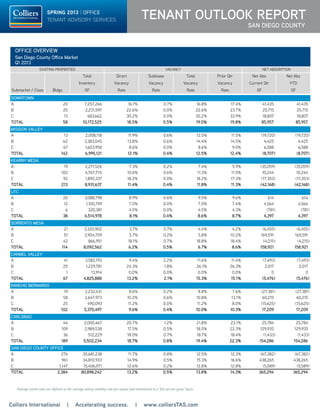

The San Diego County office market posted strong demand in Q1 2013 with over 365,000 square feet of positive net absorption. Vacancy rates declined across most classes and submarkets. Class B properties saw particularly high demand, with 413,000 square feet of net absorption. Large lease deals included XIFIN leasing 45,000 square feet in Carmel Valley and Union Bank leasing 84,000 square feet in UTC. New supply is expected to come online throughout 2013 and 2014 from projects in Sorrento Mesa, Carmel Valley, and UTC. Opportunities exist for tenants in Downtown San Diego's 19% vacancy rate and limited prime options in high-demand submarkets.

![Colliers International | Accelerating success. | www.colliersTAS.com

TENANT OUTLOOK Report

SAN DIEGO COUNTY

SPRING 2013 | OFFICE

TENANT ADVISORY SERVICES

VACANCY BY SPACE TYPE

Q1 2013 Q4 2012 CHANGE

Direct 13.25% 13.60%

SUBLEASE 0.54% 0.66%

TOTAL 13.79% 14.26%

VACANCY BY CLASS

Q1 2013 Q4 2012 CHANGE

CLASS A 12.53% 12.31%

CLASS B 15.33% 16.63%

CLASS C 12.84% 12.79%

OFFICE VACANCY RATES

Q1 2013

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

2.5

3.0

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Q1

VacancyRate

SF(Millions)

Net Absorption New Supply Vacancy

NEW SUPPLY, ABSORPTION AND VACANCY RATES

16.0%

11.2%

12.5%

19.0%

13.1%

13.8%

0% 5% 10% 15% 20%

Downtown

Suburban

S.D. County

All Classes Class A

OFFICE VACANCY RATES

Q1 2013

62.4%

25.2% 9.0%

2.6%

0.9% <= 2,000 SF [367]

2,001 - 5,000 SF [148]

5,001 - 10,000 SF [53]

10,001 - 20,000 SF [15]

>= 20,001 SF [5]

OFFICE LEASING ACTIVITY BY TENANT SIZE

Percentage of Total Leases Completed in Q1 2013

$2.00

$2.10

$2.20

$2.30

$2.40

$2.50

$2.60

$2.70

$2.80

$2.90

$3.00

$3.10

$3.20

$3.30

Q1

08

Q2

08

Q3

08

Q4

08

Q1

09

Q2

09

Q3

09

Q4

09

Q1

10

Q2

10

Q3

10

Q4

10

Q1

11

Q2

11

Q3

11

Q4

11

Q1

12

Q2

12

Q3

12

Q4

12

Q1

13

$/SF/Month(FS)

Class A All Classes

HISTORICAL RENTAL RATE TRENDS

Class A & Overall Office Rates

Quarterly Average Asking Rate Per SF Per Month (Full Service)

Office Market Starts Off 2013 With Strong Demand

MARKET OVERVIEW

Office demand continues its strong momentum resulting in fewer leasing incentives and

rising rents in the high-demand office markets. Prime office space options are diminishing as

companies “fast track” their search and lease negotiations to lock up the choice locations before

their competitors are able to. San Diego County’s office market posted a strong start as over

365,000 SF of positive net absorption (demand) was achieved in Q1 2013.

The March 2013 San Diego County unemployment rate measured 7.7%, dropping below 8% for

the first time in more than four years. Statewide, California’s unemployment rate dropped in

March to 9.4% as job growth continued to outpace the nation. San Diego County employers

added 8,300 people in March and a solid 32,600 people over the past 12 months. The industry

sectors of “Leisure and Hospitality”, “Education and Health” and “Professional and Business”

were the big employment drivers.

The steady recovery in San Diego’s office market is catching the attention of local and

national investors who have recently acquired Advanced Equities Plaza in Downtown San

Diego, the former SAIC headquarters in UTC and Foley Center in Carmel Valley. A recent

PricewaterhouseCoopers report noted that U.S. commercial property investors are looking

favorably at San Diego’s continued rent growth in high-demand submarkets such as Mission

Valley, UTC, Sorrento Mesa and Carmel Valley.

