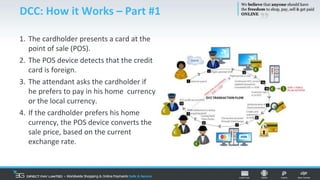

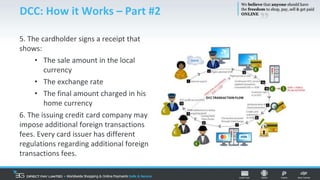

Dynamic Currency Conversion (DCC) allows travelers to pay for goods and services in their home currency while abroad, enhancing customer service and understanding of transaction costs. The process involves a point-of-sale device converting the local price to the cardholder's currency at the time of payment, with potential fees from the card issuer. Benefits for merchants include profit from foreign exchange margins and reduced chargeback risks, while cardholders gain clarity in transaction amounts and possible waivers of foreign exchange margins.