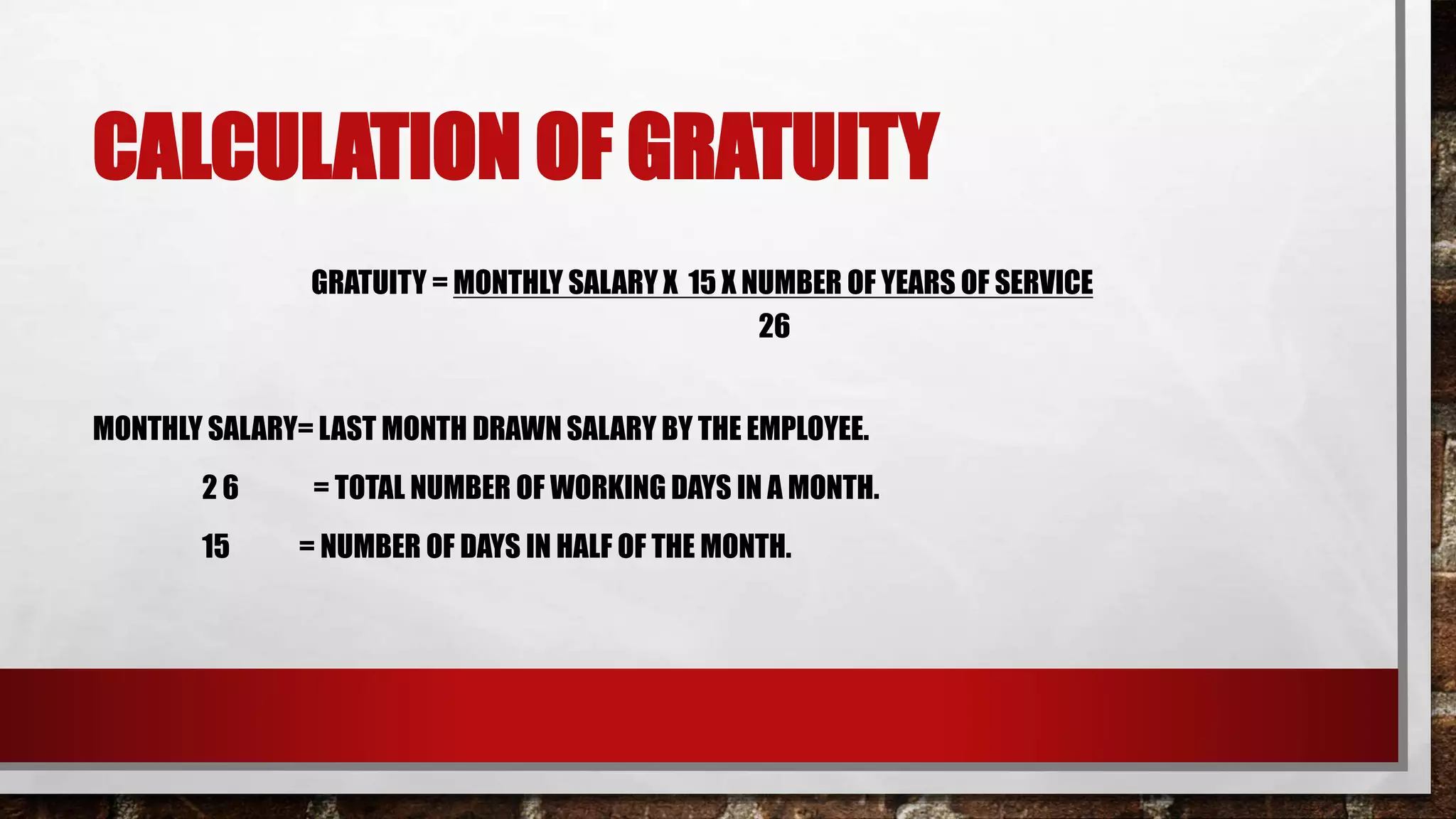

The document discusses gratuity benefits provided by employers in India. Gratuity is calculated based on an employee's last drawn salary and years of continuous service of 5 years or more. It must be paid to employees at factories, mines, ports and other establishments with 10 or more employees. The maximum gratuity amount was increased in 2018 to Rs. 20 lakh and must be paid within 30 days of application. Gratuity is exempt from tax up to 15 days' salary for each year of service.