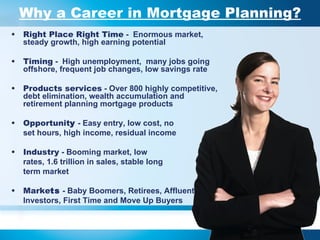

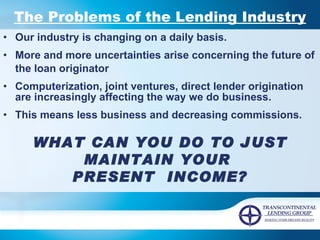

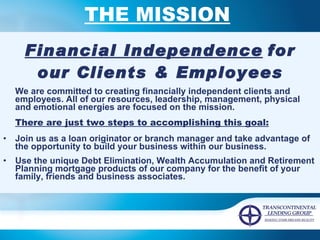

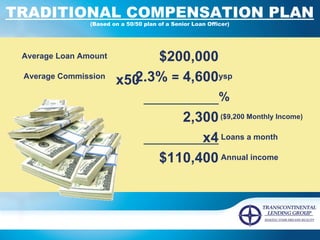

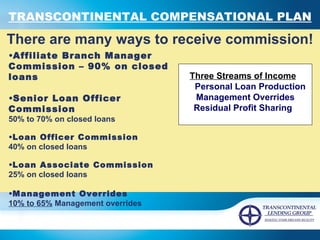

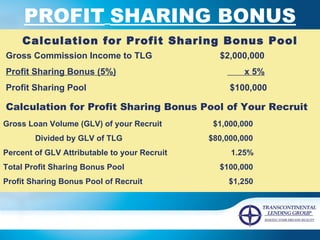

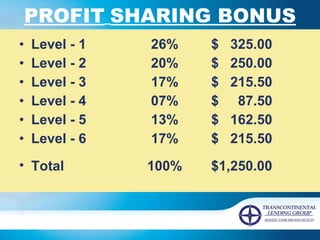

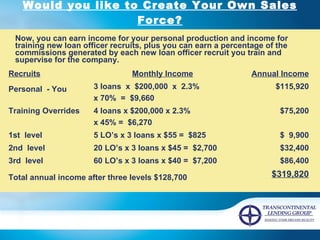

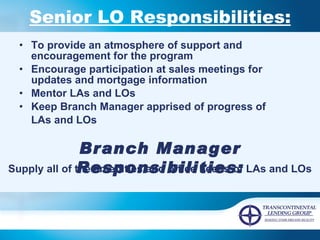

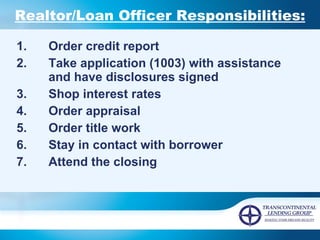

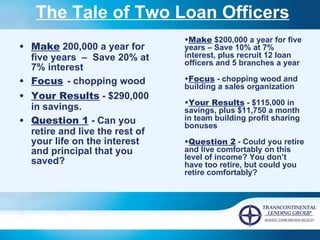

The document summarizes the benefits and opportunities of a career with The Lending Company of the Future (TLG). TLG aims to revolutionize the mortgage planning industry by offering a wide range of competitive mortgage products and a proven duplicable marketing system. The compensation plan offers loan officers multiple streams of income, including personal loan commissions, management overrides, and profit sharing bonuses. Becoming an affiliate branch manager allows for even greater earnings potential through building a team of loan officers.