Amendment in section 147&148

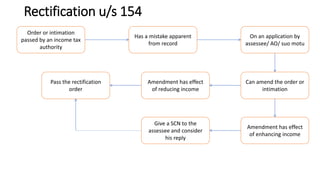

- 1. Rectification u/s 154 Order or intimation passed by an income tax authority Has a mistake apparent from record On an application by assessee/ AO/ suo motu Can amend the order or intimation Amendment has effect of enhancing income Amendment has effect of reducing income Pass the rectification order Give a SCN to the assessee and consider his reply

- 2. Rectification u/s 154 • Order shall be passed within 4 years from the end of FY in which the original order was passed • Where an application is made by assessee, the rectification will be done within 6 months from the end of month in which the application was received • Where any issue in the order has been taken in appeal or revision, then that issue cannot be taken in rectification. However other issues can be taken in rectification even if some issue has been taken in appeal(partial merger).

- 3. Section 263 – Revision of Order Order passed By AO] Erroneous & Prejudicial to the interest of Revenue CIT/PCIT revise the order – enhance or modify the income CIT/PCIT will give SCN to Assessee] Respond Direct for fresh assessment Time Limit- 2 years from the end of FY in which AO passed the relevant Order • This order can never be against the interest of Department • Concept of partial merger applies • Records means everything available at that time with CIT/PCIT • Order is appealable in HC or SC Key notes-

- 4. • This order is not appealable • Concept of total merger applies • Remedy under this section is only available if right to appeal or time limit for appeal is waived • Order to be passed within 1 year from the date of application Key notes- CIT/ PCIT Application made by assessee (within 1 year of date of order of AO) On his own Examine the records Passed Revisional order 1 year from the date of passing the order by AO 1 year from the date of receiving application Section 264 – Revision of Order

- 5. Concept of Partial Merger Concept of Total Merger However in case of Partial merger , if appeal is filed for 3 points even then rectification u/s 154 and revison u/s 263 can be done on remaining 2 points of AO order. If the assessee makes an appeal on few matters of an order passed by AO to appellate authority say 3 points after 5 points in the order of AO , then it shall be deemed that whole order of AO has been merged. Which means we can not file appeal for the remaining two points u/s 264

- 6. Assessee Return Filed Return Not Filed Return Filed Notice U/s 142(1)(i) 143(1) No Return Filed 143(2) 142(1)(ii) & other Best Judgement - 144 Response No Response 143(3) Re-assessment - 147 148

- 7. Remedies available to department Remedies available to assessee Rectification u/s 154 Appeal to CIT(A) u/s 246A Revision u/s 264 Rectification u/s 154 Income Escaping Assessment u/s 147 Revision u/s 263

- 8. Income Escaping Assessment U/s. 147 Basic condition for the assessment under this section is ; Assessing Officer has reason to believe that any income chargeable to tax has escaped assessment for any assessment year he may, subject to provision of section 148 to 153, assess or reassess such income and also any other income chargeable to tax which has escaped assessment which comes to his notice subsequently in the course of proceedings under this section. Two views in two case laws: • Jet Airways (Bom.) and Ranbaxy Labs (del.)- held No, which indicates that reopening is done on certain grounds and addition is made on other grounds on which re opening was done, then reopeniong is to be set aside. • Mehak Finevest Vs CIT –held yes, which mentions that AO can made addition on other points without making addition on other grounds. • Govindraju Alias Govinda Vs State by Sriramampura Police- which says if notice u/s 148(2) is validly served to assessee then addition can be made on all the grounds even found subsequently.

- 9. Proviso 1: for the benefit of assessee. Provided that where an assessment under sub-section (3) of section 143 or this section has been made for the relevant assessment year, no action shall be taken under this section after the expiry of four years from the end of the relevant assessment year, unless any income chargeable to tax has escaped assessment for such assessment year by • reason of the failure on the part of the assessee to make a return under section 139 or • in response to a notice issued under sub-section (1) of section 142 or section 148 or to disclose fully and truly all material facts necessary for his assessment, for that assessment year Not applicable in relation to any asset(having financial interest in the entity) located outside India. PROVISO TO SECTION 147

- 10. Proviso 2: Provided also that the Assessing Officer may assess or reassess such income, other than the income involving matters which are the subject matters of any appeal, reference or revision, which is chargeable to tax and has escaped assessment. Explanation 1.— Production before the Assessing Officer of account books or other evidence from which material evidence could with due diligence have been discovered by the Assessing Officer will not necessarily amount to disclosure within the meaning of the foregoing proviso. Explanation 3.—For the purpose of assessment or reassessment under this section, the Assessing Officer may assess or reassess the income in respect of any issue, which has escaped assessment, and such issue comes to his notice subsequently in the course of the proceedings under this section, notwithstanding that the reasons for such issue have not been included in the reasons recorded under sub-section (2) of section 148.

