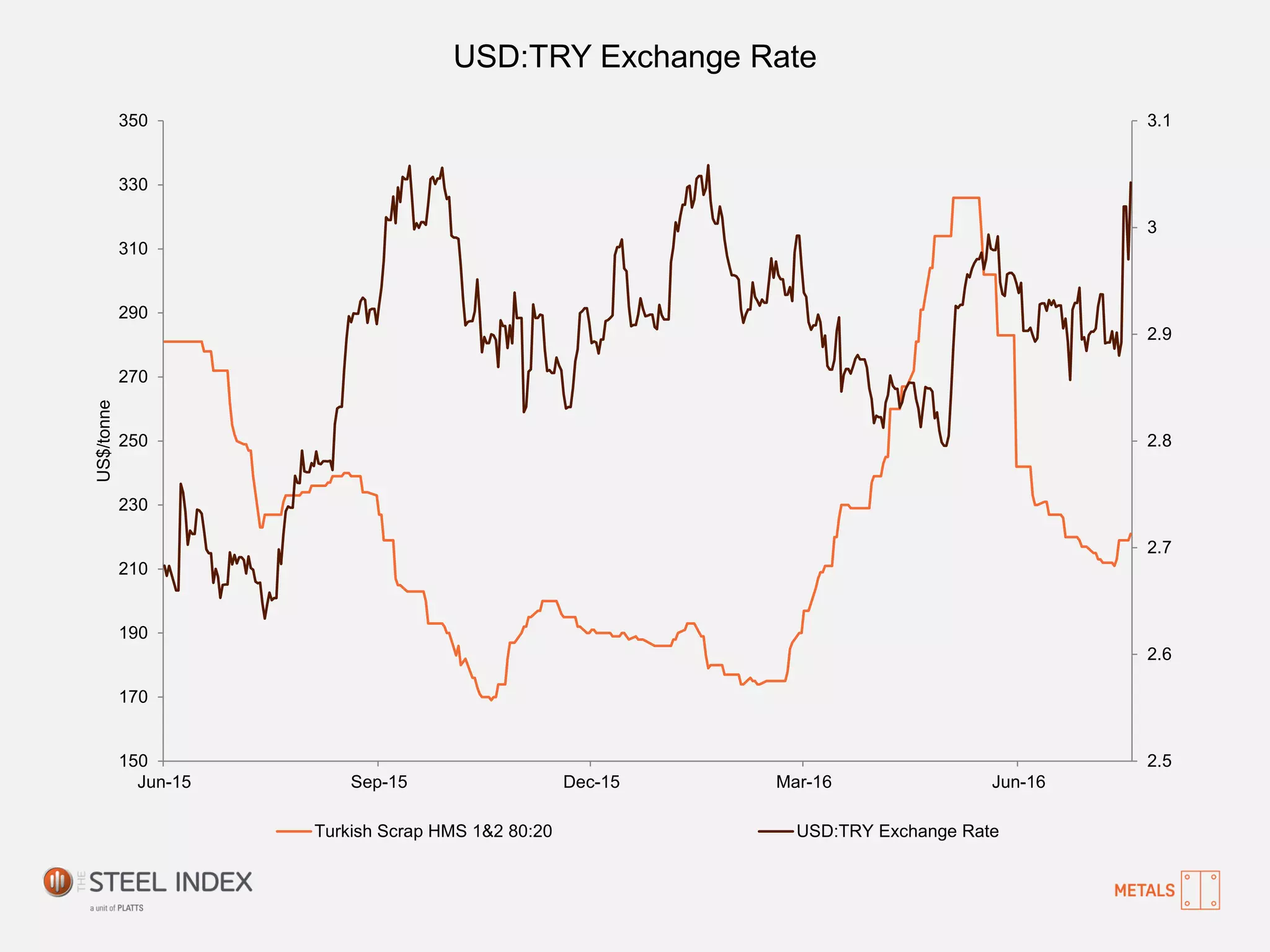

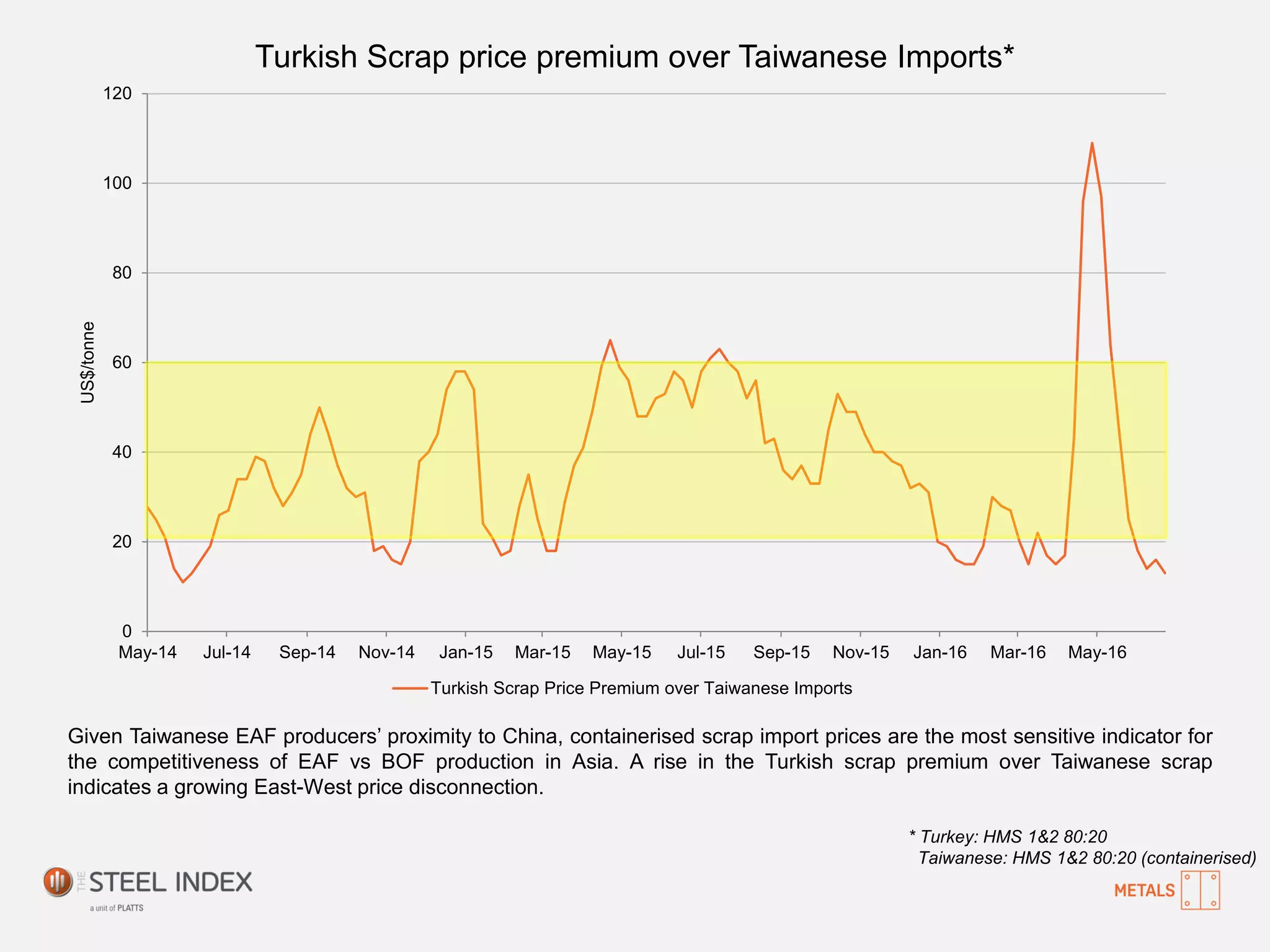

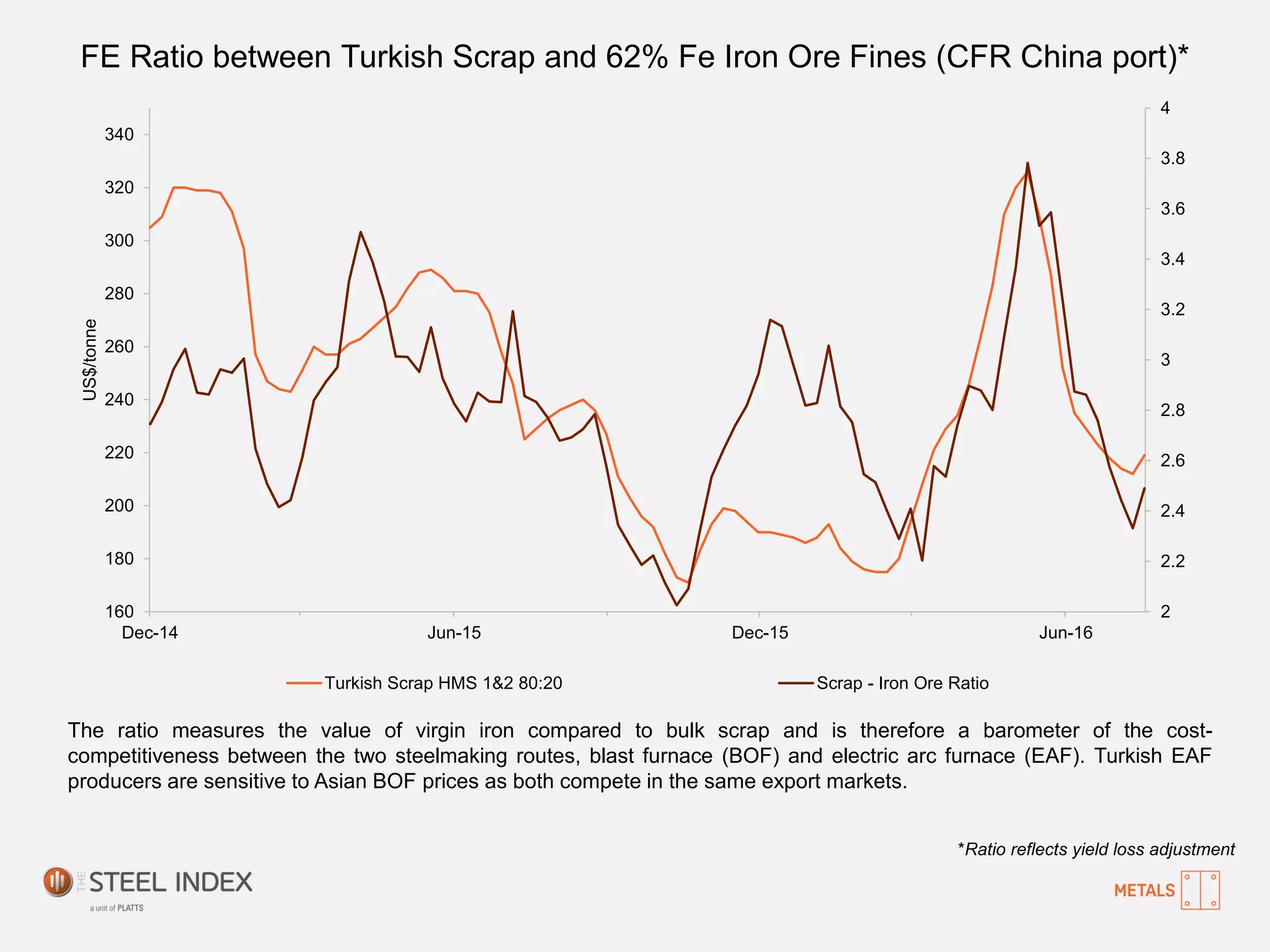

This document contains charts showing trends in the USD:TRY exchange rate, Turkish scrap steel prices relative to Taiwanese imports and Chinese billet prices, the spread between Turkish scrap and rebar prices, and the ratio of Turkish scrap prices to iron ore prices. It analyzes how these trends impact the competitiveness of electric arc furnace steel production in Turkey versus blast furnace production in Asia, and influence Turkish mills' decisions to purchase scrap versus billet.