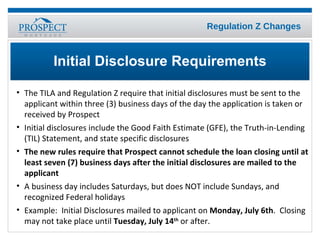

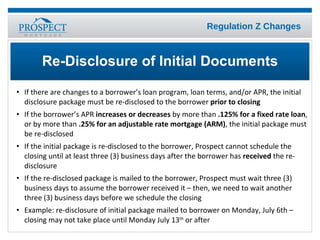

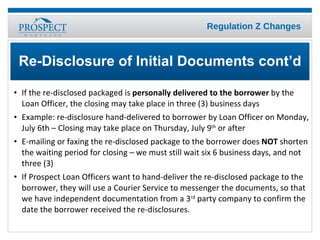

Changes to Regulation Z effective July 30, 2009, impose new disclosure requirements for mortgage loans by Prospect Mortgage. Initial disclosures must be sent within three business days of a loan application, and closings cannot be scheduled until at least seven business days after those disclosures are mailed. Additionally, any changes to loan terms require re-disclosure and adherence to new waiting periods before loan closings can occur.

![Thank You! (Mike Platt) Loan Officer Direct: 434-295-1944 Cell: 434-760-2801 [email_address]](https://image.slidesharecdn.com/regzchangesppt-090803113752-phpapp02/85/Reg-Z-Changes-Ppt-7-320.jpg)