The document outlines various time limits prescribed under the Income Tax Act related to filing of income tax returns and other procedures. It mentions the due dates for filing normal, belated and revised returns for individual taxpayers and companies. It also specifies the timelines for depositing amounts in special accounts to claim deductions, getting audit reports, challenging assessing officer's jurisdiction and other compliance procedures. The time limits prescribed in the act aim to ensure timely and accurate filing of returns and completion of tax assessments.

![Retaining books of account or other documents seized

under section 132(1) or 132(1A)

• If books of accounts or other documents seized u/s 132(1) or

132(1A) by the AO (Authorises Officer), without the approval

of CCIT/CIT/DGIT or DIT/Pr.CCIT/Pr. CIT/Pr.DGIT/Pr.DIT.

• Not more than 180 days [30 days from the date of assessment

order under section 153A or section 158BC(c)]

Section 132(8)](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-8-320.jpg)

![Time limit for making Assessment Order U/s 143 or U/s144

a) Within 9 months from end of the assessment year in which income was

first assessable. [Applicable for assessment year 2021-22]

Due date : 31st Dec. 2022

b) Within 12 months from end of the assessment year in which income was

first assessable. [Starting from assessment year 2022-23 and onwards]

Due Dated: 31st March 2024

Section -153(1)](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-49-320.jpg)

![Fresh assessment in pursuance of an order u/s 254, 263 or 264 setting aside or

cancelling an assessment order

a. Before expiry of 9 months from the end of the financial year in which order under

section 254 is received by-

– Principal Chief Commissioner or

– Chief Commissioner or - Principal Commissioner or

– Commissioner or, -

– as the case may be an order under section 263/264 is passed by Principal

Commissioner or Commissioner

b. Within 12 months from the end of the financial year in which order under section 254 is

received or order under section 263 or 264 is passed by the authority. [if order is passed

on or after financial year 2019-20]

Note: If reference is made to TPO, the period available for assessment shall be extended

by 12 months.

Sec 153(3)](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-52-320.jpg)

![Section 153(5)

• Giving effect to an order [under

Section

250/254/260/262/263/264] by

AO (or TPO) wholly or partly,

otherwise than by making a fresh

assessment or reassessment (or

order under section 92CA)

• Within a period of 3 months from the end of the

month in which order is received by –

– Principal Chief Commissioner or –

– Chief Commissioner or –

– Principal Commissioner or [As

amended by Finance Act, 2022] -

Commissioner, - As the case may be

the order under Section 263/264 is

passed by the Principal

Commissioner or Commissioner](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-53-320.jpg)

![Time limit for filing appeal to CIT(A)

• The appeal shall be furnished within 30 days of the following date:

(a) Where appeal is u/s 248, the date of payment of tax.

(b) Where the appeal relates to any assessment or penalty, the date of service of

notice of demand relating to the assessment or penalty.

(c) In any other case, the date on which the order sought to be appealed is

served.

• Condonation of delay possible, otherwise remedy available is Sec 264[CIT].

Sec 249](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-65-320.jpg)

![Filing memo of cross-objections to Tribunal

• Section 253(4)/(5): Within 30 days of receipt of notice of filing

appeal or within extended time.

• Rectification of apparent mistake by Tribunal {Section

254(2)}: Within 6 months from the end of the month in which

the order was passed [Inserted by the Finance Act, 2016 w.e.f.

1-6-2016]](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-68-320.jpg)

![Miscellaneous petition or application before ITAT

• The limitation of six months for filing Miscellaneous

Application u/s. 254(2) starts from the date of receipt of order.

• "The Appellate Tribunal may, at any time within [six months from the end of the

month in which the order was passed], with a view to rectifying any mistake

apparent from the record, amend any order passed by it under sub-section (1), and

shall make such amendment if the mistake is brought to its notice by the assessee or

the [Assessing] Officer."

Section 254(2)](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-69-320.jpg)

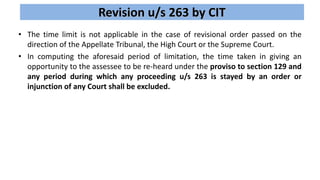

![Revision by CIT u/s 263

• To pass order within 2 years from the end of the financial year in

which the order sought to be revised was passed.

• Service of order is not included in the time limit.

• The period of limitation commences from the date of order of

assessment and not from the date on which order of re-assessment

has been passed – Ashoka Buildcon Ltd. Vs CIT[2010] Taxman

29(Bom.)

• Against order passed u/s 263 an appeal can be filed to ITAT.

Sec. 263](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-72-320.jpg)

![WHEN ASSESSMENT REFRAMED.

An order of fresh assessment in pursuance of order under section 254, 263

or 264 setting aside or cancelling assessment. Section 153(3).

a) Within 9 months from end of the financial year in which order under

section 254 is received by

- Principal Chief Commissioner or

- Chief Commissioner or

- Principal Commissioner or

- Commissioner or,

- as the case may be an order under section 263/264 is passed by Principal

Commissioner or Commissioner

b) Within 12 months from the end of the financial year in which order under

section 254 is received or order under section 263 or 264 is passed by the

authority. [if order is passed on or after financial year 2019-20]](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-85-320.jpg)

![Appeal Effect

Giving effect to an order [under Section 250/ 254/ 260/ 262/ 263 / 264] by AO

wholly or partly, otherwise than by making a fresh assessment or

reassessment. {Section 153(5)}

Within a period of 3 months from the end of the month in which order is

received by Principal Chief Commissioner or Chief Commissioner or Principal

Commissioner or Commissioner, As the case may be the order under Section

263/264 is passed by the Principal Commissioner or Commissioner

Note:

1) If it is not possible to give effect to such order within the aforesaid period, the

Principal Commissioner or Commissioner may allow an additional period of 6

months to AO.

2) If verification on any issue was required by way of submission of any

document or where an opportunity of being heard is to be provided to assessee.

Then order shall be made within the time specified in 153(3) [Inserted by

Finance Act 2017, w.e.f. 1.6.2017]](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-86-320.jpg)

![An order of assessment, reassessment or recomputation on

assessee or any person in consequence of or to give effect to

any finding or direction contained in- An order under Section

250/ 254/ 260 / 262 / 263 /264 or - An order of any court in a

proceedings otherwise than by way of appeal or reference

[Inserted by the Finance Act, 2016 w.e.f. 1-6-2016]. {Section

153(6)(i)}

Within 12 months from the end of the month in which such

order is received or passed by the Principal Commissioner or

Commissioner, as the case may be.](https://image.slidesharecdn.com/timelimitspptsatish2-240215204200-a4b24e91/85/Time-Limits-PPT-presentation-Satish-2-pdf-87-320.jpg)