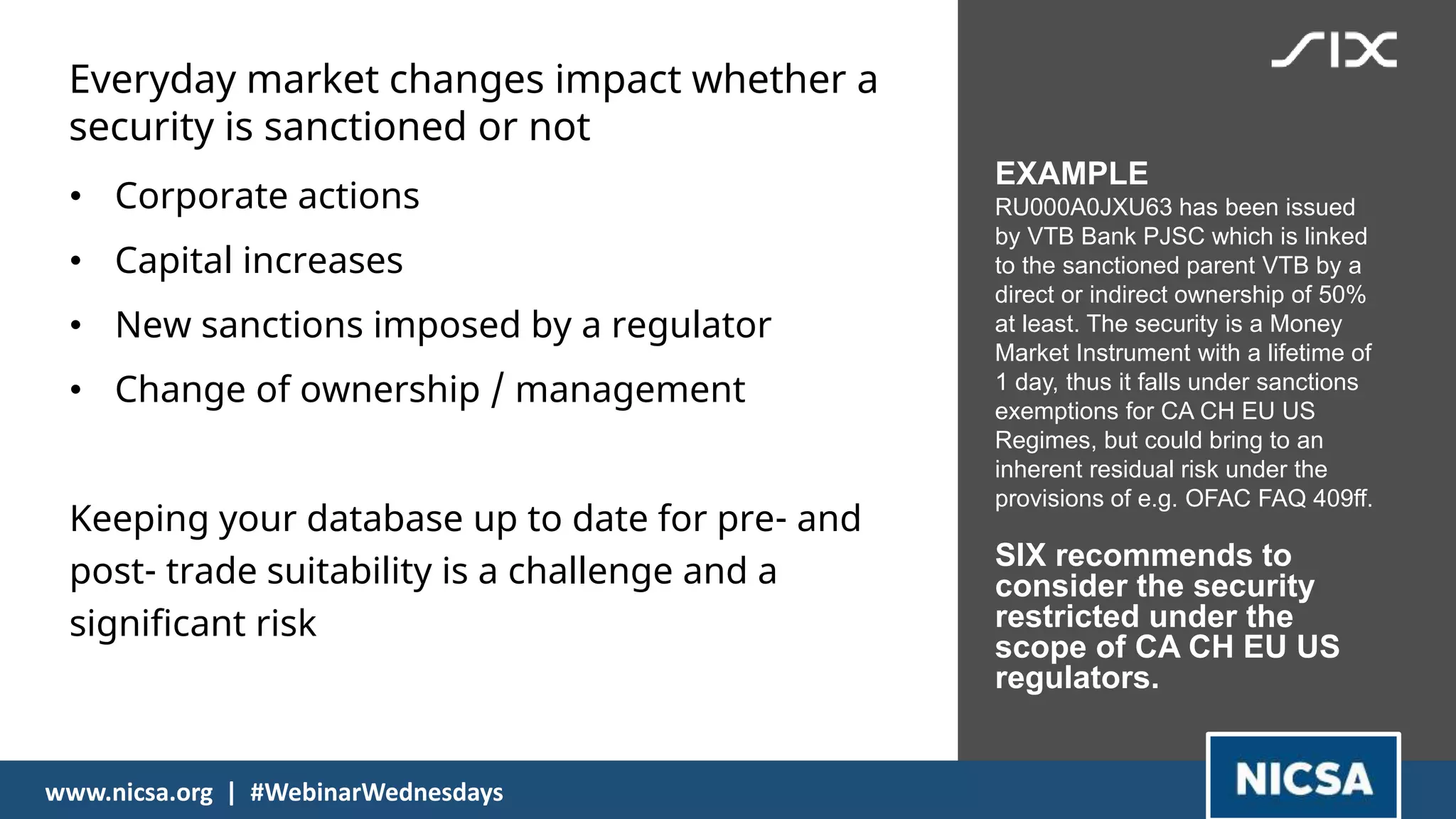

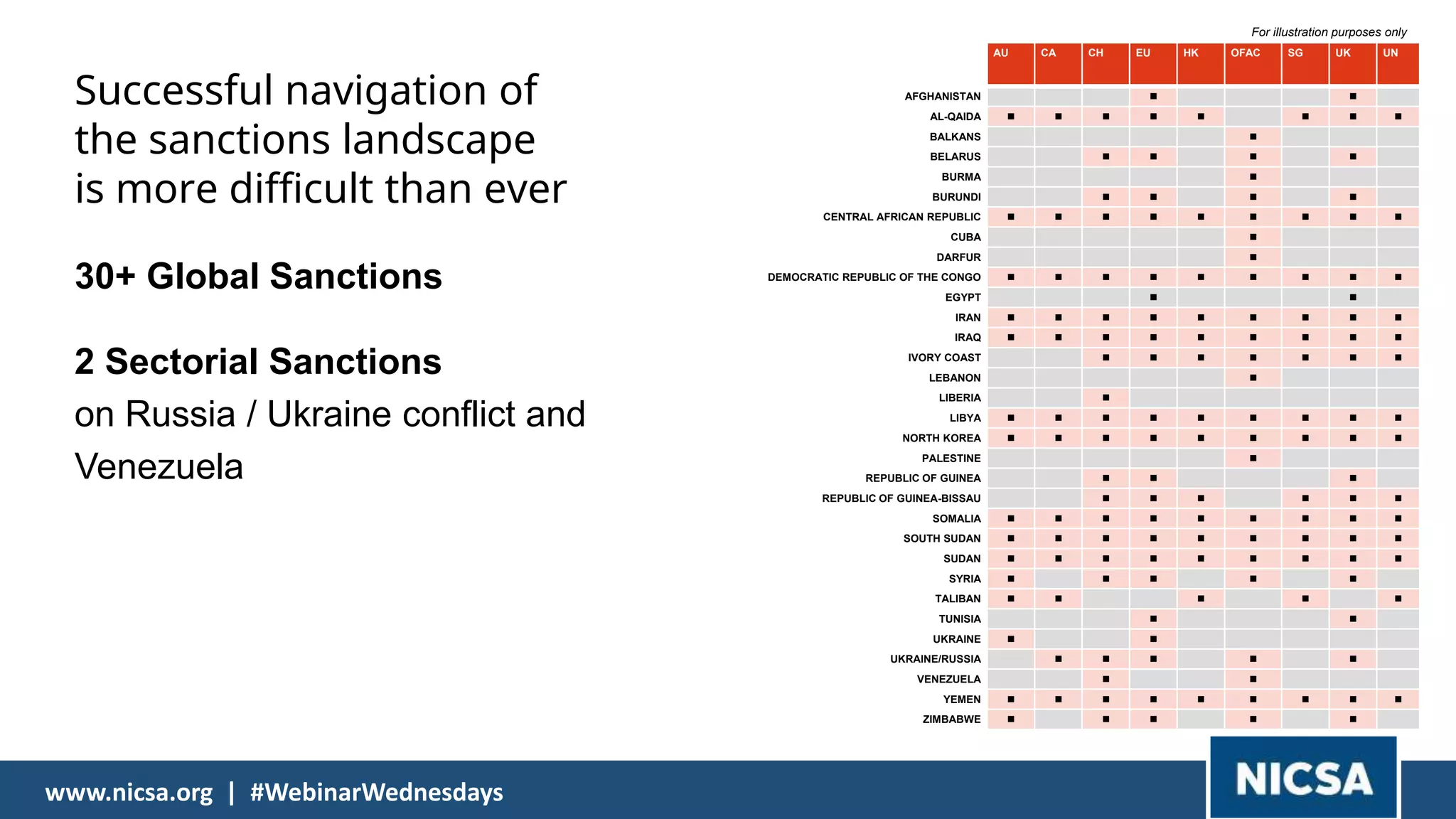

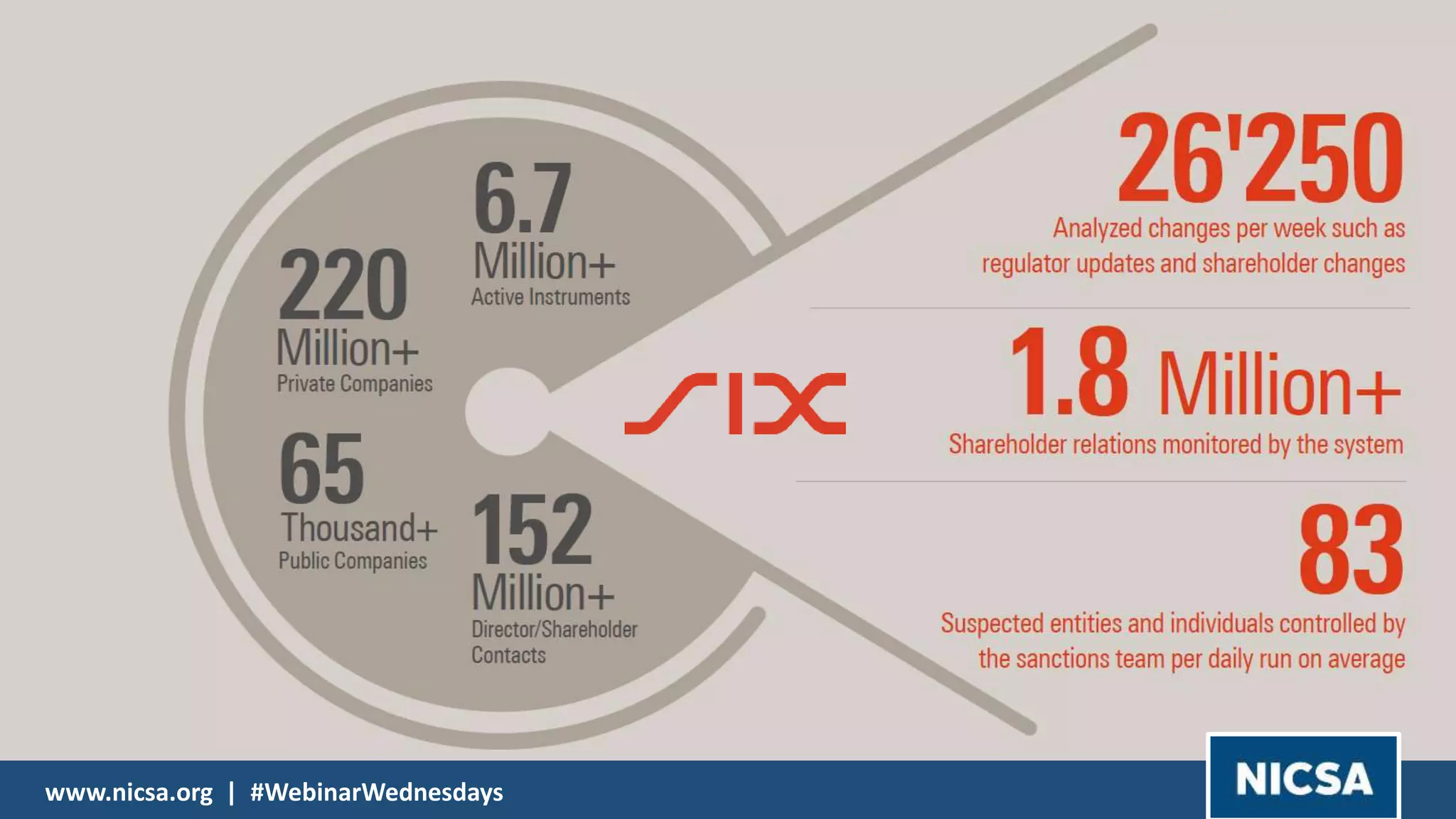

