Topup Switching - Surrender

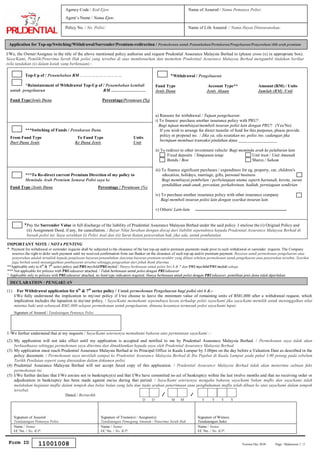

- 1. I/We, the Owner/Assignee in the title of the above mentioned policy authorise and request Prudential Assurance Malaysia Berhad to (please cross (x) in appropriate box). Saya/Kami, Pemilik/Penerima Serah Hak polisi yang tersebut di atas membenarkan dan memohon Prudential Assurance Malaysia Berhad mengambil tindakan berikut (sila tandakan (x) dalam kotak yang berkenaan):- Top-Up of / Penambahan RM …………………………… ^Reinstatement of Withdrawal Top-Up of / Penambahan kembali untuk pengeluaran RM …………………… Fund Type/Jenis Dana Percentage/Peratusan (%) ***Switching of Funds / Penukaran Dana From Fund Type To Fund Type Units Dari Dana Jenis Ke Dana Jenis Unit ***To Re-direct current Premium Direction of my policy to Meminda Arah Premium Semasa Polisi saya ke Fund Type /Jenis Dana Percentage / Peratusan (%) *Withdrawal / Pengeluaran Fund Type Account Type** Amount (RM) / Units Jenis Dana Jenis Akaun Jumlah (RM) /Unit a) Reasons for withdrawal / Tujuan pengeluaran: i) To finance/ purchase another insurance policy with PRU? Bagi tujuan membiayai/membeli insuran polisi lain dengan PRU? (Yes/No) If you wish to arrange for direct transfer of fund for this purposes, please provide policy or proposal no. / Jika ya, sila nyatakan no. polisi /no. cadangan jika bertujuan membuat transaksi pindahan dana __________________ ii) To redirect to other investment vehicle/ Bagi meminda arah ke pelaburan lain Fixed deposits / Simpanan tetap Unit trust / Unit Amanah Bonds / Bon Shares / Saham iii) To finance significant purchases / expenditure for eg, property, car, children's education, holidays, marriage, gifts, personal business Bagi membiayai pembelian / perbelanjaan utama seperti hartanah, kereta, yuran pendidikan anak-anak, percutian, perkahwinan, hadiah, perniagaan sendirian iv) To purchase another insurance policy with other insurance company Bagi membeli insuran polisi lain dengan syarikat insuran lain v) Others/ Lain-lain *Pay the Surrender Value in full discharge of the liability of Prudential Assurance Malaysia Berhad under the said policy. I enclose the (i) Original Policy and (ii) Assignment Deed, if any, for cancellation. / Bayar Nilai Serahan dengan discaj dari liabiliti sepenuhnya kepada Prudential Assurance Malaysia Berhad di bawah polisi ini. Saya serahkan (i) Polisi Asal dan (ii) Surat ikatan penyerahan hak, jika ada, untuk pembatalan. IMPORTANT NOTE / NOTA PENTING * Payment for withdrawal or surrender requests shall be subjected to the clearance of the last top-up and/or premium payments made prior to such withdrawal or surrender requests. The Company reserves the right to defer such payment until we received confirmation from our Banker on the clearance of such top-up and/or premium payment. Bayaran untuk permohonan pengeluaran atau penyerahan adalah tertakluk kepada penjelasan bayaran penambahan dan/atau bayaran premium terakhir yang dibuat sebelum permohonan untuk pengeluaran atau penyerahan tersebut. Syarikat juga berhak untuk menangguhkan pembayaran tersebut sehingga pengesahan dari pihak Bank diterima. **Applicable only to 6th & 7th series policy and PRUmychild/PRUmykid / Hanya berkenaan untuk polisi Siri 6 & 7 dan PRUmychild/PRUmykid sahaja. *** Not applicable for policies with PRUedusaver attached. / Tidak berkenaan untuk polisi dengan PRUedusaver ^ Applicable only to policies with PRUedusaver attached, no fund type indication required. Hanya berkenaan untuk polisi dengan PRUedusaver, pemilihan jenis dana tidak diperlukan. DECLARATION / PENGAKUAN (1) For Withdrawal application for 6th & 7th series policy / Untuk permohonan Pengeluaran bagi polisi siri 6 &:- I/We fully understand the implication to my/our policy if I/we choose to leave the minimum value of remaining units of RM1,000 after a withdrawal request, which implication includes