Embed presentation

Download to read offline

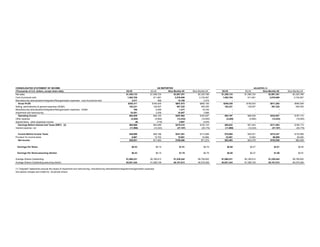

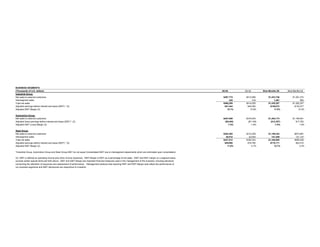

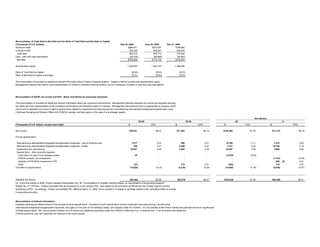

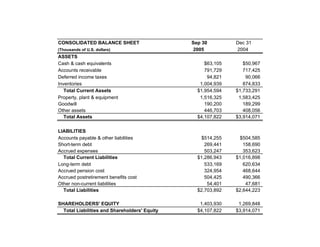

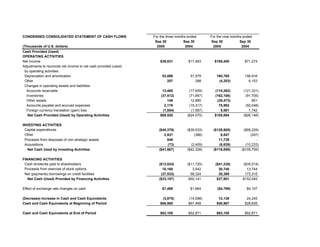

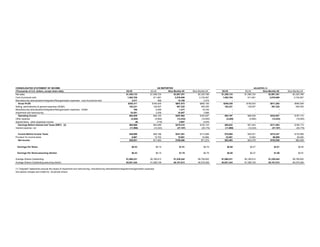

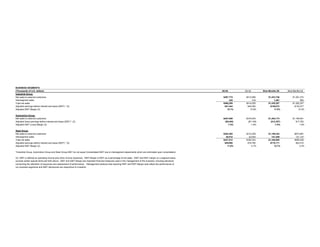

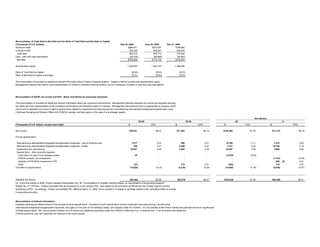

The Timken Company reported record third quarter sales and net income that more than doubled from the previous year. Sales increased 15% to $1.3 billion due to strong performance in the industrial and steel groups. However, the automotive group continued to struggle in the challenging North American market. The company increased its full-year earnings outlook due to strong global industrial demand and expects its restructuring programs to improve automotive group performance and reduce costs.