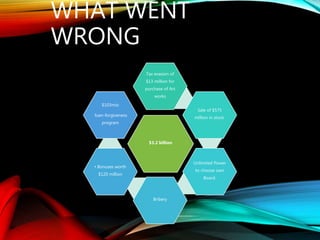

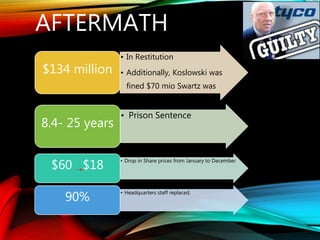

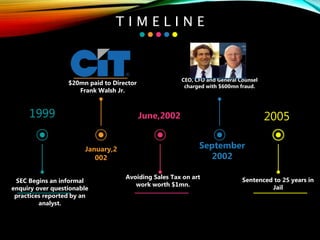

This document summarizes a corporate governance failure at Tyco International. It provides background on Tyco's history and industries. In 2002, the CEO Dennis Kozlowski and CFO Mark Swartz were charged with fraud for misusing company funds totaling $600 million for personal expenses like art purchases and unauthorized bonuses. Both were later sentenced to prison. The scandal led to a drop in Tyco's stock price and replacement of top executives. It highlights the need for stronger internal controls, corporate governance, and government oversight to prevent such failures.