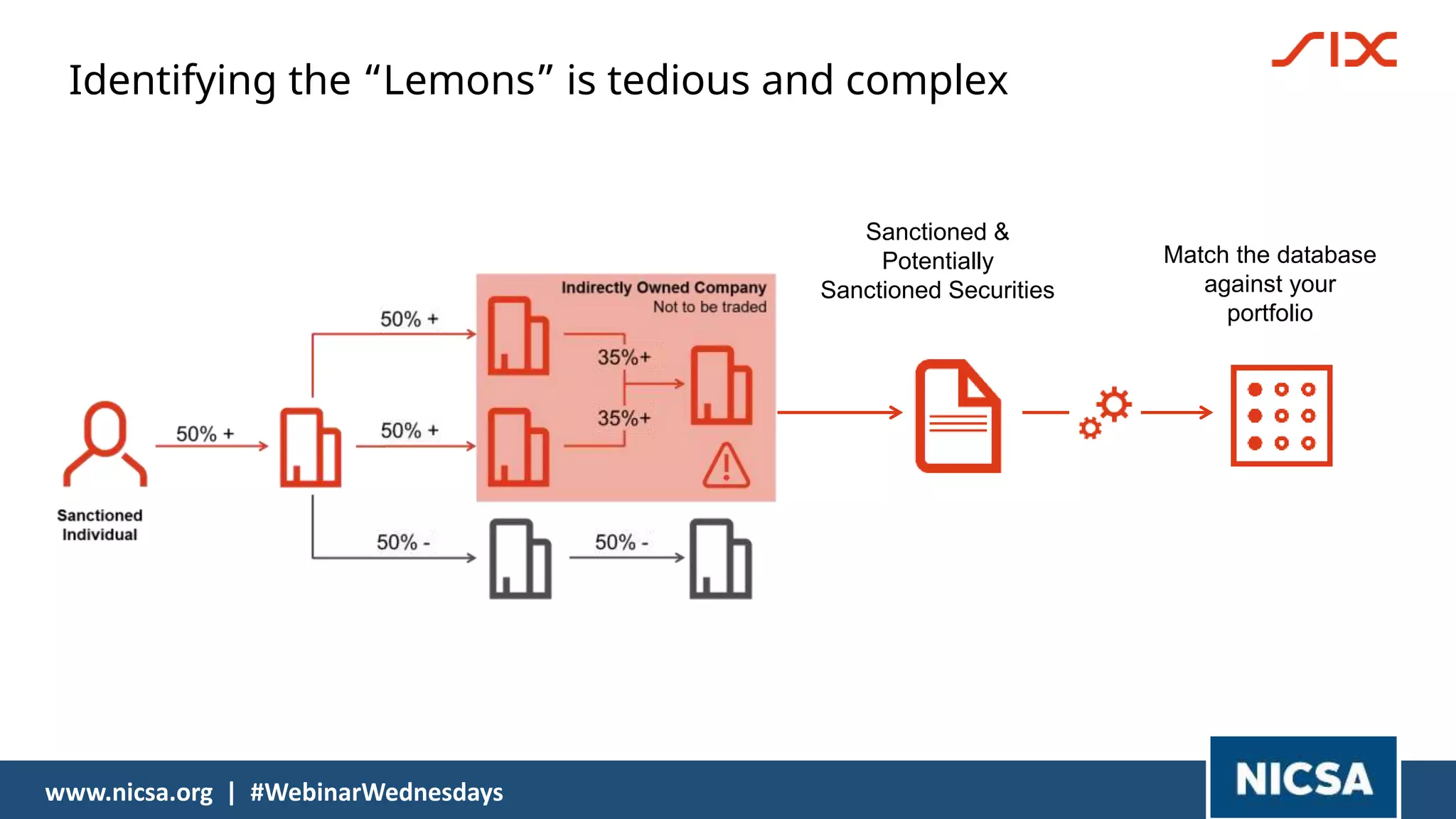

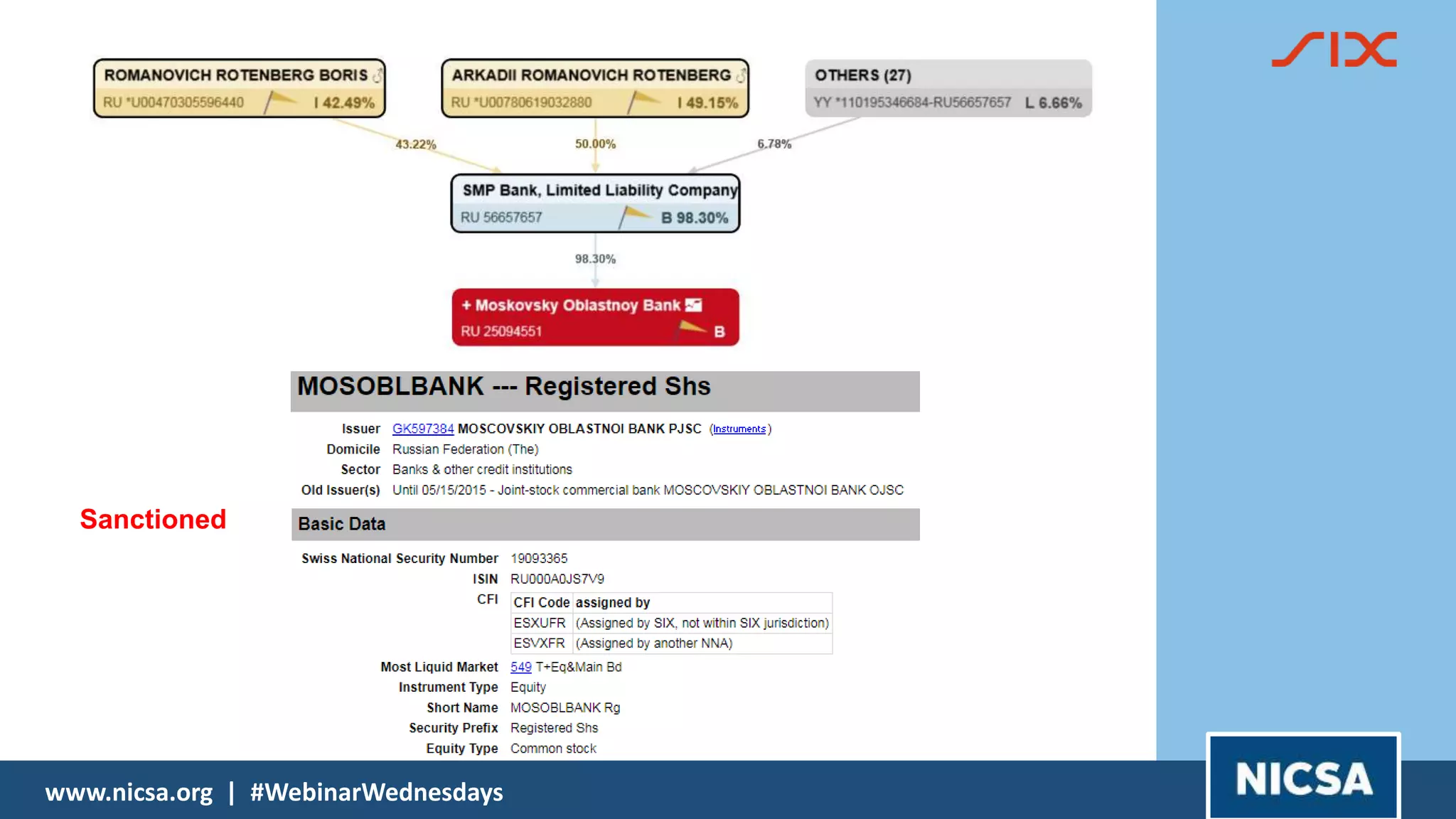

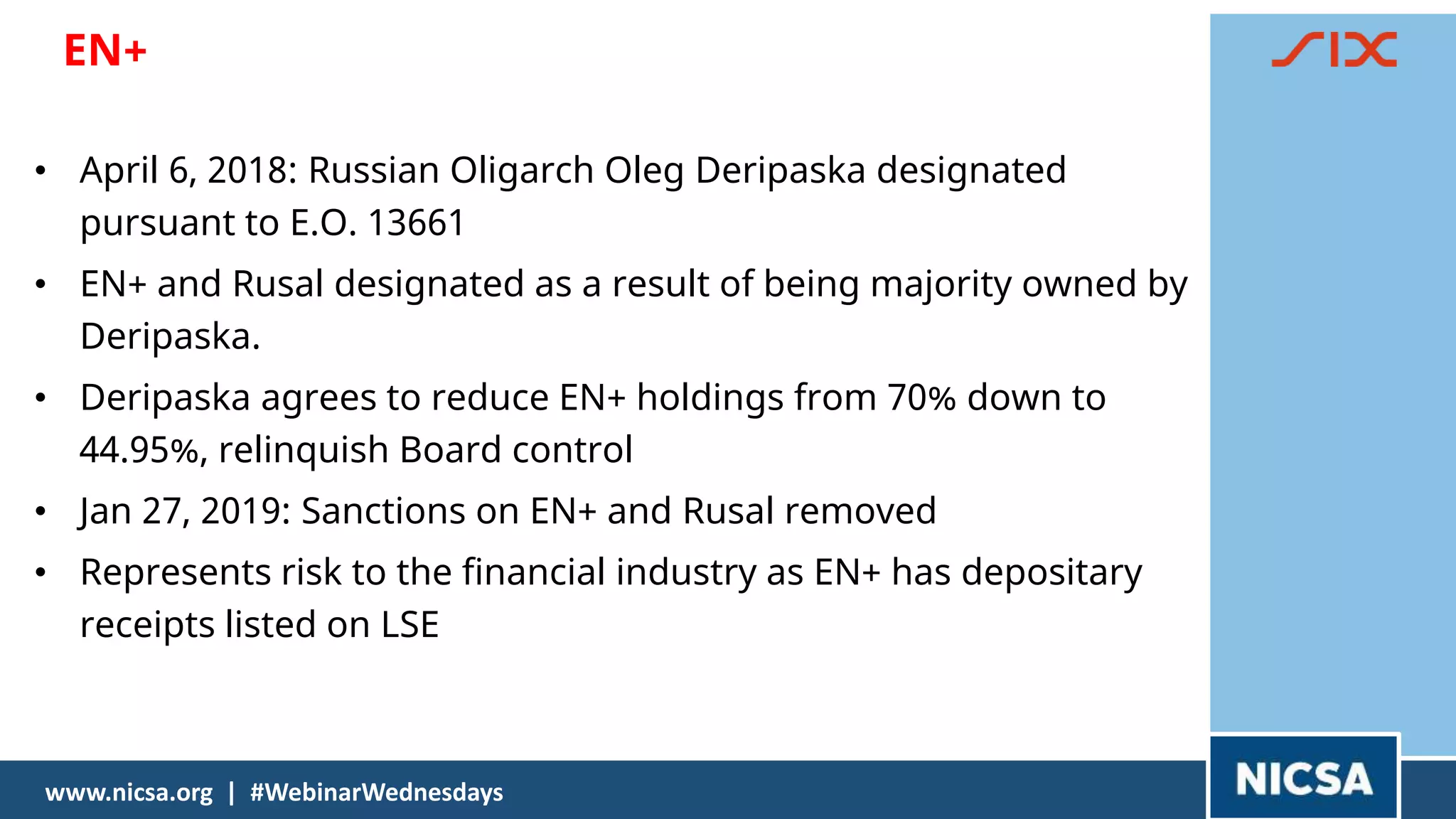

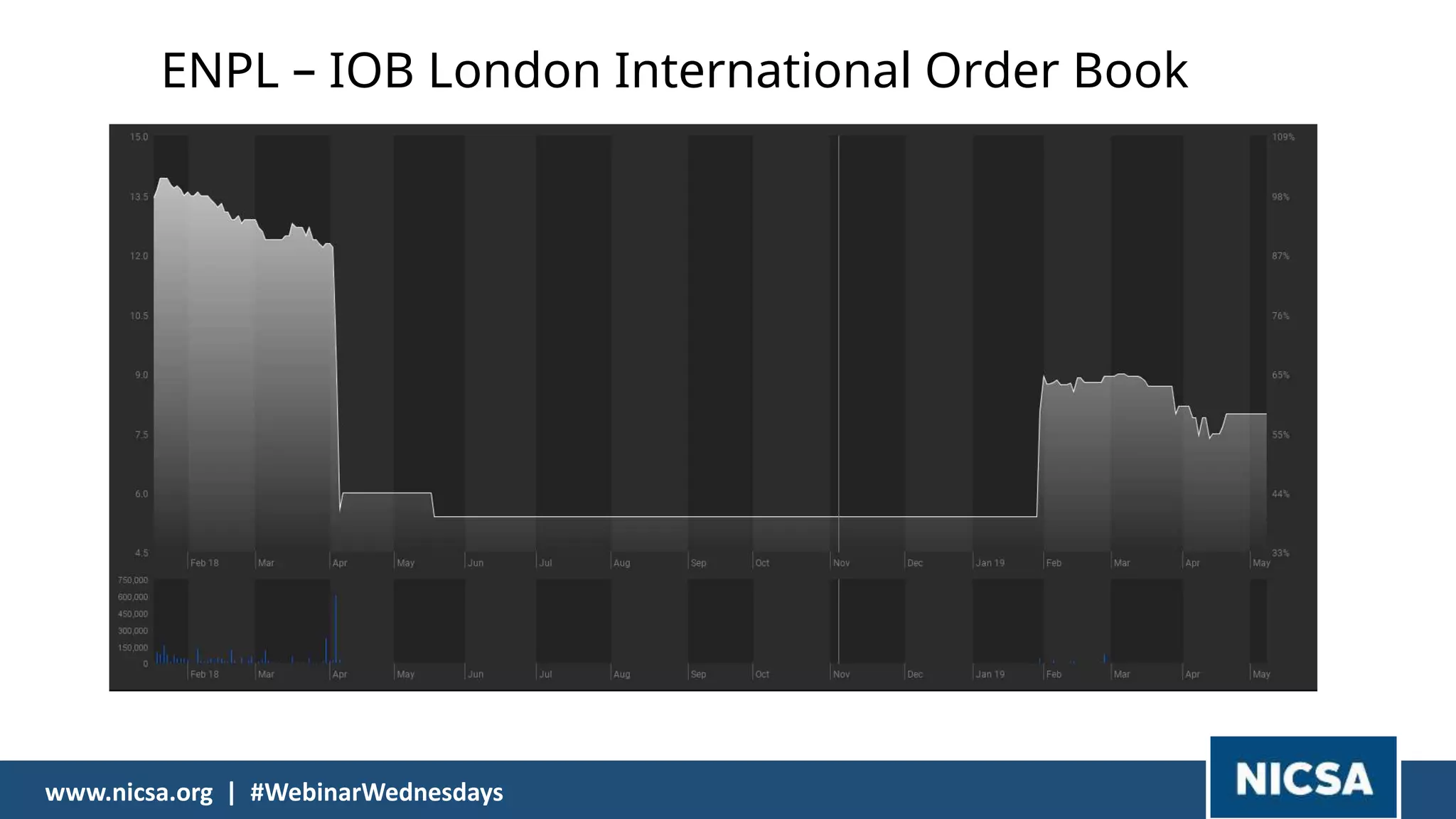

The document discusses the complexities surrounding ownership and sanctions compliance in a globalized financial landscape, highlighting dynamic ownership structures and the challenges posed by updated sanctions and corporate actions. It emphasizes the need for financial institutions to continuously analyze ownership data and maintain up-to-date compliance frameworks due to constant changes in ownership and the ever-evolving sanctions environment. Specific examples, such as the case of Octo Telematics and sanctions involving Russian oligarchs, illustrate the tangible risks that arise from indirect ownership and the intricate relationships between sanctioned entities.