Large lease transactions during Q1 included XIFIN leasing 45,000 SF at ServiceNow’s former

Carmel Valley space, Union Bank leasing 84,000 SF at Illumina’s former UTC space and Konica/

Minolta’s renewal of 27,000 SF in Sorrento Mesa.

NET ABSORPTION and VACANCY

Continuing a trend that began in Q3 2012, Class B demand ratcheted up significantly in Q1 and

dominated all classes with 413,000 SF of net absorption. For the first time since Q4 2009,

Class A posted negative absorption of 67,000 SF for Q1 as many companies followed the “Flight

to Value” leasing opportunities in Class B office buildings.

Downtown San Diego (CBD) posted positive net absorption of 86,000 SF in Q1 which doubles

the level of demand during all of 2012. Overall net absorption for the suburban markets totaled

a positive 279,000 SF.

With net absorption trending positive for 12 of the last 13 quarters, the countywide total vacancy

rate declined to 13.8%. A sub-14% countywide rate hasn’t been seen in over five years. The

countywide total vacancy is comprised of 13.2% direct vacancy and 0.5% sublease vacancy.

Downtown (CBD) posted a 19% overall vacancy while the suburban office markets achieved

a 13% vacancy. Q1 vacancy for the key suburban office markets are: Mission Valley (12.5%),

Kearny Mesa (11.8%), UTC (8.5%), Sorrento Mesa (6.7%), Carmel Valley (15.3%), Carlsbad

(19.5%) and Rancho Bernardo (10%).

OPPORTUNITIES

There seems to be a renaissance for creative non-traditional uses in Downtown as the

“Generation Y” workforce prefers to live and work in more vibrant urban settings. Emerging

industries such as technology, design, internet-service related companies, and schools are

creating a more diversified tenant base for Downtown. With a 19% office vacancy, companies

can achieve strong leasing concessions in the majority of high-rise towers along with

commanding views.

Elsewhere in Mission Valley and North City West (Carmel Valley, Sorrento Mesa, and UTC) large

blocks of available office space are becoming more scarce causing rents to rise and leasing

concessions to shrink. Both The Irvine Company and Kilroy Realty are contemplating breaking

ground on new Class A office buildings in UTC and Sorrento Mesa subject to market timing.

NEW SUPPLY

New development is picking up in 2013 and into 2014. Construction on the 250,000 SF FBI

building and a 250,000 SF expansion of Qualcomm – both in Sorrento Mesa – will be completed

in 2013. Del Mar Corporate Plaza is undergoing a major redevelopment of its two building

125,000 SF Class A office project in Carmel Valley with Latham Watkins committing to 70,000

SF in early 2014 leaving 55,000 SF available for lease in mid-2014. Additionally, 40,000 SF

of new construction is underway at the Torrey Reserve project in Carmel Valley and 33,000 SF

at Quail Gardens Corporate Center in Encinitas. Finally, the 415,000 SF build-to-suit for LPL

Financial in UTC will be completed in 2014.

CLICK

HERE

TENANT ADVISORY SERVICES

WEBSITE](https://image.slidesharecdn.com/torq12013draft02-130716114847-phpapp01/75/Tor-q1-2013_draft02-1-2048.jpg)

![Colliers International

4660 La Jolla Village Drive, Suite 100 San Diego, CA 92122 | USA

tel +1 858.677.5363

522 offices in

62 countries on

6 continents

United States: 125

Canada: 38

Latin America: 18

Asia Pacific: 214

EMEA: 117

• $68 billion in annual revenue

• 1.25 billion square feet under

management

• Over 12,300 professionals

This report has been prepared by Colliers International for general information only. Information contained herein has been obtained from sources deemed reliable and no representation is made

as to the accuracy thereof. Colliers International does not guarantee, warrant or represent that the information contained in this document is correct. Any interested party should undertake their

own inquiries as to the accuracy of the information. Colliers International excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes

all liability for loss and damages arising there from.

Accelerating success.