the lapsation to my/our policy. / Saya/Kami memahami sepenuhnya kesan terhadap polisi saya/kami jika saya/kami memilih untuk meninggalkan nilai minima baki unit sebanyak RM1,000 selepas permohonan untuk pengeluaran, dimana kesannya termasuk polisi saya/kami luput. Signature of Assured / Tandatangan Pemunya Polisi I /We further understand that at my requests / Saya/Kami seterusnya memahami bahawa atas permintaan saya/kami :- (2) My application will not take effect until my application is accepted and notified to me by Prudential Assurance Malaysia Berhad. / Permohonan saya tidak akan berkuatkuasa sehingga permohonan saya diterima dan dimaklumkan kepada saya oleh Prudential Assurance Malaysia Berhad. (3) My application must reach Prudential Assurance Malaysia Berhad at its Principal Office in Kuala Lumpur by 3.00pm on the day before a Valuation Date as described in the policy document. / Permohonan saya mestilah sampai ke Prudential Assurance Malaysia Berhad di Ibu Pejabat di Kuala Lumpur pada pukul 3.00 petang pada sebelum Tarikh Penilaian seperti yang dinyatakan dalam dokumen polisi. (4) Prudential Assurance Malaysia Berhad will not accept faxed copy of this application. / Prudential Assurance Malaysia Berhad tidak akan menerima salinan faks permohonan ini. (5) I/We further declare that I/We am/are not in bankruptcy(s) and that I/We have committed no act of bankruptcy within the last twelve months and that no receiving order or adjudication in bankruptcy has been made against me/us during that period. / Saya/Kami seterusnya mengaku bahawa saya/kami bukan muflis dan saya/kami tidak melakukan kegiatan muflis dalam tempoh dua belas bulan yang lalu dan tiada arahan penerimaan atau penghukuman muflis telah dibuat ke atas saya/kami dalam tempoh tersebut. Dated / Bertarikh D D M M Y Y Y Y Signature of Assured Tandatangan Pemunya Polisi Signature of Trustee(s) / Assignee(s) Tandatangan Pemegang Amanah / Penerima Serah Hak Signature of Witness Tandatangan Saksi Name / Nama: I/C No. / No. K/P: Name / Nama: I/C No. / No. K/P: Name / Nama: I/C No. / No. K/P: Agency Code / Kod Ejen: Agent’s Name / Nama Ejen: Policy No. / No. Polisi: Name of Assured / Nama Pemunya Polisi: Name of Life Assured / Nama Hayat Diinsuranskan: Application for Top-up/Switching/Withdrawal/Surrender/Premium-redirection / Permohonan untuk Penambahan/Pertukaran/Pengeluaran/Penyerahan/Alih arah premium / / Form ID 11001008 Version Dec 2010 Page / Mukasurat 1 / 2

- 2. TERMS AND CONDITIONS / TERMA-TERMA DAN SYARAT-SYARAT TOP-UP / PENAMBAHAN (1) The minimum amount of top-up is RM1,000 and the maximum top-up a year is limited to 5 times of single premium for PRUlink investor account policies. / Jumlah minima penambahan ialah RM1,000 dan penambahan maksima setahun dihadkan kepada 5 kali premium tunggal untuk polisi PRUlink investor account. (2) Initial charge 5% per top-up and administration fees of RM25.00 (subject to change from time to time) is charged for every top-up. / Caj permulaan 5% bagi setiap penambahan dan yuran pentadbiran sebanyak RM25.00 (tertakluk kepada perubahan dari semasa ke semasa) akan dikenakan untuk setiap penambahan. (3) Top-up will be used to buy unit at the next pricing date of receipt of payment. / Penambahan akan digunakan untuk membeli unit pada harga tarikh hadapan selepas tarikh bayaran diterima. (4) For keyman policy, Service Tax of 5% is charged. / Untuk polisi ‘keyman’, Cukai Perkhidmatan sebanyak 5% akan dikenakan. (5) Full payment must be submitted together with this application. / Bayaran penuh mestilah disertakan bersama-sama permohonan ini. SWITCHING OF FUNDS / PENUKARAN DANA (1) Switching fee of 1% of the total amount to be switched, maximum of RM50 will be charged for each application. Prudential Assurance Malaysia Berhad will waive this charge for my first four switching application in each policy year. No