- 11. Explanation 2 to section 147 : - Income Escaping Assessment For the purpose of Sec. 147, the following shall be deemed to be cases where income chargeable to tax has escaped assessment: - a) No Return of Income is furnished during the previous year in which income exceeded the Basic exemption limit. b) Return of Income is furnished but no assessment has been made and it is noticed by AO that Assessee has understated the income or claimed excessive loss, deduction, allowance or relief. c) Assessee has failed to furnish a report from accountant in respect of any international transaction under section 92E of Income Tax Act, 1961. d) An Assessment has been made, but- i) Income has been underassessed or ii) income has been assessed at low rate or iii) excessive relief granted or iv) excessive loss or depreciation or any other allowance has been computed e) Reference received from the prescribed income tax authority , u/s 133C. e) Person is found to have any asset located outside India (Includes Financial Interest in any entity).

- 12. Time Limit for issue of Notice Under section 148 ( Section 149): - Particulars Time Limit U/s 149 Approval U/s 151 Income escaping assessment if any amount Up to 4 years from the end of the relevant AY From joint Commissioner If the amount of income which has escaped assessment is more than Rs. 1,00,000 Beyond 4 years but up to 6 years from the end of the relevant AY From Principal Chief Commissioner, Chief Commissioner or Principal Commissioner or Commissioner For any income in relation to any asset located outside India Beyond 4 years but up to 16 years from the end of the relevant AY From Principal Chief Commissioner, Chief Commissioner or Principal Commissioner or Commissioner

- 13. Procedure for Assessment Proceedings U/s. 147 Assessing Officer should have ‘Reason to Believe’ and record it to assess or re-assess income escaping assessment Assessing Officer should have ‘Reason to Believe’ and record it to assess or re-assess the income escaping assessment Issue of notice under section 148 for income escaping assessment within the time limit Time Limit for issue of notice under section 148 is specified under section 149 Assessee is required to file return of income in pursuance to notice under section 148 Assessee should seek for the reasons recorded by the Assessing Officer Assessing officer should issue notice under section 143(2)

- 14. Assessing Officer Should issue notice under section 142(1)(ii) Assessing Officer Should complete and pass the final assessment order under section 147 r. w. s. 143(3) within the time limit Time limit for passing the assessment order is specified under section 153 (1) i.e within 12 months from the end of the Financial year in which notice U/s 148 was issued

- 15. AO has information suggesting income has escaped assessment Conduct enquiry u/s 148A Issue SCN to assessee u/s 148A Pass order u/s 148A Issue Notice u/s 148 Assessee will file a return u/s 148 Assess the income u/s 147 r.w.s 143(3) or 144 AO has reason to believe income has escaped assessment Issue Notice u/s 148 Assessee will file a return u/s 148 Assess the income u/s 147 r.w.s 143(3) or 144 OLD NEW A search has been conducted Issue Notice u/s 153A Assessee will file a return u/s 153A Assess the income u/s 153A r.w.s 143(3) or 144

- 16. Explanation —For the purpose of assessment or reassessment under this section, the Assessing Officer may assess or reassess the income in respect of any issue, which has escaped assessment, and such issue comes to his notice subsequently in the course of the proceedings under this section, irrespective of the fact that the provisions of section 148A have not been complied with. Except above Explanation-3, three proviso and Explanation 1,2 & 4 are not appearing in new section EXPLANATION-

- 17. Meaning of information Suggesting that Income has escaped assessment - Explanation 1.—For the purposes of this section and section 148A, the information with the Assessing Officer which suggests that the income chargeable to tax has escaped assessment means— (i) Any information flagged in the case of the assessee for the relevant assessment year in accordance with the risk management strategy formulated by the Board from time to time; (ii) Any final objection raised by the Comptroller and Auditor General of India to the effect that the assessment in the case of the assessee for the relevant assessment year has not been made in accordance with the provisions of this Act.

- 18. Explanation.3—For the purposes of this section, specified authority means the specified authority referred to in section 151.”. Deemed Information Explanation 2.—For the purposes of this section, where — A search is initiated under section 132 or books of account, other documents or any assets are requisitioned under section 132A, on or after the 1st day of April, 2021, in the case of the assessee; or a survey is conducted under section 133A in the case of the assessee on or after the 1st day of April, 2021; or the Assessing Officer is satisfied, with the prior approval of the Principal Commissioner or Commissioner, that any money, bullion, jewellery or other valuable article or thing, seized or requisitioned in case of any other person on or after the 1st day of April, 2021, belongs to the assessee; or the Assessing Officer is satisfied, with the prior approval of Principal Commissioner or Commissioner, that any books of account or documents, seized or requisitioned in case of any other person on or after the 1st day of April, 2021, pertains or pertain to, or any information contained therein, relate to, the assessee, The Assessing Officer shall be deemed to have information which suggests that the income chargeable to tax has escaped assessment in the case of the assessee for the three assessment years immediately preceding the assessment year relevant to the previous year in which the search is initiated or books of account, other documents or any assets are requisitioned or survey is conducted in the case of the assessee or money, bullion, jewellery or other valuable article or thing or books of account or documents are seized or requisitioned in case of any other person.