TENANT OUTLOOK REPORT | SPRING 2013 | OFFICE | SAN DIEGO COUNTY

Tenant Advisory Services

www.ColliersTAS.com

> Only represent tenants in their

office lease and purchase

negotiations

> Provide objective conflict-free

advice with full service

resources

> Increase profitability &

mitigate risk

RON MILLER

Senior Director

Tenant Advisory

Services

858.677.5363

LIC # 00874868

Ron Miller is a tenant advisory

specialist. His expertise encompasses

relocation / expansion / contraction

strategies, lease renewal and

restructuring, market analysis, and

user purchase opportunities. With

his extensive career experience

in representing both tenants

and landlords, Ron offers a

unique perspective and valuable

insight to his tenant clients.

33.2

23.0

14.2

16.5

13.3

25.4

17.6

31.1

25.2

29.8

18.1

19.5

14.6

19.2

19.8

32.8

24.8

23.7

32.8

19.1

18.0

15.3

16.8

23.4

28.3

26.3

24.3

0

6

12

18

24

30

36

Downtown Mission

Valley

Kearny

Mesa

UTC Sorrento

Mesa

Carmel

Valley

Rancho

Bernardo

Carlsbad San Diego

County

Months

Class A Class B All Classes

OFFICE SPACE TIME-ON-THE-MARKET

Average Months by Submarket and Class

TIME ON MARKET

Time-on-the-market for Class A office space is averaging 25.2 months countywide.

62.4%

25.2% 9.0%

2.6%

0.9% <= 2,000 SF [367]

2,001 - 5,000 SF [148]

5,001 - 10,000 SF [53]

10,001 - 20,000 SF [15]

>= 20,001 SF [5]

OFFICE LEASING ACTIVITY BY TENANT SIZE

Percentage of Total Leases Completed in Q1 2013

$2.00

$2.10

$2.20

$2.30

$2.40

$2.50

$2.60

$2.70

$2.80

$2.90

$3.00

$3.10

$3.20

$3.30

Q1

08

Q2

08

Q3

08

Q4

08

Q1

09

Q2

09

Q3

09

Q4

09

Q1

10

Q2

10

Q3

10

Q4

10

Q1

11

Q2

11

Q3

11

Q4

11

Q1

12

Q2

12

Q3

12

Q4

12

Q1

13

$/SF/Month(FS)

Class A All Classes

HISTORICAL RENTAL RATE TRENDS

Class A & Overall Office Rates

Quarterly Average Asking Rate Per SF Per Month (Full Service)

RENTAL RATES

For four years, the average

asking rental rate in all office

classes had been steadily

decreasing and bottomed out

at $2.10/SF/month “full

service gross” at the end of

2011. In 2012, the average

rate for all classes increased

and remained level at $2.11/

SF. However, as of Q1 2013,

this rate increased to $2.12/

SF (+$0.01) while the Class

A rate increased by $0.05 to

stand at $2.70/SF.

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

10 2011 2012 2013

Q1

VacancyRate

Vacancy

Y RATES

62.4%

25.2% 9.0%

2.6%

0.9% <= 2,000 SF [367]

2,001 - 5,000 SF [148]

5,001 - 10,000 SF [53]

10,001 - 20,000 SF [15]

>= 20,001 SF [5]

OFFICE LEASING ACTIVITY BY TENANT SIZE

Percentage of Total Leases Completed in Q1 2013

$2.00

$2.10

$2.20

$2.30

$2.40

$2.50

$2.60

$2.70

$2.80

$2.90

$3.00

$3.10

$3.20

$3.30

Q1

08

Q2

08

Q3

08

Q4

08

Q1

09

Q2

09

Q3

09

Q4

09

Q1

10

Q2

10

Q3

10

Q4

10

Q1

11

Q2

11

Q3

11

Q4

11

Q1

12

Q2

12

Q3

12

Q4

12

Q1

13

$/SF/Month(FS)

Class A All Classes

HISTORICAL RENTAL RATE TRENDS

Class A & Overall Office Rates

Quarterly Average Asking Rate Per SF Per Month (Full Service)

LEASING ACTIVITY

A total of 588 leases were

completed in Q1 2013

totaling 1.5 million square

feet. This equated to a 5%

decrease in lease

transactions compared to

the previous quarter. The

drop in leasing activity will

likely be reflected in

diminished – yet positive –

net absorption in Q2 2013.

www.ronmillersd.com

Colliers International | Accelerating success. | www.colliersTAS.com](https://image.slidesharecdn.com/torq12013draft02-130716114847-phpapp01/85/Tor-q1-2013_draft02-3-320.jpg)