carry forward of ‘unused’ switches to another year would be allowed. / Yuran penambahan sebanyak 1% daripada jumlah yang mahu ditukarkan, sehingga maksima RM50 akan dikenakan pada setiap permohonan. Prudential Assurance Malaysia Berhad akan mengecualikan bayaran ini untuk empat permohonan pertama saya pada setiap tahun polisi. Membawa kehadapan pertukaran ‘tidak terguna’ ke tahun berikutnya tidak dibenarkan. (2) The minimum amount that can be switched is RM1,000 and it may be varied from time to time. / Jumlah minima yang boleh ditukarkan ialah RM1,000 dan jumlah ini boleh diubah dari semasa ke semasa. (3) Prudential Assurance Malaysia Berhad reserves the right to vary the amount of switching fee. / Prudential Assurance Malaysia Berhad berhak untuk mengubah yuran pertukaran. Example: Switch 5000 units from PRUequity fund to PRUbond fund. / Contoh: Tukarkan 5000 unit dari PRUequity fund ke PRUbond fund. From Fund / Dari Dana To Fund / Ke Dana Units / Unit PRUequity fund PRUbond fund 5000 PREMIUM RE-DIRECTION / ALIH ARAH PREMIUM (1) The premium re-direction for regular premium investment must be in multiple of 5%. / Alih arah premium untuk premium tetap pelaburan mestilah dalam gandaan 5%. (2) If the future premium is to be re-directed, to indicate the new direction of the fund and the percentage, else the current premium re-direction will remain. Jika premium yang akan datang akan dialih arah, tunjukkan arah baru dana dan peratusan, jika tidak, arah semasa premium akan dikekalkan. (3) This premium re-direction will supersede any previous instruction and will apply for the total premium paid on this policy for the purchase of units. / Alih arah premium akan menggantikan mana- mana arahan sebelumnya dan akan diaplikasikan untuk jumlah penuh premium yang dibayar terhadap polisi, bagi pembelian unit. Example: Re-direction of premium from PRUequity fund to PRUbond fund. / Contoh: Alih arah premium dari dana PRUequity fund ke PRUbond fund. Fund Type / Jenis Dana Percentage / Peratusan (%) PRUbond fund 100% WITHDRAWAL / PENGELUARAN Important Note / Nota Penting : i) For 6th & 7th Series and PRUmychild/PRUmykid Policy, withdrawal can be made from the following accounts / Untuk Polisi Siri 6 & 7 dan PRUmychild/PRUmykid, pengeluaran boleh dibuat dari akaun-akaun berikut: BUA – Basic Unit Account. / Akaun Unit Asas PUA – Protection Unit Account. / Akaun Unit Perlindungan IUA – Investment Unit Account (If applicable). / Akaun Unit Pelaburan (Jika berkenaan). ii) Full withdrawal of BUA & PUA account is not allowed, unless in the event of termination of policy. / Pengeluaran sepenuhnya sesuatu akaun tidak dibenarkan, kecuali jika polisi ditamatkan. Withdrawal Rules / Peraturan Pengeluaran 4th & 5th Series Polisi Siri 4 & 5 6th & 7th Series and PRUmychild/PRUmykid Polisi Siri 6 & 7 dan PRUmychild/PRUmykid Minimum withdrawal amount. / Jumlah pengeluaran minima RM1,000 Minimum value of remaining units after withdrawal. / Nilai minima baki unit selepas pengeluaran. Note: For 6th & 7th series and PRUmychild/PRUmykid policy, policy owner can also choose to leave the minimum value of remaining units of RM1,000 in BUA & PUA after a withdrawal and policy owner must fully understand the implication to his/her policy (higher chance for lapsation of policy) as highlighted in the Declaration section. Nota: Untuk polisi siri 6 & 7 dan PRUmychild/PRUmykid, pemunya polisi juga boleh memilih untuk meninggalkan nilai minima baki unit sebanyak RM1,000 di dalam BUA & PUA selepas pengeluaran dan pemunya polisi mestilah memahami sepenuhnya kesan terhadap polisi mereka (risiko yang tinggi untuk polisi luput) seperti yang ditekankan di bahagian Pengakuan. RM2,000 RM 2,000 as a total in all accounts. RM 2,000 sebagai jumlah dalam semua akaun. Minimum withdrawal amount from IUA. / Jumlah pengeluaran minima dari IUA Note: If value of IUA is