- 19. New Section 148 Before making the assessment, reassessment or recomputation under section 147, and subject to the provisions of section 148A The Assessing Officer shall serve on the assessee a notice, along with a copy of the order passed, if required, under clause (d) of section 148A A return of his income under this Act during the previous year corresponding to the relevant assessment year The income of any other person in respect of which he is assessable under this Act during the previous year corresponding to the relevant assessment year To furnish within such period, as may be specified in such notice- The provisions of this Act shall, so far as may be, apply accordingly as if such return were a return required to be furnished under section 139 Provided that no notice under this section shall be issued unless there is information with the Assessing Officer which suggests that the income chargeable to tax has escaped assessment in the case of the assessee for the relevant assessment year and the Assessing Officer has obtained prior approval of the specified authority to issue such notice

- 20. New Section 148 A The Assessing Officer shall, before issuing any notice under section-48, — a) Conduct any enquiry, if required, with the prior approval of specified authority, with respect to the information which suggests that the income chargeable to tax has escaped assessment; b) Provide an opportunity of being heard to the assessee, with the prior approval of specified authority, by serving upon him a notice to show cause within such time, as specified in the notice, being not less than seven days and but not exceeding thirty days from the date on which such notice is issued, or such time, as may be extended by him on the basis of an application in this behalf, as to why a notice under section 148 should not be issued on the basis of information which suggests that income chargeable to tax has escaped assessment in his case for the relevant assessment year and results of enquiry conducted, if any, as per clause (a); c) consider the reply of assessee furnished, if any, in response to the show-cause notice referred to in clause (b); d) decide, on the basis of material available on record including reply of the assessee, whether or not it is a fit case to issue a notice under section 148, by passing an order, with the prior approval of specified authority, within one month from the end of the month in which the reply referred to in clause (c) is received by him, or where no such reply is furnished, within one month from the end of the month in which time or extended time allowed to furnish a reply as per clause (b) expires:

- 21. Section 148A continues….. PROVISO -148 Not applies- A search is initiated under section 132 or books of account, other documents or any assets are requisitioned under section 132A in the case of the assessee on or after the 1st day of April, 2021; or The Assessing Officer is satisfied, with the prior approval of the Principal Commissioner or Commissioner that any money, bullion, jewellery or other valuable article or thing, seized in a search under section 132 or requisitioned under section 132A, in the case of any other person on or after the 1st day of April, 2021, belongs to the assessee; or The Assessing Officer is satisfied, with the prior approval of the Principal Commissioner or Commissioner that any books of account or documents, seized in a search under section 132 or requisitioned under section 132A, in case of any other person on or after the 1st day of April, 2021, pertains or pertain to, or any information contained therein, relate to, the assessee. Explanation.—For the purposes of this section, specified authority means the specified authority referred to in section 151.

- 22. Section 149 No notice under section 148 shall be issued for the relevant assessment year,— (a) if three years have elapsed from the end of the relevant assessment year, unless the case falls under clause (b); b) if three years, but not more than ten years, have elapsed from the end of the relevant assessment year unless the Assessing Officer has in his possession books of accounts or other documents or evidence which reveal that the income chargeable to tax, represented in the form of asset, which has escaped assessment amounts to or is likely to amount to fifty lakh rupees or more for that year: Provided further that the provisions of this sub-section shall not apply in a case, where a notice under section 153A, or section 153C read with section 153A, is required to be issued in relation to a search initiated under section 132 or books of account, other documents or any assets requisitioned under section 132A, on or before the 31st day of March, 2021

- 23. 151. Specified authority for the purposes of section 148 and section 148A shall be,— • Principal Commissioner or Principal Director or Commissioner or Director, if three years or less than three years have elapsed from the end of the relevant assessment year; • Principal Chief Commissioner or Principal Director General or where there is no Principal Chief Commissioner or Principal Director General, Chief Commissioner or Director General, if more than three years have elapsed from the end of the relevant assessment year.”. SECTION 151-

- 24. How many years can notice be issued in old law For Search u/s 153A? Year Current AY + 6 AYs preceding current AY Compulsory opening 4 AYs preceding 6 AYs above Opening only if AO has books etc revealing that income, represented in the form of asset, not less than 50 lakhs has escaped assessment in aggregate for 4 AYs Search case – notice u/s 153A

- 25. How many years can notice be issued in new law? Assessment Year If AO has documents etc, revealing that income, represented in form of asset, escaped assessment amounts to (or likely to amount to) 50 lakh or more for that year If not more than 10 years have elapsed from the end of relevant AY Any other case If not more than 3 years have elapsed from the end of relevant AY