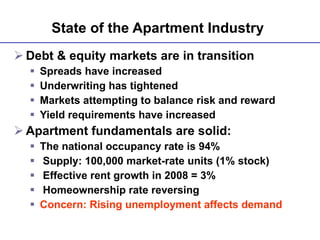

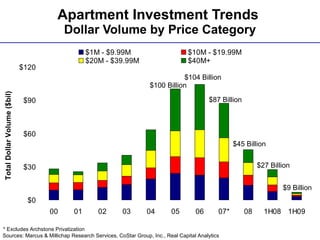

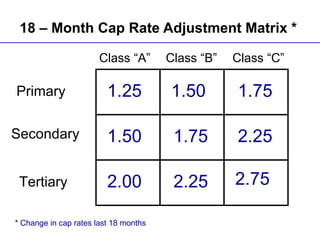

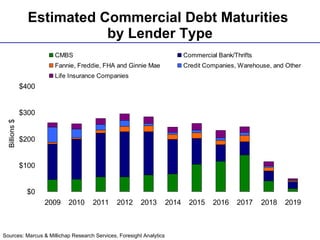

The document summarizes trends in the US apartment market in 2009. It finds that the market diverged into two camps based on long-term investment value versus short-term transactional value. Fundamentals remained solid, but debt markets were challenging and investors were cautious. It predicts that multi-family capital markets will remain difficult in 2009 with low transaction volumes and rising cap rates, especially for lower quality properties.