less than RM500, only full withdrawal is allowed. Nota: Jika nilai IUA kurang dari RM500, hanya pengeluaran semua dibenarkan. Not applicable Tidak berkenaan. RM500 Minimum value of remaining units after withdrawal from IUA. / Nilai minima baki unit selepas pengeluaran dari IUA Not applicable Tidak berkenaan. Not required. Tidak berkenaan. Withdrawal by Account Type. / Pengeluaran menerusi Jenis Akaun Note: Fund type must be indicated. Otherwise, application will be rejected. Nota: Jenis dana mesti dinyatakan. Jika tidak, permohonan akan ditolak. Not applicable Tidak berkenaan. Allowed Dibenarkan (1) The minimum withdrawal amount and/or remaining value of units after withdrawal may be varied by Prudential Assurance Malaysia Berhad from time to time. / Jumlah minima pengeluaran dan/atau baki dana selepas pengeluaran boleh diubah oleh Prudential Assurance Malaysia Berhad dari masa ke semasa. (2) Withdrawal of top-up is upon clearance of the top-up cheque. / Pengeluaran penambahan boleh dibuat apabila cek penambahan dijelaskan. (3) The withdrawals of the cancelled units will be determined in accordance with the Provisions of the said policy and other such documentation required by Prudential Assurance Malaysia Berhad to prove the title of the person claiming payment. / Pengeluaran unit yang dibatalkan akan ditentukan menurut Peruntukan polisi tersebut dan dokumen lain yang dikehendaki oleh Prudential Assurance Malaysia Berhad bagi mengesahkan hak milik individu yang menuntut bayaran. (4) Reinstatement of withdrawal is not allowed. / Pengembalian semula pengeluaran tidak dibenarkan. Example for 4th & 5th Series / Contoh untuk Siri 4 & 5: Withdraw 1000 units from PRUbond fund / Pengeluaran 1000 unit dari PRUbond fund Fund Type/Jenis Dana Account Type/Jenis Akaun Amount(RM)/Units/Jumlah(RM)/Unit √ PRUbond fund 1000 units Example for 6th & 7th Series / Contoh untuk Siri 6 & 7: Withdraw 2000 units from PRUequity fund / Pengeluaran 2000 unit dari PRUequity fund Fund Type/Jenis Dana Account Type/Jenis Akaun Amount(RM)/Units/Jumlah(RM)/Unit √ PRUequity fund PUA 2000 units X PRUequity fund PUA REINSTATEMENT OF WITHDRAWAL TOP-UP / PENAMBAHAN KEMBALI UNTUK PENGELUARAN (1) The full withdrawal amount must be returned to Prudential Assurance Malaysia Berhad together with this application. / Jumlah penuh pengeluaran mestilah dikembalikan kepada Prudential Assurance Malaysia Berhad bersama permohonan ini. (2) Top-up will be used to buy unit at the next pricing date of receipt of payment. / Penambahan akan digunakan untuk membeli unit pada harga tarikh hadapan selepas tarikh bayaran diterima. (3) Reinstatement of withdrawal is only allowed within the 1st year from the date of withdrawal from BUA/ PUA account./Penambahan kembali untuk pengeluaran hanya boleh dilakukan dalam tempoh satu tahun dari tarikh pengeluaran dari akaun BUA/PUA. SURRENDER / SERAHAN (1) The Surrender Value will be determined in accordance with the Provision of the said Policy and other such documentation required by Prudential Assurance Malaysia Berhad to prove the title of the person claiming payment. / Nilai Serahan akan ditentukan menurut Peruntukan polisi tersebut dan dokumen lain yang dikehendaki oleh Prudential Assurance Malaysia Berhad bagi mengesahkan hak milik individu yang menuntut bayaran. (2) Consent from trustee is required. / Kebenaran dari pemegang amanah adalah dikehendaki. (3) No reinstatement of surrender is allowed. / Pengembalian semula serahan tidak dibenarkan. (4) The policy terminates upon a surrender. / Polisi tamat setelah serahan. Prudential Assurance Malaysia Berhad (107655-U) Level 17, Menara Prudential, No. 10, Jalan Sultan Ismail, 50250 Kuala Lumpur. P.O. Box 10025, 50700 Kuala Lumpur. Customer Service Hotline: 603-2116 0228, Fax: 603-2032 3939, E-mail: customer.mys@prudential.com.my Version Dec 2010 Page / Mukasurat 2 / 2