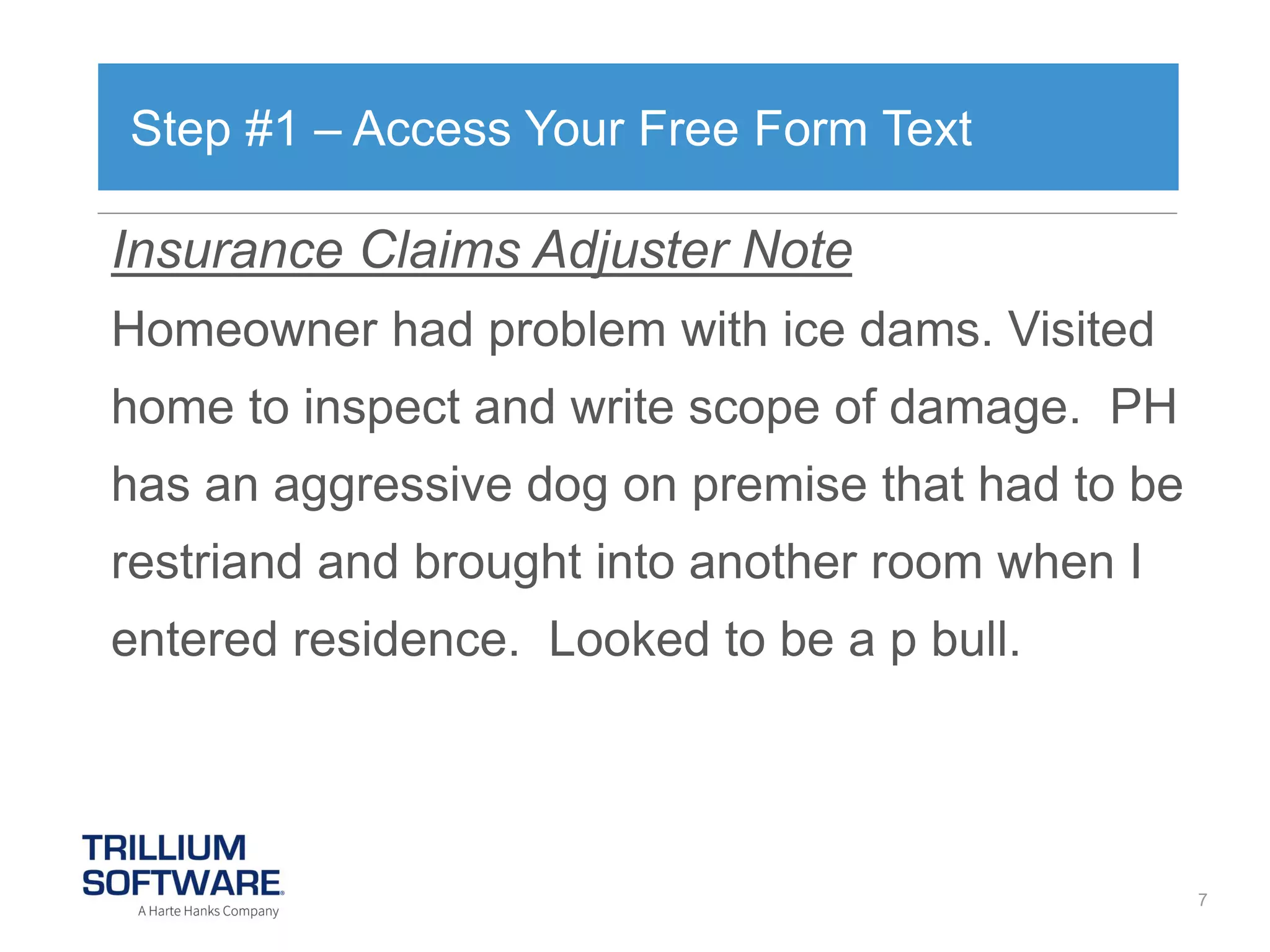

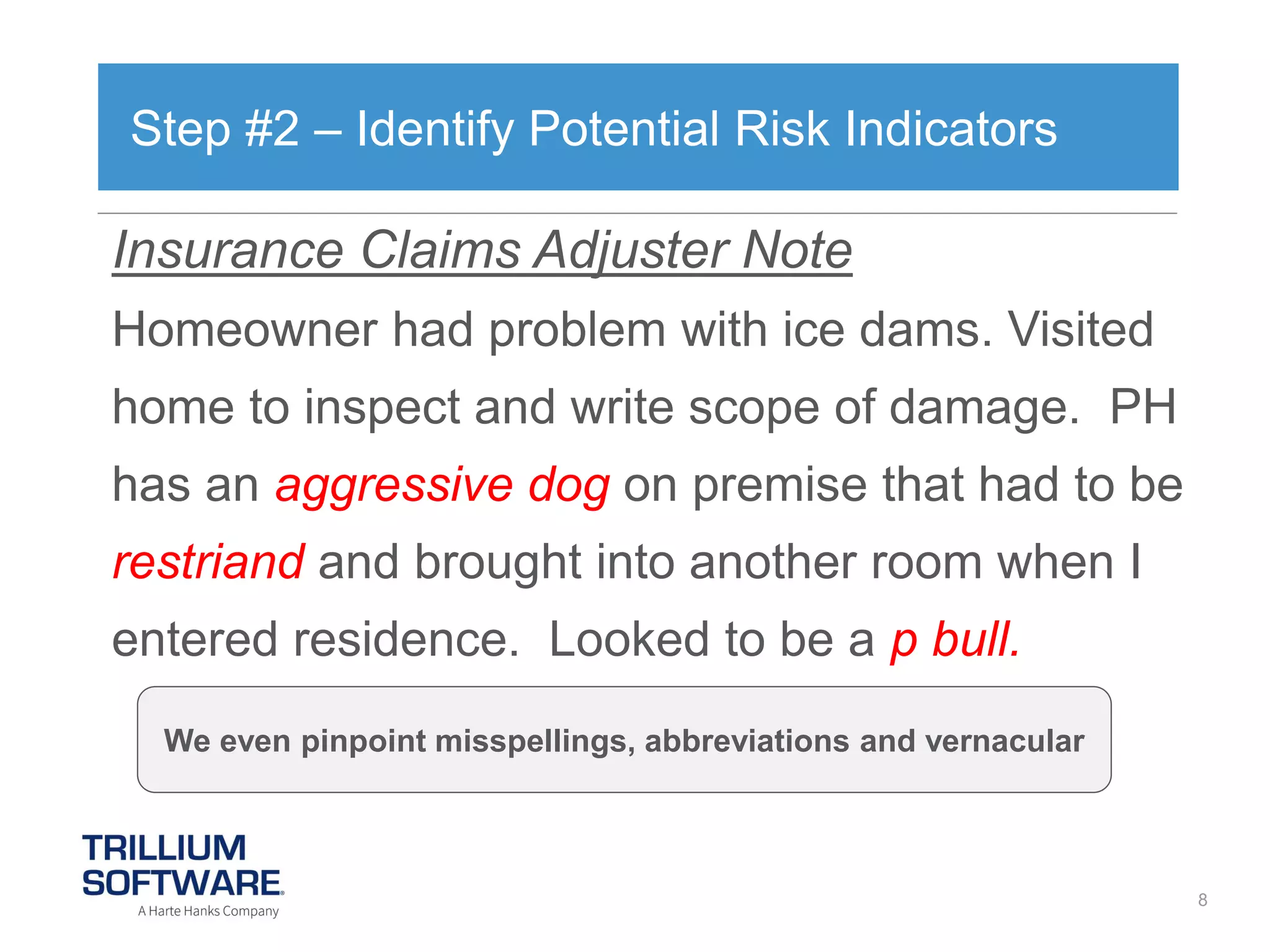

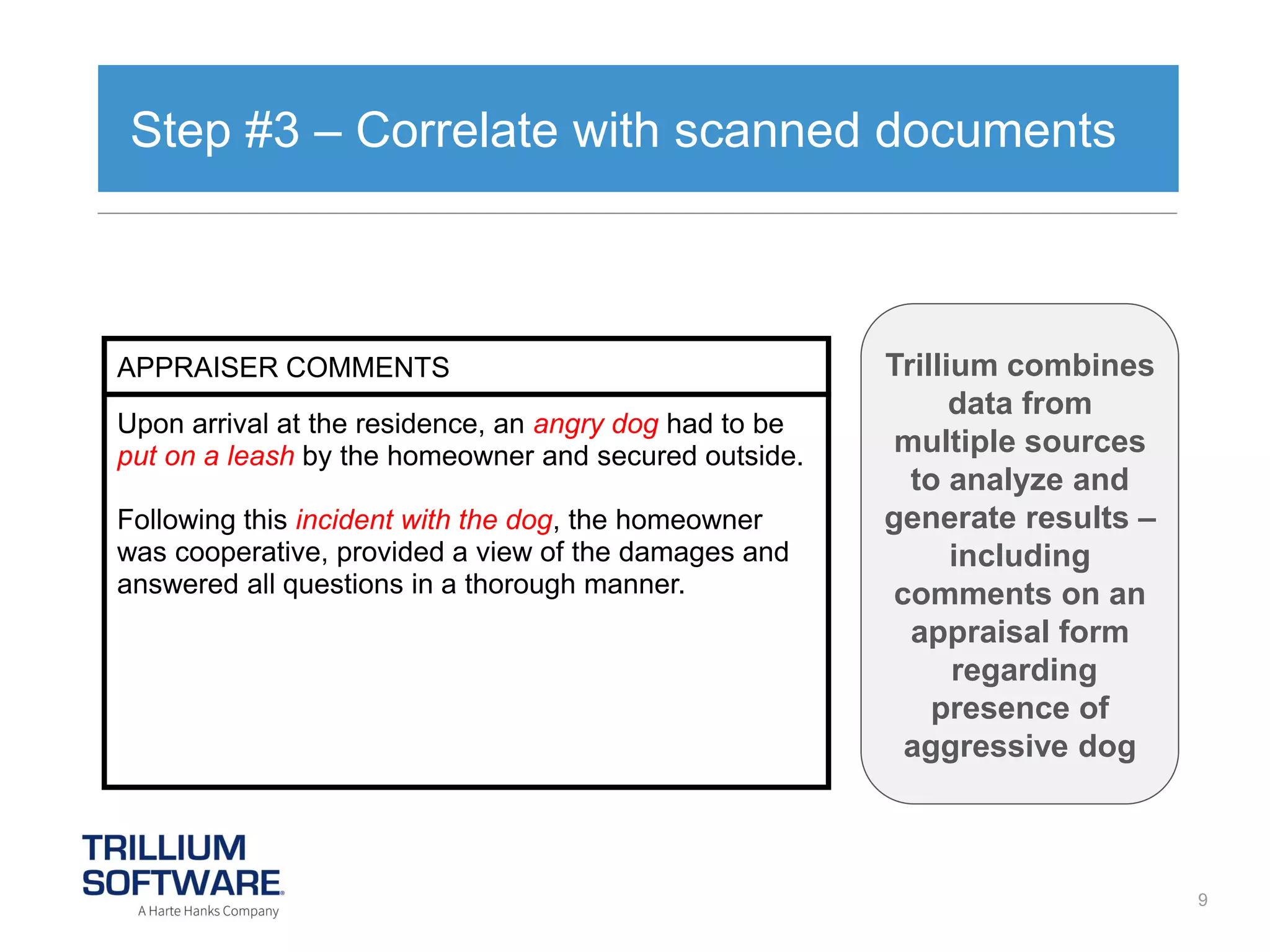

Trillium software analyzes unstructured text and scanned documents in insurance claims files to identify valuable risk indicators for underwriters. The software extracts information from free form text in claims adjuster notes and correlates it with scanned documents. It then notifies underwriters of potential non-renewals, premium increases, or higher risks so they can make more informed underwriting decisions.